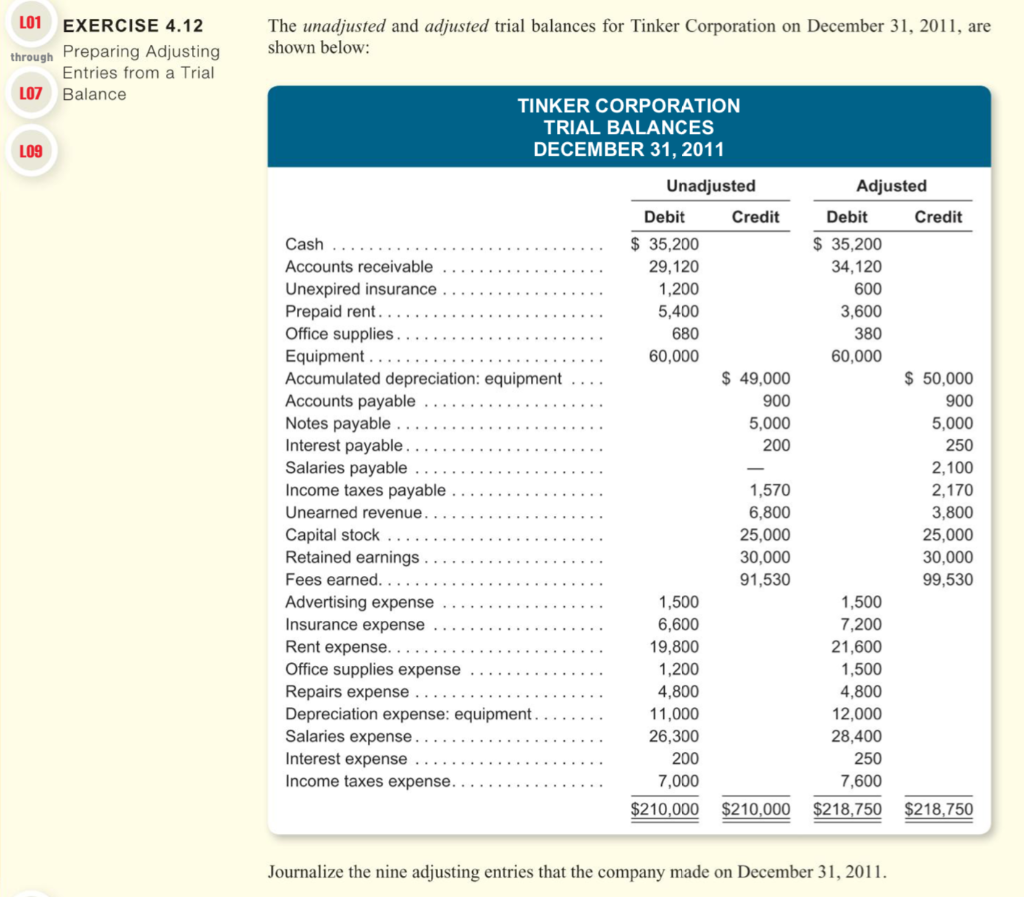

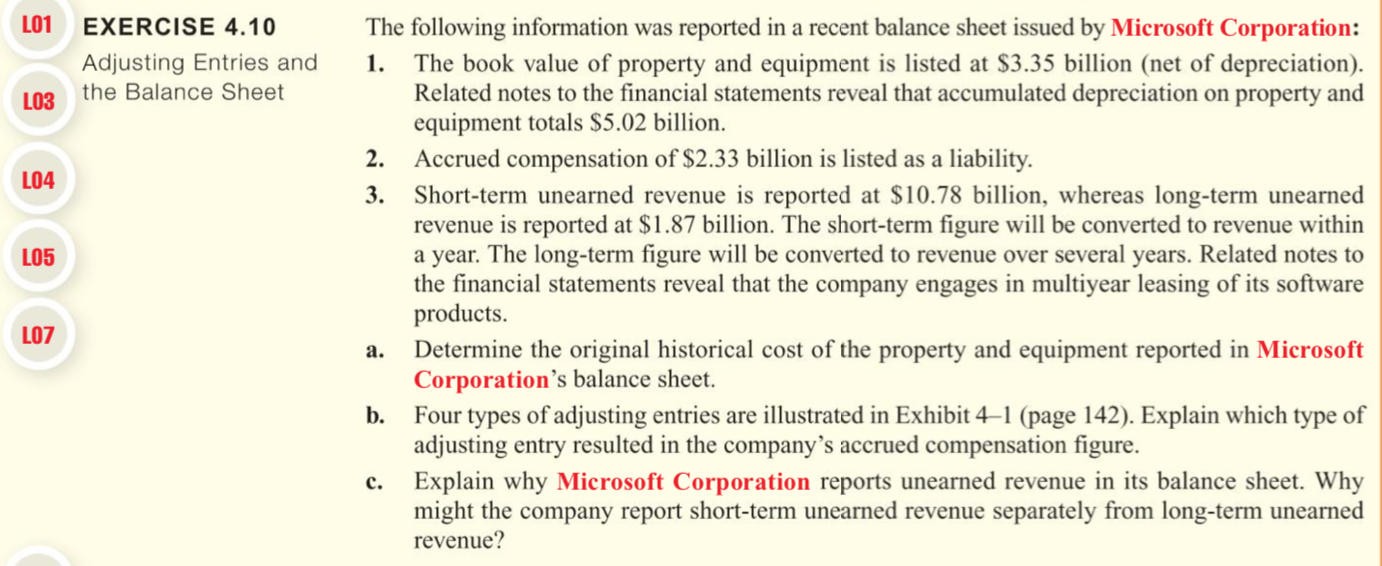

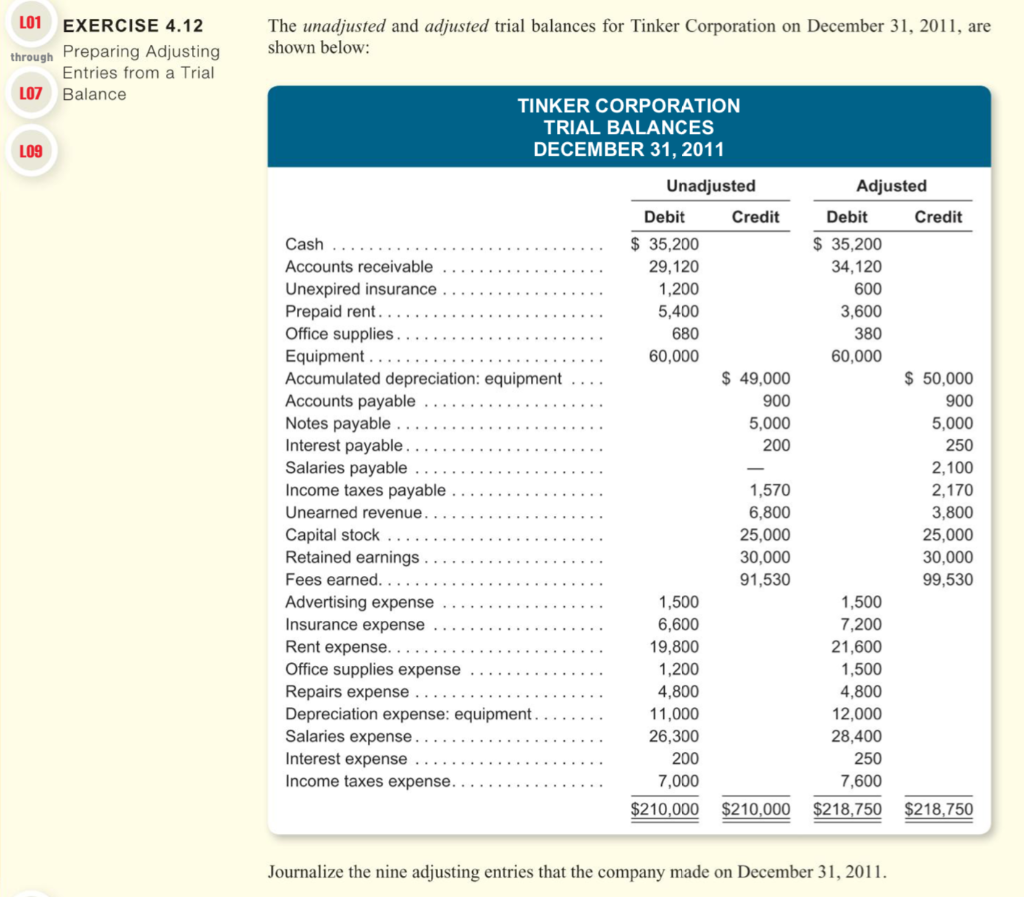

LO1 EXERCISE 4.7 Preparing Various Adjusting Entries through LOG L09 Sweeney & Associates, a large marketing firm, adjusts its accounts at the end of each month. The following information is available for the year ending December 31, 2011: 1. A bank loan had been obtained on December 1. Accrued interest on the loan at December 31 amounts to $1,200. No interest expense has yet been recorded. 2. Depreciation of the firm's office building is based on an estimated life of 25 years. The build- ing was purchased in 2007 for $330,000. 3. Accrued, but unbilled, revenue during December amounts to $64,000. 4. On March 1, the firm paid $1,800 to renew a 12-month insurance policy. The entire amount was recorded as Prepaid Insurance. 5. The firm received $14,000 from King Biscuit Company in advance of developing a six-month marketing campaign. The entire amount was initially recorded as Unearned Revenue. At December 31, $3,500 had actually been earned by the firm. Exercises 169 6. The company's policy is to pay its employees every Friday. Since December 31 fell on a Wednesday, there was an accrued liability for salaries amounting to $2,400. Record the necessary adjusting journal entries on December 31, 2011. b. By how much did Sweeney & Associates's net income increase or decrease as a result of the adjusting entries performed in part a? (Ignore income taxes.) a. L01 EXERCISE 4.10 Adjusting Entries and the Balance Sheet LO3 L04 LO5 The following information was reported in a recent balance sheet issued by Microsoft Corporation: 1. The book value of property and equipment is listed at $3.35 billion (net of depreciation). Related notes to the financial statements reveal that accumulated depreciation on property and equipment totals $5.02 billion. 2. Accrued compensation of $2.33 billion is listed as a liability. 3. Short-term unearned revenue is reported at $10.78 billion, whereas long-term unearned revenue is reported at $1.87 billion. The short-term figure will be converted to revenue within a year. The long-term figure will be converted to revenue over several years. Related notes to the financial statements reveal that the company engages in multiyear leasing of its software products. Determine the original historical cost of the property and equipment reported in Microsoft Corporation's balance sheet. b. Four types of adjusting entries are illustrated in Exhibit 41 (page 142). Explain which type of adjusting entry resulted in the company's accrued compensation figure. c. Explain why Microsoft Corporation reports unearned revenue in its balance sheet. Why might the company report short-term unearned revenue separately from long-term unearned revenue? LO7 a. The unadjusted and adjusted trial balances for Tinker Corporation on December 31, 2011, are shown below: L01 EXERCISE 4.12 through Preparing Adjusting Entries from a Trial LO7 Balance TINKER CORPORATION TRIAL BALANCES DECEMBER 31, 2011 LOS Adjusted Credit Unadjusted Debit Credit $ 35,200 29,120 1,200 5,400 680 60,000 $ 49,000 900 5,000 200 Debit $ 35,200 34,120 600 3,600 380 60,000 $ 50,000 900 Cash.. Accounts receivable Unexpired insurance Prepaid rent. Office supplies. Equipment Accumulated depreciation: equipment Accounts payable Notes payable Interest payable Salaries payable Income taxes payable Unearned revenue. Capital stock Retained earnings Fees earned. Advertising expense Insurance expense Rent expense. Office supplies expense Repairs expense.. Depreciation expense: equipment. Salaries expense. Interest expense Income taxes expense. 1,570 6,800 25,000 30,000 91,530 5,000 250 2,100 2,170 3,800 25,000 30,000 99,530 1,500 6,600 19,800 1,200 4,800 11,000 26,300 200 7,000 $210,000 1,500 7,200 21,600 1,500 4,800 12,000 28,400 250 7,600 $218,750 $210,000 $218,750 Journalize the nine adjusting entries that the company made on December 31, 2011