Answered step by step

Verified Expert Solution

Question

1 Approved Answer

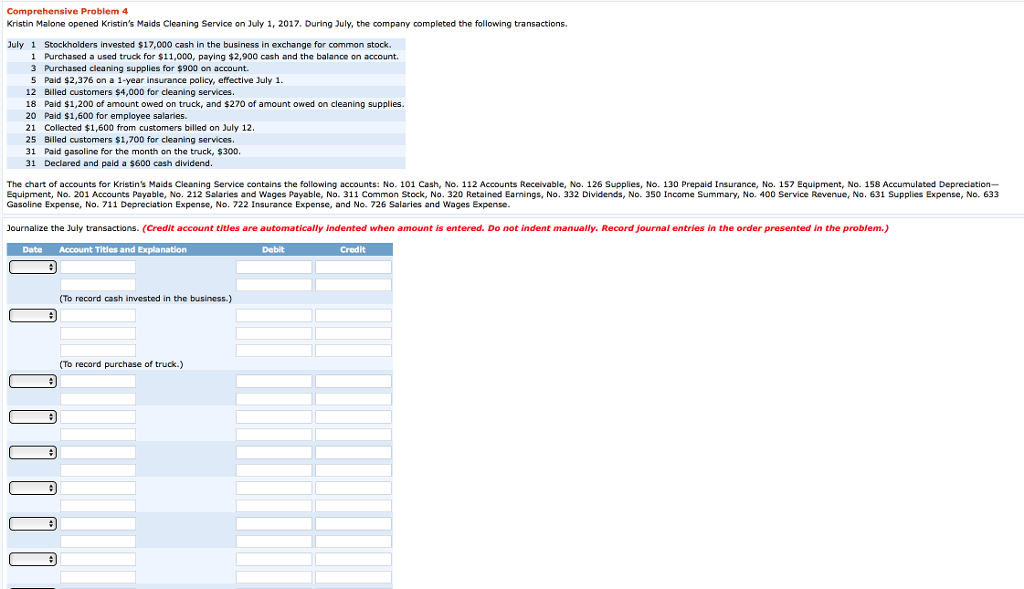

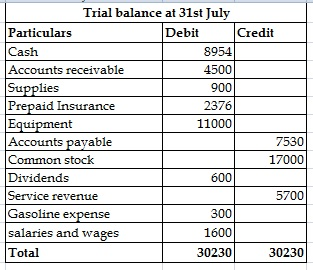

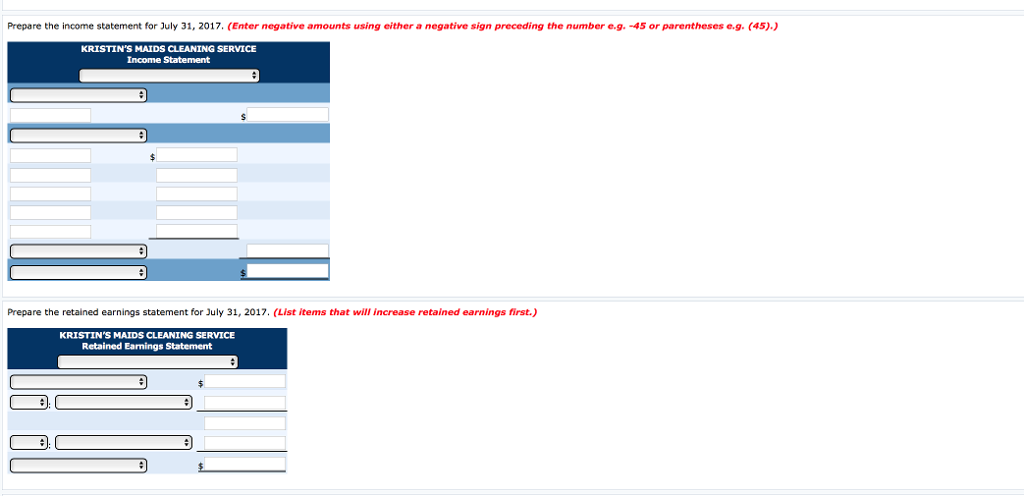

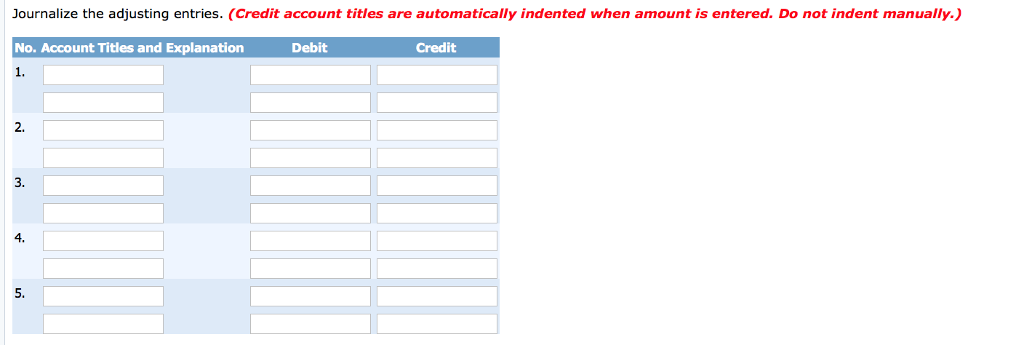

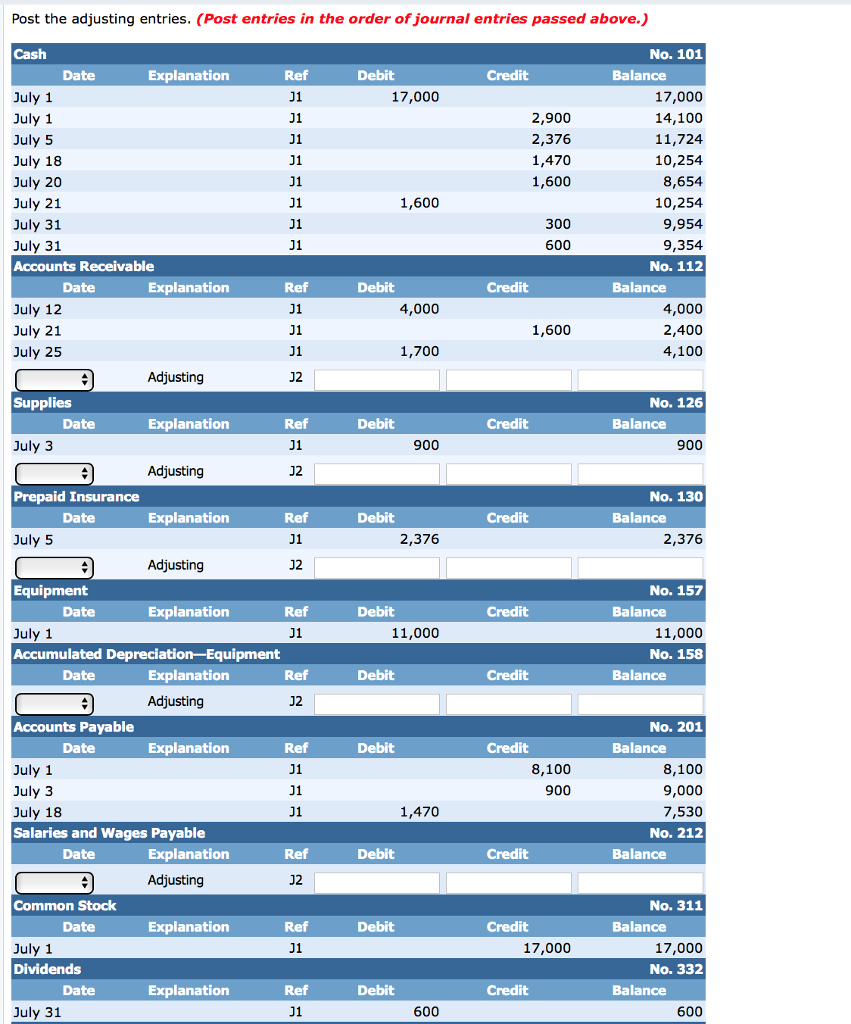

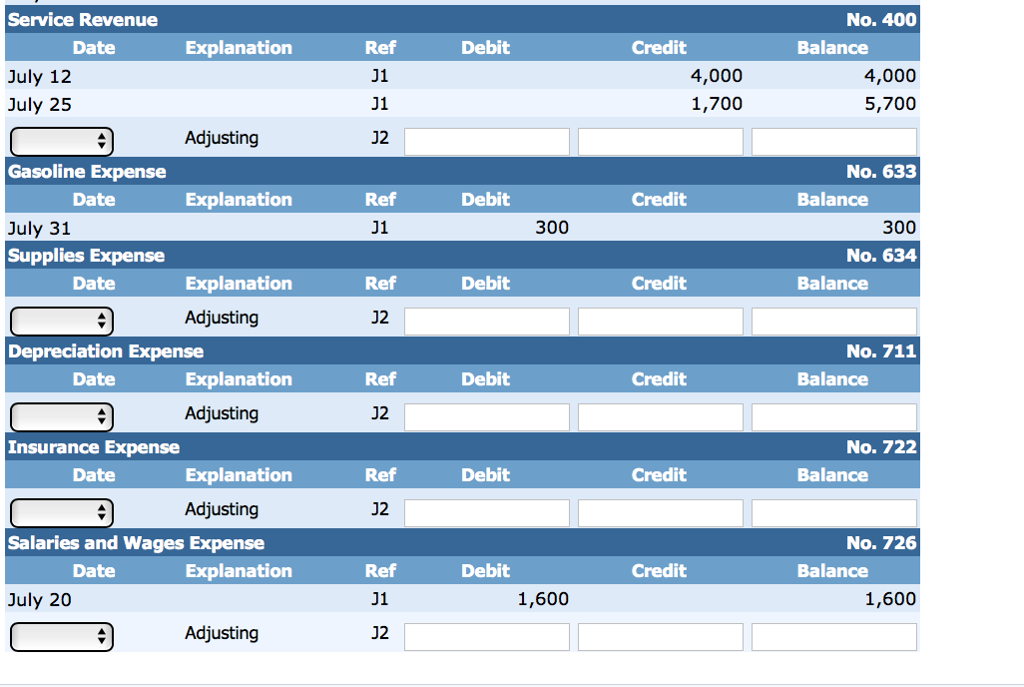

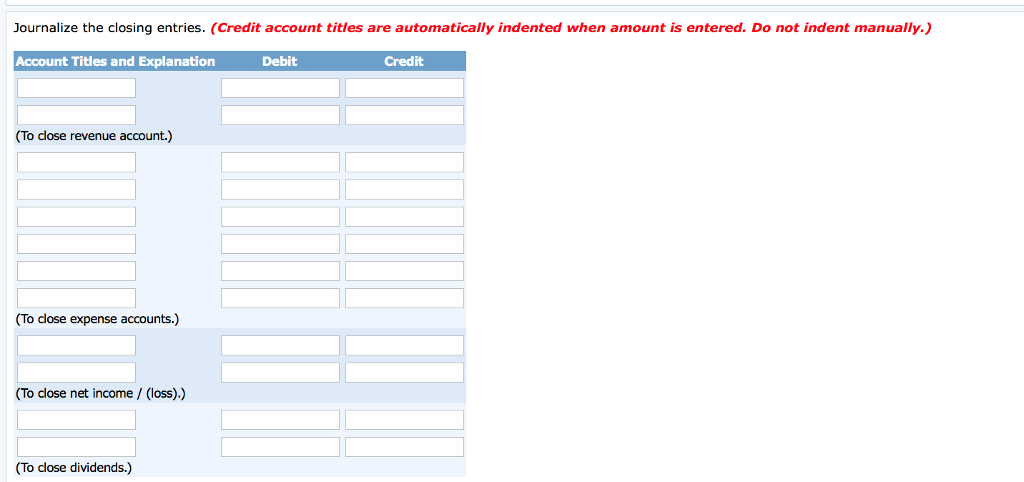

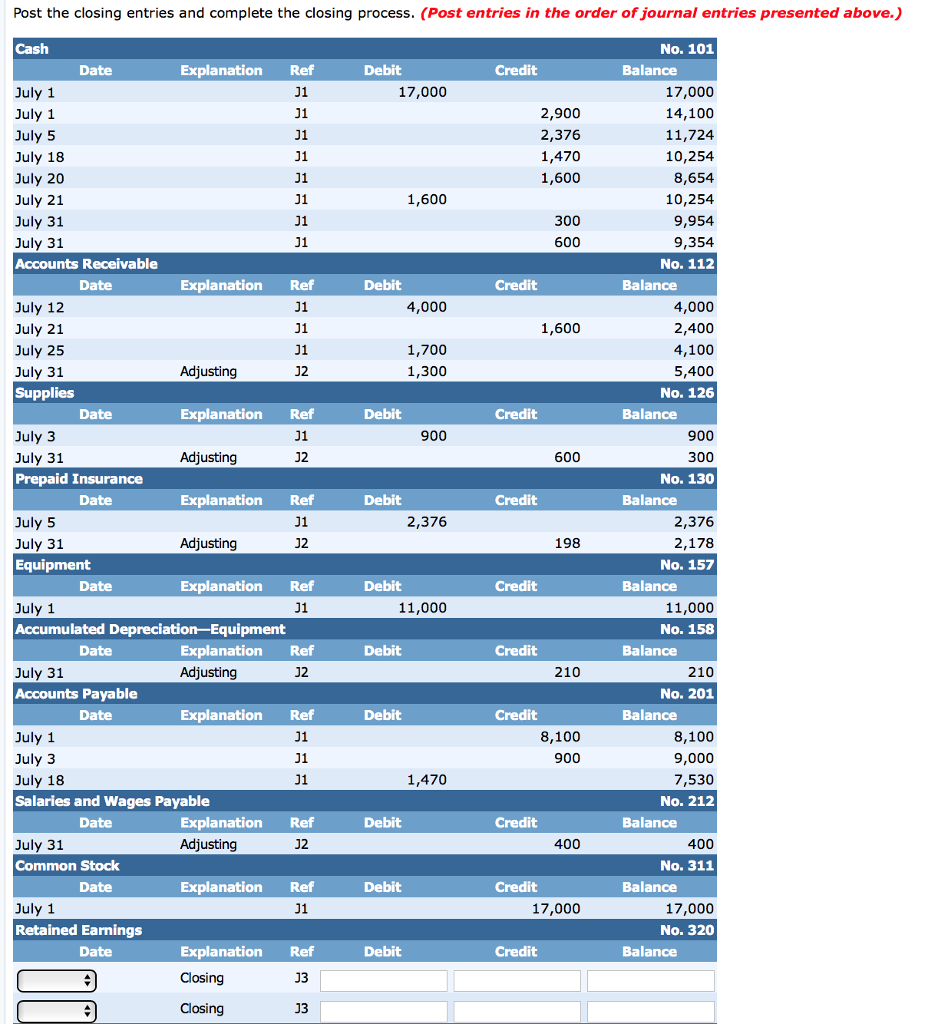

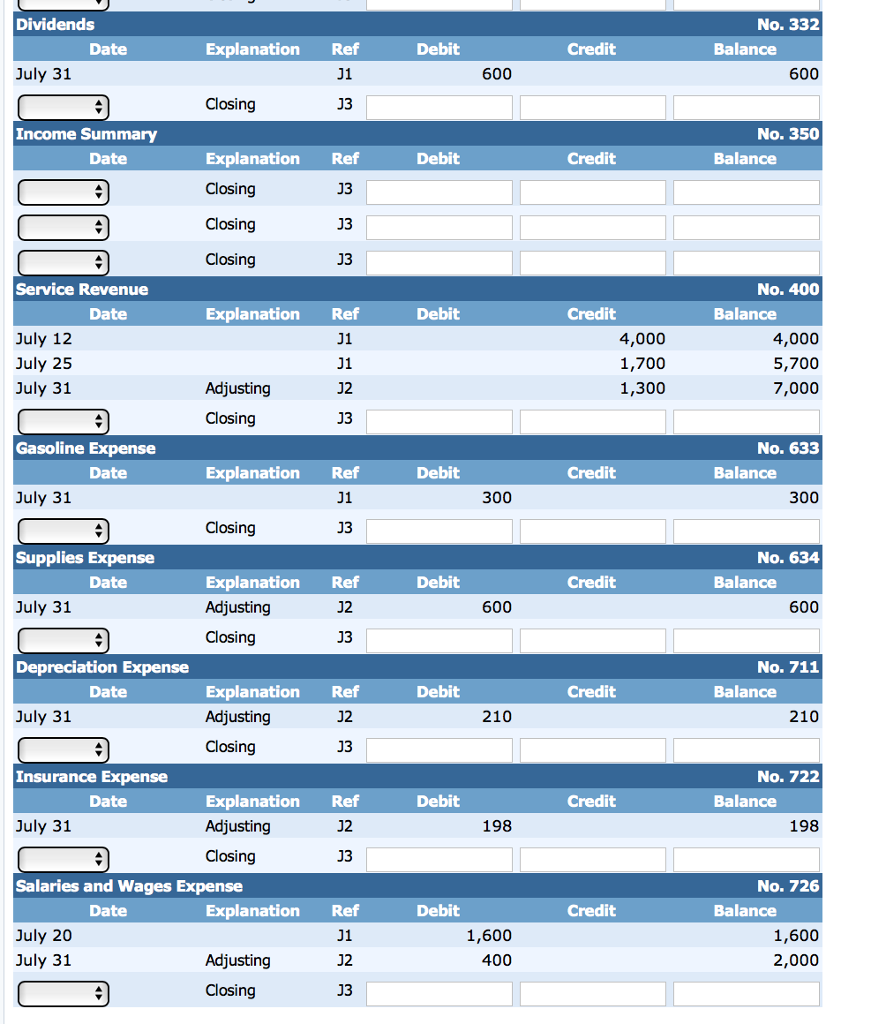

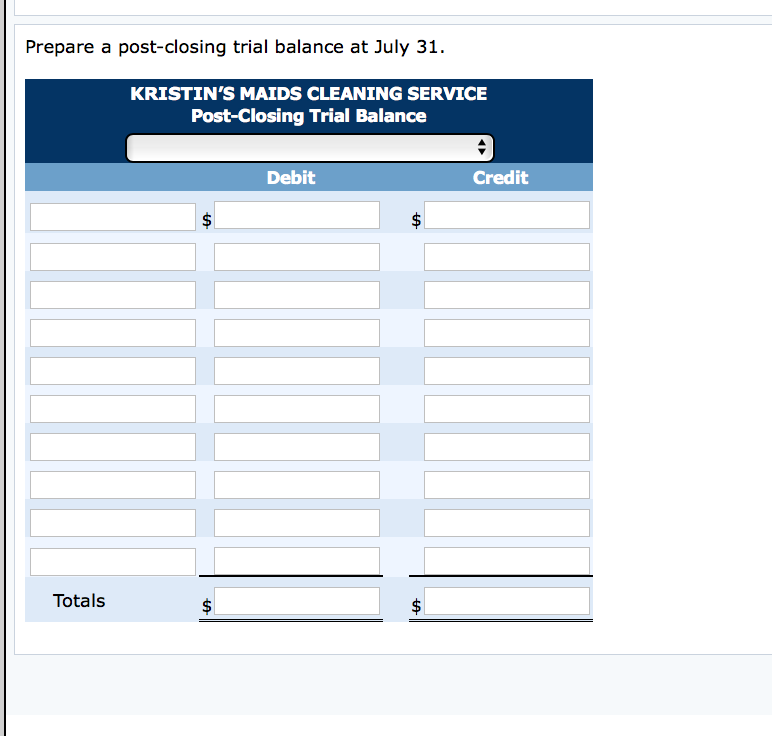

Long question thanks so much for your help! Comprehensive Problem 4 Kristin Malone opened Kristin's Maids Cleaning Service on July 1, 2017. During July, the

Long question thanks so much for your help!

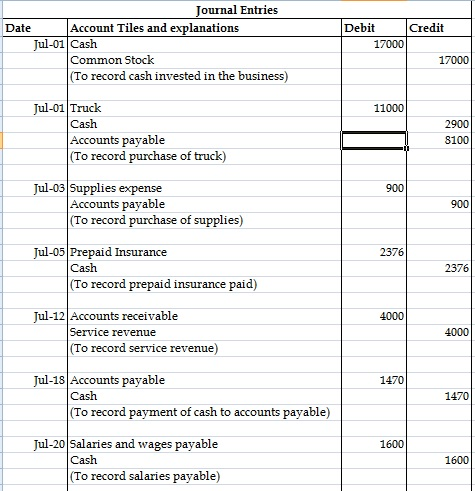

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

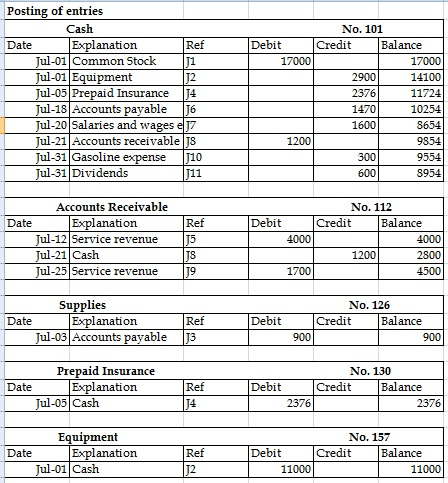

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started