Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acme Corporation enters into a 5 year term loan with JP Morgan bank on January 1, 2020. JP Morgan is the lead with 40%

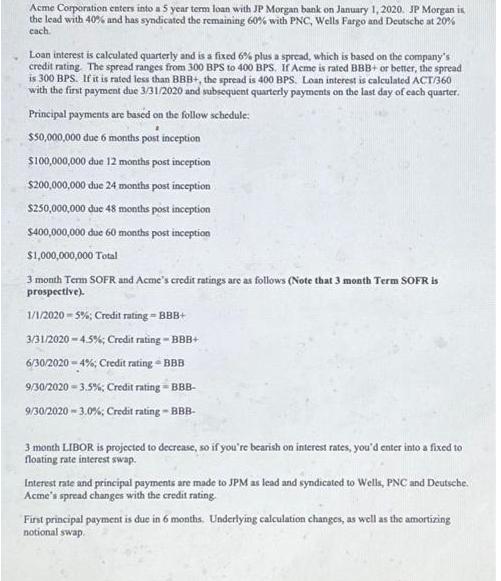

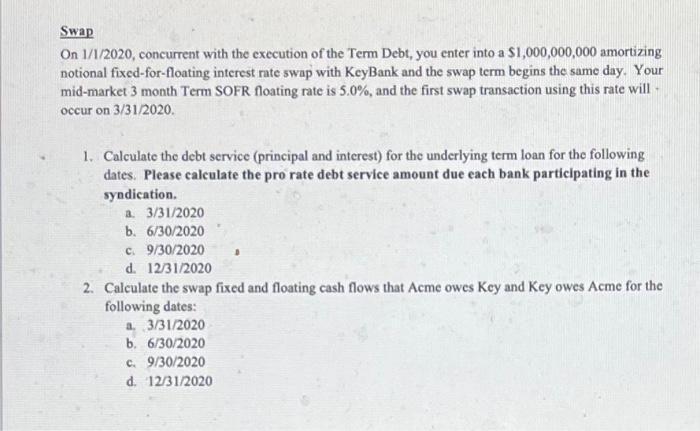

Acme Corporation enters into a 5 year term loan with JP Morgan bank on January 1, 2020. JP Morgan is the lead with 40% and has syndicated the remaining 60% with PNC, Wells Fargo and Deutsche at 20% cch Loan interest is calculated quarterly and is a fixed 6% plus a spread, which is based on the company's credit rating. The spread ranges from 300 BPS to 400 BPS. If Acme is rated BBB+ or better, the spread is 300 BPS. If it is rated less than BBB+, the spread is 400 BPS. Loan interest is calculated ACT/360 with the first payment due 3/31/2020 and subsequent quarterly payments on the last day of each quarter. Principal payments are based on the follow schedule: $50,000,000 due 6 months post inception $100,000,000 due 12 months post inception $200,000,000 due 24 months post inception $250,000,000 due 48 months post inception $400,000,000 due 60 months post inception $1,000,000,000 Total 3 month Term SOFR and Acme's credit ratings are as follows (Note that 3 month Term SOFR is prospective). 1/1/2020-5%; Credit rating - BBB+ 3/31/2020-4.5%; Credit rating - BBB+ 6/30/2020-4%; Credit rating - BBB 9/30/2020 -3.5%; Credit rating - BBB- 9/30/2020 -3.0%; Credit rating - BBB- 3 month LIBOR is projected to decrease, so if you're bearish on interest rates, you'd enter into a fixed to floating rate interest swap. Interest rate and principal payments are made to JPM as lead and syndicated to Wells, PNC and Deutsche. Acme's spread changes with the credit rating. First principal payment is due in 6 months. Underlying calculation changes, as well as the amortizing notional swap. Swap On 1/1/2020, concurrent with the execution of the Term Debt, you enter into a $1,000,000,000 amortizing notional fixed-for-floating interest rate swap with KeyBank and the swap term begins the same day. Your mid-market 3 month Term SOFR floating rate is 5.0%, and the first swap transaction using this rate will - occur on 3/31/2020. 1. Calculate the debt service (principal and interest) for the underlying term loan for the following dates. Please calculate the pro rate debt service amount due each bank participating in the syndication. a. 3/31/2020 b. 6/30/2020 c. 9/30/2020 d. 12/31/2020 2. Calculate the swap fixed and floating cash flows that Acme owes Key and Key owes Acme for the following dates: a 3/31/2020 b. 6/30/2020 c. 9/30/2020 d. 12/31/2020

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The swap would have a notional value of 1000000000 a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started