Answered step by step

Verified Expert Solution

Question

1 Approved Answer

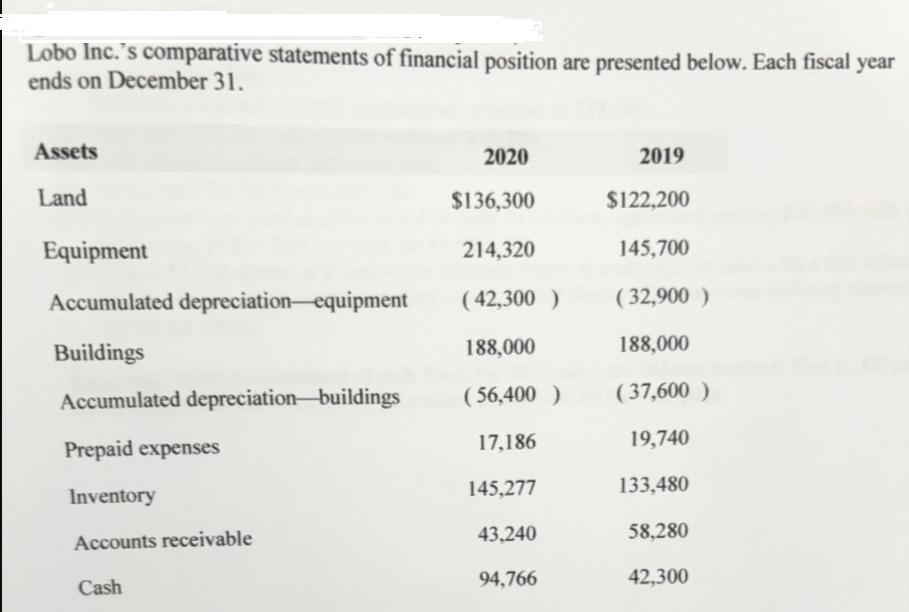

Lobo Inc.'s comparative statements of financial position are presented below. Each fiscal year ends on December 31. Assets Land Equipment Accumulated depreciation equipment Buildings

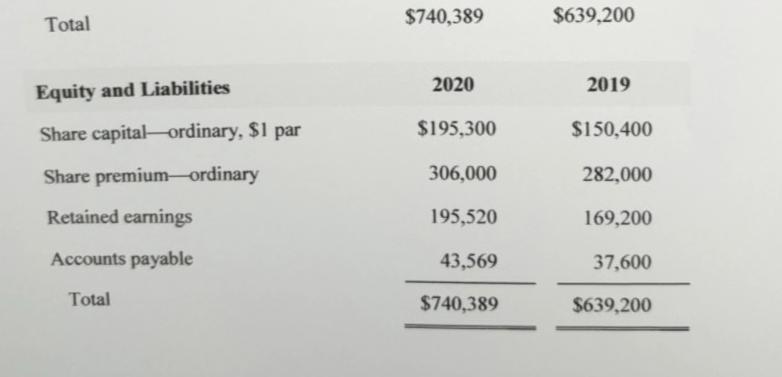

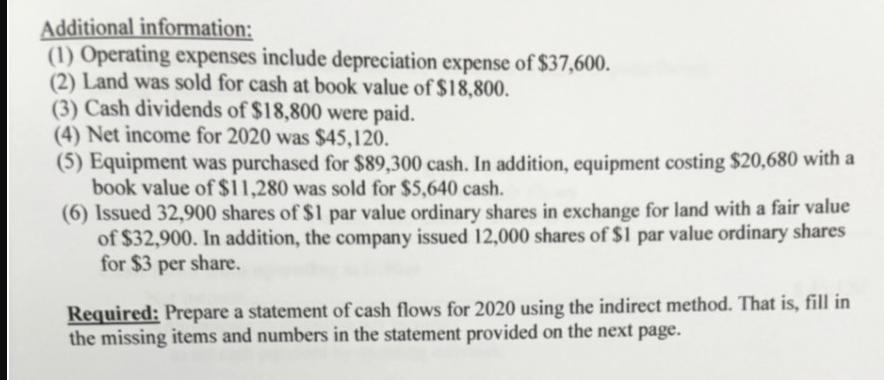

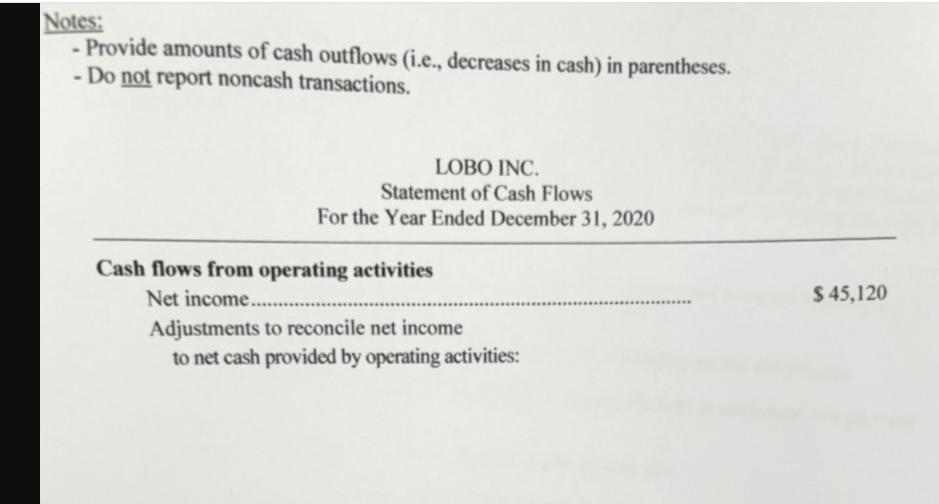

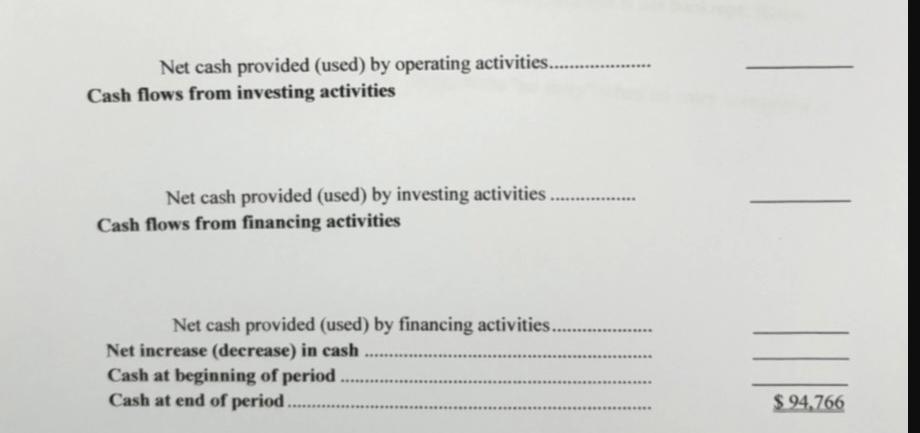

Lobo Inc.'s comparative statements of financial position are presented below. Each fiscal year ends on December 31. Assets Land Equipment Accumulated depreciation equipment Buildings Accumulated depreciation buildings Prepaid expenses Inventory Accounts receivable Cash 2020 $136,300 214,320 (42,300 ) 188,000 (56,400 ) 17,186 145,277 43,240 94,766 2019 $122,200 145,700 (32,900) 188,000 (37,600) 19,740 133,480 58,280 42,300 Total Equity and Liabilities Share capital-ordinary, $1 par Share premium ordinary Retained earnings Accounts payable Total $740,389 2020 $195,300 306,000 195,520 43,569 $740,389 $639,200 2019 $150,400 282,000 169,200 37,600 $639,200 Additional information: (1) Operating expenses include depreciation expense of $37,600. (2) Land was sold for cash at book value of $18,800. (3) Cash dividends of $18,800 were paid. (4) Net income for 2020 was $45,120. (5) Equipment was purchased for $89,300 cash. In addition, equipment costing $20,680 with a book value of $11,280 was sold for $5,640 cash. (6) Issued 32,900 shares of $1 par value ordinary shares in exchange for land with a fair value of $32,900. In addition, the company issued 12,000 shares of $1 par value ordinary shares for $3 per share. Required: Prepare a statement of cash flows for 2020 using the indirect method. That is, fill in the missing items and numbers in the statement provided on the next page. Notes: - Provide amounts of cash outflows (i.e., decreases in cash) in parentheses. - Do not report noncash transactions. LOBO INC. Statement of Cash Flows For the Year Ended December 31, 2020 Cash flows from operating activities Net income..... ********* Adjustments to reconcile net income to net cash provided by operating activities: $45,120 Net cash provided (used) by operating activities............ Cash flows from investing activities Net cash provided (used) by investing activities.................... Cash flows from financing activities Net cash provided (used) by financing activities. Net increase (decrease) in cash Cash at beginning of period. Cash at end of period. ******* ************* **************** 1 $94,766

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Statement of cash flows using indirect method is given below LOBO Inc Statement of Cash Flows For th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started