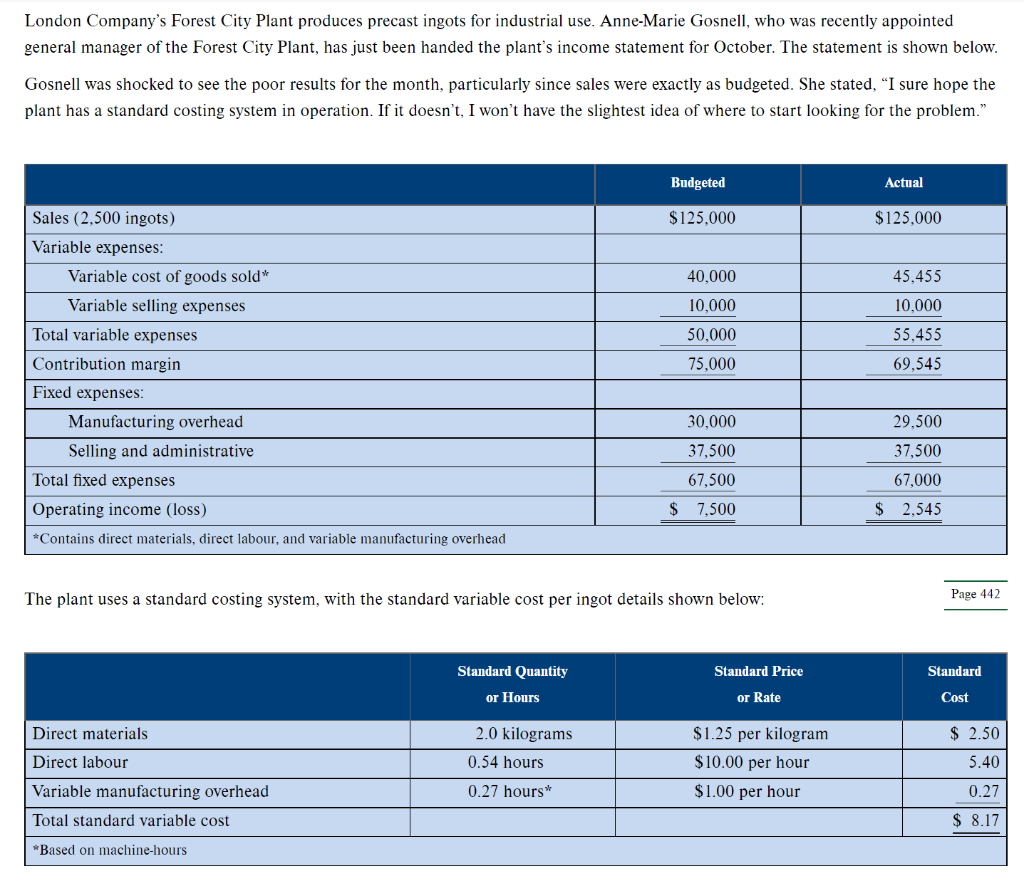

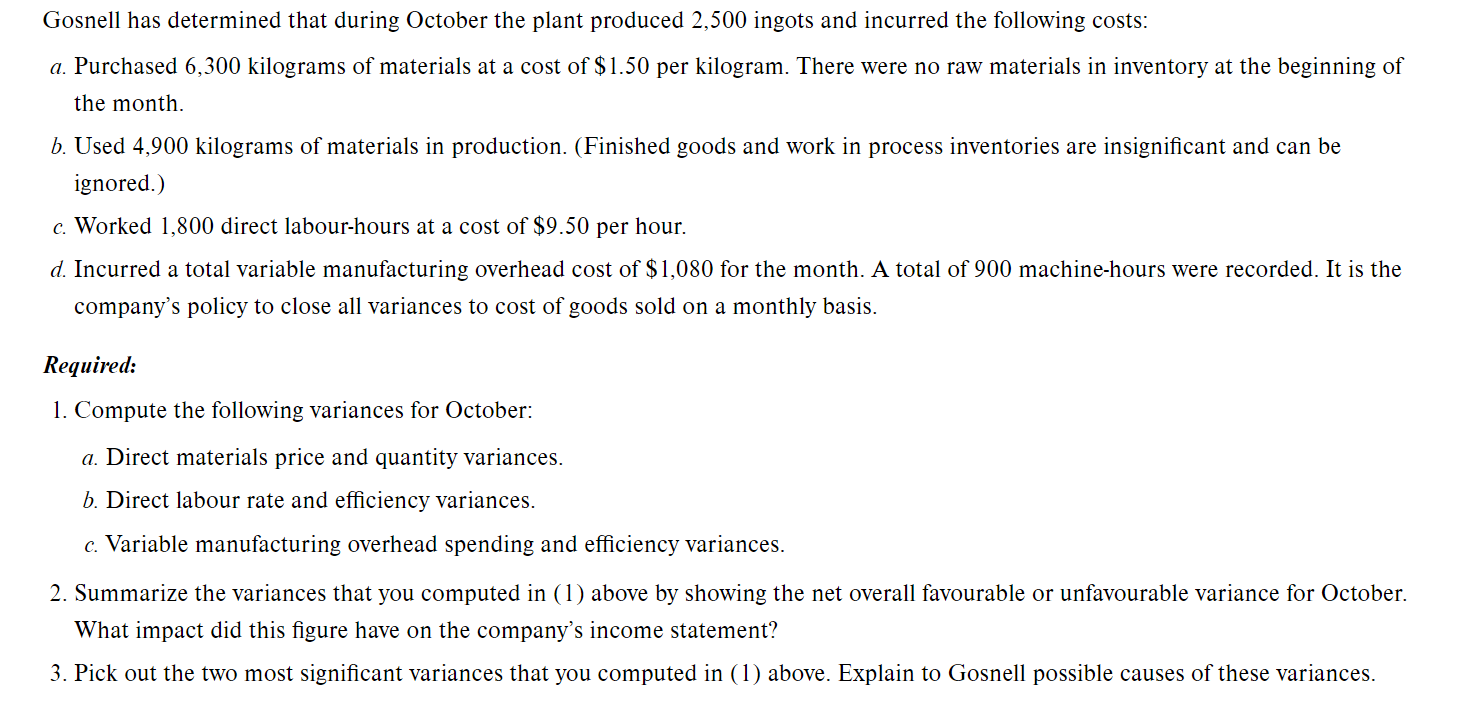

London Company's Forest City Plant produces precast ingots for industrial use. Anne-Marie Gosnell, who was recently appointed general manager of the Forest City Plant, has just been handed the plant's income statement for October. The statement is shown below. Gosnell was shocked to see the poor results for the month, particularly since sales were exactly as budgeted. She stated, I sure hope the plant has a standard costing system in operation. If it doesn't, I won't have the slightest idea of where to start looking the problem." Budgeted Actual $125,000 $125,000 40,000 45,455 10,000 10,000 50,000 55,455 75,000 69,545 Sales (2,500 ingots) Variable expenses: Variable cost of goods sold* Variable selling expenses Total variable expenses Contribution margin Fixed expenses Manufacturing overhead Selling and administrative Total fixed expenses Operating income (loss) *Contains direct materials, direct labour, and variable manufacturing overhead 30,000 29,500 37,500 37,500 67,000 67,500 $ 7,500 $ 2,545 The plant uses a standard costing system, with the standard variable cost per ingot details shown below: Page 442 Standard Price Standard Standard Quantity or Hours or Rate Cost Direct materials 2.0 kilograms 0.54 hours $1.25 per kilogram $ 10.00 per hour $1.00 per hour $ 2.50 5.40 Direct labour 0.27 hours* Variable manufacturing overhead Total standard variable cost 0.27 $ 8.17 *Based on machine-hours Gosnell has determined that during October the plant produced 2,500 ingots and incurred the following costs: a. Purchased 6,300 kilograms of materials at a cost of $1.50 per kilogram. There were no raw materials in inventory at the beginning of the month. b. Used 4,900 kilograms of materials in production. (Finished goods and work in process inventories are insignificant and can be ignored.) c. Worked 1,800 direct labour-hours at a cost of $9.50 per hour. d. Incurred a total variable manufacturing overhead cost of $1,080 for the month. A total of 900 machine-hours were recorded. It is the company's policy to close all variances to cost of goods sold on a monthly basis. Required: 1. Compute the following variances for October: a. Direct materials price and quantity variances. b. Direct labour rate and efficiency variances. c. Variable manufacturing overhead spending and efficiency variances. 2. Summarize the variances that you computed in (1) above by showing the net overall favourable or unfavourable variance for October. What impact did this figure have on the company's income statement? 3. Pick out the two most significant variances that you computed in (1) above. Explain to Gosnell possible causes of these variances