Answered step by step

Verified Expert Solution

Question

1 Approved Answer

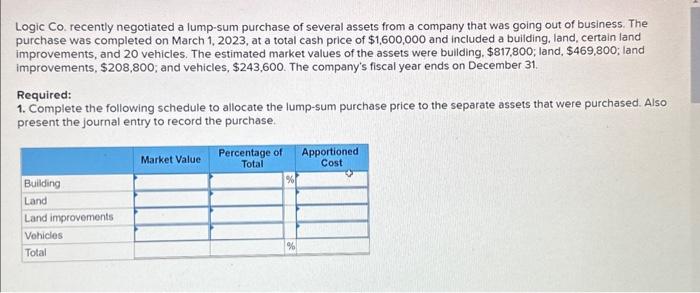

Logic Logic Co. recently negotiated a lump-sum purchase of several assets from a company that was going out of business. The purchase was completed on

Logic

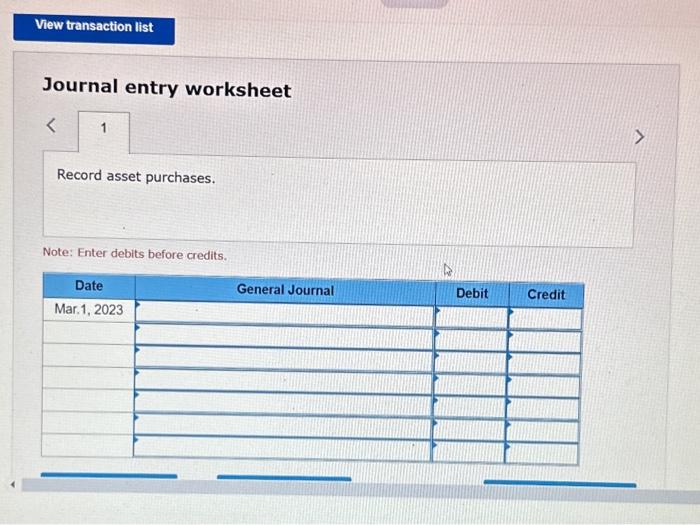

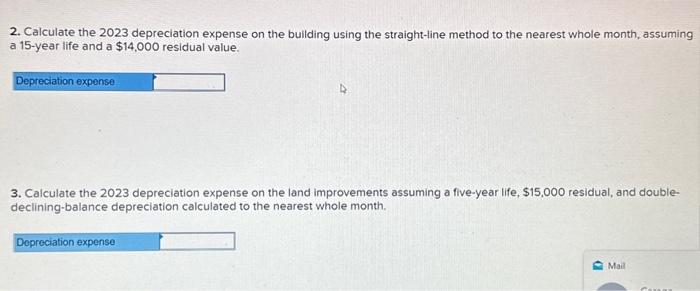

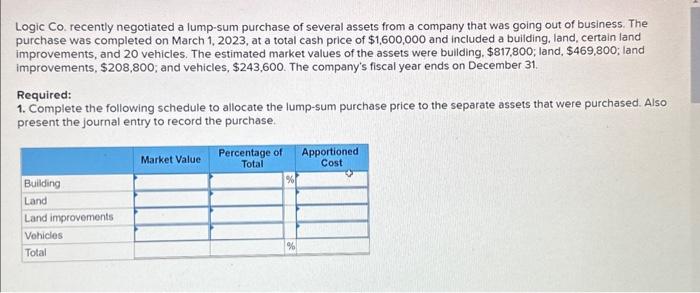

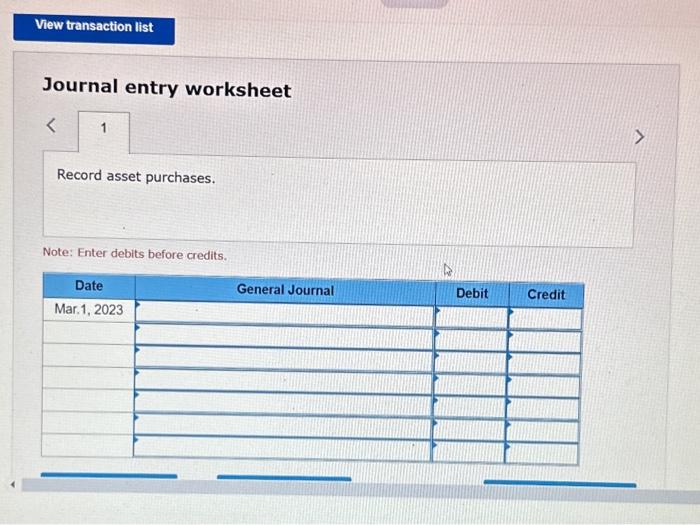

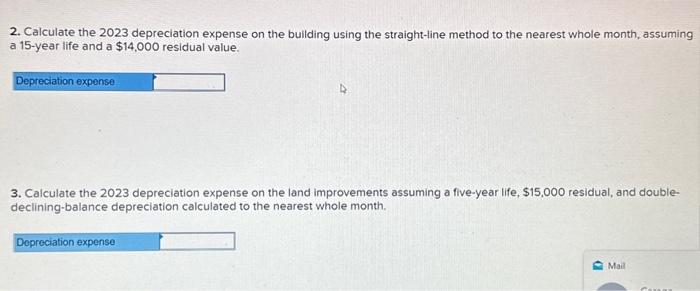

Logic Co. recently negotiated a lump-sum purchase of several assets from a company that was going out of business. The purchase was completed on March 1, 2023, at a total cash price of $1,600,000 and included a building, land, certain land improvements, and 20 vehicles. The estimated market values of the assets were buliding. $817,800; land, $469,800; land improvements, $208,800; and vehicles, $243,600. The company's fiscal year ends on December 31. Required: 1. Complete the following schedule to allocate the lump-sum purchase price to the separate assets that were purchased. Also present the journal entry to record the purchase. Journal entry worksheet ivote: Enter debits before credits. 2. Calculate the 2023 depreciation expense on the building using the straight-line method to the nearest whole month, assuming a 15 -year life and a $14,000 residual value. 3. Calculate the 2023 depreciation expense on the land improvements assuming a five-year life, $15,000 residual, and doubledeclining-balance depreciation calculated to the nearest whole month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started