Answered step by step

Verified Expert Solution

Question

1 Approved Answer

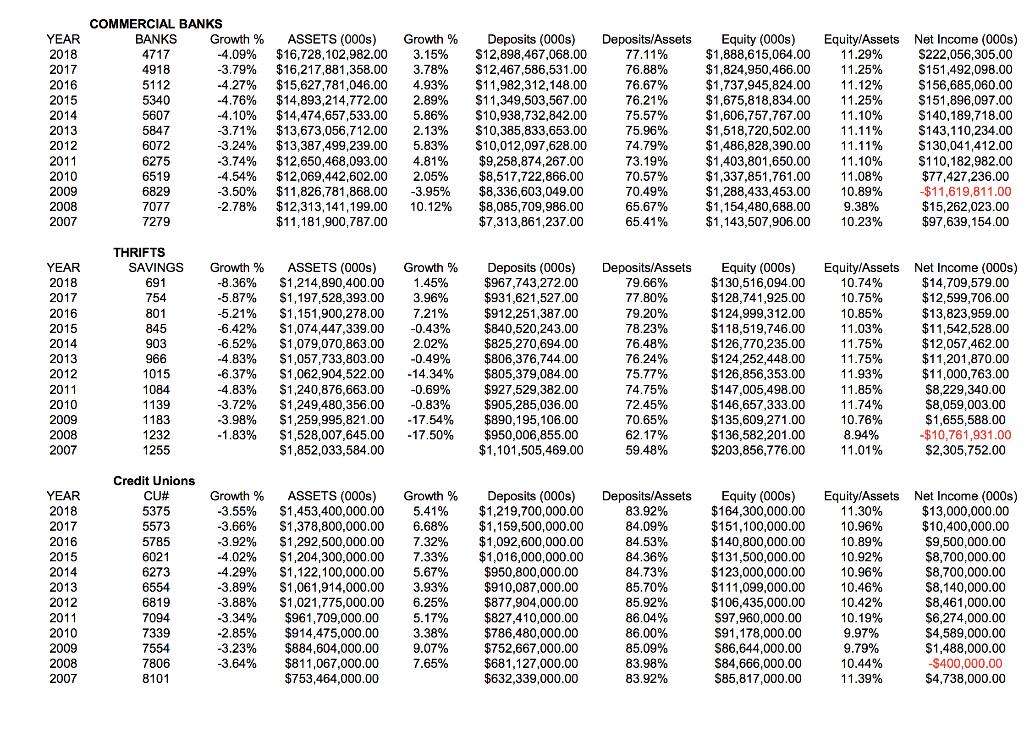

Looking at the chart showing the number of institutions and their assets, deposits, equity, and income and profitability data from 2007-2018 comment on the significant

Looking at the chart showing the number of institutions and their assets, deposits, equity, and income and profitability data from 2007-2018 comment on the significant changes in each category for each institution.

YEAR 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 YEAR 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 YEAR 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 COMMERCIAL BANKS BANKS 4717 4918 5112 5340 5607 5847 6072 6275 6519 6829 7077 7279 THRIFTS SAVINGS 691 754 801 845 903 966 1015 1084 1139 1183 1232 1255 Credit Unions CU# 5375 5573 5785 6021 6273 6554 6819 7094 7339 7554 7806 8101 Growth % ASSETS (000s) Growth % -4.09% $16,728,102,982.00 3.15% -3.79% $16,217,881,358.00 3.78% $12,467,586,531.00 -4.27% $15,627,781,046.00 4.93% $11,982,312,148.00 -4.76% $14,893,214,772.00 2.89% $11,349,503,567.00 -4.10% $14,474,657,533.00 5.86% $10,938,732,842.00 -3.71% $13,673,056,712.00 2.13% $10,385,833,653.00 -3.24% $13,387,499,239.00 5.83% $10,012,097,628.00 -3.74% $12,650,468,093.00 4.81% $9,258,874,267.00 -4.54% $12,069,442,602.00 2.05% $8,517,722,866.00 $8,336,603,049.00 $8,085,709,986.00 $7,313,861,237.00 -3.50% -2.78% $11,826,781,868.00 -3.95% $12,313,141,199.00 10.12% $11,181,900,787.00 Growth % ASSETS (000s) Growth % -8.36% $1,214,890,400.00 1.45% -5.87% $1,197,528,393.00 3.96% -5.21% $1,151,900,278.00 7.21% -6.42% $1,074,447,339.00 -0.43% -6.52% $1,079,070,863.00 2.02% -4.83% $1,057,733,803.00 -0.49% -6.37% $1,062,904,522.00 -14.34% -4.83% $1,240,876,663.00 -0.69% -3.72% $1,249,480,356.00 -0.83% -3.98% $1,259,995,821.00 -17.54% -1.83% $1,528,007,645.00 -17.50% $1,852,033,584.00 Growth % -3.55% -3.66% ASSETS (000s) Growth % $1,453,400,000.00 5.41% $1,378,800,000.00 6.68% -3.92% $1,292,500,000.00 7.32% -4.02% $1,204,300,000.00 7.33% -4.29% $1,122,100,000.00 5.67% -3.89% $1,061,914,000.00 3.93% -3.88% $1,021,775,000.00 6.25% -3.34% $961,709,000.00 5.17% $914,475,000.00 3.38% $884,604,000.00 9.07% $811,067,000.00 7.65% $753,464,000.00 Deposits (000s) Deposits/Assets $12,898,467,068.00 77.11% 76.88% 76.67% 76.21% 75.57% 75.96% 74.79% 73.19% 70.57% 70.49% 65.67% 65.41% -2.85% -3.23% -3.64% Deposits (000s) $967,743,272.00 $931,621,527.00 $912,251,387.00 $840,520,243.00 $825,270,694.00 $806,376,744.00 $805,379,084.00 $927,529,382.00 $905,285,036.00 $890,195,106.00 $950,006,855.00 $1,101,505,469.00 Deposits/Assets 79.66% 77.80% 79.20% 78.23% 76.48% 76.24% 75.77% 74.75% 72.45% 70.65% 62.17% 59.48% Deposits (000s) Deposits/Assets $1,219,700,000.00 $1,159,500,000.00 $1,092,600,000.00 $1,016,000,000.00 $950,800,000.00 $910,087,000.00 $877,904,000.00 $827,410,000.00 $786,480,000.00 $752,667,000.00 $681,127,000.00 $632,339,000.00 83.92% 84.09% 84.53% 84.36% 84.73% 85.70% 85.92% 86.04% 86.00% 85.09% 83.98% 83.92% Equity (000s) Equity/Assets $1,888,615,064.00 11.29% $1,824,950,466.00 11.25% $1,737,945,824.00 11.12% $1,675,818,834.00 11.25% $1,606,757,767.00 11.10% $1,518,720,502.00 11.11% $1,486,828,390.00 11.11% $1,403,801,650.00 11.10% $1,337,851,761.00 11.08% $1,288,433,453.00 10.89% $1,154,480,688.00 9.38% $1,143,507,906.00 10.23% Net Income (000s) $222,056,305.00 $151,492,098.00 10.75% 10.85% 11.03% 11.75% 11.75% 11.93% 11.85% 11.74% 10.76% 8.94% 11.01% $156,685,060.00 $151,896,097.00 $140,189,718.00 $143,110,234.00 $130,041,412.00 $110,182,982.00 $77,427,236.00 -$11,619,811.00 $15,262,023.00 $97,639,154.00 10.74% $14.709,579.00 Equity (000s) Equity/Assets Net Income (000s) $130,516,094.00 $128,741,925.00 $124,999,312.00 $118,519,746.00 $126,770,235.00 $124,252,448.00 $126,856,353.00 $147,005,498.00 $146,657,333.00 $135,609,271.00 $136,582,201.00 $12,599,706.00 $13,823,959.00 $11,542,528.00 $12,057,462.00 $11,201,870.00 $11,000,763.00 $8,229,340.00 $8,059,003.00 $1,655,588.00 -$10,761,931.00 $203,856,776.00 $2,305,752.00 Equity (000s) Equity/Assets Net Income (000s) $164,300,000.00 11.30% $13,000,000.00 $10,400,000.00 $151,100,000.00 10.96% $140,800,000.00 10.89% $131,500,000.00 10.92% $123,000,000.00 10.96% $111,099,000.00 10.46% $106,435,000.00 10.42% $97,960,000.00 10.19% $91,178,000.00 9.97% $86,644,000.00 9.79% $84,666,000.00 10.44% $85,817,000.00 11.39% $9,500,000.00 $8,700,000.00 $8,700,000.00 $8,140,000.00 $8,461,000.00 $6,274,000.00 $4,589,000.00 $1,488,000.00 -$400,000.00 $4,738,000.00

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Institution type Commercial banks ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started