Question

Loans to Employees Because of her outstanding performance, Tricia fox is negotiating a significant increase in her annual compensation. After considering various alternatives she has

Loans to Employees

Because of her outstanding performance, Tricia fox is negotiating a significant increase in her annual compensation. After considering various alternatives she has decided her preferable increase in the form of a $300000 interest free loan. She will use the proceeds of loan to purchase income producing investment. This mean any interest on loan either amounts paid or amounts imputed as a taxable benefit, will be fully deductible. Other information that is relevant to this decision is as follows:

Her investments are expected to provide a pre tax return of 11%. She can acquire a similar term 300000 loan at an annual rate of 4.6% her employer, a Canadian public company is subject to tax at a combined federal and provincial rate of 28%. The company has a alternative investment opportunities that earn a pre tax rate of 5% Her various sources of income are such that any additional income will be taxed at a rate of 49% Assume that relevant prescribed rate for all periods under consideration is 2%

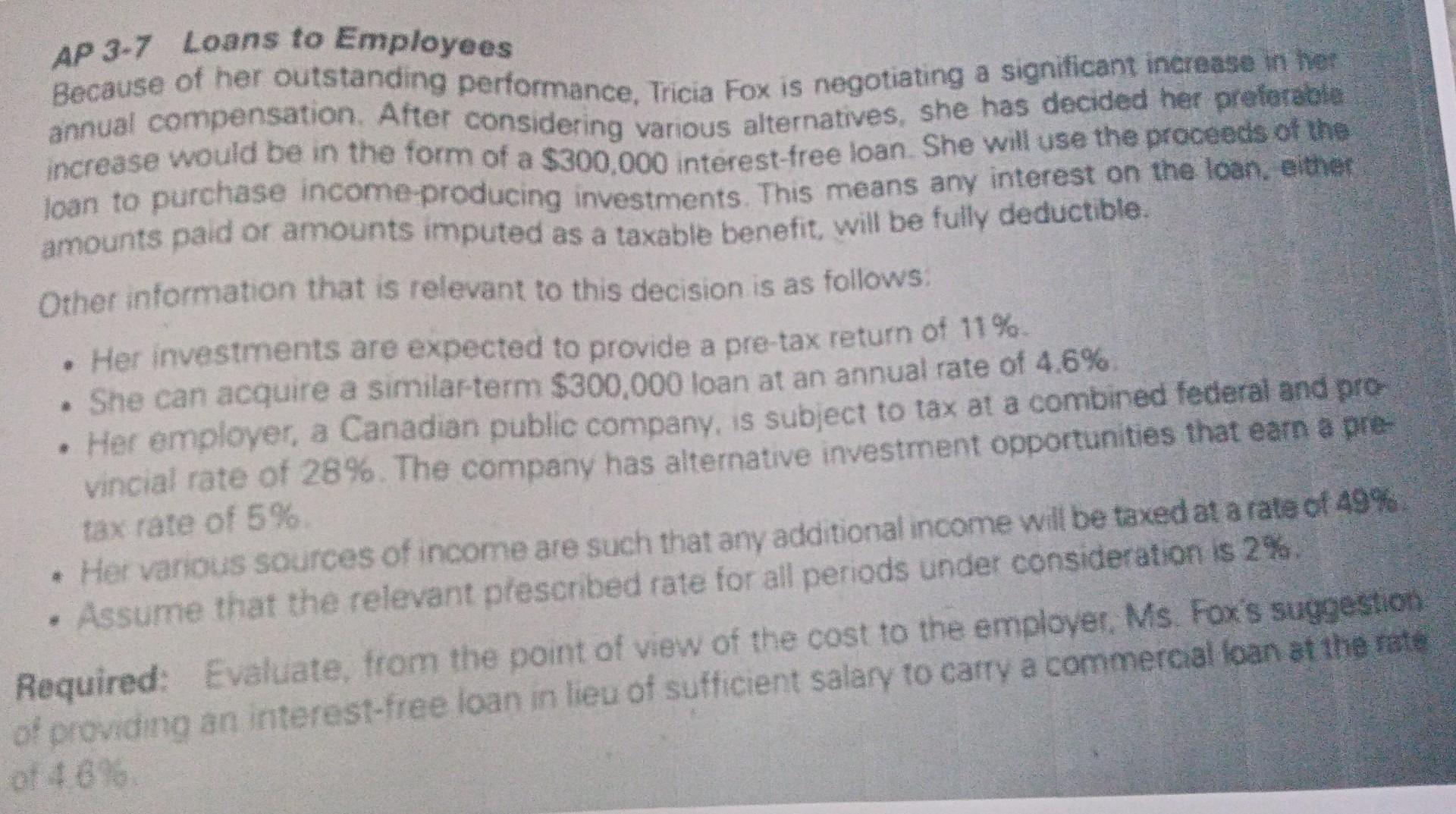

AP 3-7 Loans to Employees Because of her outstanding performance, Tricia Fox is negotiating a significant increase in her annual compensation. After considering various alternatives, she has decided her preferable increase would be in the form of a $300,000 interest-free loan. She will use the proceeds of the loan to purchase income-producing investments. This means any interest on the loan, either amounts paid or amounts imputed as a taxable benefit, will be fully deductible. Other information that is relevant to this decision is as follows: . Her investments are expected to provide a pre-tax return of 11%. She can acquire a similar-term $300,000 loan at an annual rate of 4.6%. # # Her employer, a Canadian public company, is subject to tax at a combined federal and pro- vincial rate of 28%. The company has alternative investment opportunities that earn a pre- tax rate of 5%. Her various sources of income are such that any additional income will be taxed at a rate of 49%. Assume that the relevant prescribed rate for all periods under consideration is 2%. Required: Evaluate, from the point of view of the cost to the employer, Ms. Fox's suggestion of providing an interest-free loan in lieu of sufficient salary to carry a commercial loan at the rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started