Answered step by step

Verified Expert Solution

Question

1 Approved Answer

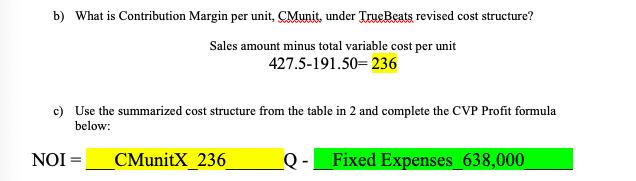

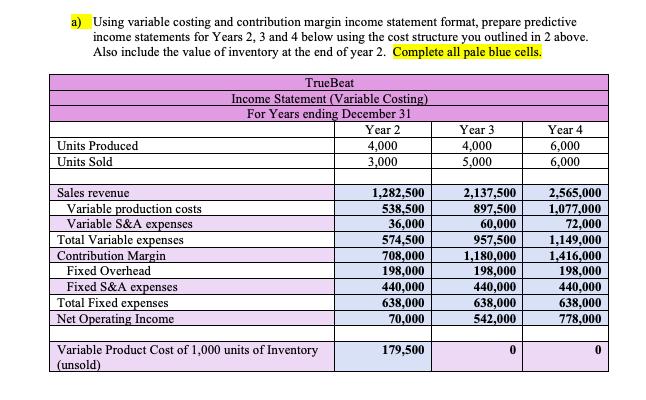

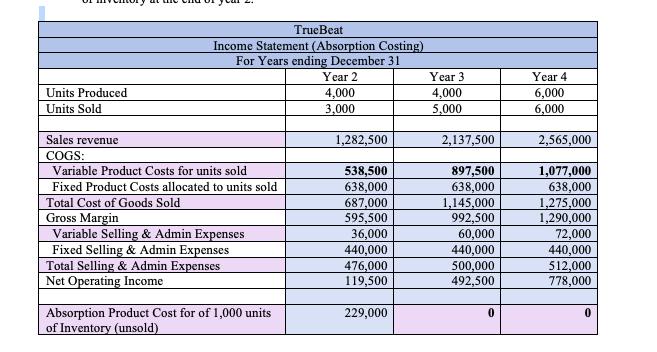

looking at the revised cost structure and contribution margin from 2B(second image) and variable and absorption income statement, how do I calculate everything from Question

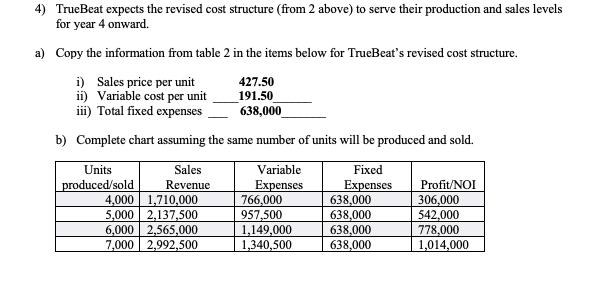

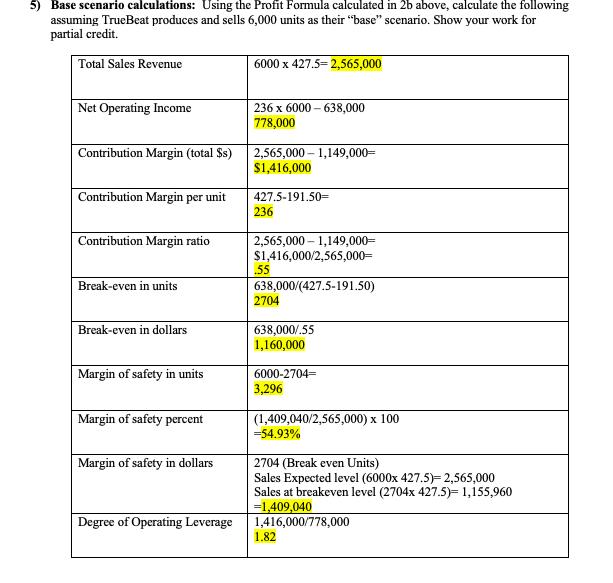

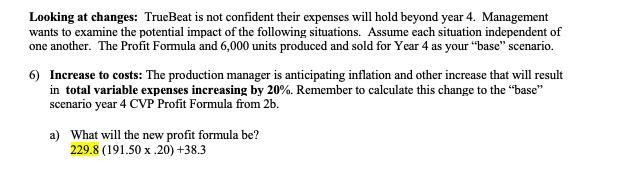

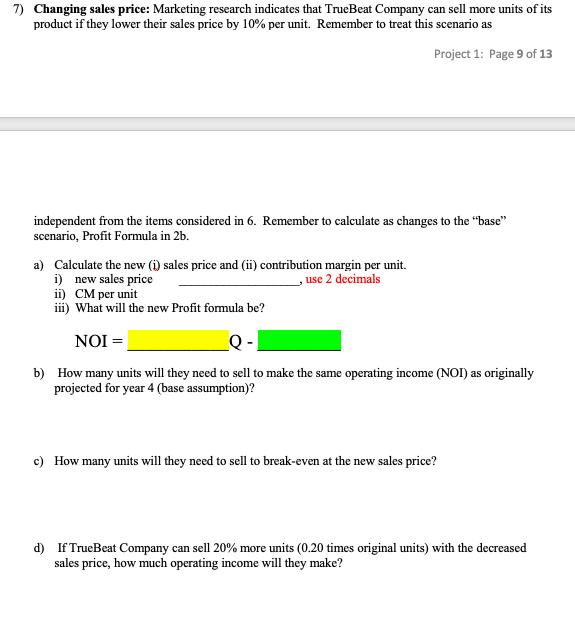

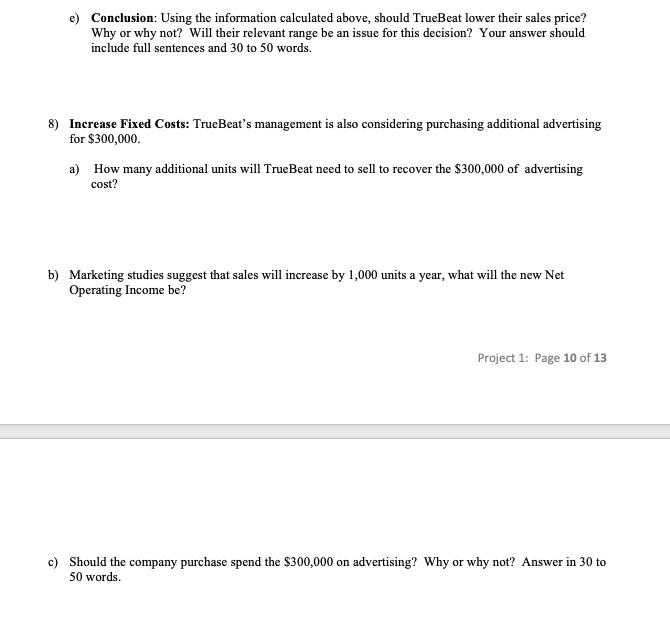

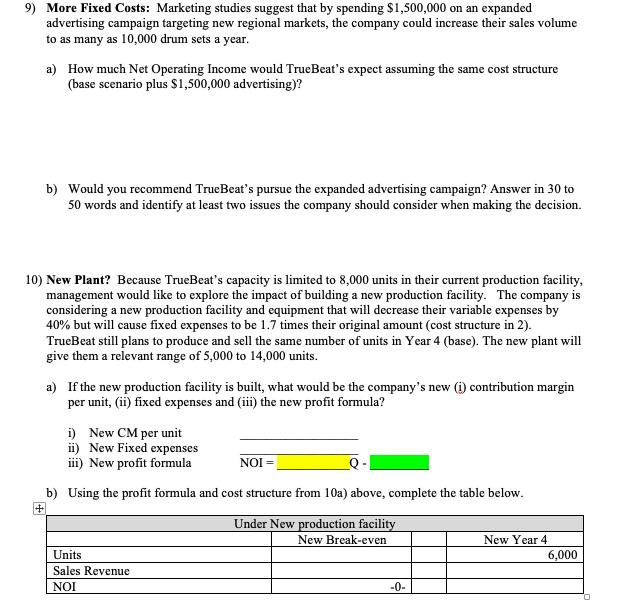

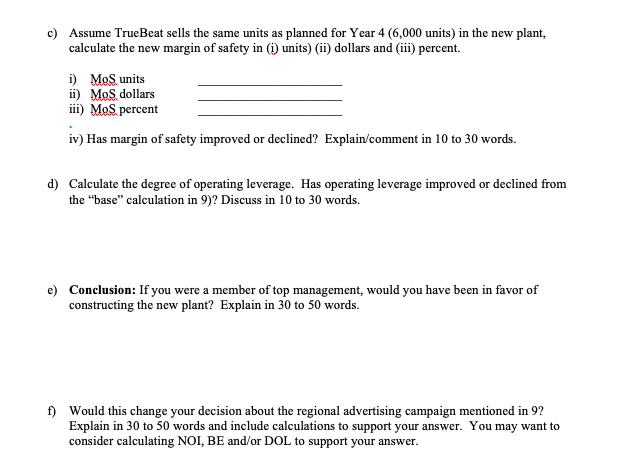

looking at the revised cost structure and contribution margin from 2B(second image) and variable and absorption income statement, how do I calculate everything from Question 4 to 10?

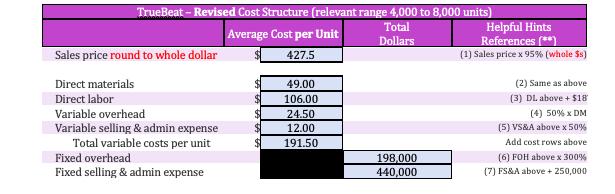

TrueBeat - Revised Cost Structure (relevant range 4,000 to 8,000 units) Helpful Hints References (**) Total Average Cost per Unit Dollars Sales price round to whole dollar 427.5 (1) Sales price x 95% (whole $s) Direct materials 49.00 (2) Same as above Direct labor 106.00 (3) DL above + $18 Variable overhead 24.50 (4) 50% x DM Variable selling & admin expense Total variable costs per unit Fixed overhead Fixed selling & admin expense 12.00 (5) VSAA above x 50% 191.50 Add cost rows above (6) FOH above x 300% 198,000 440,000 (7) FS&A above + 250,000

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Before examining contribution margins lets review some key concepts fixed costs relevant range variable costs and contribution margin Fixed costs are those costs that will not change within a given ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started