Answered step by step

Verified Expert Solution

Question

1 Approved Answer

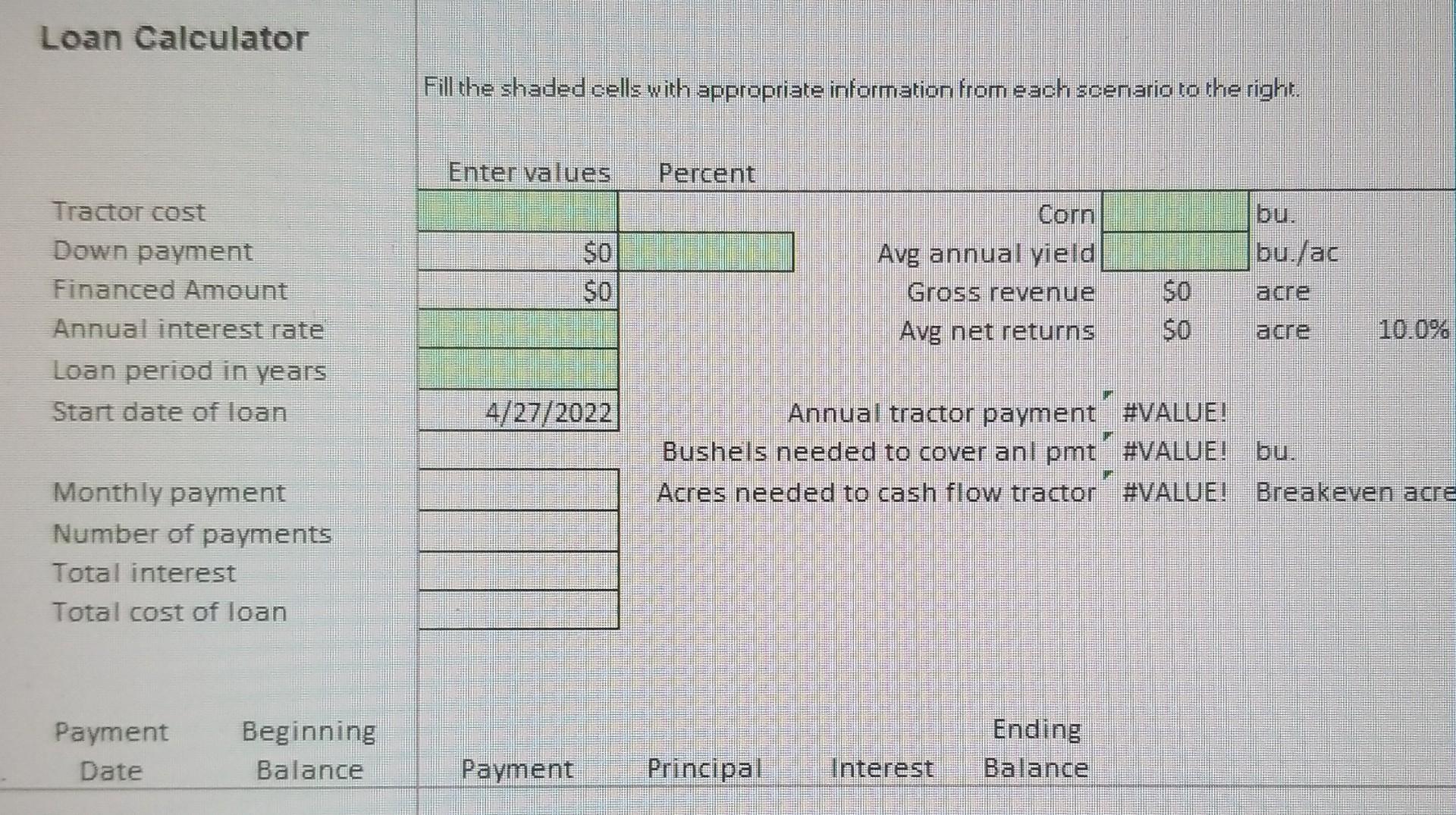

Loan Calculator Fill the shaded cells with appropriate information from each scenario to the right. Enter values Percent bu./ac acre $0 Tractor cost Down payment

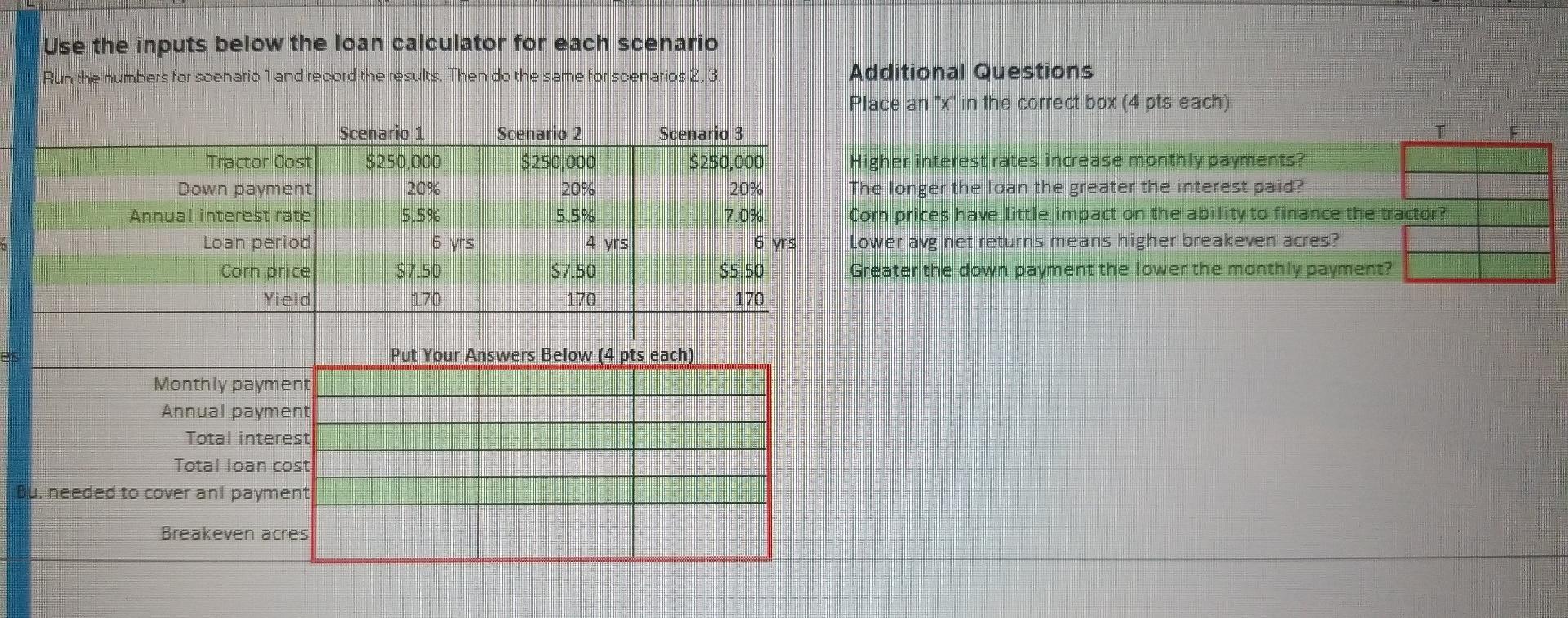

Loan Calculator Fill the shaded cells with appropriate information from each scenario to the right. Enter values Percent bu./ac acre $0 Tractor cost Down payment Financed Amount Annual interest rate Loan period in years Start date of loan Avg annual yield Gross revenue Avg net returns so acre 10.0% 4/27/2022 Annual tractor payment #VALUE! Bushels needed to cover anl pmt #VALUE! bu. Acres needed to cash flow tractor #VALUE! Breakeven acre Monthly payment Number of payments Total interest Total cost of loan Payment Date Beginning Balance Ending Balance Payment Principal Interest Use the inputs below the loan calculator for each scenario Run the numbers for scenario 1 and record the results. Then do the same for scenarios 2, 3. Additional Questions Place an "x" in the correct box (4 pts each) Scenario 1 $250,000 20%6 5.596 Scenario 2 $250,000 20% 5.5% 4 yrs $7.50 170 Soenario 3 $250,000 20 7.0% Tractor Cost Down payment Annual interest rate Loan period Corn price Yield Higher interest rates increase monthly payments? The longer the loan the greater the interest paid? Corn prices have little impact on the ability to finance the tractor? Lower avg net returns means higher breakeven acres? Greater the down payment the lower the monthly payment? 6 yrs 6 VS 57.50 $5.50 170 170 Put Your Answers Below (4 pts each) Monthly payment Annual payment Total interest Total loan cost Bu. needed to cover anl payment Breakeven acres Loan Calculator Fill the shaded cells with appropriate information from each scenario to the right. Enter values Percent bu./ac acre $0 Tractor cost Down payment Financed Amount Annual interest rate Loan period in years Start date of loan Avg annual yield Gross revenue Avg net returns so acre 10.0% 4/27/2022 Annual tractor payment #VALUE! Bushels needed to cover anl pmt #VALUE! bu. Acres needed to cash flow tractor #VALUE! Breakeven acre Monthly payment Number of payments Total interest Total cost of loan Payment Date Beginning Balance Ending Balance Payment Principal Interest Use the inputs below the loan calculator for each scenario Run the numbers for scenario 1 and record the results. Then do the same for scenarios 2, 3. Additional Questions Place an "x" in the correct box (4 pts each) Scenario 1 $250,000 20%6 5.596 Scenario 2 $250,000 20% 5.5% 4 yrs $7.50 170 Soenario 3 $250,000 20 7.0% Tractor Cost Down payment Annual interest rate Loan period Corn price Yield Higher interest rates increase monthly payments? The longer the loan the greater the interest paid? Corn prices have little impact on the ability to finance the tractor? Lower avg net returns means higher breakeven acres? Greater the down payment the lower the monthly payment? 6 yrs 6 VS 57.50 $5.50 170 170 Put Your Answers Below (4 pts each) Monthly payment Annual payment Total interest Total loan cost Bu. needed to cover anl payment Breakeven acres

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started