Answered step by step

Verified Expert Solution

Question

1 Approved Answer

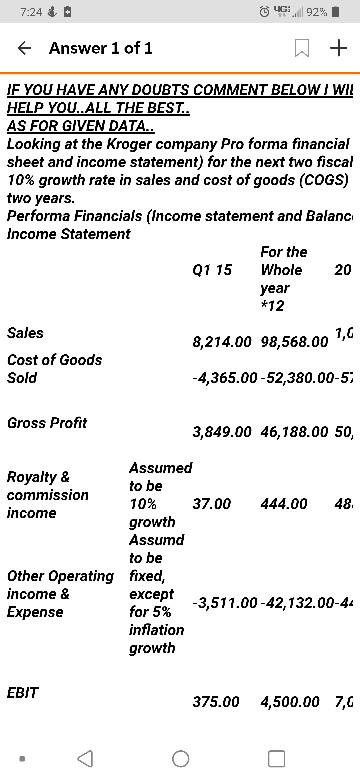

Looking at Krogers Pro Forma financial statements(balance sheet and income statement) for the next two fiscal years, assuming a 10% growth rate in sales and

Looking at Krogers Pro Forma financial statements(balance sheet and income statement) for the next two fiscal years, assuming a 10% growth rate in sales and cost of goods sold (COGS) for each of the next two years. *PLEASE MAKE SURE I CAN SEE ALL THE NUMBERS THANKS

the image is incomplete because this is what one of the other people put when i asked this same question so i could not read what they put....

yes it is

7:24 & 2 4G,92% + Answer 1 of 1 0 + IF YOU HAVE ANY DOUBTS COMMENT BELOW / WIL HELP YOU..ALL THE BEST.. AS FOR GIVEN DATA.. Looking at the Kroger company Pro forma financial sheet and income statement) for the next two fiscal 10% growth rate in sales and cost of goods (COGS) two years. Performa Financials (Income statement and Balanc Income Statement For the 01 15 Whole 20 year *12 8,214.00 98,568.00 7,0 Sales Cost of Goods Sold -4,365.00-52,380.00-5 Gross Profit 3,849.00 46,188.00 50, Royalty & commission income Assumed to be 10% 37.00 444.00 48. growth Assumd to be fixed, except -3,511.00-42,132.00-44 inflation growth Other Operating income & Expense EBIT 375.00 4,500.00 7,6 7:24 & 2 4G,92% + Answer 1 of 1 0 + IF YOU HAVE ANY DOUBTS COMMENT BELOW / WIL HELP YOU..ALL THE BEST.. AS FOR GIVEN DATA.. Looking at the Kroger company Pro forma financial sheet and income statement) for the next two fiscal 10% growth rate in sales and cost of goods (COGS) two years. Performa Financials (Income statement and Balanc Income Statement For the 01 15 Whole 20 year *12 8,214.00 98,568.00 7,0 Sales Cost of Goods Sold -4,365.00-52,380.00-5 Gross Profit 3,849.00 46,188.00 50, Royalty & commission income Assumed to be 10% 37.00 444.00 48. growth Assumd to be fixed, except -3,511.00-42,132.00-44 inflation growth Other Operating income & Expense EBIT 375.00 4,500.00 7,6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started