Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lompat Tikam Berhad (LTB) wants to purchase a new network file server for its wide-area computer network. The server costs RM65,000. It will be

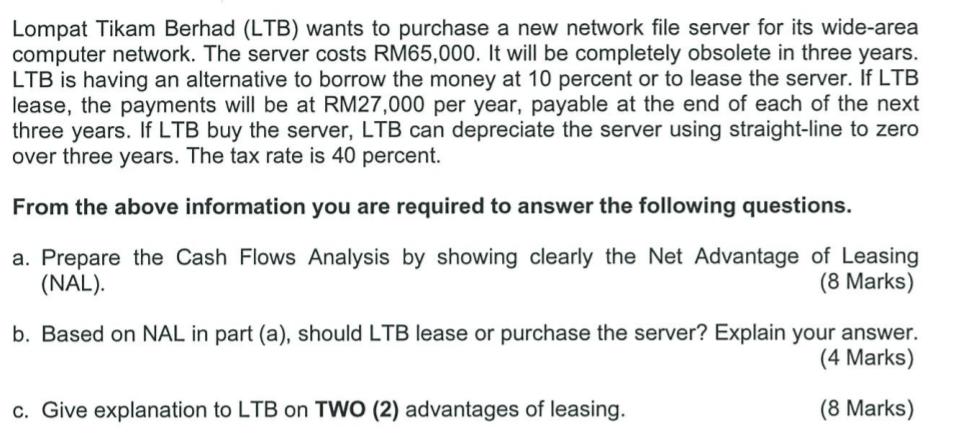

Lompat Tikam Berhad (LTB) wants to purchase a new network file server for its wide-area computer network. The server costs RM65,000. It will be completely obsolete in three years. LTB is having an alternative to borrow the money at 10 percent or to lease the server. If LTB lease, the payments will be at RM27,000 per year, payable at the end of each of the next three years. If LTB buy the server, LTB can depreciate the server using straight-line to zero over three years. The tax rate is 40 percent. From the above information you are required to answer the following questions. a. Prepare the Cash Flows Analysis by showing clearly the Net Advantage of Leasing (NAL). (8 Marks) b. Based on NAL in part (a), should LTB lease or purchase the server? Explain your answer. (4 Marks) c. Give explanation to LTB on TWO (2) advantages of leasing. (8 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Cash Flows Analysis Leasing Option Year 0 Initial payment RM0 Year 1 Lease payment RM27000 Year 2 Lease payment RM27000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started