Answered step by step

Verified Expert Solution

Question

1 Approved Answer

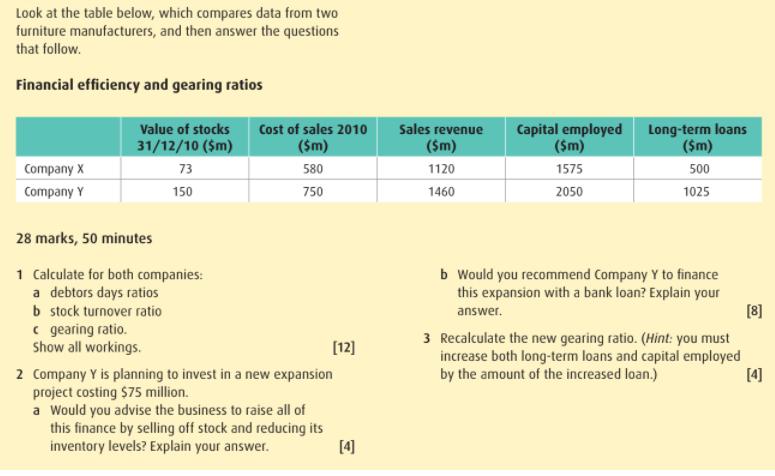

Look at the table below, which compares data from two furniture manufacturers, and then answer the questions that follow. Financial efficiency and gearing ratios

Look at the table below, which compares data from two furniture manufacturers, and then answer the questions that follow. Financial efficiency and gearing ratios Company X Company Y Value of stocks 31/12/10 ($m) 73 150 28 marks, 50 minutes 1 Calculate for both companies: a debtors days ratios b stock turnover ratio c gearing ratio. Show all workings. Cost of sales 2010 ($m) 580 750 [12] 2 Company Y is planning to invest in a new expansion project costing $75 million. a Would you advise the business to raise all of this finance by selling off stock and reducing its inventory levels? Explain your answer. [4] Sales revenue ($m) 1120 1460 Capital employed ($m) 1575 2050 Long-term loans ($m) 500 1025 b Would you recommend Company Y to finance this expansion with a bank loan? Explain your answer. 3 Recalculate the new gearing ratio. (Hint: you must increase both long-term loans and capital employed by the amount of the increased loan.) [8] [4]

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculations for both companies a Debtors days ratio Company X Debtors Total receivables Cost of s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started