Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Logan Reynor recently started working for Deplantis Mondo LLP (DML) in the tax department. Eduardo Silva, a personal tax client, has approached DML for

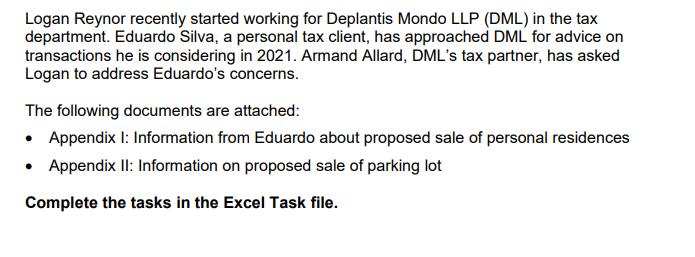

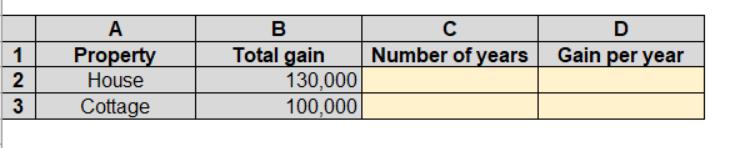

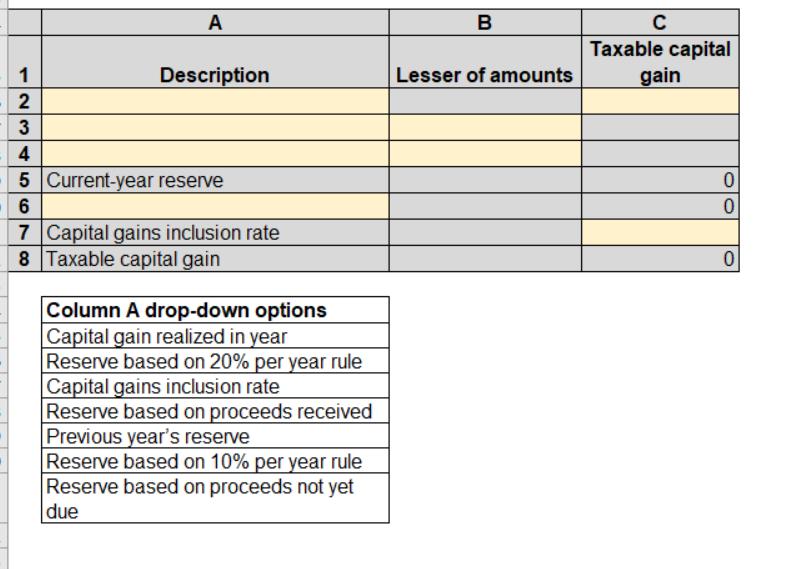

Logan Reynor recently started working for Deplantis Mondo LLP (DML) in the tax department. Eduardo Silva, a personal tax client, has approached DML for advice on transactions he is considering in 2021. Armand Allard, DML's tax partner, has asked Logan to address Eduardo's concerns. The following documents are attached: Appendix I: Information from Eduardo about proposed sale of personal residences Appendix II: Information on proposed sale of parking lot Complete the tasks in the Excel Task file. I have recently retired and plan to travel extensively in the next few years. Currently I own a house in the city and a cottage at the lake. I plan to sell those properties and purchase a condominium. I can't remember the actual years I purchased the properties, but for now, please use the following years as estimates: Cottage House 2012 2006 Based on current market conditions, I estimate I will have a net gain on the cottage of $100,000 and a net gain on the house of $130,000. For a number of years, I have owned a parking lot that I have successfully used to generate income. I am planning to sell the land in the current year. I estimate that I will realize a capital gain of $180,000 on the sale and that the proceeds will be payable as follows: 2021 2022 2024 $ 30,000 100,000 170,000 1 2 3 A Property House Cottage B Total gain 130,000 100,000 C Number of years D Gain per year A 1 2 House 3 Cottage Property B Maximum principal residence exemption 1 2 3 A Description of amount Column A drop-down options Reserve based on proceeds not yet due Reserve based on 10% per year rule Reserve based on proceeds received Reserve based on 20% per year rule B Amount of reserves 1 2 A Description 3 4 5 Current-year reserve 6 7 Capital gains inclusion rate Taxable capital gain 8 Column A drop-down options Capital gain realized in year Reserve based on 20% per year rule Capital gains inclusion rate Reserve based on proceeds received Previous year's reserve Reserve based on 10% per year rule Reserve based on proceeds not yet due B Lesser of amounts C Taxable capital gain 0 0 0

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started