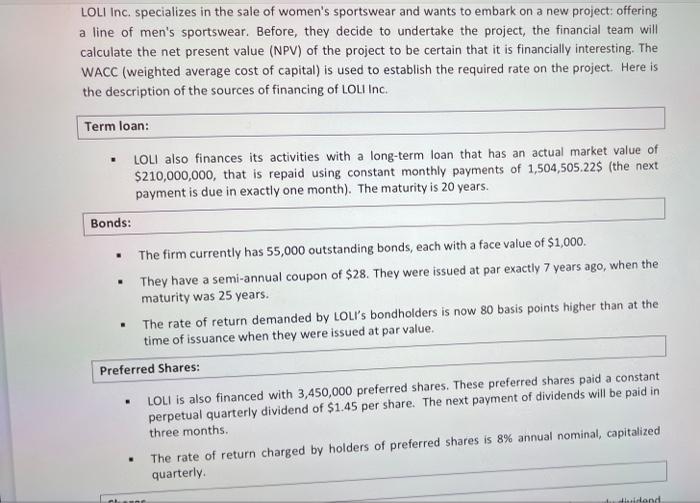

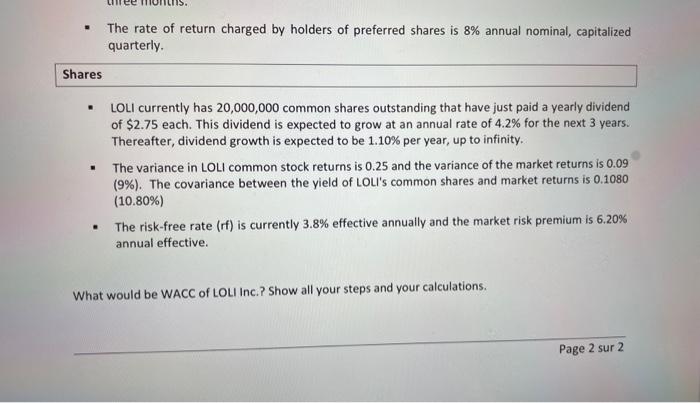

LOLI Inc. specializes in the sale of women's sportswear and wants to embark on a new project: offering a line of men's sportswear. Before, they decide to undertake the project, the financial team will calculate the net present value (NPV) of the project to be certain that it is financially interesting. The WACC (weighted average cost of capital) is used to establish the required rate on the project. Here is the description of the sources of financing of LOLI Inc. Term loan: - LOLI also finances its activities with a long-term loan that has an actual market value of $210,000,000, that is repaid using constant monthly payments of 1,504,505.22$ (the next payment is due in exactly one month). The maturity is 20 years. Bonds: - The firm currently has 55,000 outstanding bonds, each with a face value of $1,000. - They have a semi-annual coupon of $28. They were issued at par exactly 7 years ago, when the maturity was 25 years. - The rate of return demanded by LOLl's bondholders is now 80 basis points higher than at the time of issuance when they were issued at par value. Preferred Shares: - LOLI is also financed with 3,450,000 preferred shares. These preferred shares paid a constant perpetual quarterly dividend of $1.45 per share. The next payment of dividends will be paid in - The rate of return charged by holders of preferred shares is 8% annual nominal, capitalized three months. quarterly. - The rate of return charged by holders of preferred shares is 8% annual nominal, capitalized quarterly. - LOLI currently has 20,000,000 common shares outstanding that have just paid a yearly dividend of $2.75 each. This dividend is expected to grow at an annual rate of 4.2% for the next 3 years. Thereafter, dividend growth is expected to be 1.10% per year, up to infinity. - The variance in LOLI common stock returns is 0.25 and the variance of the market returns is 0.09 (9\%). The covariance between the yield of LOLI's common shares and market returns is 0.1080 (10.80%) - The risk-free rate (rf) is currently 3.8% effective annually and the market risk premium is 6.20% annual effective. What would be WACC of LOLI Inc.? Show all your steps and your calculations. LOLI Inc. specializes in the sale of women's sportswear and wants to embark on a new project: offering a line of men's sportswear. Before, they decide to undertake the project, the financial team will calculate the net present value (NPV) of the project to be certain that it is financially interesting. The WACC (weighted average cost of capital) is used to establish the required rate on the project. Here is the description of the sources of financing of LOLI Inc. Term loan: - LOLI also finances its activities with a long-term loan that has an actual market value of $210,000,000, that is repaid using constant monthly payments of 1,504,505.22$ (the next payment is due in exactly one month). The maturity is 20 years. Bonds: - The firm currently has 55,000 outstanding bonds, each with a face value of $1,000. - They have a semi-annual coupon of $28. They were issued at par exactly 7 years ago, when the maturity was 25 years. - The rate of return demanded by LOLl's bondholders is now 80 basis points higher than at the time of issuance when they were issued at par value. Preferred Shares: - LOLI is also financed with 3,450,000 preferred shares. These preferred shares paid a constant perpetual quarterly dividend of $1.45 per share. The next payment of dividends will be paid in - The rate of return charged by holders of preferred shares is 8% annual nominal, capitalized three months. quarterly. - The rate of return charged by holders of preferred shares is 8% annual nominal, capitalized quarterly. - LOLI currently has 20,000,000 common shares outstanding that have just paid a yearly dividend of $2.75 each. This dividend is expected to grow at an annual rate of 4.2% for the next 3 years. Thereafter, dividend growth is expected to be 1.10% per year, up to infinity. - The variance in LOLI common stock returns is 0.25 and the variance of the market returns is 0.09 (9\%). The covariance between the yield of LOLI's common shares and market returns is 0.1080 (10.80%) - The risk-free rate (rf) is currently 3.8% effective annually and the market risk premium is 6.20% annual effective. What would be WACC of LOLI Inc.? Show all your steps and your calculations