Lone Star Company is a calendar-year corporation, and this year Lone Star reported $124,000 in current E&P that accrue evenly throughout the year. At

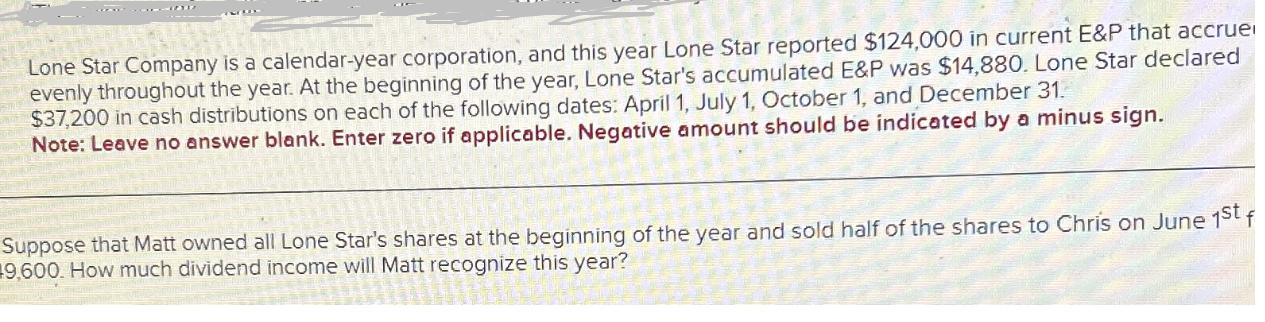

Lone Star Company is a calendar-year corporation, and this year Lone Star reported $124,000 in current E&P that accrue evenly throughout the year. At the beginning of the year, Lone Star's accumulated E&P was $14,880. Lone Star declared $37,200 in cash distributions on each of the following dates: April 1, July 1, October 1, and December 31. Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Suppose that Matt owned all Lone Star's shares at the beginning of the year and sold half of the shares to Chris on June 1st f 9,600. How much dividend income will Matt recognize this year?

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the dividend income that Matt will recognize for the year we need to determine the port...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started