Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LO7-I, LO7-6 PROBLEM 7.3A Aging Accounts Receivable; Write-offs Putnam & Putnam, a legal firm, uses the balance sheet approach to estimate uncollectible accounts expense. At

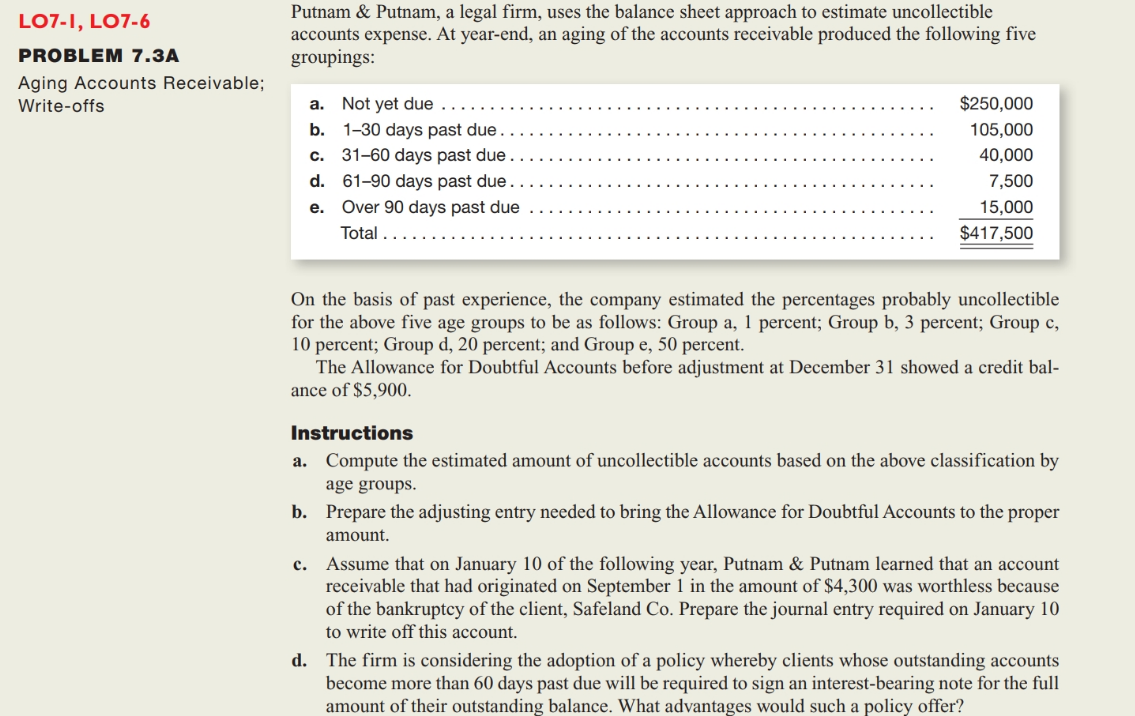

LO7-I, LO7-6 PROBLEM 7.3A Aging Accounts Receivable; Write-offs Putnam \& Putnam, a legal firm, uses the balance sheet approach to estimate uncollectible accounts expense. At year-end, an aging of the accounts receivable produced the following five groupings: On the basis of past experience, the company estimated the percentages probably uncollectible for the above five age groups to be as follows: Group a, 1 percent; Group b, 3 percent; Group c, 10 percent; Group d, 20 percent; and Group e, 50 percent. The Allowance for Doubtful Accounts before adjustment at December 31 showed a credit balance of $5,900. Instructions a. Compute the estimated amount of uncollectible accounts based on the above classification by age groups. b. Prepare the adjusting entry needed to bring the Allowance for Doubtful Accounts to the proper amount. c. Assume that on January 10 of the following year, Putnam \& Putnam learned that an account receivable that had originated on September 1 in the amount of $4,300 was worthless because of the bankruptcy of the client, Safeland Co. Prepare the journal entry required on January 10 to write off this account. d. The firm is considering the adoption of a policy whereby clients whose outstanding accounts become more than 60 days past due will be required to sign an interest-bearing note for the full amount of their outstanding balance. What advantages would such a policy offer? LO7-I, LO7-6 PROBLEM 7.3A Aging Accounts Receivable; Write-offs Putnam \& Putnam, a legal firm, uses the balance sheet approach to estimate uncollectible accounts expense. At year-end, an aging of the accounts receivable produced the following five groupings: On the basis of past experience, the company estimated the percentages probably uncollectible for the above five age groups to be as follows: Group a, 1 percent; Group b, 3 percent; Group c, 10 percent; Group d, 20 percent; and Group e, 50 percent. The Allowance for Doubtful Accounts before adjustment at December 31 showed a credit balance of $5,900. Instructions a. Compute the estimated amount of uncollectible accounts based on the above classification by age groups. b. Prepare the adjusting entry needed to bring the Allowance for Doubtful Accounts to the proper amount. c. Assume that on January 10 of the following year, Putnam \& Putnam learned that an account receivable that had originated on September 1 in the amount of $4,300 was worthless because of the bankruptcy of the client, Safeland Co. Prepare the journal entry required on January 10 to write off this account. d. The firm is considering the adoption of a policy whereby clients whose outstanding accounts become more than 60 days past due will be required to sign an interest-bearing note for the full amount of their outstanding balance. What advantages would such a policy offer

LO7-I, LO7-6 PROBLEM 7.3A Aging Accounts Receivable; Write-offs Putnam \& Putnam, a legal firm, uses the balance sheet approach to estimate uncollectible accounts expense. At year-end, an aging of the accounts receivable produced the following five groupings: On the basis of past experience, the company estimated the percentages probably uncollectible for the above five age groups to be as follows: Group a, 1 percent; Group b, 3 percent; Group c, 10 percent; Group d, 20 percent; and Group e, 50 percent. The Allowance for Doubtful Accounts before adjustment at December 31 showed a credit balance of $5,900. Instructions a. Compute the estimated amount of uncollectible accounts based on the above classification by age groups. b. Prepare the adjusting entry needed to bring the Allowance for Doubtful Accounts to the proper amount. c. Assume that on January 10 of the following year, Putnam \& Putnam learned that an account receivable that had originated on September 1 in the amount of $4,300 was worthless because of the bankruptcy of the client, Safeland Co. Prepare the journal entry required on January 10 to write off this account. d. The firm is considering the adoption of a policy whereby clients whose outstanding accounts become more than 60 days past due will be required to sign an interest-bearing note for the full amount of their outstanding balance. What advantages would such a policy offer? LO7-I, LO7-6 PROBLEM 7.3A Aging Accounts Receivable; Write-offs Putnam \& Putnam, a legal firm, uses the balance sheet approach to estimate uncollectible accounts expense. At year-end, an aging of the accounts receivable produced the following five groupings: On the basis of past experience, the company estimated the percentages probably uncollectible for the above five age groups to be as follows: Group a, 1 percent; Group b, 3 percent; Group c, 10 percent; Group d, 20 percent; and Group e, 50 percent. The Allowance for Doubtful Accounts before adjustment at December 31 showed a credit balance of $5,900. Instructions a. Compute the estimated amount of uncollectible accounts based on the above classification by age groups. b. Prepare the adjusting entry needed to bring the Allowance for Doubtful Accounts to the proper amount. c. Assume that on January 10 of the following year, Putnam \& Putnam learned that an account receivable that had originated on September 1 in the amount of $4,300 was worthless because of the bankruptcy of the client, Safeland Co. Prepare the journal entry required on January 10 to write off this account. d. The firm is considering the adoption of a policy whereby clients whose outstanding accounts become more than 60 days past due will be required to sign an interest-bearing note for the full amount of their outstanding balance. What advantages would such a policy offer Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started