Question

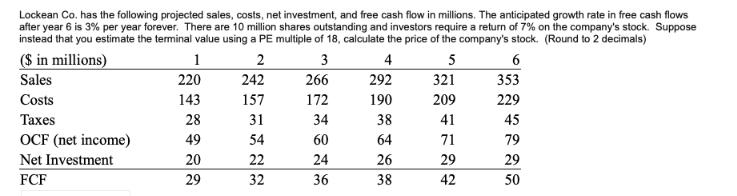

Lockean Co. has the following projected sales, costs, net investment, and free cash flow in millions. The anticipated growth rate in free cash flows

Lockean Co. has the following projected sales, costs, net investment, and free cash flow in millions. The anticipated growth rate in free cash flows after year 6 is 3% per year forever. There are 10 million shares outstanding and investors require a return of 7% on the company's stock. Suppose instead that you estimate the terminal value using a PE multiple of 18, calculate the price of the company's stock. (Round to 2 decimals) 2 3 4 5 6 353 229 ($ in millions) Sales Costs Taxes OCF (net income) Net Investment FCF 1 220 143 28 49 20 29 242 157 31 54 22 32 266 172 34 60 24 36 292 190 38 64 26 38 321 209 41 71 29 42 45 79 29 50

Step by Step Solution

3.47 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the stock price using the terminal value approach with a pricetoearnings PE multiple of 18 we need to determine the terminal free cash fl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App