Answered step by step

Verified Expert Solution

Question

1 Approved Answer

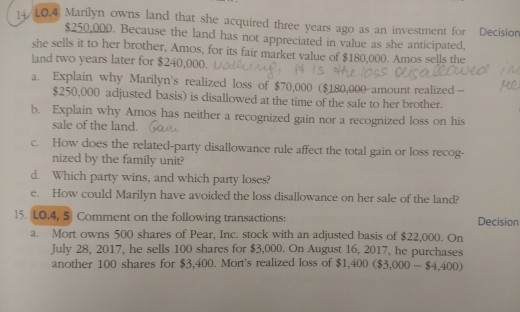

Lo.4 Marilyn owns land that she acquired three years ago as an investment for Decision not appreciated in value as she anticipated, she sells it

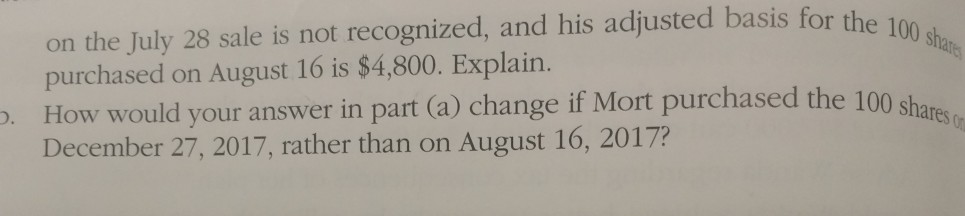

Lo.4 Marilyn owns land that she acquired three years ago as an investment for Decision not appreciated in value as she anticipated, she sells it to her brother, Amos, for its fair market value of $180,000. Amos sells the land rwo years later for $240,000. I/Jdlu ref. is 4h/ 'OSS O/Souto a. Explain why Marilyn's realized loss of $70,000 ($180,000 amount realized- $250,000 adjusted basis) is disallowed at the time of the sale to her brother sale of the land. Ga nized by the family unit? b. Explain why Amos has neither a recognized gain nor a recognized loss on his c. How does the related-party disallowance rule affect the total gain or loss recog- d. Which party wins, and which party loses? How could Marilyn have avoided the loss disallowance on her sale of the land? e. Decision 15. LO.4, 5 Comment on the following transactions: a. Mort owns 500 shares of Pear, Inc. stock with an adjusted basis of $22,000. Orn July 28, 2017, he sells 100 shares for $3,000. On August 16, 2017, he purchases another 100 shares for $3,400. Mort's realized loss of $1,400 ($3,000-$4,400)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started