look below for any missing amount

the calculation above for december 12is wrong. below is the correction

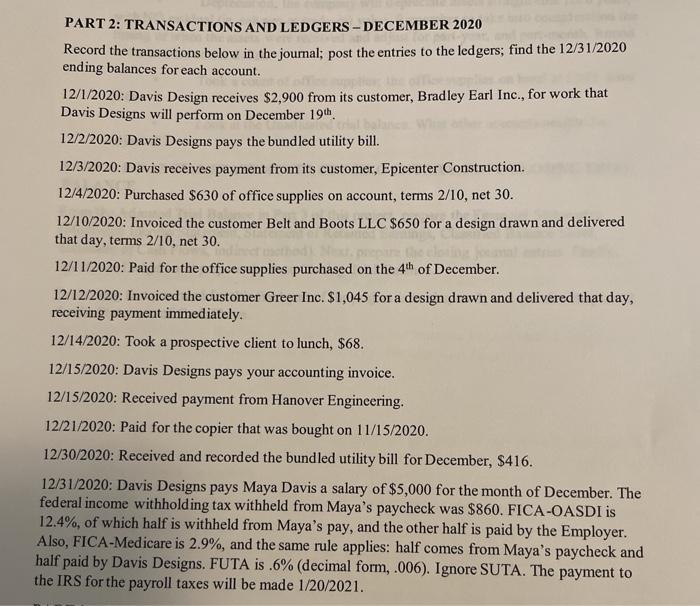

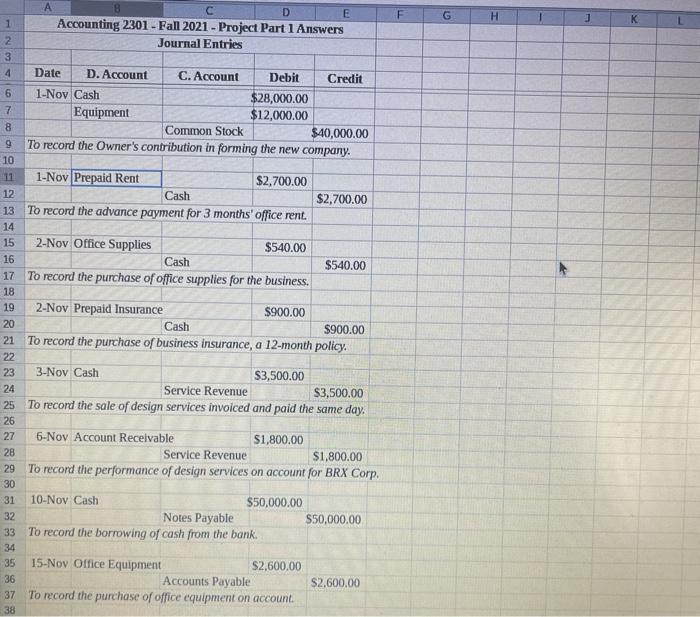

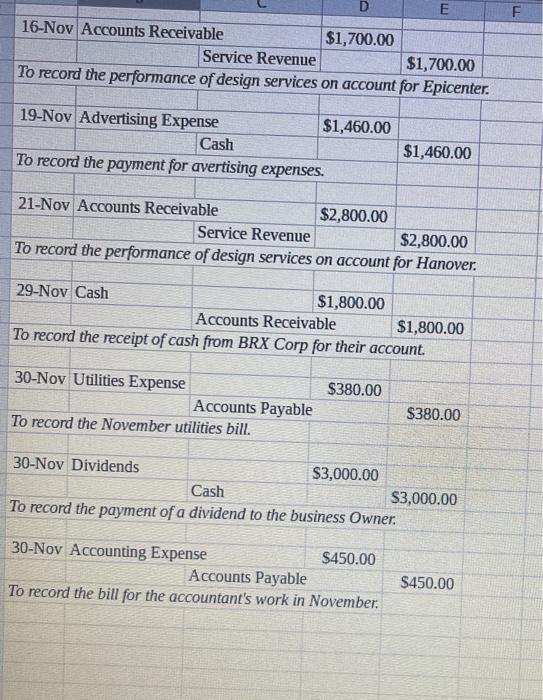

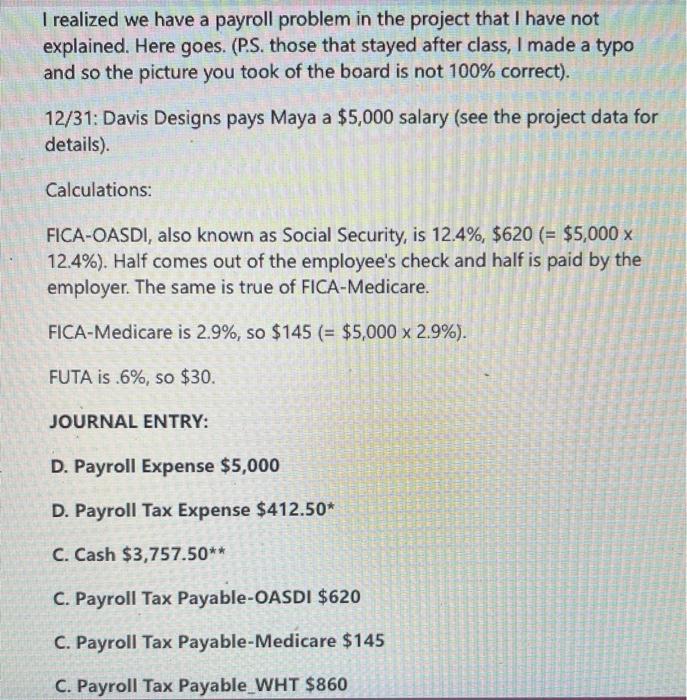

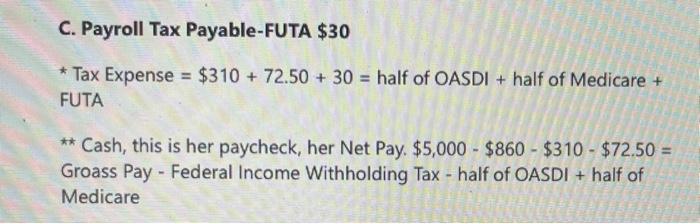

PART 2: TRANSACTIONS AND LEDGERS - DECEMBER 2020 Record the transactions below in the journal; post the entries to the ledgers; find the 12/31/2020 ending balances for each account. 12/1/2020: Davis Design receives $2,900 from its customer, Bradley Earl Inc., for work that Davis Designs will perform on December 19th 12/2/2020: Davis Designs pays the bundled utility bill. 12/3/2020: Davis receives payment from its customer, Epicenter Construction. 12/4/2020: Purchased $630 of office supplies on account, terms 2/10, net 30. 12/10/2020: Invoiced the customer Belt and Boots LLC $650 for a design drawn and delivered that day, terms 2/10, net 30. 12/11/2020: Paid for the office supplies purchased on the 4th of December. 12/12/2020: Invoiced the customer Greer Inc. $1,045 for a design drawn and delivered that day, receiving payment immediately. 12/14/2020: Took a prospective client to lunch, $68. 12/15/2020: Davis Designs pays your accounting invoice. 12/15/2020: Received payment from Hanover Engineering. 12/21/2020: Paid for the copier that was bought on 11/15/2020. 12/30/2020: Received and recorded the bundled utility bill for December, $416. 12/31/2020: Davis Designs pays Maya Davis a salary of $5,000 for the month of December. The federal income withholding tax withheld from Maya's paycheck was $860. FICA-OASDI is 12.4%, of which half is withheld from Maya's pay, and the other half is paid by the Employer. Also, FICA-Medicare is 2.9%, and the same rule applies: half comes from Maya's paycheck and half paid by Davis Designs. FUTA is .6% (decimal form, .006). Ignore SUTA. The payment to the IRS for the payroll taxes will be made 1/20/2021. F G H J K B E 1 Accounting 2301 - Fall 2021 - Project Part 1 Answers 2 Journal Entries 3 4 Date D. Account C. Account Debit Credit 6 1-Nov Cash $28,000.00 7 Equipment $12,000.00 8 Common Stock $40,000.00 9 To record the Owner's contribution in forming the new company. 10 11 1-Nov Prepaid Rent $2,700.00 12 Cash $2,700.00 13 To record the advance payment for 3 months' office rent. 14 15 2-Nov Office Supplies $540.00 16 Cash $540.00 17 To record the purchase of office supplies for the business. 18 19 2-Nov Prepaid Insurance $900.00 20 Cash $900.00 21 To record the purchase of business insurance, a 12-month policy. 22 23 3-Nov Cash $3,500.00 24 Service Revenue $3,500.00 25 To record the sale of design services invoiced and paid the same day, 26 27 5-Nov Account Receivable $1,800.00 28 Service Revenue $1,800.00 29 To record the performance of design services on account for BRX Corp. 30 31 10-Nov Cash $50,000.00 32 Notes Payable $50,000.00 33 To record the borrowing of cash from the bank 34 35 15-Nov Office Equipment S2,600.00 36 Accounts Payable $2,600.00 37 To record the purchase of office equipment on account 38 D E F 16-Nov Accounts Receivable $1,700.00 Service Revenue $1,700.00 To record the performance of design services on account for Epicenter. 19-Nov Advertising Expense $1,460.00 Cash To record the payment for avertising expenses. $1,460.00 21-Nov Accounts Receivable $2,800.00 Service Revenue $2,800.00 To record the performance of design services on account for Hanover. 29-Nov Cash $1,800.00 Accounts Receivable $1,800.00 To record the receipt of cash from BRX Corp for their account. 30-Nov Utilities Expense Accounts Payable To record the November utilities bill. $380.00 $380.00 30-Nov Dividends $3,000.00 Cash $3,000.00 To record the payment of a dividend to the business Owner. 30-Nov Accounting Expense $450.00 Accounts Payable To record the bill for the accountant's work in November $450.00 I realized we have a payroll problem in the project that I have not explained. Here goes. (P.S. those that stayed after class, I made a typo and so the picture you took of the board is not 100% correct). 12/31: Davis Designs pays Maya a $5,000 salary (see the project data for details). Calculations: FICA-OASDI, also known as Social Security, is 12.4%, $620 (= $5,000 x 12.4%). Half comes out of the employee's check and half is paid by the employer. The same is true of FICA-Medicare. FICA-Medicare is 2.9%, so $145 (= $5,000 x 2.9%). FUTA is .6%, so $30. JOURNAL ENTRY: D. Payroll Expense $5,000 D. Payroll Tax Expense $412.50* C. Cash $3,757.50** C. Payroll Tax Payable-OASDI $620 C. Payroll Tax Payable-Medicare $145 C. Payroll Tax Payable_WHT $860 C. Payroll Tax Payable-FUTA $30 * Tax Expense = $310 + 72.50 + 30 = half of OASDI + half of Medicare + FUTA ** Cash, this is her paycheck, her Net Pay. $5,000 - $860 - $310 - $72.50 = Groass Pay - Federal Income Withholding Tax - half of OASDI + half of Medicare