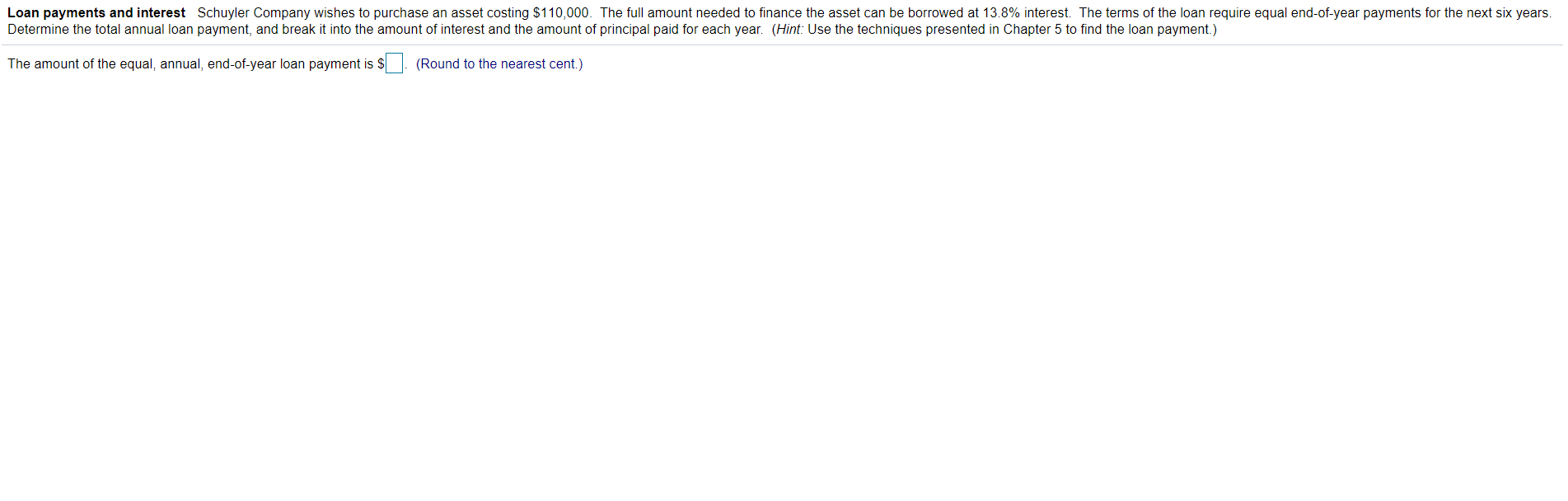

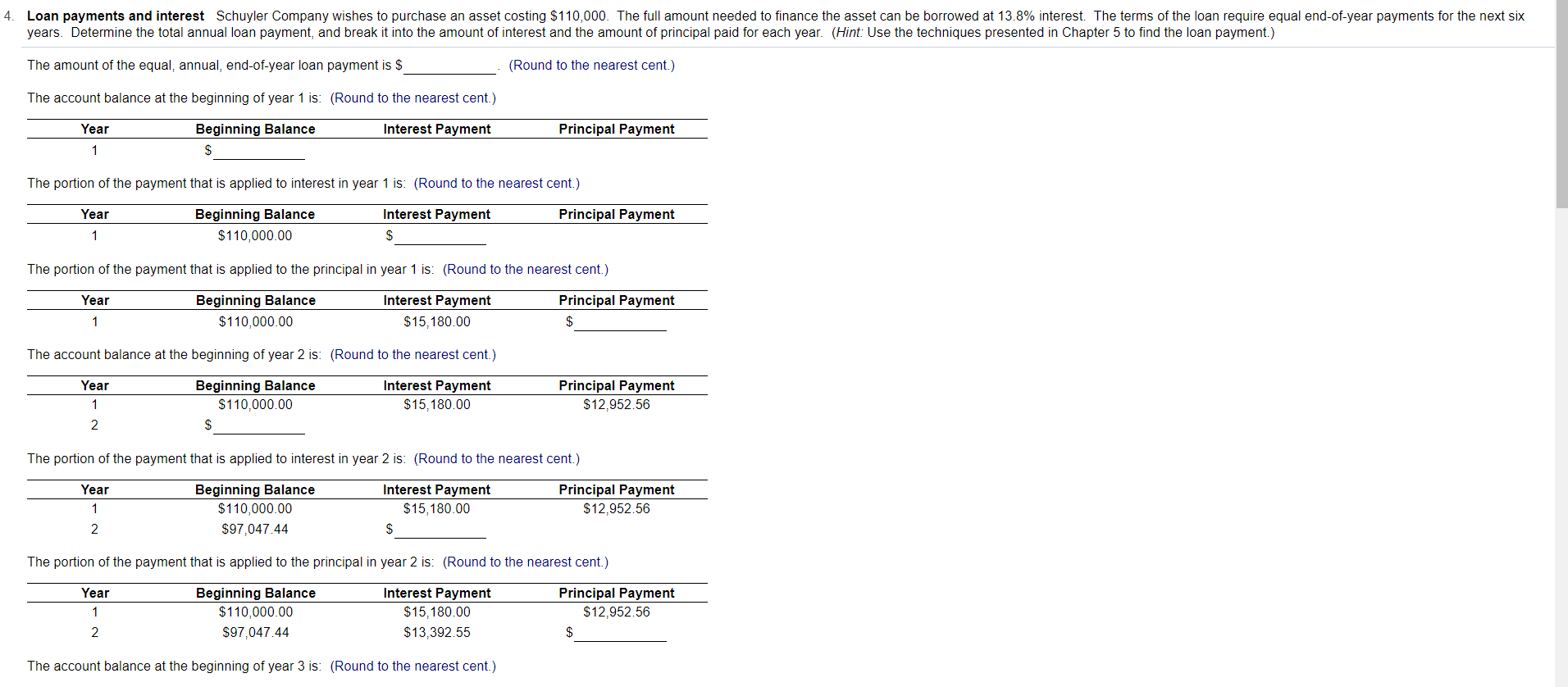

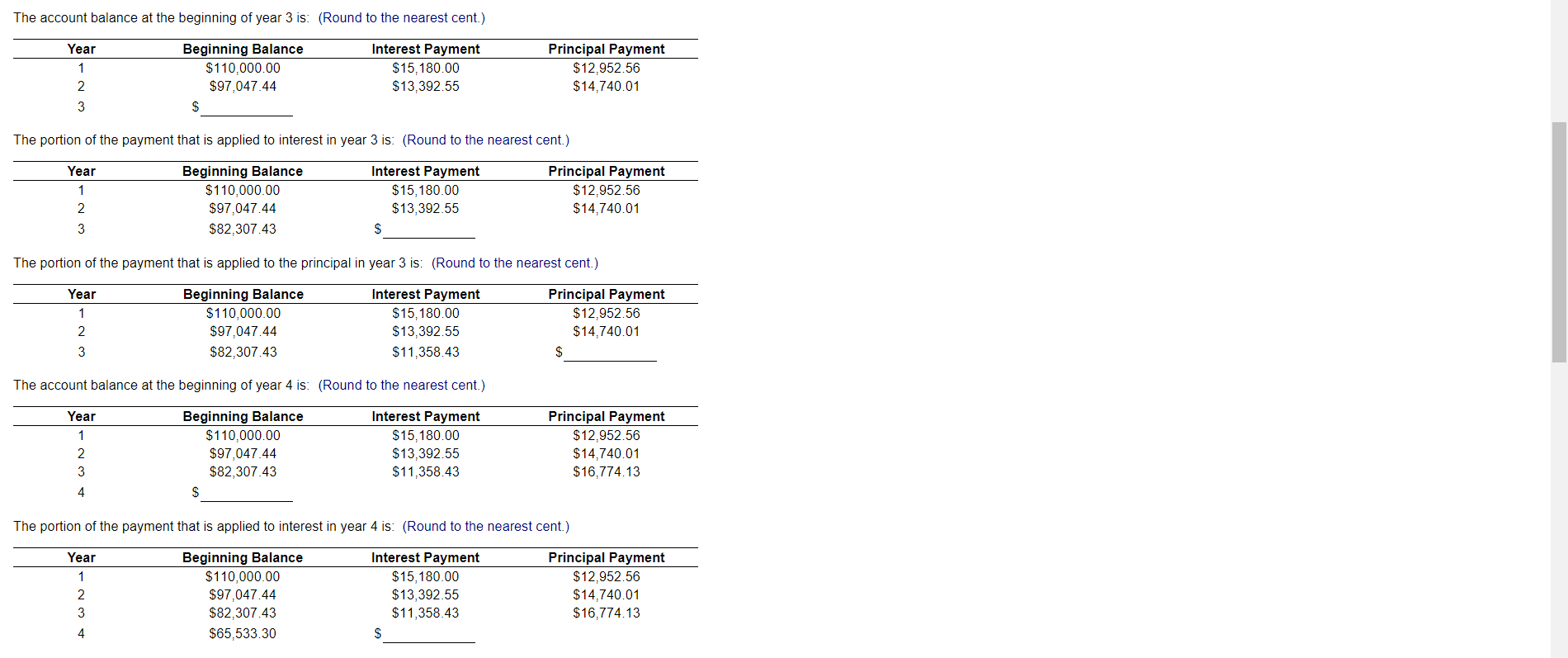

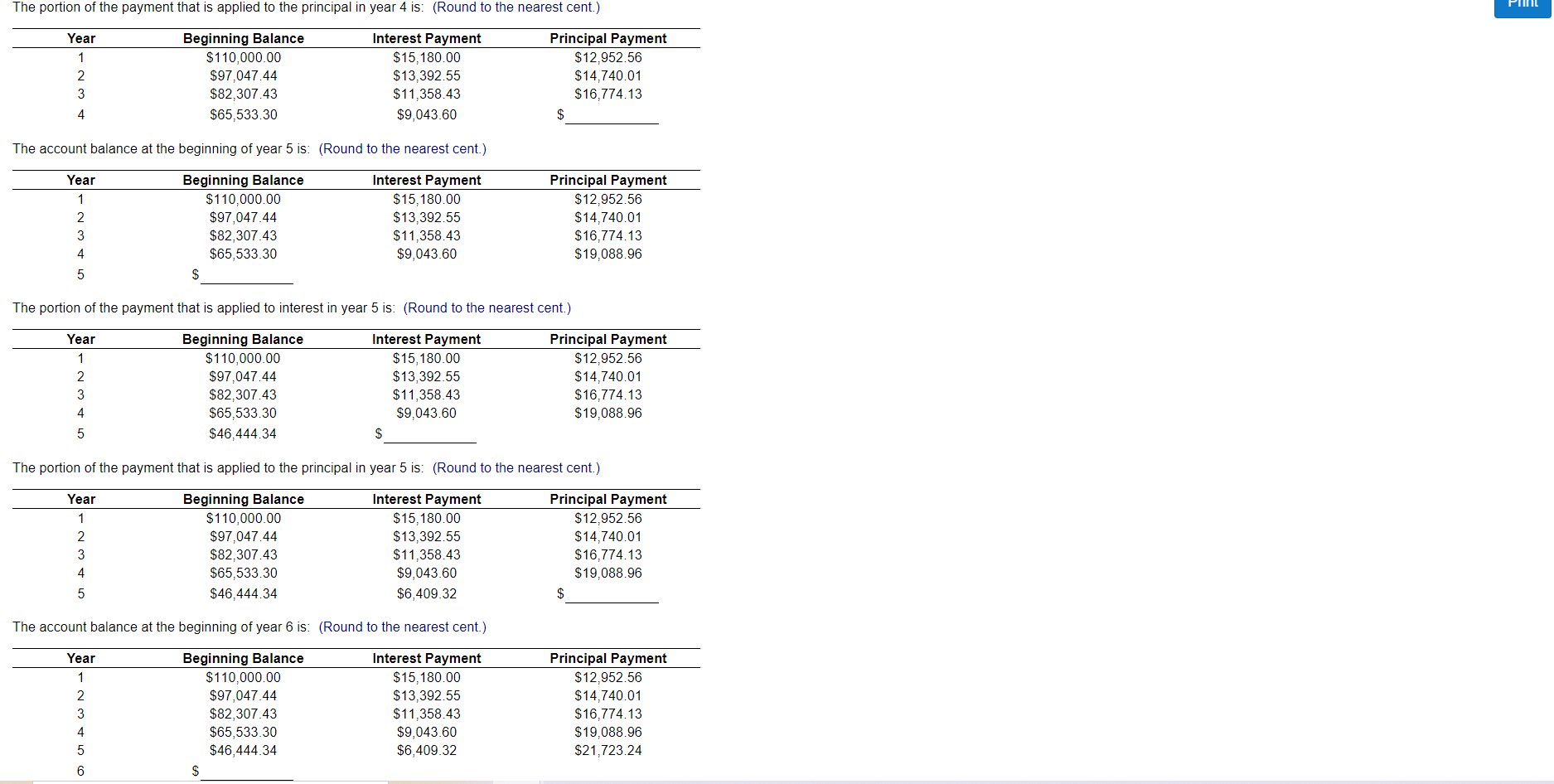

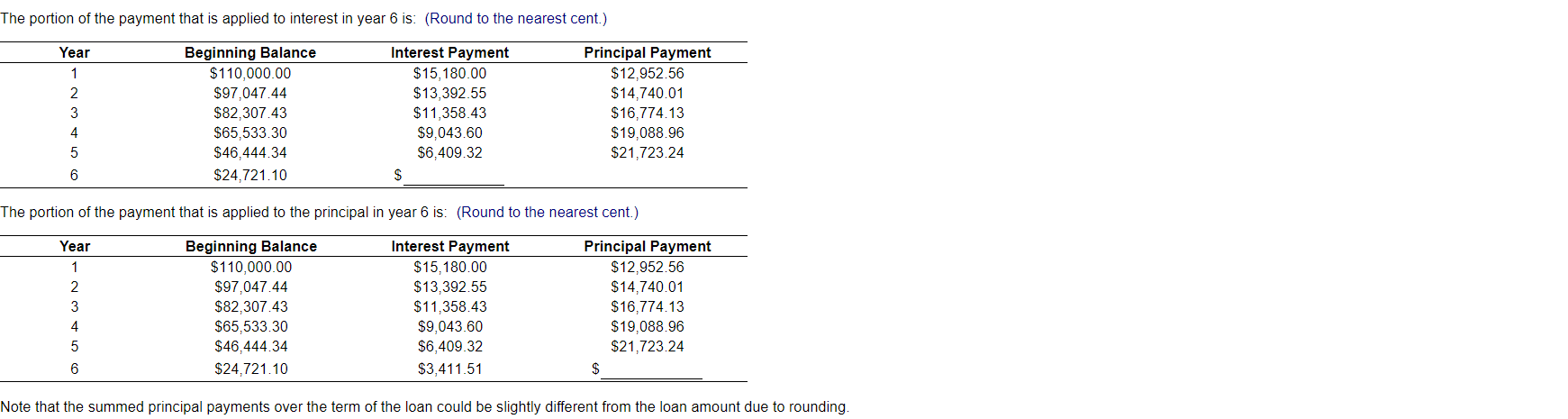

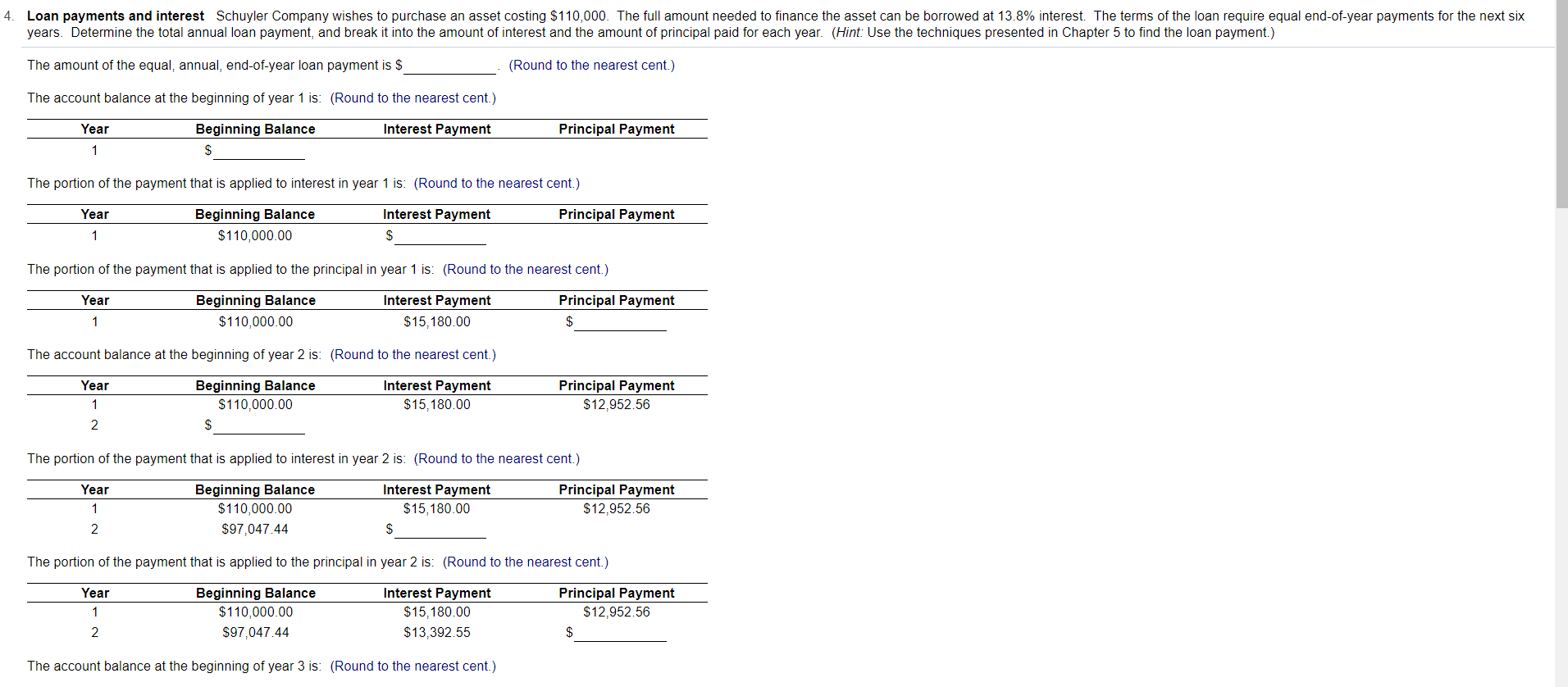

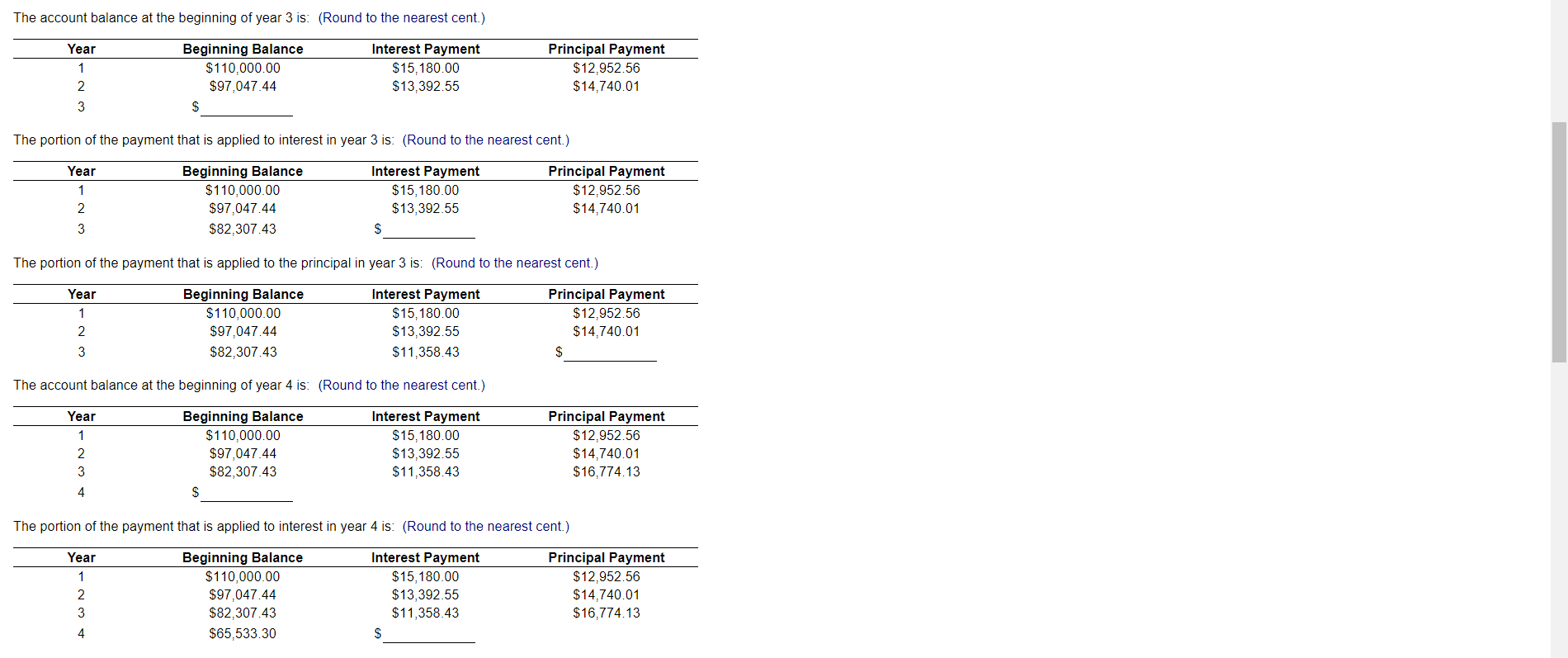

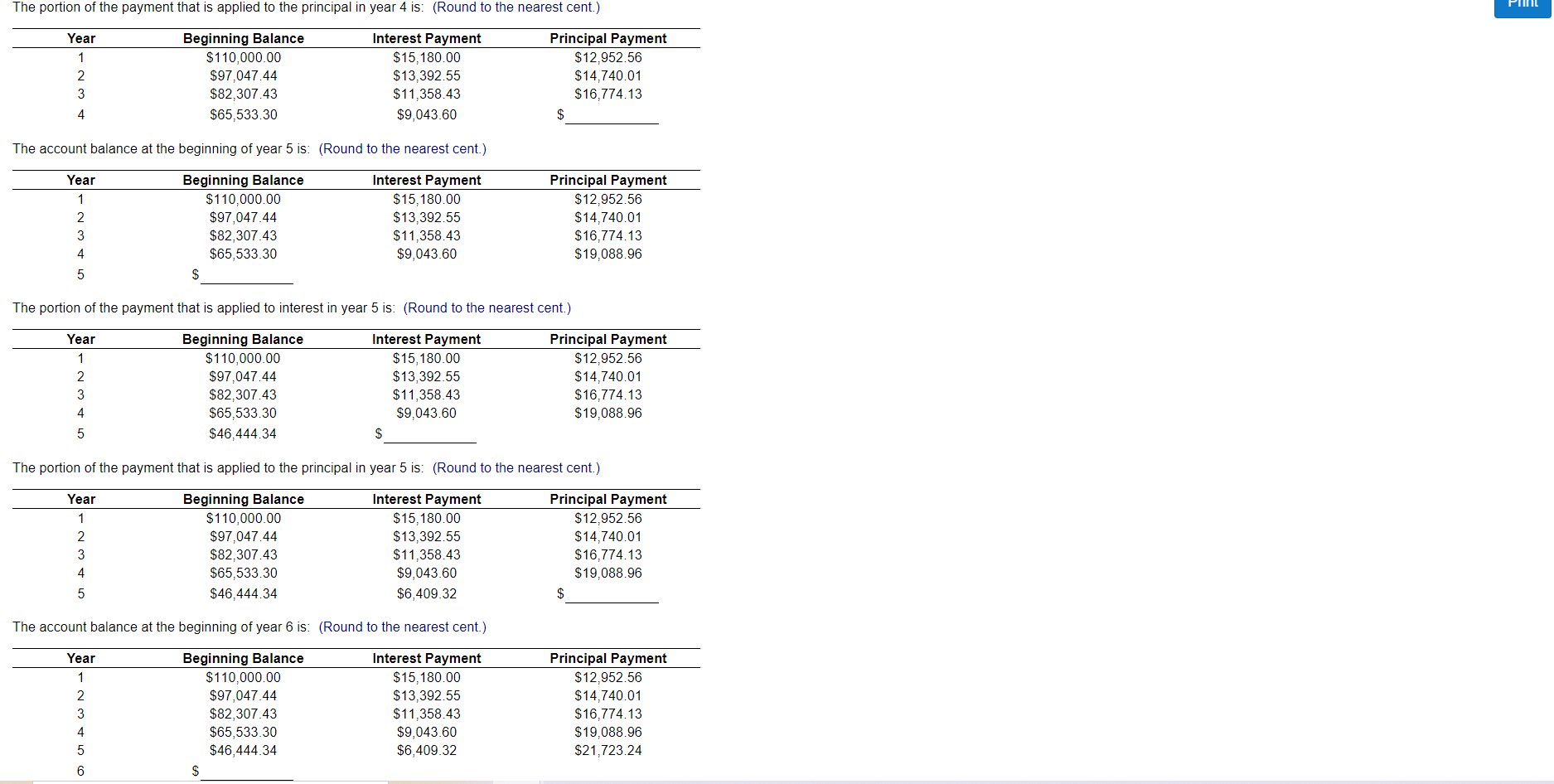

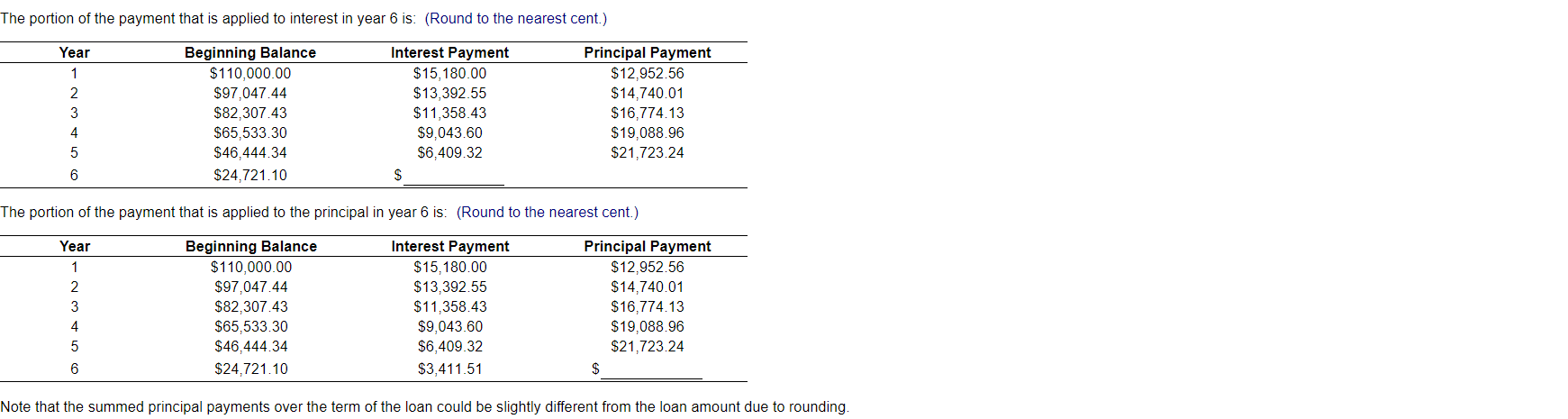

Loan payments and interest Schuyler Company wishes to purchase an asset costing $110,000. The full amount needed to finance the asset can be borrowed at 13.8% interest. The terms of the loan require equal end-of-year payments for the next six years. Determine the total annual loan payment, and break it into the amount of interest and the amount of principal paid for each year. (Hint: Use the techniques presented in Chapter 5 to find the loan payment.) The amount of the equal, annual, end-of-year loan payment is $ (Round to the nearest cent.) 4. Loan payments and interest Schuyler Company wishes to purchase an asset costing $110,000. The full amount needed to finance the asset can be borrowed at 13.8% interest. The terms of the loan require equal end-of-year payments for the next six years. Determine the total annual loan payment, and break it into the amount of interest and the amount of principal paid for each year. (Hint: Use the techniques presented in Chapter 5 to find the loan payment.) The amount of the equal, annual, end-of-year loan payment is $ (Round to the nearest cent.) The account balance at the beginning of year 1 is: (Round to the nearest cent.) Year Interest Payment Principal Payment Beginning Balance $ 1 The portion of the payment that is applied to interest in year 1 is: (Round to the nearest cent.) Year Principal Payment Beginning Balance $110,000.00 Interest Payment $ 1 The portion of the payment that is applied to the principal in year 1 is: (Round to the nearest cent.) Year Beginning Balance $110,000.00 Interest Payment $15,180.00 Principal Payment $ 1 The account balance at the beginning of year 2 is: (Round to the nearest cent.) Year Beginning Balance $110,000.00 S Interest Payment $15,180.00 Principal Payment $12,952.56 1 2 The portion of the payment that is applied to interest in year 2 is: (Round to the nearest cent.) Year 1 2 Beginning Balance $110,000.00 $97,047.44 Interest Payment $15,180.00 $ Principal Payment $12,952.56 The portion of the payment that is applied to the principal in year 2 is: (Round to the nearest cent.) Year Beginning Balance $110,000.00 $97,047.44 1 Interest Payment $15,180.00 $13,392.55 Principal Payment $12,952.56 2 The account balance at the beginning of year 3 is: (Round to the nearest cent.) The account balance at the beginning of year 3 is: (Round to the nearest cent.) Year 1 2 3 Beginning Balance $110,000.00 $97,047.44 S Interest Payment $15,180.00 $13,392.55 Principal Payment $12,952.56 $14,740.01 The portion of the payment that is applied to interest in year 3 is: (Round to the nearest cent.) Year 1 2 Beginning Balance $110,000.00 $97,047.44 $82,307.43 Interest Payment $15,180.00 $13,392.55 $ Principal Payment $12,952.56 $14,740.01 3 The portion of the payment that is applied to the principal in year 3 is: (Round to the nearest cent.) Year 1 2 Beginning Balance $110,000.00 $97,047.44 $82,307.43 Interest Payment $15,180.00 $13,392.55 $11,358.43 Principal Payment $12,952.56 $14,740.01 $ 3 The account balance at the beginning of year 4 is: (Round to the nearest cent.) Year 1 2 3 Beginning Balance $110,000.00 $97,047.44 $82,307.43 Interest Payment $15,180.00 $13,392.55 $11,358.43 Principal Payment $12.952.56 $14,740.01 $16,774.13 4 S The portion of the payment that is applied to interest in year 4 is: (Round to the nearest cent.) Year 1 2 3 Beginning Balance $110,000.00 $97,047.44 $82,307.43 $65,533.30 Interest Payment $15,180.00 $13,392.55 $11,358.43 Principal Payment $12,952.56 $14.740.01 $16.774.13 4 S The portion of the payment that is applied to the principal in year 4 is: (Round to the nearest cent.) Year 1 2 3 4 Beginning Balance $110,000.00 $97,047.44 $82,307.43 $65,533.30 Interest Payment $15,180.00 $13,392.55 $11,358.43 $9,043.60 Principal Payment $12,952.56 $14,740.01 $16,774.13 $ The account balance at the beginning of year 5 is: (Round to the nearest cent.) Year 1 2 3 4 Beginning Balance $110,000.00 $97,047.44 $82,307.43 $65,533.30 S Interest Payment $15,180.00 $13,392.55 $11,358.43 $9,043.60 Principal Payment $12,952.56 $14,740.01 $16.774.13 $19,088.96 5 The portion of the payment that is applied to interest in year 5 is: (Round to the nearest cent.) Year 1 2 3 4 Beginning Balance $110,000.00 $97,047.44 $82,307.43 $65,533.30 $46,444.34 Interest Payment $15,180.00 $13,392.55 $11,358.43 $9,043.60 Principal Payment $12,952.56 $14,740.01 $16,774.13 $19,088.96 5 The portion of the payment that is applied to the principal in year 5 is: (Round to the nearest cent.) Year 1 2 3 4 Beginning Balance $110,000.00 $97,047.44 $82,307.43 $65,533.30 $46,444.34 Interest Payment $15,180.00 $13,392.55 $11,358.43 $9,043.60 $6,409.32 Principal Payment $12.952.56 $14,740.01 $16.774.13 $19,088.96 5 The account balance at the beginning of year 6 is: (Round to the nearest cent.) Year 1 2 3 Beginning Balance $110,000.00 $97,047.44 $82,307.43 $65,533.30 $46,444.34 S Interest Payment $15,180.00 $13,392.55 $11,358.43 $9,043.60 $6,409.32 Principal Payment $12,952.56 $14,740.01 $16,774.13 $19,088.96 $21,723.24 4 5 6 The portion of the payment that is applied to interest in year 6 is: (Round to the nearest cent.) Year 1 2 3 4 5 Beginning Balance $110,000.00 $97,047.44 $82,307.43 $65,533.30 $46,444.34 $24.721.10 Interest Payment $15,180.00 $13,392.55 $11,358.43 $9,043.60 $6,409.32 S Principal Payment $12,952.56 $14,740.01 $16,774.13 $19.088.96 $21,723.24 6 The portion of the payment that is applied to the principal in year 6 is: (Round to the nearest cent.) Year 1 2 Beginning Balance $110,000.00 $97,047.44 $82,307.43 $65,533.30 $46,444.34 $24,721.10 3 Interest Payment $15,180.00 $13,392.55 $11,358.43 $9,043.60 $6,409.32 $3,411.51 Principal Payment $12,952.56 $14,740.01 $16,774.13 $19,088.96 $21,723.24 4 5 6 Note that the summed principal payments over the term of the loan could be slightly different from the loan amount due to rounding