Answered step by step

Verified Expert Solution

Question

1 Approved Answer

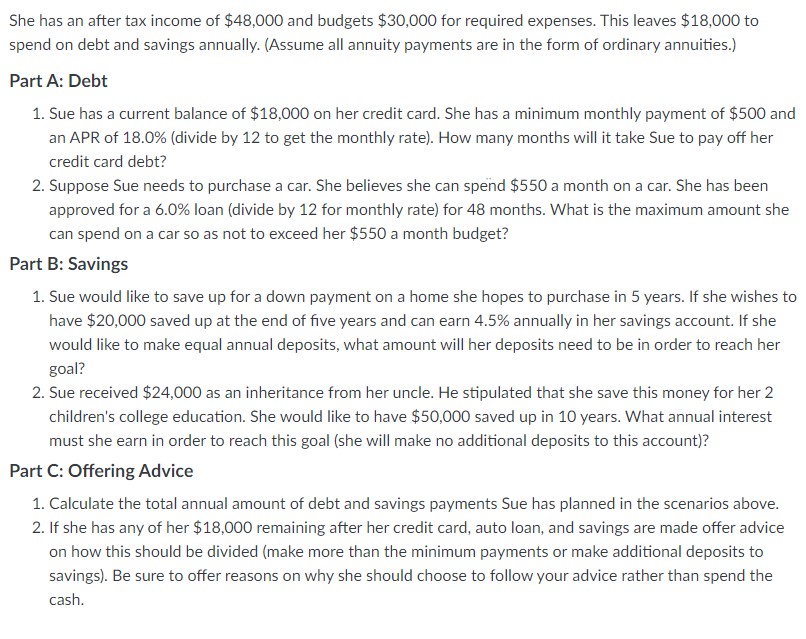

She has an after tax income of $48,000 and budgets $30,000 for required expenses. This leaves $18,000 to spend on debt and savings annually.

She has an after tax income of $48,000 and budgets $30,000 for required expenses. This leaves $18,000 to spend on debt and savings annually. (Assume all annuity payments are in the form of ordinary annuities.) Part A: Debt 1. Sue has a current balance of $18,000 on her credit card. She has a minimum monthly payment of $500 and an APR of 18.0% (divide by 12 to get the monthly rate). How many months will it take Sue to pay off her credit card debt? 2. Suppose Sue needs to purchase a car. She believes she can spend $550 a month on a car. She has been approved for a 6.0% loan (divide by 12 for monthly rate) for 48 months. What is the maximum amount she can spend on a car so as not to exceed her $550 a month budget? Part B: Savings 1. Sue would like to save up for a down payment on a home she hopes to purchase in 5 years. If she wishes to have $20,000 saved up at the end of five years and can earn 4.5% annually in her savings account. If she would like to make equal annual deposits, what amount will her deposits need to be in order to reach her goal? 2. Sue received $24,000 as an inheritance from her uncle. He stipulated that she save this money for her 2 children's college education. She would like to have $50,000 saved up in 10 years. What annual interest must she earn in order to reach this goal (she will make no additional deposits to this account)? Part C: Offering Advice 1. Calculate the total annual amount of debt and savings payments Sue has planned in the scenarios above. 2. If she has any of her $18,000 remaining after her credit card, auto loan, and savings are made offer advice on how this should be divided (make more than the minimum payments or make additional deposits to savings). Be sure to offer reasons on why she should choose to follow your advice rather than spend the cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part A Debt 1 Credit Card Debt To calculate the number of months required to pay off the credit card debt with a monthly payment use the formula N log ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started