Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Look carefully at the examples given Complete 3B 3C Please make sure your answers are correct (Rain insurance) Gavin Jones's friend is planning to invest

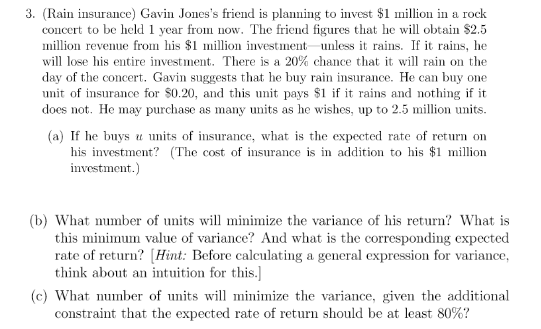

Look carefully at the examples given Complete 3B 3C Please make sure your answers are correct (Rain insurance) Gavin Jones's friend is planning to invest $1 million in a rock concert to be held 1 year from now. The friend figures that he will obtain $3 million revenue from his $1 million investment-unless, my goodness, it rains. If it rains, he will lose his entire investment. There is a 50% chance that it will rain the day of the concert. Gavin suggests that he buy rain insurance. He can buy one unit of insurance for $.50, and this unit pays $1 if it rains and nothing if it does not. He may purchase as many units as he wishes, up to $3 million. (a) What is the expected rate of return on his investment if he buys u units of insurance? (The cost of insurance is in addition to his $1 million investment.) (b) What number of units will minimize the variance of his return? What is this minimum value? And what is the corresponding expected rate of them? [Hint: Before calculating a general expression for variance, think about a simple answer.] The rate of return is {10000000+0.5u30000001,10000000+0.5uu1,ifitdoesnotrain,ifitrains. Because the probability of raining is 50%, the expected rate of return is 1000000+0.5u1500000+0.5u1=1000000+0.5u500000. Similarly, we can calculate the variance of the rate of return as (1000000+0.5u15000000.5u)2. We try to minimize the variance by choosing the number of insurance unit u[0,3000000]. Because the variance is a decreasing function in u when 0 u3000000, it is minimized at u=3000000. Thus, you need buy 3,000,000 units of insurance to minimize the variance, and the minimum variance is 0 . The expected rate of return is 20%. Without calculating the general expression of variance, one can still find the optimal u in the following way. Note that whether or not it rains, the difference in revenue is $3,000,000. On the other hand, the difference in insurance payment is $1 per unit. Therefore, by purchasing 3000000 units of the insurance, the gap in revenue is fully compensated by the insurance payment, ensuring a certain payoff and minimizing the variance of return. 3. (Rain insurance) Gavin Jones's friend is planning to invest $1 million in a rock concert to be held 1 year from now. The friend figures that he will obtain $2.5 million revenue from his $1 million investment - unless it rains. If it rains, he will lose his entire investment. There is a 20% chance that it will rain on the day of the concert. Gavin suggests that he buy rain insurance. He can buy one unit of insurance for $0.20, and this unit pays $1 if it rains and nothing if it does not. He may purchase as many units as he wishes, up to 2.5 million units. (a) If he buys u units of insurance, what is the expected rate of return on his investment? (The cost of insurance is in addition to his $1 million investment.) (b) What number of units will minimize the variance of his return? What is this minimum value of variance? And what is the corresponding expected rate of return? [Hint: Before calculating a general expression for variance, think about an intuition for this.] (c) What number of units will minimize the variance, given the additional constraint that the expected rate of return should be at least 80%

Look carefully at the examples given Complete 3B 3C Please make sure your answers are correct (Rain insurance) Gavin Jones's friend is planning to invest $1 million in a rock concert to be held 1 year from now. The friend figures that he will obtain $3 million revenue from his $1 million investment-unless, my goodness, it rains. If it rains, he will lose his entire investment. There is a 50% chance that it will rain the day of the concert. Gavin suggests that he buy rain insurance. He can buy one unit of insurance for $.50, and this unit pays $1 if it rains and nothing if it does not. He may purchase as many units as he wishes, up to $3 million. (a) What is the expected rate of return on his investment if he buys u units of insurance? (The cost of insurance is in addition to his $1 million investment.) (b) What number of units will minimize the variance of his return? What is this minimum value? And what is the corresponding expected rate of them? [Hint: Before calculating a general expression for variance, think about a simple answer.] The rate of return is {10000000+0.5u30000001,10000000+0.5uu1,ifitdoesnotrain,ifitrains. Because the probability of raining is 50%, the expected rate of return is 1000000+0.5u1500000+0.5u1=1000000+0.5u500000. Similarly, we can calculate the variance of the rate of return as (1000000+0.5u15000000.5u)2. We try to minimize the variance by choosing the number of insurance unit u[0,3000000]. Because the variance is a decreasing function in u when 0 u3000000, it is minimized at u=3000000. Thus, you need buy 3,000,000 units of insurance to minimize the variance, and the minimum variance is 0 . The expected rate of return is 20%. Without calculating the general expression of variance, one can still find the optimal u in the following way. Note that whether or not it rains, the difference in revenue is $3,000,000. On the other hand, the difference in insurance payment is $1 per unit. Therefore, by purchasing 3000000 units of the insurance, the gap in revenue is fully compensated by the insurance payment, ensuring a certain payoff and minimizing the variance of return. 3. (Rain insurance) Gavin Jones's friend is planning to invest $1 million in a rock concert to be held 1 year from now. The friend figures that he will obtain $2.5 million revenue from his $1 million investment - unless it rains. If it rains, he will lose his entire investment. There is a 20% chance that it will rain on the day of the concert. Gavin suggests that he buy rain insurance. He can buy one unit of insurance for $0.20, and this unit pays $1 if it rains and nothing if it does not. He may purchase as many units as he wishes, up to 2.5 million units. (a) If he buys u units of insurance, what is the expected rate of return on his investment? (The cost of insurance is in addition to his $1 million investment.) (b) What number of units will minimize the variance of his return? What is this minimum value of variance? And what is the corresponding expected rate of return? [Hint: Before calculating a general expression for variance, think about an intuition for this.] (c) What number of units will minimize the variance, given the additional constraint that the expected rate of return should be at least 80% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started