Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Loco Berhad issued 2,000 convertible bonds on January 1, 2019. The bonds have a three years term and are issued with a face value

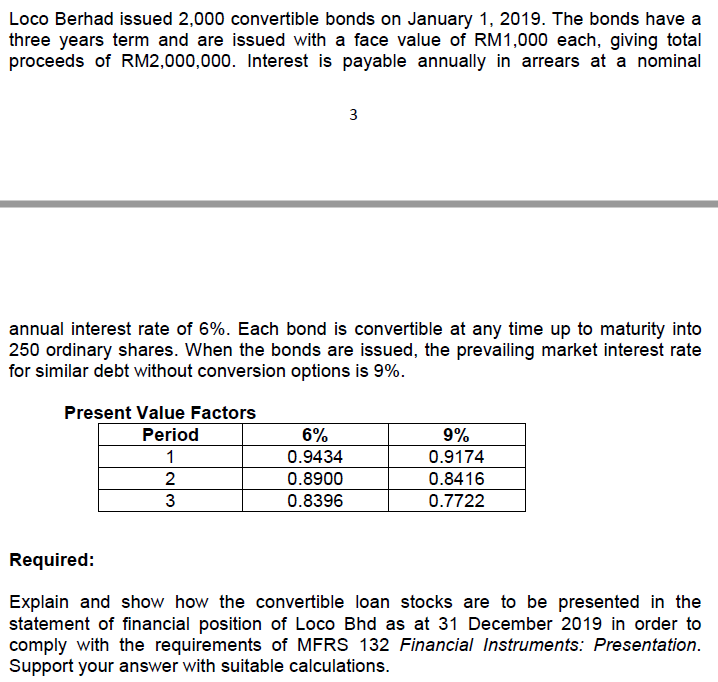

Loco Berhad issued 2,000 convertible bonds on January 1, 2019. The bonds have a three years term and are issued with a face value of RM1,000 each, giving total proceeds of RM2,000,000. Interest is payable annually in arrears at a nominal 3 annual interest rate of 6%. Each bond is convertible at any time up to maturity into 250 ordinary shares. When the bonds are issued, the prevailing market interest rate for similar debt without conversion options is 9%. Present Value Factors Period 6% 9% 0.9174 1 0.9434 2 0.8900 0.8416 3 0.8396 0.7722 Required: Explain and show how the convertible loan stocks are to be presented in the statement of financial position of Loco Bhd as at 31 December 2019 in order to comply with the requirements of MFRS 132 Financial Instruments: Presentation. Support your answer with suitable calculations.

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Period Cash Flows PV Factor 9 PV Value 1 120000 09174 110088 2 120000 08416 100992 3 120000 07722 92...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started