Answered step by step

Verified Expert Solution

Question

1 Approved Answer

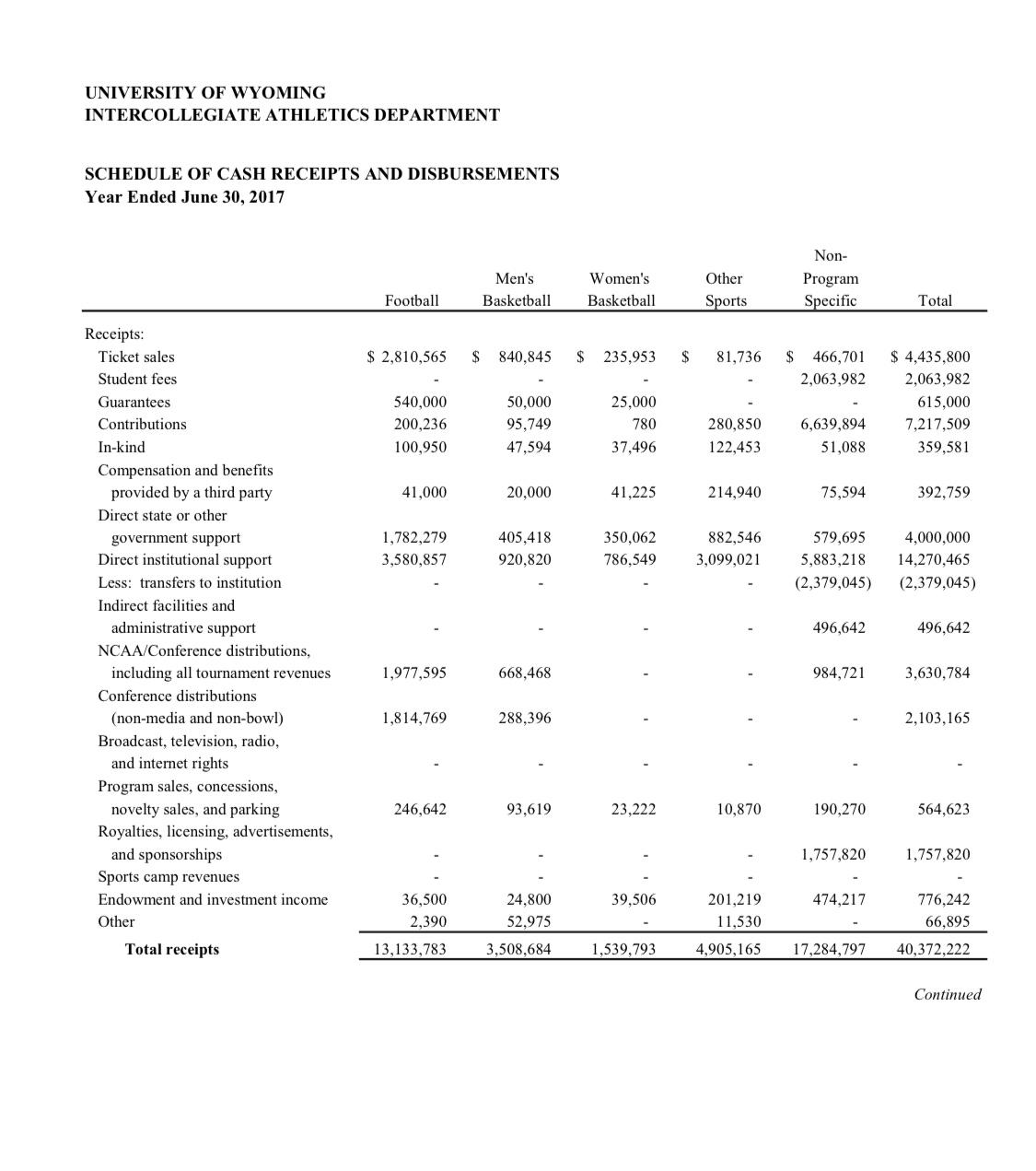

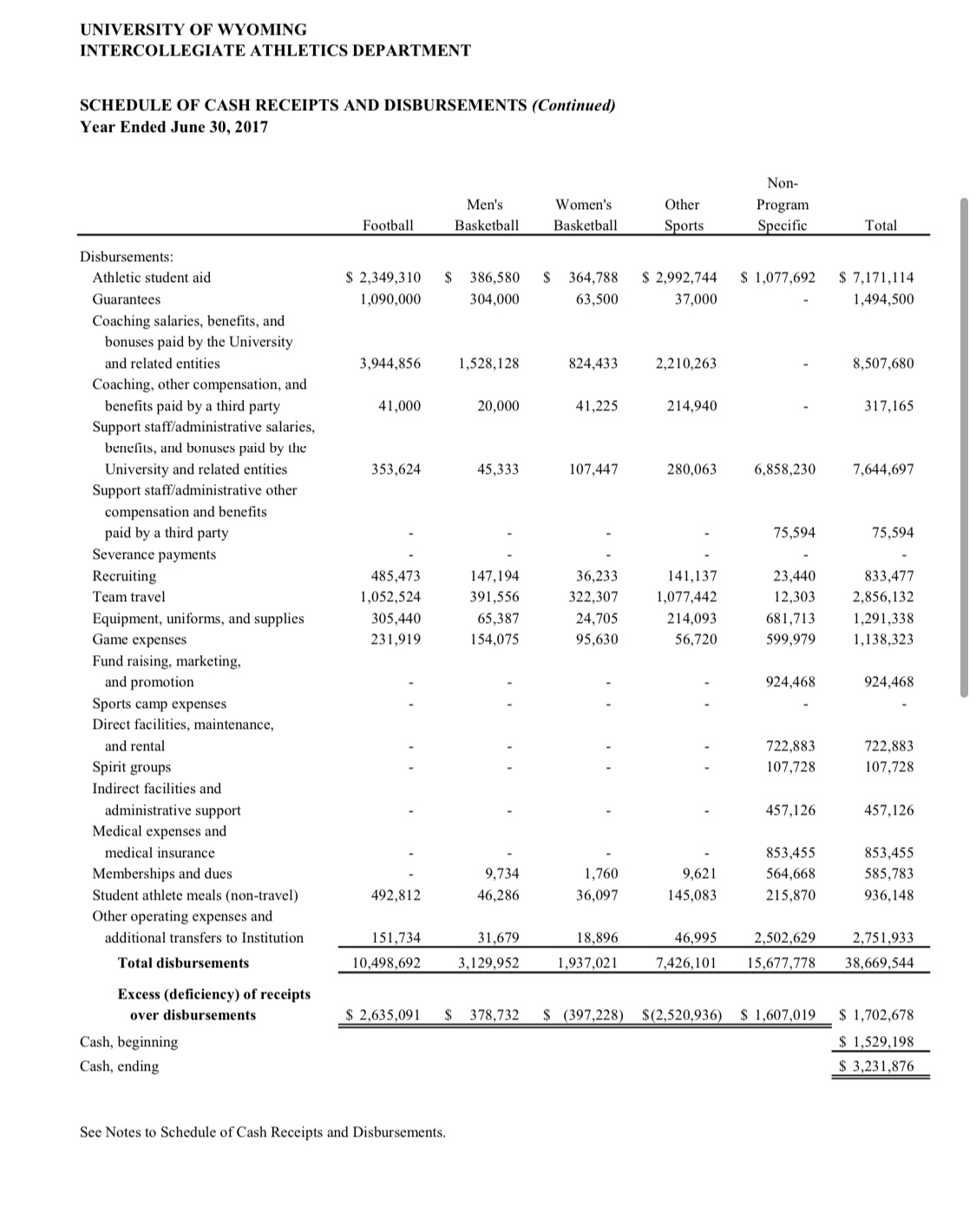

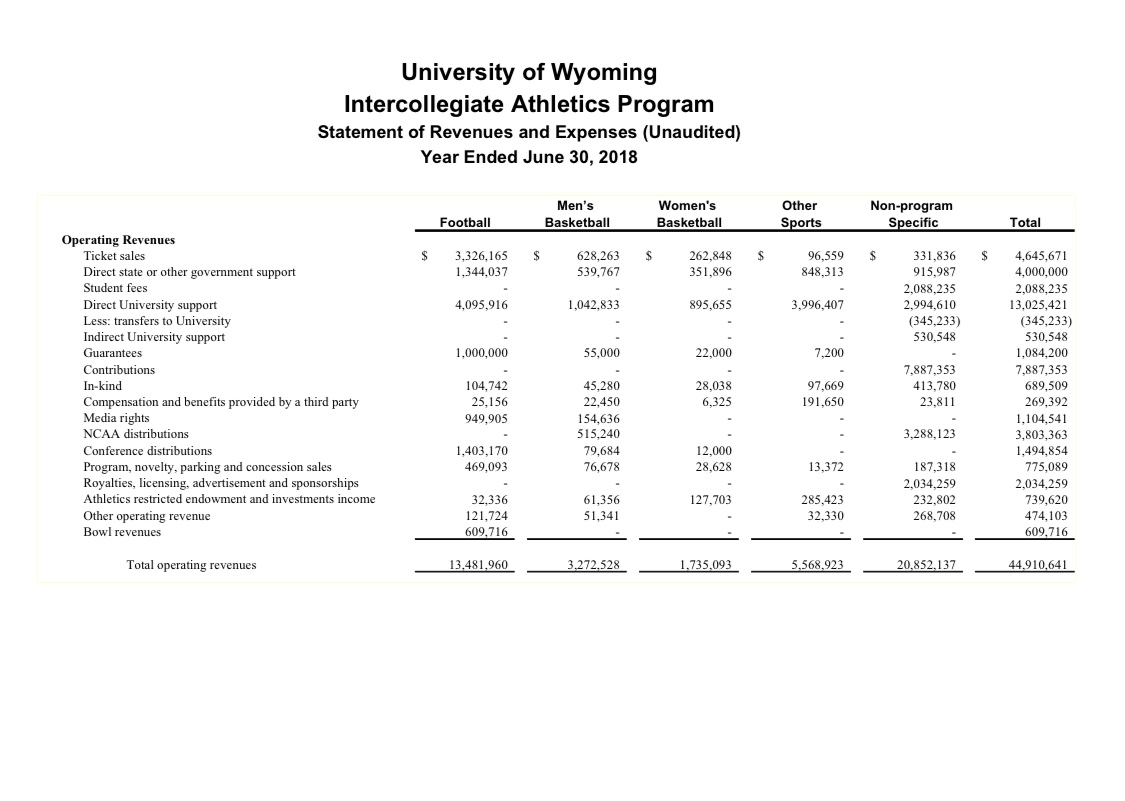

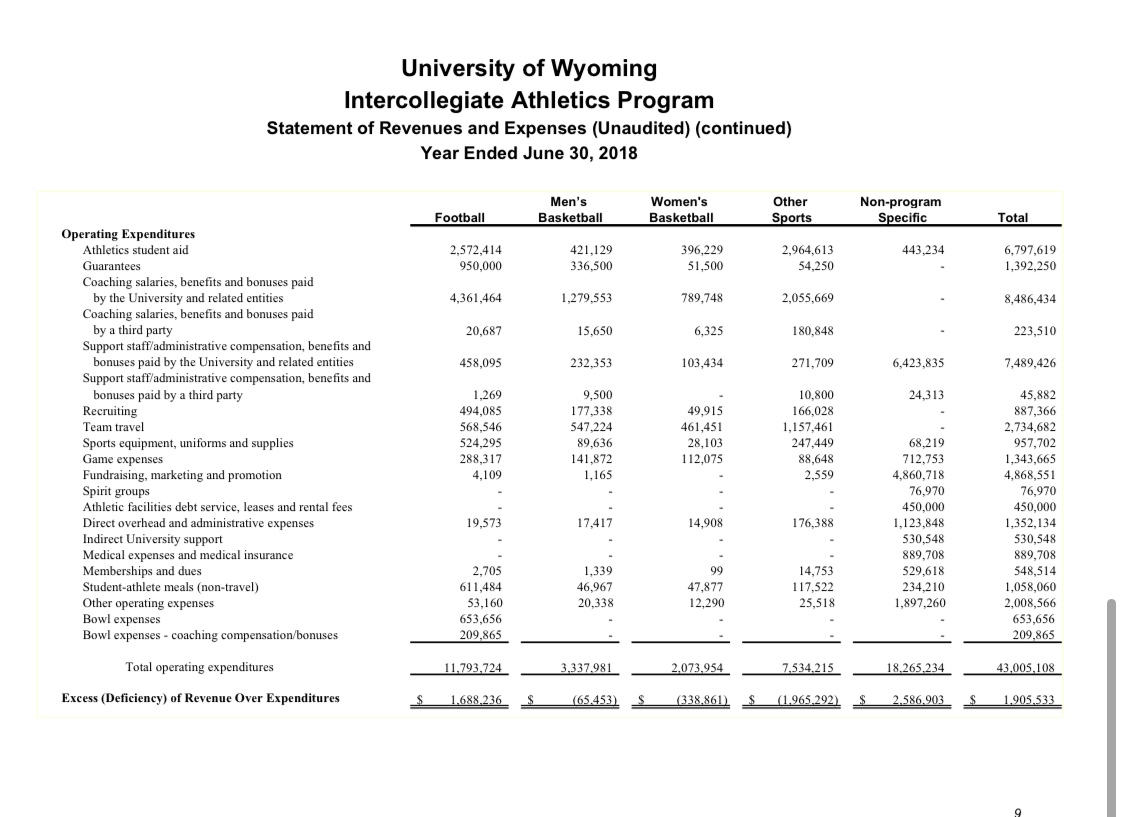

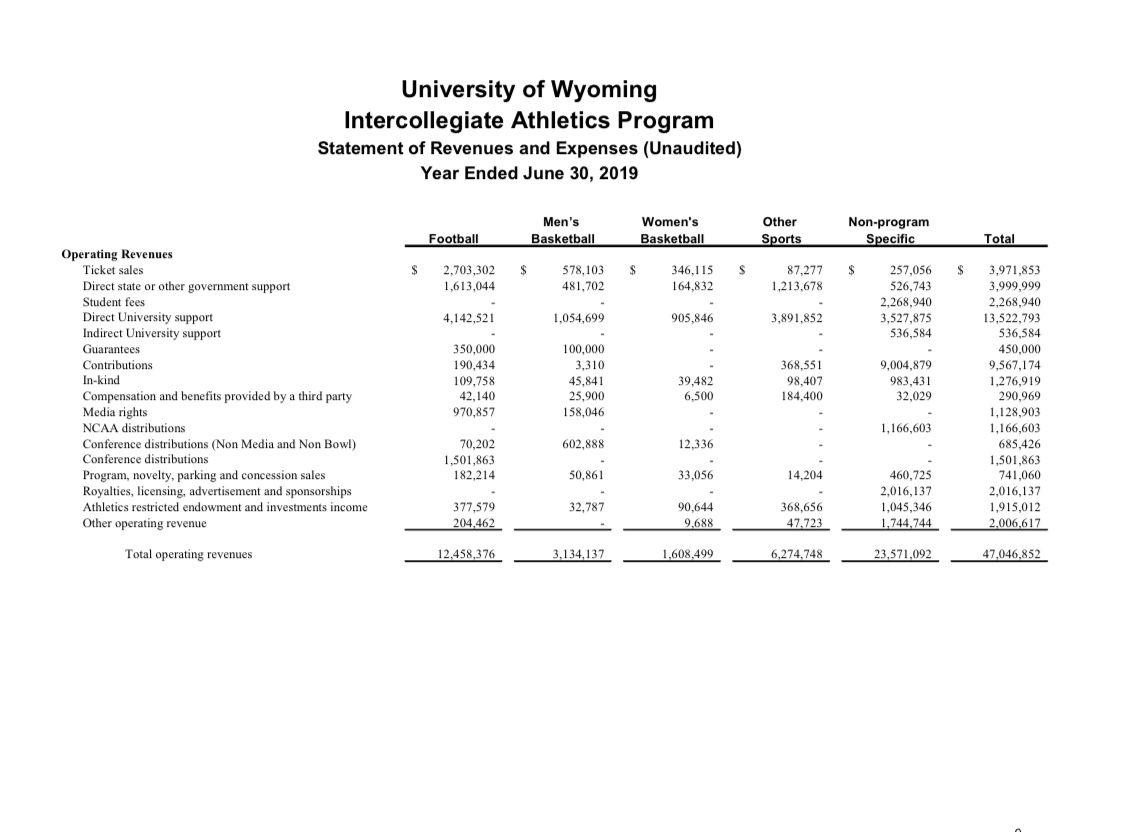

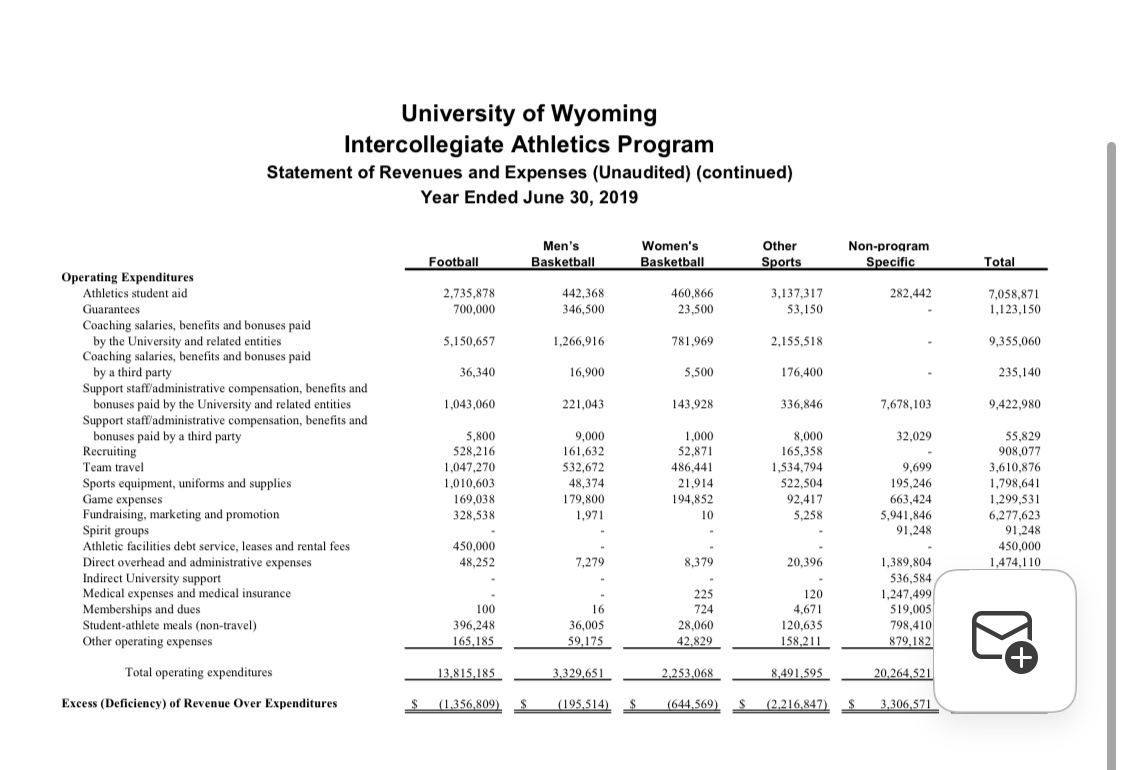

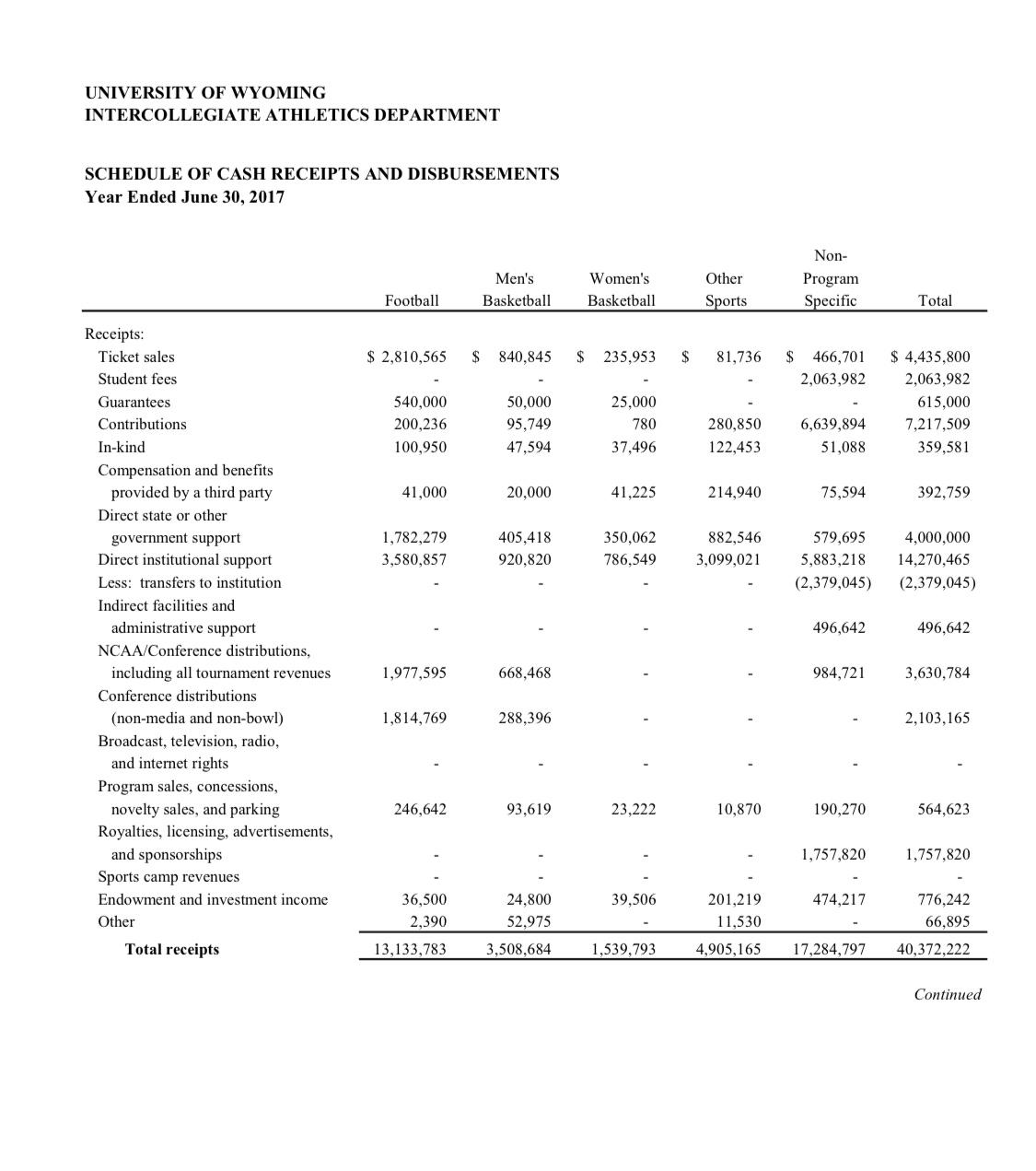

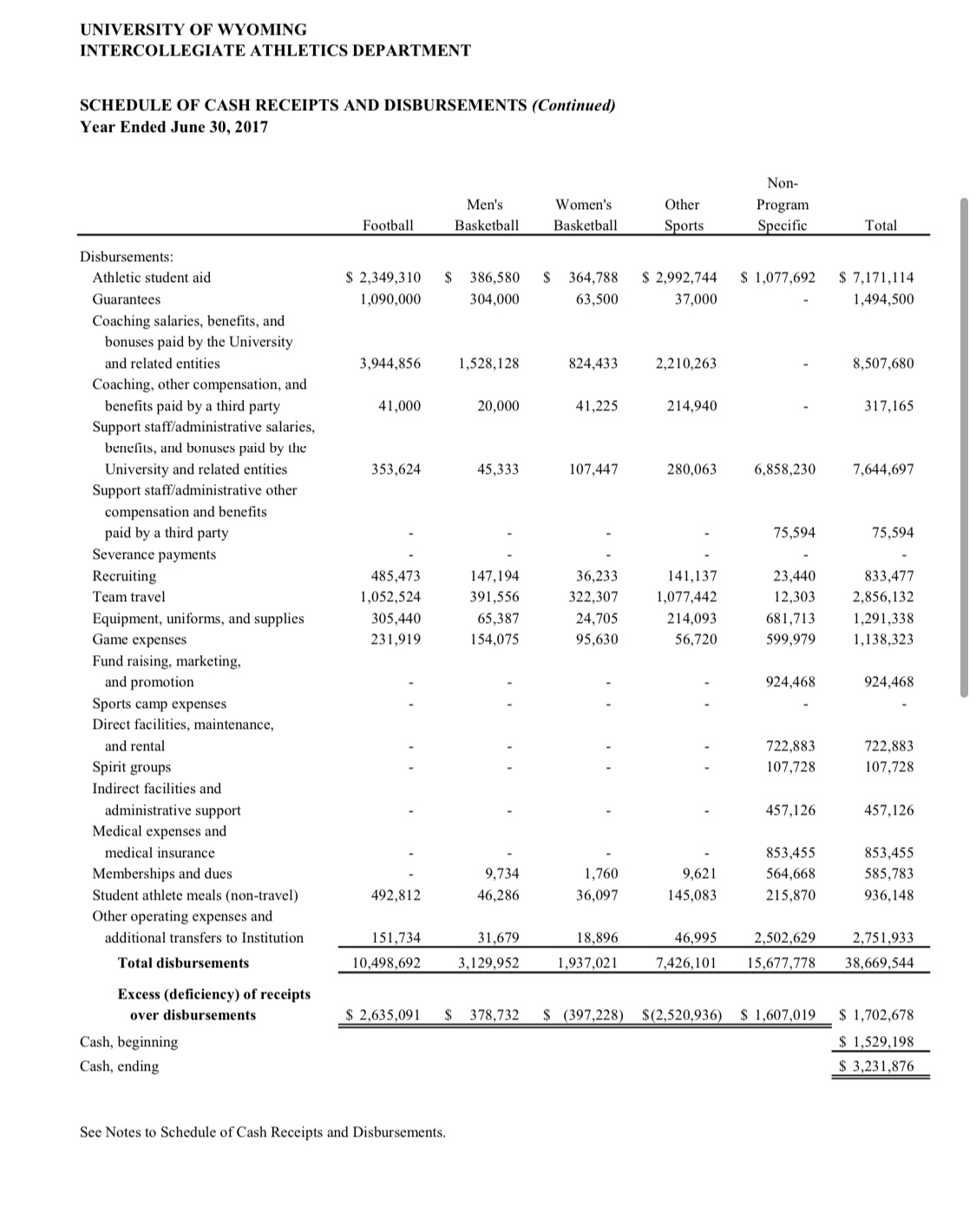

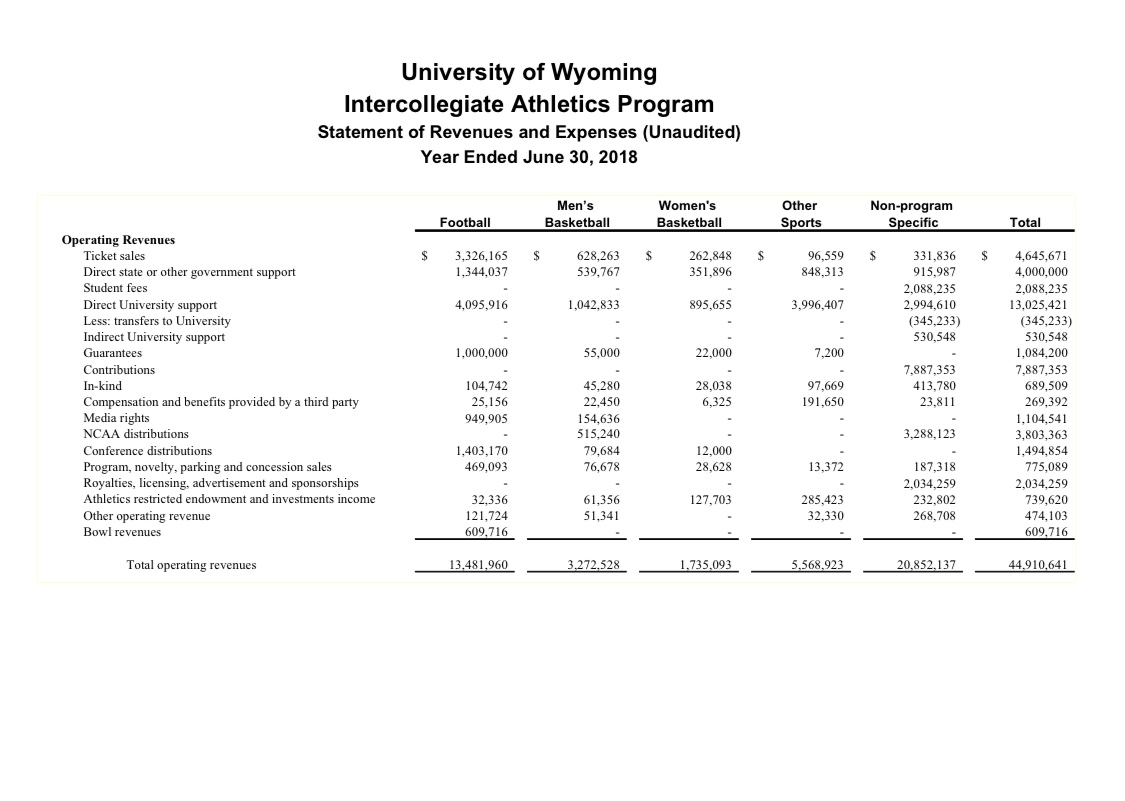

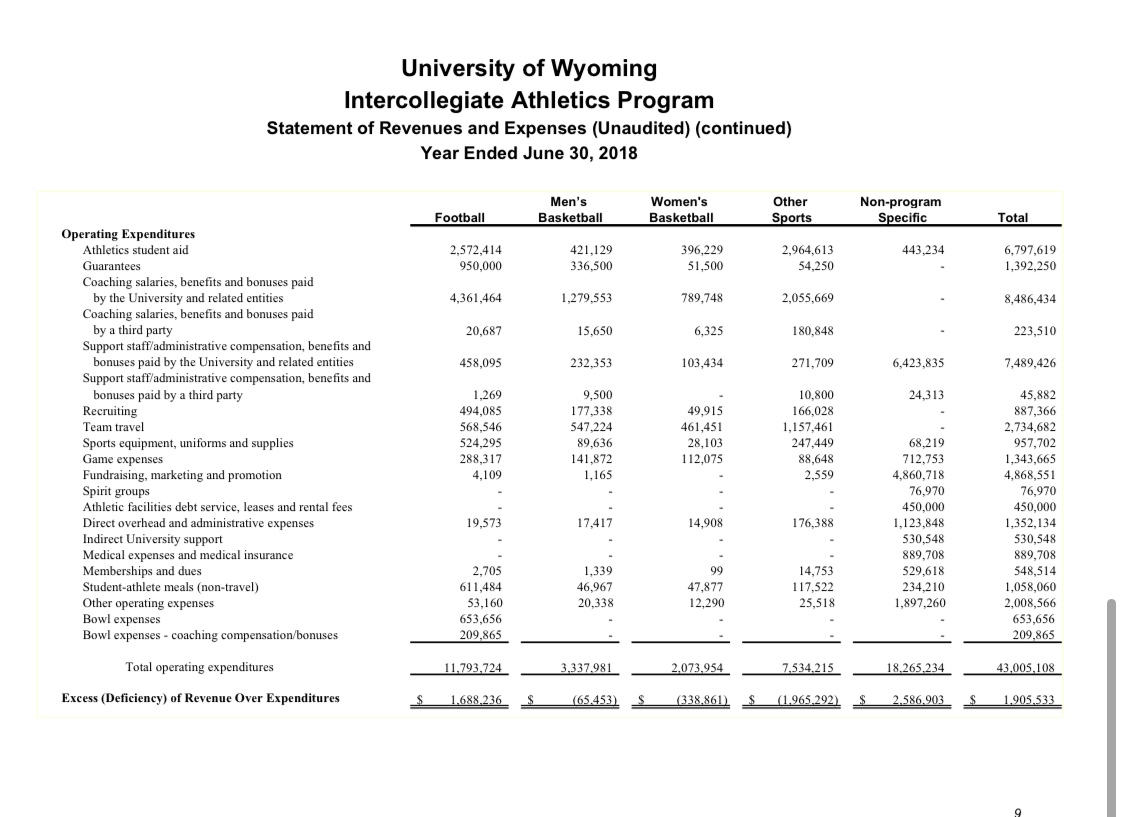

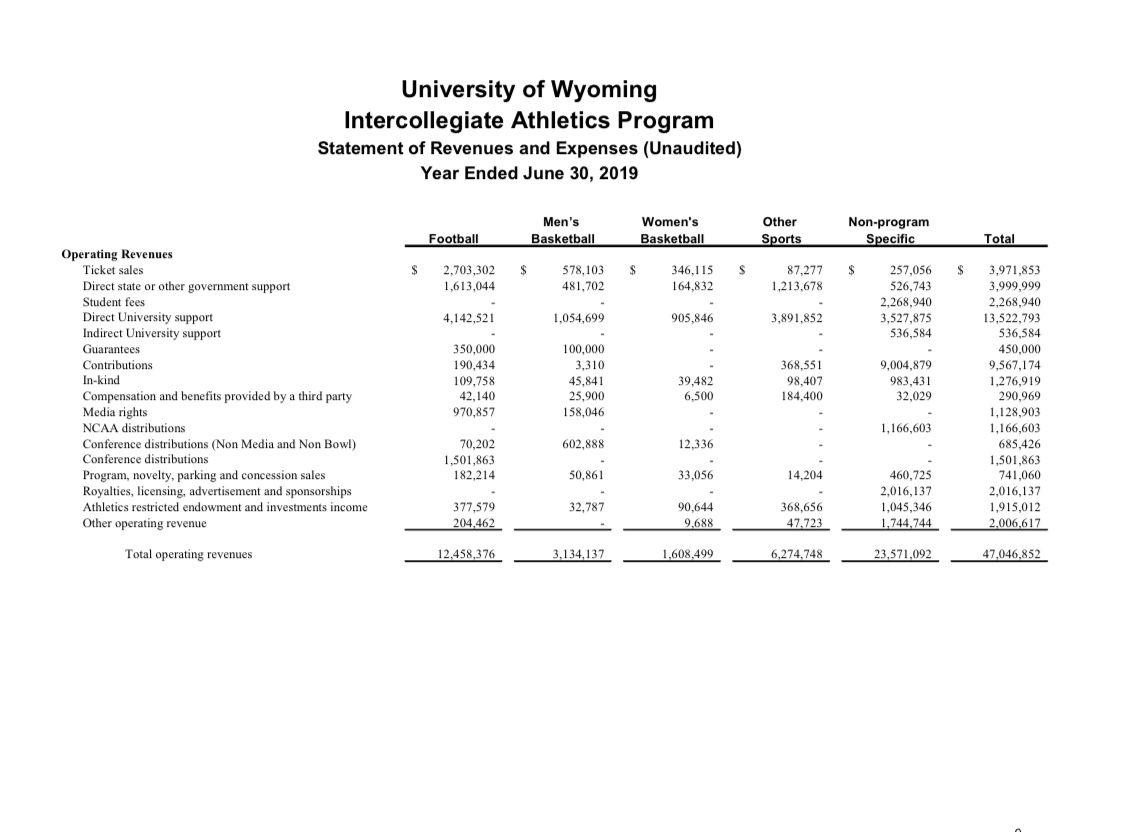

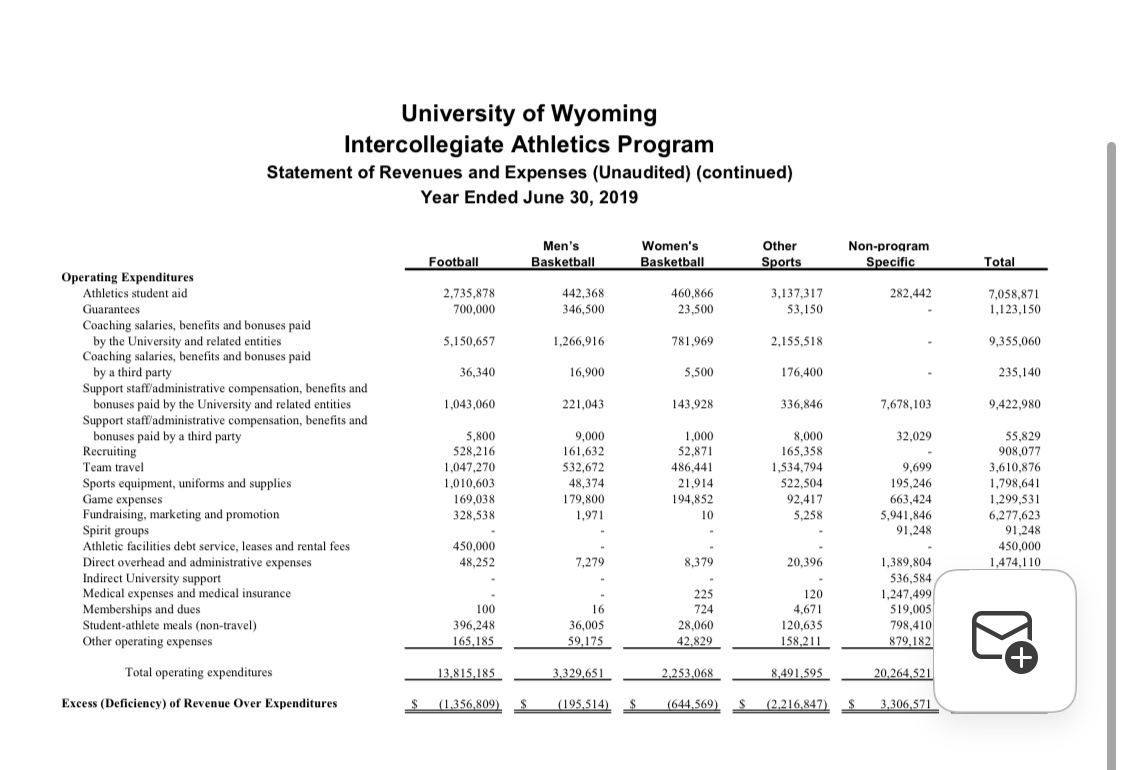

Looking at the statement of revenue and expenses in 2018 and 2019 here above but also at the schedule of cash receipts and disbursements in

Looking at the statement of revenue and expenses in 2018 and 2019 here above but also at the schedule of cash receipts and disbursements in 2017, describe the financial position of the athletics department. Is the department in a good position financially? Could it sustain operation without subsidization from its university? Give 2 cost cutting and 2 revenue enhancing proposals for the department.

UNIVERSITY OF WYOMING INTERCOLLEGIATE ATHLETICS DEPARTMENT SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS Year Ended June 30, 2017 Non- Football Men's Basketball Women's Basketball Other Program Sports Specific Total Receipts: Ticket sales Student fees Guarantees Contributions $ 2,810,565 $ 840,845 $ 235,953 $ 81,736 $ 466,701 $ 4,435,800 2,063,982 540,000 50,000 25,000 2,063,982 615,000 200,236 95,749 780 280,850 6,639,894 7,217,509 In-kind 100,950 47,594 37,496 122,453 51,088 359,581 Compensation and benefits provided by a third party 41,000 20,000 41,225 214,940 75,594 392,759 Direct state or other government support 1,782,279 405,418 350,062 882,546 Direct institutional support 3,580,857 920,820 786,549 3,099,021 579,695 4,000,000 5,883,218 14,270,465 Less: transfers to institution (2,379,045) (2,379,045) Indirect facilities and administrative support 496,642 496,642 NCAA/Conference distributions, including all tournament revenues 1,977,595 668,468 984,721 3,630,784 Conference distributions (non-media and non-bowl) 1,814,769 288,396 2,103,165 Broadcast, television, radio, and internet rights Program sales, concessions, novelty sales, and parking 246,642 93,619 23,222 10,870 190,270 564,623 Royalties, licensing, advertisements, and sponsorships 1,757,820 1,757,820 Sports camp revenues Endowment and investment income Other 36,500 2,390 Total receipts 13,133,783 24,800 52,975 3,508,684 39,506 1,539,793 201,219 11,530 4,905,165 17,284,797 474,217 776,242 66,895 40,372,222 Continued

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started