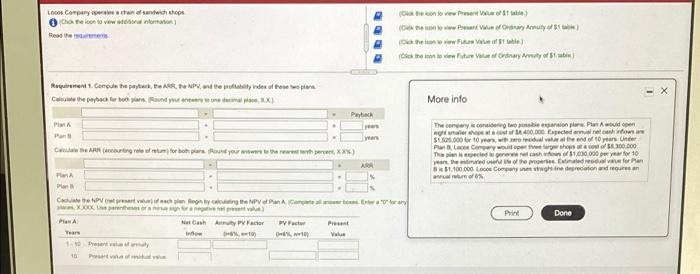

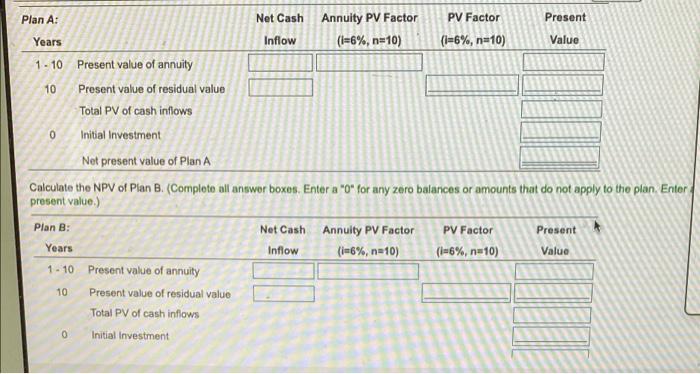

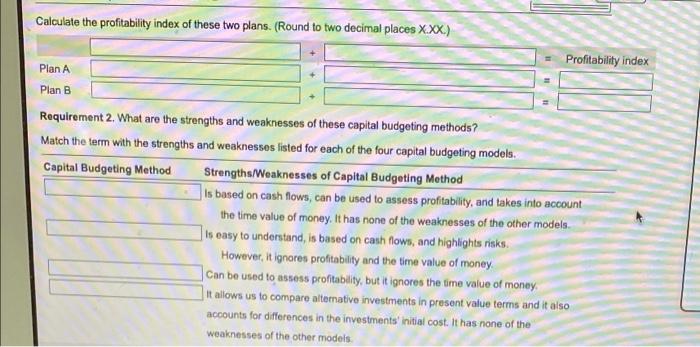

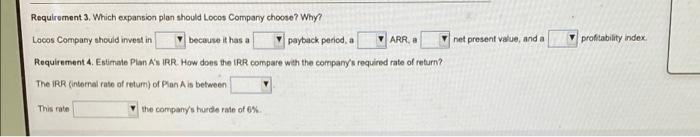

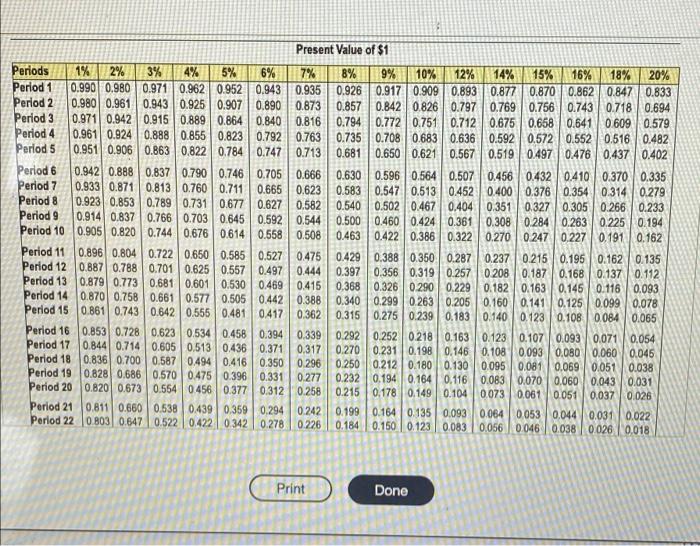

Locos Company and with tops One me lean to van dharam internation) Read Choke on to view Present) Cenew Arruty of Owee of id the non lo ven Wordenary of this Requirement 1. Com the pack, ARR. NPV and the probly index of these were Cite the paper and your decimal XX) More info Pay ya yan Casting more for both for your XXX The concordatorio por PA would open e aerop we cost of $8.400.000 gecedar ret how sist.000 years, while and often The parece ser ou 080.000 per year 10 up parte de propriedade 51.100.000 Coco Company at Mine degreclined more on album AR PA Print Cat Planleg ty ng NPV PAC XOXO Plan Cash ty PF Puct Years O. Done Present Vue 18 Plan A: Net Cash Annuity PV Factor PV Factor Present Years Inflow (1=6%, n=10) (i=6%, n=10) Value 1 - 10 Present value of annuity 10 Present value of residual value Total PV of cash inflows 0 Initial Investment Net present value of Plan A Calculate the NPV of Pian B. (Complete all answer boxes. Enter a "O" for any zero balances or amounts that do not apply to the plan. Enter present value.) Plan B : Net Cash Present Annuity PV Factor (1=6%, n=10) PV Factor (1=6%, n=10) Year's Inflow Value 1 - 10 10 Present value of annuity Present value of residual value Total PV of cash inflows 0 Initial Investment Calculate the profitability index of these two plans. (Round to two decimal places X.XX.) Profitability index Plan A Plan B Requirement 2. What are the strengths and weaknesses of these capital budgeting methods? Match the term with the strengths and weaknesses listed for each of the four capital budgeting models. Capital Budgeting Method Strengths/Weaknesses of Capital Budgeting Method Is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other models Is easy to understand, is based on cash flows, and highlights risks. However, it ignores profitability and the time value of money. Can be used to assess profitability, but it ignores the time value of money, It allows us to compare alternative investments in present value terms and it also accounts for differences in the investments initial cost. It has none of the weaknesses of the other models ARR. net present value, and a profitability index Requirement 3. Which expansion plan should Locos Company choose? Why? Lacos Company should invest in because it has a payback period, a Requirement 4. Estimato Plan A IRR. How does the IRR compare with the company's required rate of return? The IRR (internal rate of retum) of Plan A is between This rate the company's hurde rate of 0% % Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 | 0.909 0.893 0.877 0.870 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.7180.694 Period 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 / 0.668 0.641 0.609 0.579 Period 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 | 0.567 0.519 0.497 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.7600.7110.665 0.623 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 Period 9 0.914 0.837 0.766 0.703 0.6450.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 / 0.225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 Period 11 0.896 0.8040.722 0.650 0.585 0.527 0.475 0.429 0.3880.350 0.287 0.237 0.215 0.1950.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 02080.187 0.1680.137/0.112 Period 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 Period 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 Period 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.0840.065 Period 16 0.853 0.7280.623 0.534 0.4580.394 0.339 0.292 0.252 0.218 0.163 0.123 0.1070.093 0.071 0.054 Period 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.146 0.108 0.093 0.080 0.060 0.045 Period 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 Period 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 Period 20 0.820 0.673 0.5540.456 0.377 0.3120.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 Period 21 0.811 0.660 0.5380439 0.359 0.294 0.242 0.1990.1640.135 0.093 0.064 0.053 0.044 0.031 0.022 Period 22 0803 0.647 0.522 0422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0,018 Print Done Locos Company and with tops One me lean to van dharam internation) Read Choke on to view Present) Cenew Arruty of Owee of id the non lo ven Wordenary of this Requirement 1. Com the pack, ARR. NPV and the probly index of these were Cite the paper and your decimal XX) More info Pay ya yan Casting more for both for your XXX The concordatorio por PA would open e aerop we cost of $8.400.000 gecedar ret how sist.000 years, while and often The parece ser ou 080.000 per year 10 up parte de propriedade 51.100.000 Coco Company at Mine degreclined more on album AR PA Print Cat Planleg ty ng NPV PAC XOXO Plan Cash ty PF Puct Years O. Done Present Vue 18 Plan A: Net Cash Annuity PV Factor PV Factor Present Years Inflow (1=6%, n=10) (i=6%, n=10) Value 1 - 10 Present value of annuity 10 Present value of residual value Total PV of cash inflows 0 Initial Investment Net present value of Plan A Calculate the NPV of Pian B. (Complete all answer boxes. Enter a "O" for any zero balances or amounts that do not apply to the plan. Enter present value.) Plan B : Net Cash Present Annuity PV Factor (1=6%, n=10) PV Factor (1=6%, n=10) Year's Inflow Value 1 - 10 10 Present value of annuity Present value of residual value Total PV of cash inflows 0 Initial Investment Calculate the profitability index of these two plans. (Round to two decimal places X.XX.) Profitability index Plan A Plan B Requirement 2. What are the strengths and weaknesses of these capital budgeting methods? Match the term with the strengths and weaknesses listed for each of the four capital budgeting models. Capital Budgeting Method Strengths/Weaknesses of Capital Budgeting Method Is based on cash flows, can be used to assess profitability, and takes into account the time value of money. It has none of the weaknesses of the other models Is easy to understand, is based on cash flows, and highlights risks. However, it ignores profitability and the time value of money. Can be used to assess profitability, but it ignores the time value of money, It allows us to compare alternative investments in present value terms and it also accounts for differences in the investments initial cost. It has none of the weaknesses of the other models ARR. net present value, and a profitability index Requirement 3. Which expansion plan should Locos Company choose? Why? Lacos Company should invest in because it has a payback period, a Requirement 4. Estimato Plan A IRR. How does the IRR compare with the company's required rate of return? The IRR (internal rate of retum) of Plan A is between This rate the company's hurde rate of 0% % Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 | 0.909 0.893 0.877 0.870 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.7180.694 Period 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 / 0.668 0.641 0.609 0.579 Period 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 | 0.567 0.519 0.497 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.507 0.456 0.432 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.7600.7110.665 0.623 0.583 0.547 0.513 0.452 0.400 0.376 0.354 0.314 0.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.404 0.351 0.327 0.305 0.266 0.233 Period 9 0.914 0.837 0.766 0.703 0.6450.592 0.544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 / 0.225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 Period 11 0.896 0.8040.722 0.650 0.585 0.527 0.475 0.429 0.3880.350 0.287 0.237 0.215 0.1950.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 02080.187 0.1680.137/0.112 Period 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 Period 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 Period 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.0840.065 Period 16 0.853 0.7280.623 0.534 0.4580.394 0.339 0.292 0.252 0.218 0.163 0.123 0.1070.093 0.071 0.054 Period 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.146 0.108 0.093 0.080 0.060 0.045 Period 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 Period 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 Period 20 0.820 0.673 0.5540.456 0.377 0.3120.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 Period 21 0.811 0.660 0.5380439 0.359 0.294 0.242 0.1990.1640.135 0.093 0.064 0.053 0.044 0.031 0.022 Period 22 0803 0.647 0.522 0422 0.342 0.278 0.226 0.184 0.150 0.123 0.083 0.056 0.046 0.038 0.026 0,018 Print Done