Answered step by step

Verified Expert Solution

Question

1 Approved Answer

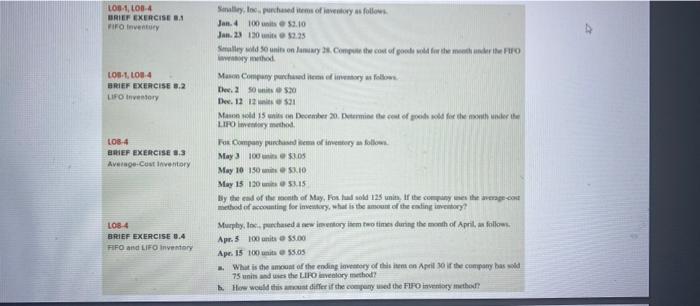

LOB-1, LOB-4 BRIEF EXERCISE 8.1 FIFO Inventory LOB-1, LOB-4 BRIEF EXERCISE 8.2 LIFO Inventory LOB-4 BRIEF EXERCISE 8.3 Average-Cost Inventory Smalley, Inc., purchased items

LOB-1, LOB-4 BRIEF EXERCISE 8.1 FIFO Inventory LOB-1, LOB-4 BRIEF EXERCISE 8.2 LIFO Inventory LOB-4 BRIEF EXERCISE 8.3 Average-Cost Inventory Smalley, Inc., purchased items of inventory as follows Jan. 4 100 units $2.10 Jan. 23 120 units $2.25 Smalley sold 50 units on January 28. Compute the cost of goods sold for the month under the FIFO avratory method Mason Company purchased items of inventory as follows Dec. 2 50 units $20 Dec. 12 12 units $21 Mason sold 15 units on December 20. Determine the cost of goods sold for the month under the LIFO inventory method. Fox Company purchased items of inventory as follows. May 3100 units $3.05 May 10 150 units 53.10 $3.15 L08-4 BRIEF EXERCISE 8.4 FIFO and LIFO Inventory May 15 120 units By the end of the month of May, Fos had sold 125 units, If the company uses the average-cont method of accounting for inventory, what is the amount of the ending inventory? Murphy, Inc., purchased a new inventory item two times during the month of April, as follows. Apr. 5 100 units $5.00 Apr. 15 100 units 55.05 a. What is the amount of the ending inventory of this item on April 30 if the company has sold 75 units and uses the LIFO inventory method? b. How would this amount differ if the company used the FIFO inventory method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started