Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Loner Products Ltd. was incorporated and commenced to trade in 2001. Its several shareholders consisted of members of the Grant family. The business was

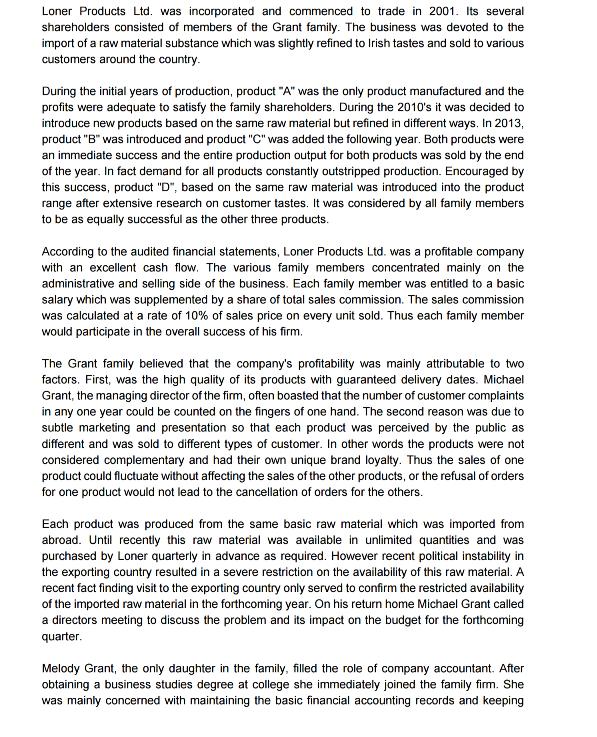

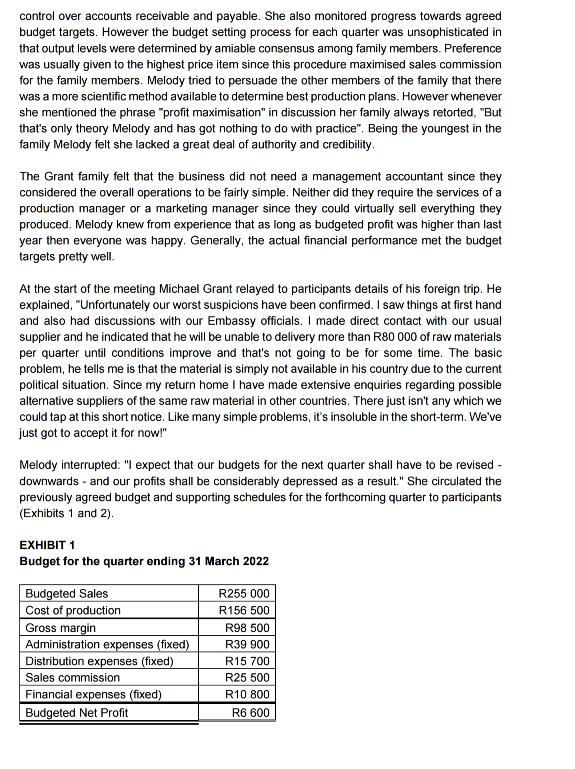

Loner Products Ltd. was incorporated and commenced to trade in 2001. Its several shareholders consisted of members of the Grant family. The business was devoted to the import of a raw material substance which was slightly refined to Irish tastes and sold to various customers around the country. During the initial years of production, product "A" was the only product manufactured and the profits were adequate to satisfy the family shareholders. During the 2010's it was decided to introduce new products based on the same raw material but refined in different ways. In 2013, product "B" was introduced and product "C" was added the following year. Both products were an immediate success and the entire production output for both products was sold by the end of the year. In fact demand for all products constantly outstripped production. Encouraged by this success, product "D", based on the same raw material was introduced into the product range after extensive research on customer tastes. It was considered by all family members to be as equally successful as the other three products. According to the audited financial statements, Loner Products Ltd. was a profitable company with an excellent cash flow. The various family members concentrated mainly on the administrative and selling side of the business. Each family member was entitled to a basic salary which was supplemented by a share of total sales commission. The sales commission was calculated at a rate of 10% of sales price on every unit sold. Thus each family member would participate in the overall success of his firm. The Grant family believed that the company's profitability was mainly attributable to two factors. First, was the high quality of its products with guaranteed delivery dates. Michael Grant, the managing director of the firm, often boasted that the number of customer complaints in any one year could be counted on the fingers of one hand. The second reason was due to subtle marketing and presentation so that each product was perceived by the public as different and was sold to different types of customer. In other words the products were not considered complementary and had their own unique brand loyalty. Thus the sales of one product could fluctuate without affecting the sales of the other products, or the refusal of orders for one product would not lead to the cancellation of orders for the others. Each product was produced from the same basic raw material which was imported from abroad. Until recently this raw material was available in unlimited quantities and was purchased by Loner quarterly in advance as required. However recent political instability in the exporting country resulted in a severe restriction on the availability of this raw material. A recent fact finding visit to the exporting country only served to confirm the restricted availability of the imported raw material in the forthcoming year. On his return home Michael Grant called a directors meeting to discuss the problem and its impact on the budget for the forthcoming quarter. Melody Grant, the only daughter in the family, filled the role of company accountant. After obtaining a business studies degree at college she immediately joined the family firm. She was mainly concerned with maintaining the basic financial accounting records and keeping control over accounts receivable and payable. She also monitored progress towards agreed budget targets. However the budget setting process for each quarter was unsophisticated in that output levels were determined by amiable consensus among family members. Preference was usually given to the highest price item since this procedure maximised sales commission for the family members. Melody tried to persuade the other members of the family that there was a more scientific method available to determine best production plans. However whenever she mentioned the phrase "profit maximisation" in discussion her family always retorted, "But that's only theory Melody and has got nothing to do with practice". Being the youngest in the family Melody felt she lacked a great deal of authority and credibility. The Grant family felt that the business did not need a management accountant since they considered the overall operations to be fairly simple. Neither did they require the services of a production manager or a marketing manager since they could virtually sell everything they produced. Melody knew from experience that as long as budgeted profit was higher than last year then everyone was happy. Generally, the actual financial performance met the budget targets pretty well. At the start of the meeting Michael Grant relayed to participants details of his foreign trip. He explained, "Unfortunately our worst suspicions have been confirmed. I saw things at first hand and also had discussions with our Embassy officials. I made direct contact with our usual supplier and he indicated that he will be unable to delivery more than R80 000 of raw materials per quarter until conditions improve and that's not going to be for some time. The basic problem, he tells me is that the material is simply not available in his country due to the current political situation. Since my return home I have made extensive enquiries regarding possible alternative suppliers of the same raw material in other countries. There just isn't any which we could tap at this short notice. Like many simple problems, it's insoluble in the short-term. We've just got to accept it for now!" Melody interrupted: "I expect that our budgets for the next quarter shall have to be revised - downwards - and our profits shall be considerably depressed as a result." She circulated the previously agreed budget and supporting schedules for the forthcoming quarter to participants (Exhibits 1 and 2). EXHIBIT 1 Budget for the quarter ending 31 March 2022 Budgeted Sales Cost of production Gross margin Administration expenses (fixed) Distribution expenses (fixed) Sales commission Financial expenses (fixed) Budgeted Net Profit R255 000 R156 500 R98 500 R39 900 R15 700 R25 500 R10 800 R6 600 EXHIBIT 2 Schedule of Revenue and Production Costs per Product. Product Sales price Direct material (imported) Direct labour and packing Production overhead Budgeted sales (units) A B Product A B C D R24 R55 R7 R16 R4 R5 R4 R5 R6 1 500 2 000 2 000 Rands 60 000 110 000 63 000 39 988 R35 R13 R7 NOTE: Production overhead includes both fixed and variable expense. The estimated fixed overhead for the forthcoming quarter amounts to R17 000 and has been apportioned to each product on the basis of total anticipated sales revenue for each product. D Melody continued "In my opinion there is no scope for any reduction in costs. We can't change, at least in the short term, our direct material costs. Neither can we change our packaging costs. Our direct labour consists of the part-time assembly workers which we need in order to produce. Likewise variable overheads will be incurred if we want to produce and our fixed overheads are already down to an absolute minimum. Commission is the only thing that we could effectively cut." CASE Study Assignment R26 R10 R5 R5 1500 Michael Grant interjected. "No, I recommend that the sales commission be left alone. We're all in this venture together and I reckon we're going to have to sell our way out of our problems. We need to retain the incentive to sell and keep our selling prices intact." Everyone agreed. Patrick Grant, the eldest member of the family, who was chiefly responsible for sales, raised the possibility of maximum sales levels of each product. He said, "We must take into consideration that there is a definite limit on the amount of goods which we can sell at existing prices next quarter." Michael Grant accepted that the point was valid. After much discussion all family members agreed that maximum sales value of each product at current prices for the forthcoming quarter would be as follows: Subsequently everyone at the meeting realised that due to the definite shortage of raw materials it was not possible to produce simultaneously all these quantities. Michael Grant added "I think we shall have to be more selective in what we produce in future. However, I BAPCY5A 2021 November 5 recommend that we produce a minimum of 1 000 units of each product during the forthcoming recommend that we produce a minimum of 1 000 units of each product during the forthcoming quarter. This would, at least, keep the company's products in the minds of the public and satisfy our major customers. It's important to do this. Any remaining materials should be used in the most profitable manner. Melody, now is the ideal time to put some of that theory of yours into practice. If you feel that there is a single, best way to utilise our production facilities in these circumstances now is the ideal time to let us know." REQUIRED 2.1 Prepare a statement showing the most profitable production plan for Loner Products Ltd. for the forthcoming quarter. Prepare a detailed profit and loss account to accompany your recommendation. (25) Calculate the firm's break-even point in units and value for the forthcoming quarter if the production plan in 2.1 is adopted. (10) 2.2 2.3 2.4 What is the "opportunity cost", if any, associated with the minimum production of 1 000 units of each product? (10) Assuming it was possible to increase all selling prices by R7 per unit without influencing demand, would this price increase affect your analysis. Explain your answer. (19) [64] ROUND ALL CALCULATIONS TO 2 DECIMALS

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

21 Most Profitable Production Plan for Loner Products Ltd Product Unit Quantity Total Direct Direct ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started