Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Long-term Orientation in the Benedictine Monastery of Admont Calculate the current ratio, debt ratio, profit margin, and inventory turnover of the company. Explain what each

Long-term Orientation in the Benedictine Monastery of Admont

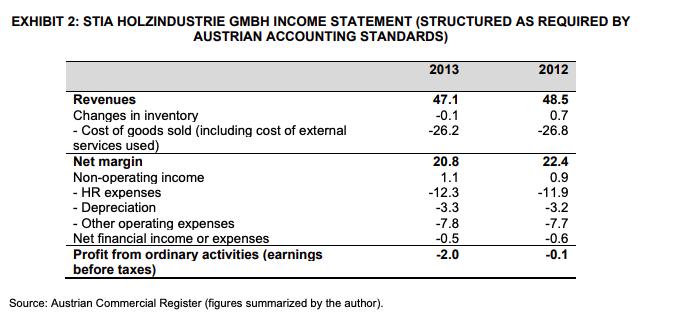

- Calculate the current ratio, debt ratio, profit margin, and inventory turnover of the company.

- Explain what each calculated ratio tells you about how well (or poorly) the company is performing.

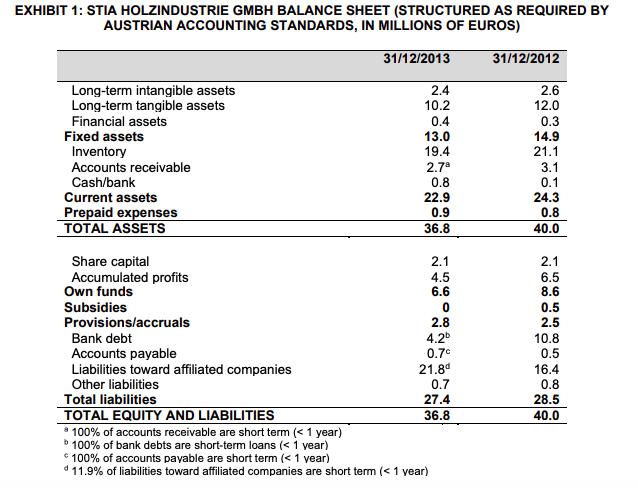

EXHIBIT 1: STIA HOLZINDUSTRIE GMBH BALANCE SHEET (STRUCTURED AS REQUIRED BY AUSTRIAN ACCOUNTING STANDARDS, IN MILLIONS OF EUROS) 31/12/2013 31/12/2012 Long-term intangible assets Long-term tangible assets Financial assets Fixed assets 2.4 2.6 12.0 10.2 0.4 13.0 19.4 0.3 14.9 21.1 Inventory Accounts receivable Cash/bank 2.7 0.8 22.9 0.9 3.1 0.1 24.3 0.8 Current assets Prepaid expenses TOTAL ASSETS 36.8 40.0 Share capital Accumulated profits Own funds 2.1 2.1 4.5 6.6 6.5 8.6 Subsidies Provisions/accruals 0.5 2.8 2.5 4.2 0.7 Bank debt 10.8 0.5 Accounts payable Liabilities toward affiliated companies Other liabilities Total liabilities 21.8d 0.7 27.4 16.4 0.8 28.5 40.0 TOTAL EQUITY AND LIABILITIES 36.8 * 100% of accounts receivable are short term ( < 1 year) 100% of bank debts are short-term loans ( < 1 ear) 100% of accounts payable are short term ( < 1 year) d 11.9% of liabilities toward affiliated companies are short term ( < 1 year)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started