Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lomas Company owns 100% of the working interest in an unproved property with a 1/5 royalty interest. Lomas conveys 40% of the working interest

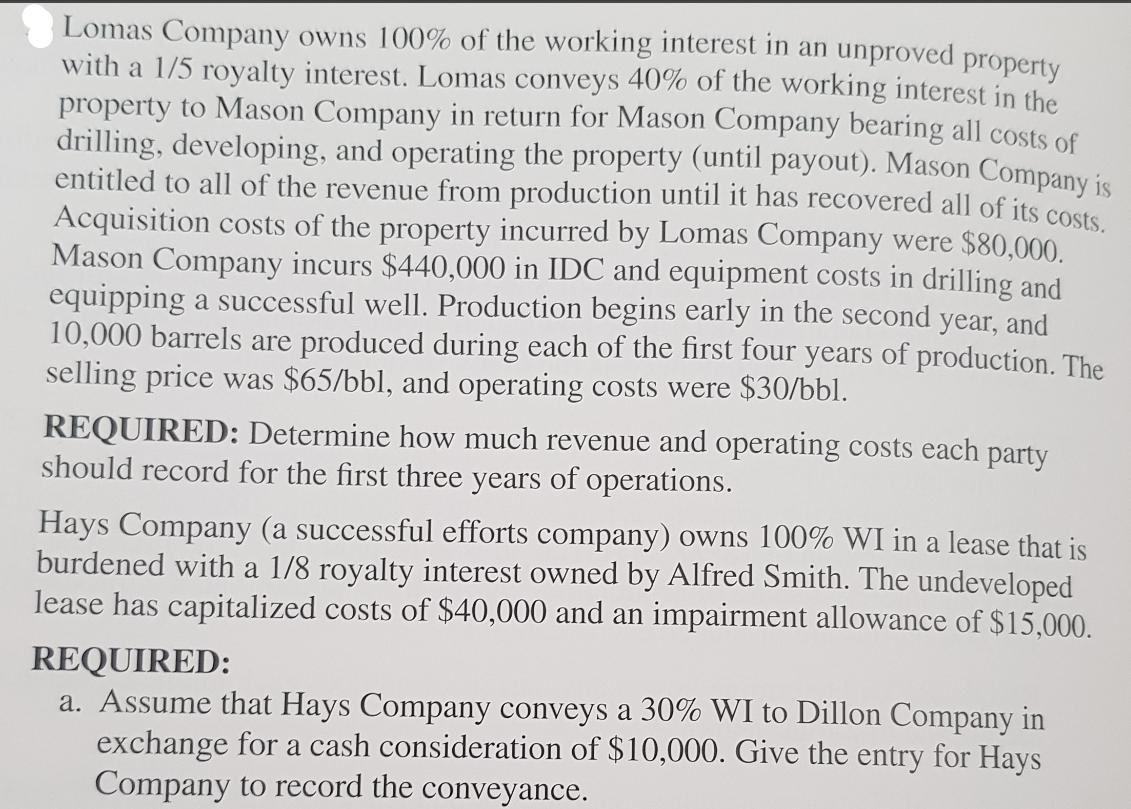

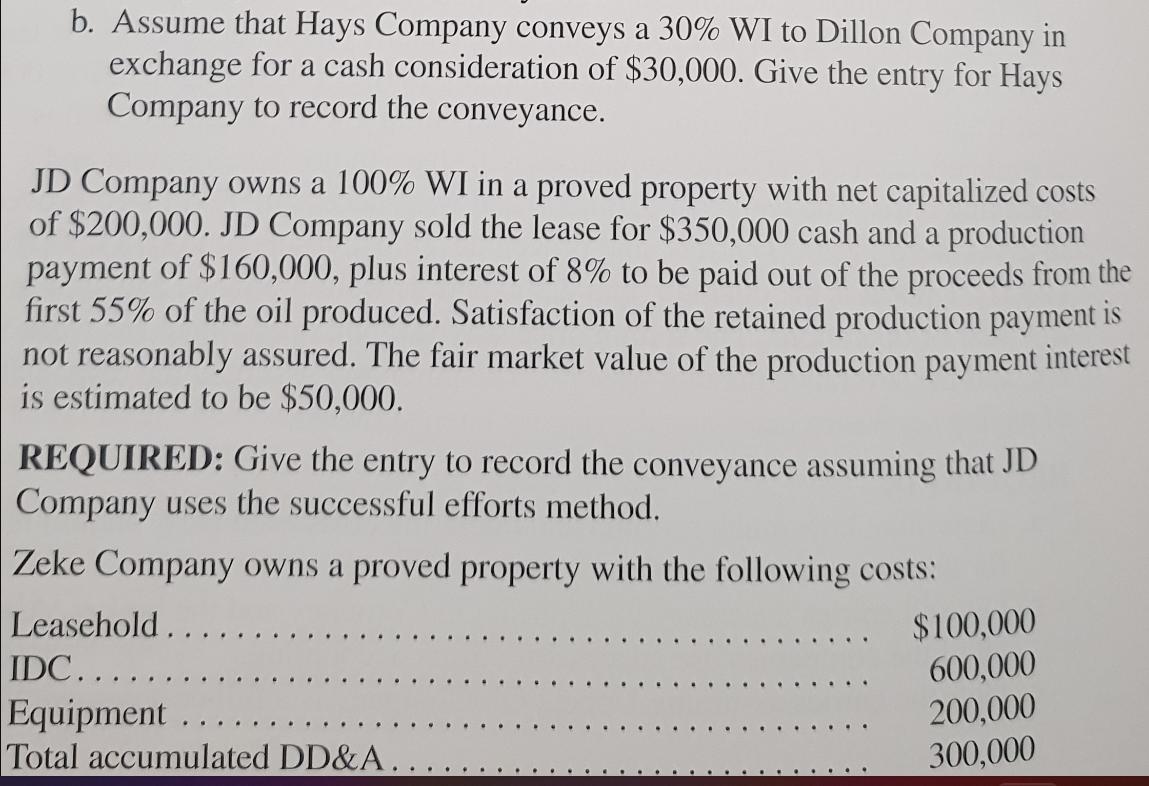

Lomas Company owns 100% of the working interest in an unproved property with a 1/5 royalty interest. Lomas conveys 40% of the working interest in the property to Mason Company in return for Mason Company bearing all costs of drilling, developing, and operating the property (until payout). Mason Company is entitled to all of the revenue from production until it has recovered all of its costs. Acquisition costs of the property incurred by Lomas Company were $80,000. Mason Company incurs $440,000 in IDC and equipment costs in drilling and equipping a successful well. Production begins early in the second year, and 10,000 barrels are produced during each of the first four years of production. The selling price was $65/bbl, and operating costs were $30/bbl. REQUIRED: Determine how much revenue and operating costs each party should record for the first three years of operations. Hays Company (a successful efforts company) owns 100% WI in a lease that is burdened with a 1/8 royalty interest owned by Alfred Smith. The undeveloped lease has capitalized costs of $40,000 and an impairment allowance of $15,000. REQUIRED: a. Assume that Hays Company conveys a 30% WI to Dillon Company in exchange for a cash consideration of $10,000. Give the entry for Hays Company to record the conveyance. b. Assume that Hays Company conveys a 30% WI to Dillon Company in exchange for a cash consideration of $30,000. Give the entry for Hays Company to record the conveyance. JD Company owns a 100% WI in a proved property with net capitalized costs of $200,000. JD Company sold the lease for $350,000 cash and a production payment of $160,000, plus interest of 8% to be paid out of the proceeds from the first 55% of the oil produced. Satisfaction of the retained production payment is not reasonably assured. The fair market value of the production payment interest is estimated to be $50,000. REQUIRED: Give the entry to record the conveyance assuming that JD Company uses the successful efforts method. Zeke Company owns a proved property with the following costs: Leasehold... IDC.... Equipment Total accumulated DD&A. $100,000 600,000 200,000 300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started