Looking for a solution to the following:

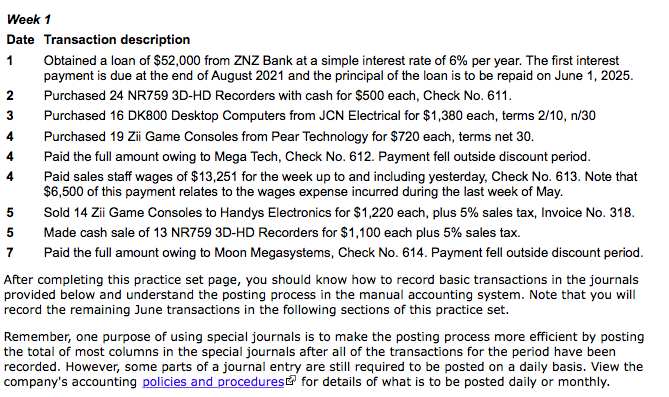

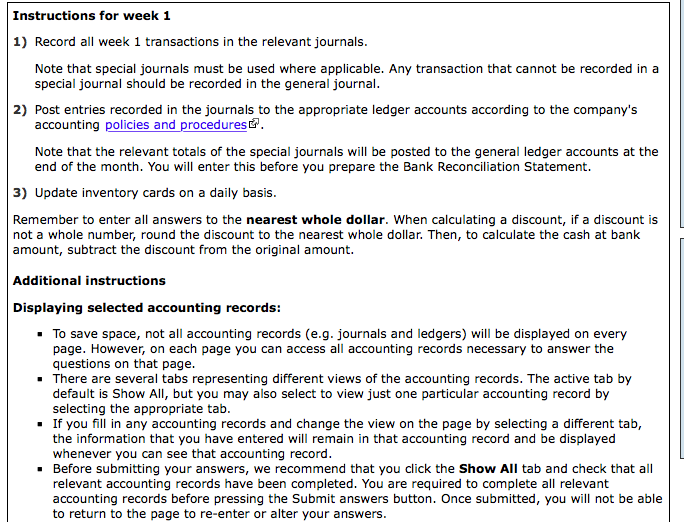

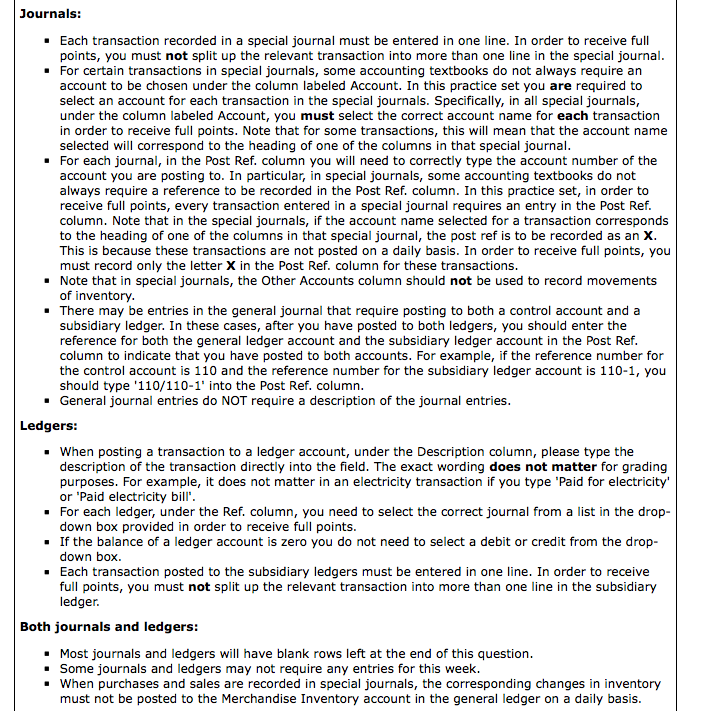

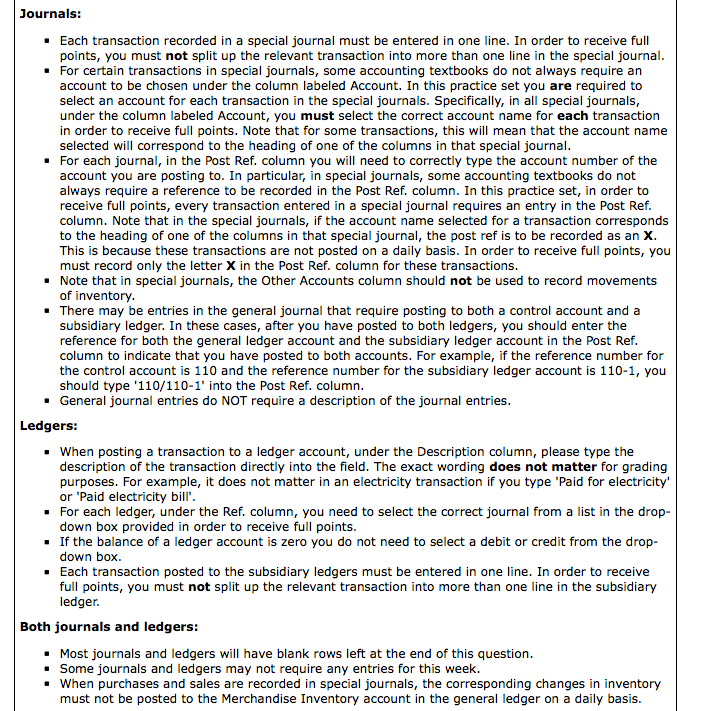

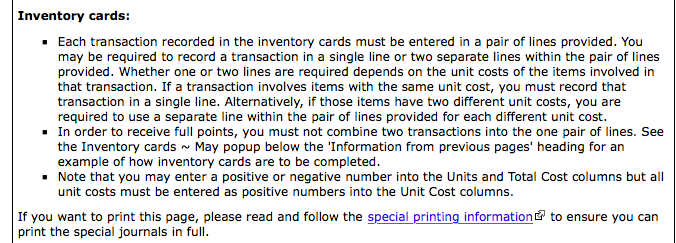

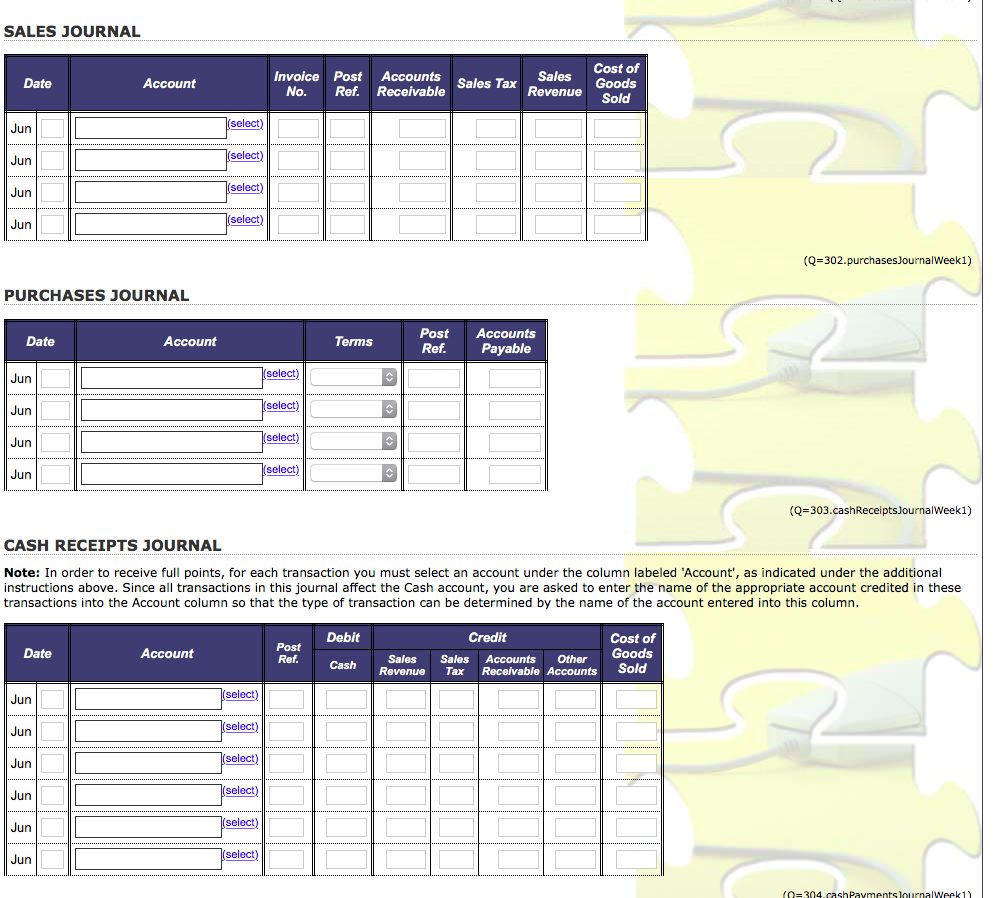

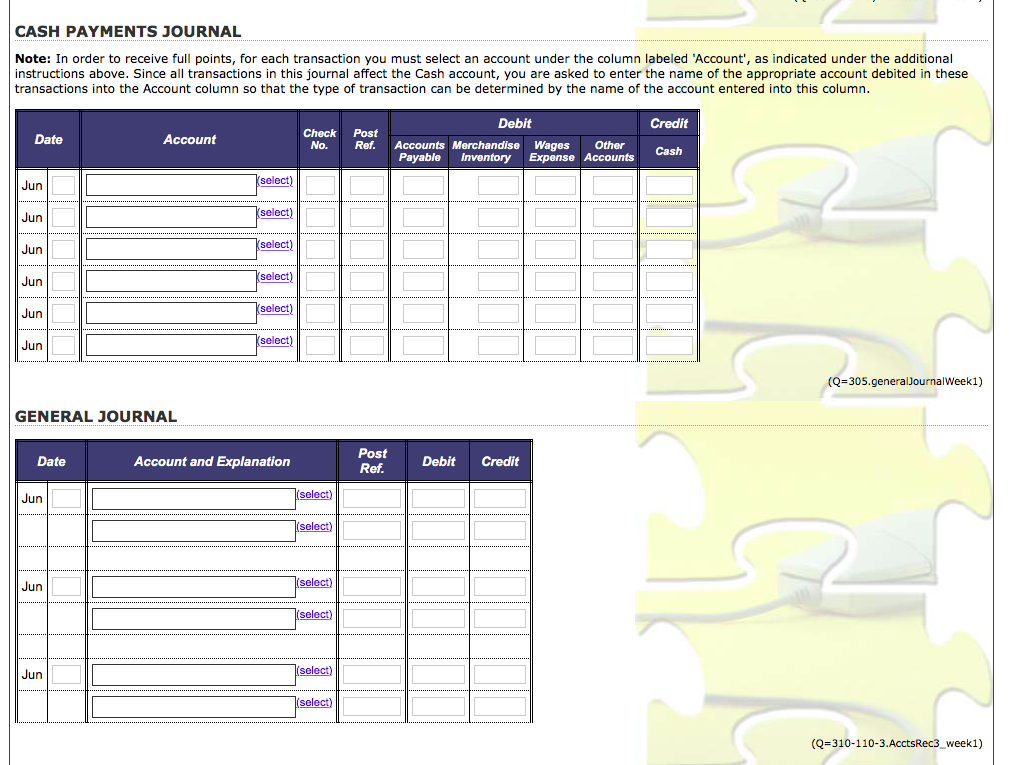

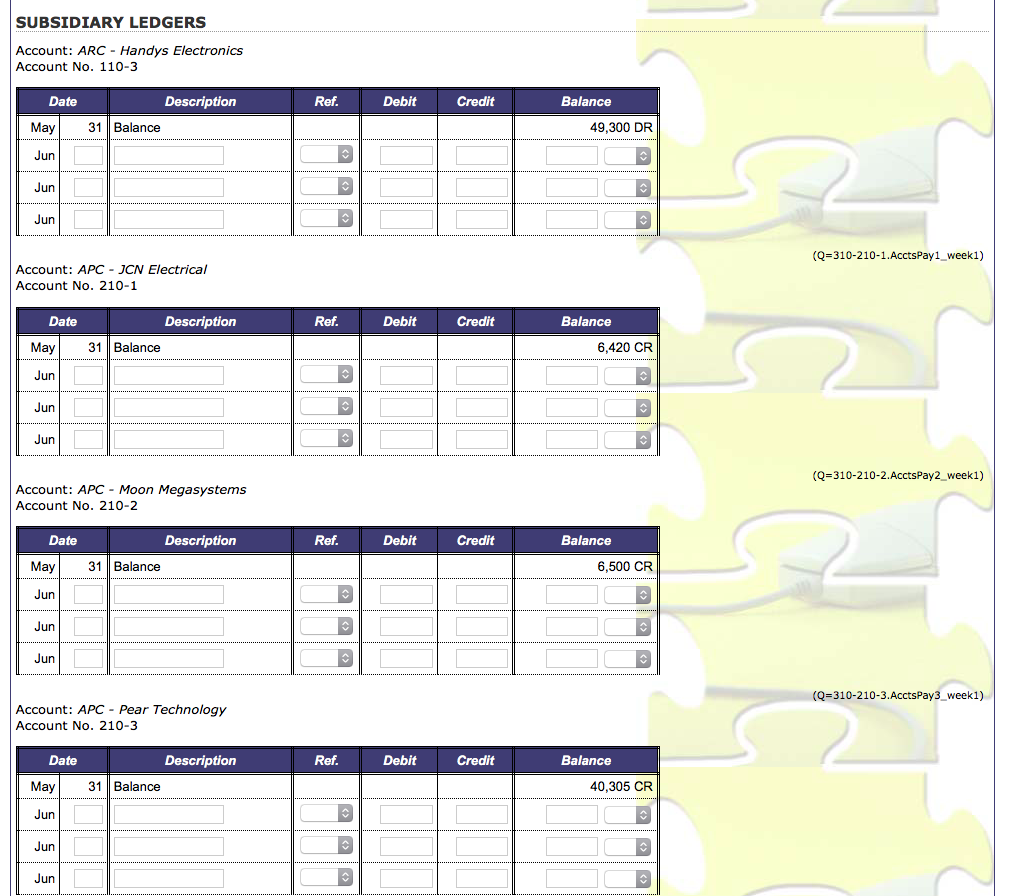

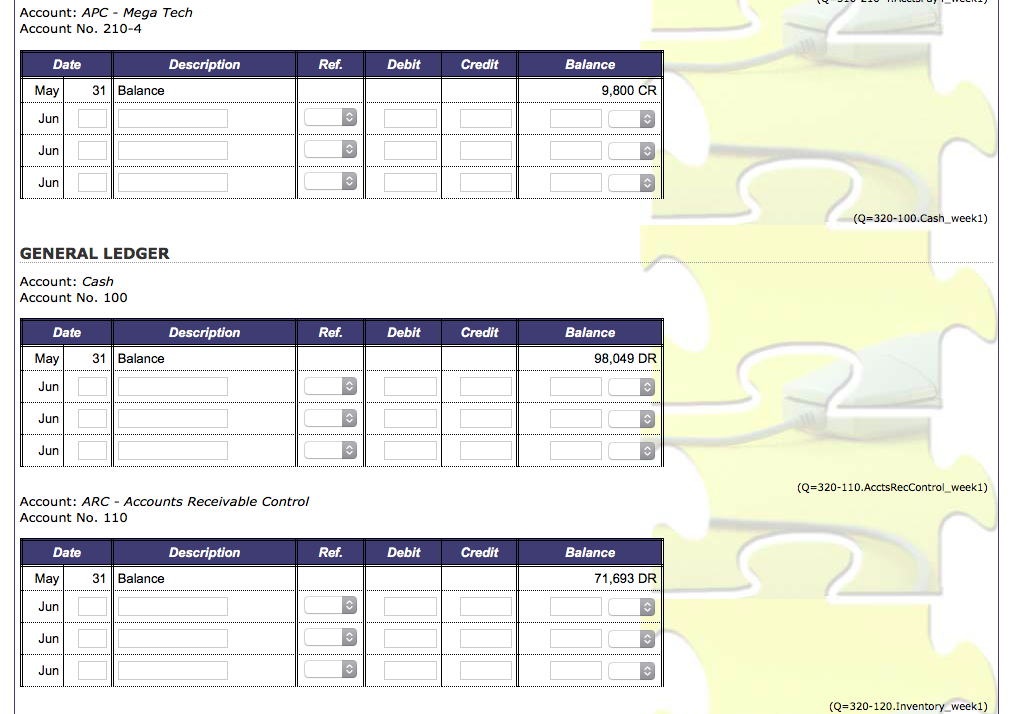

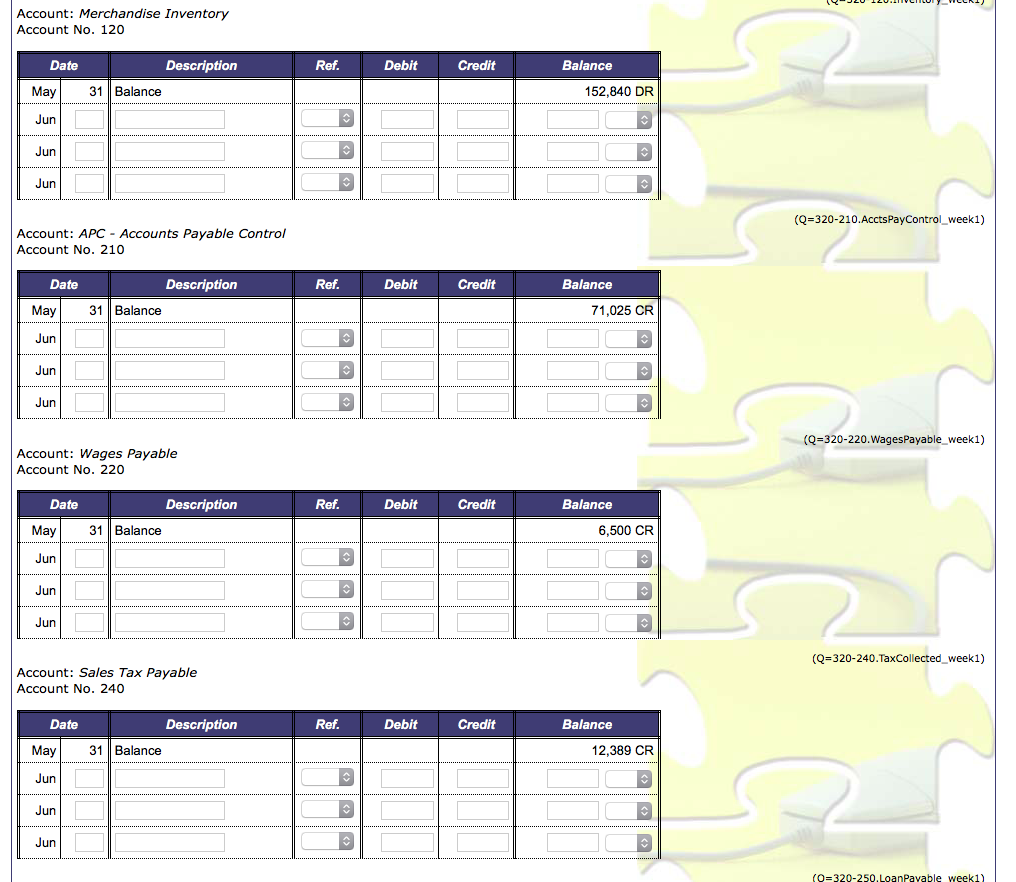

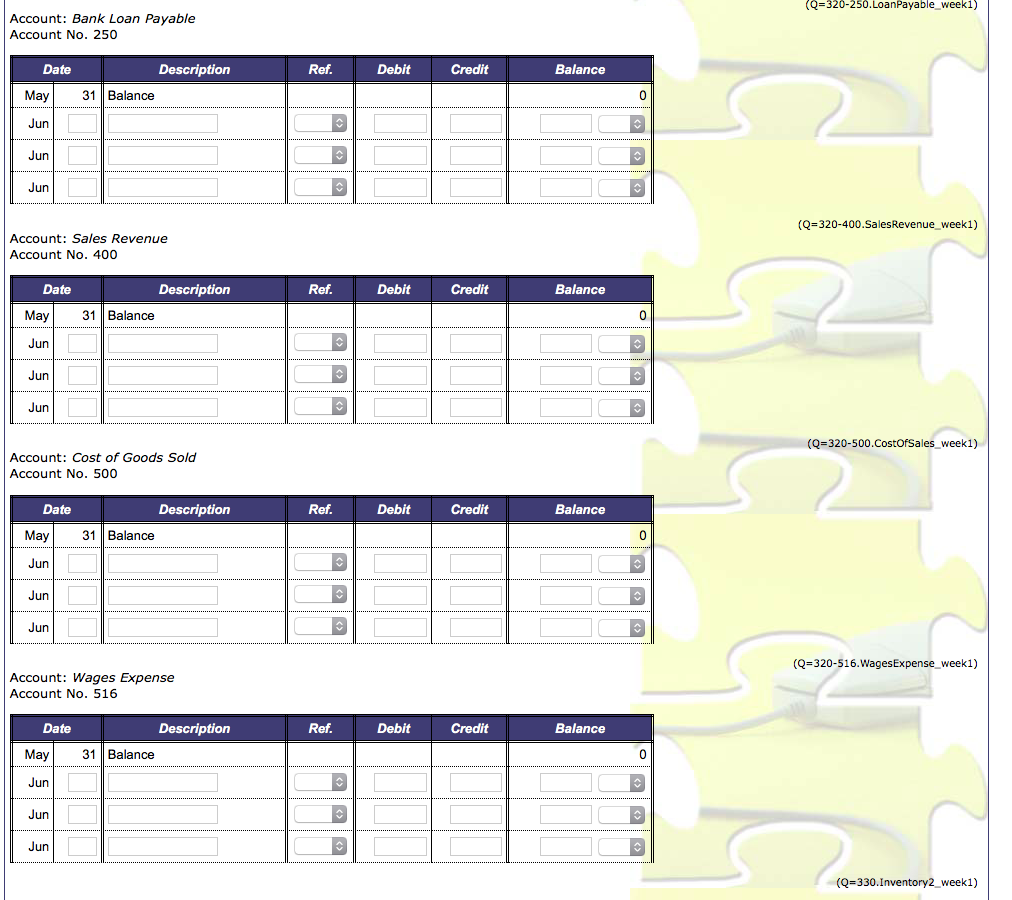

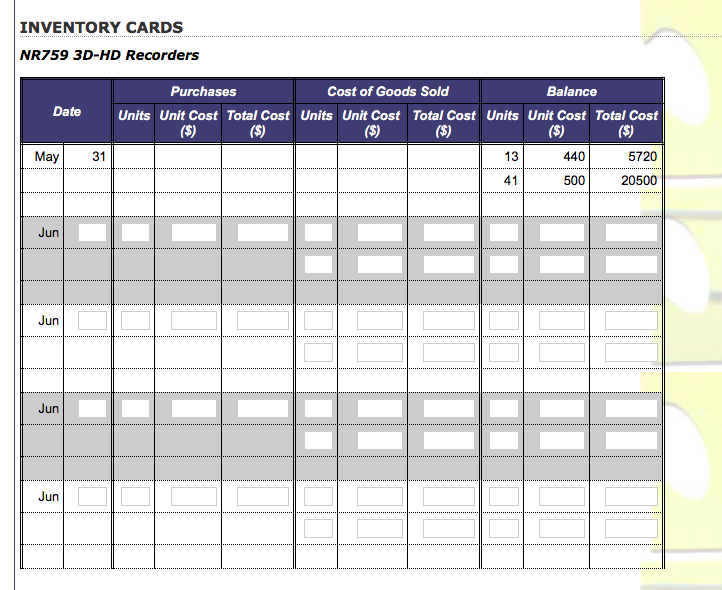

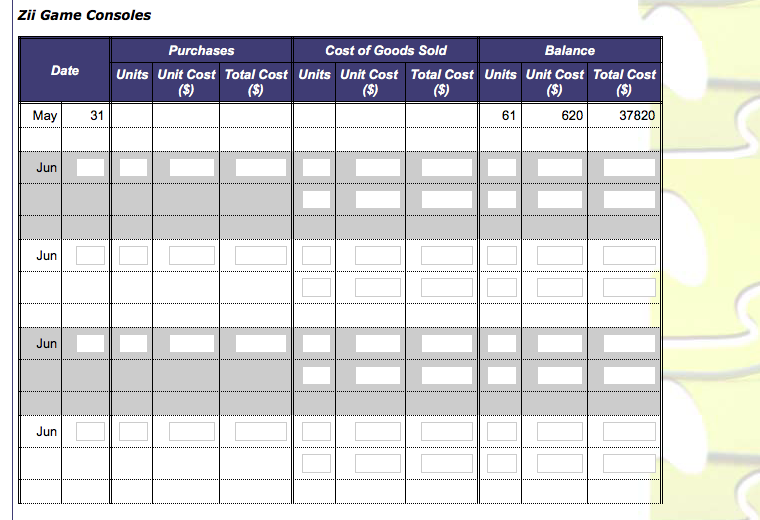

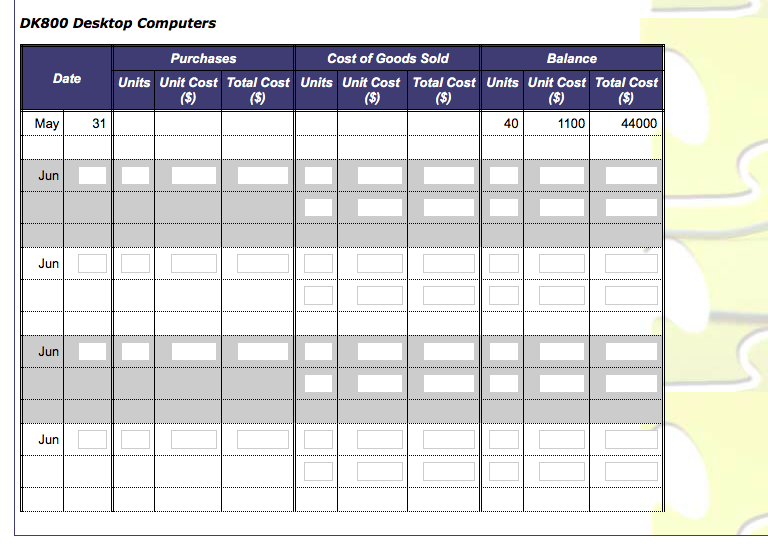

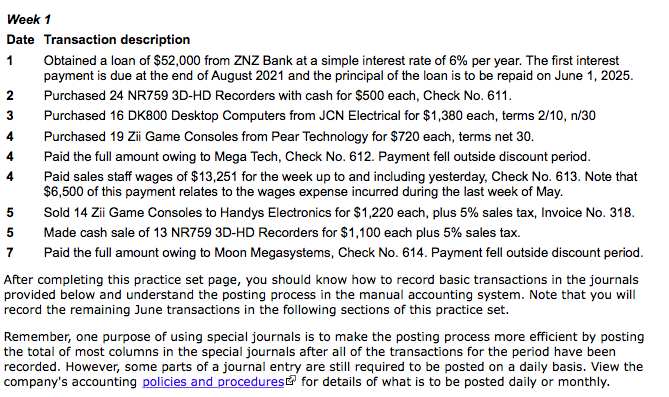

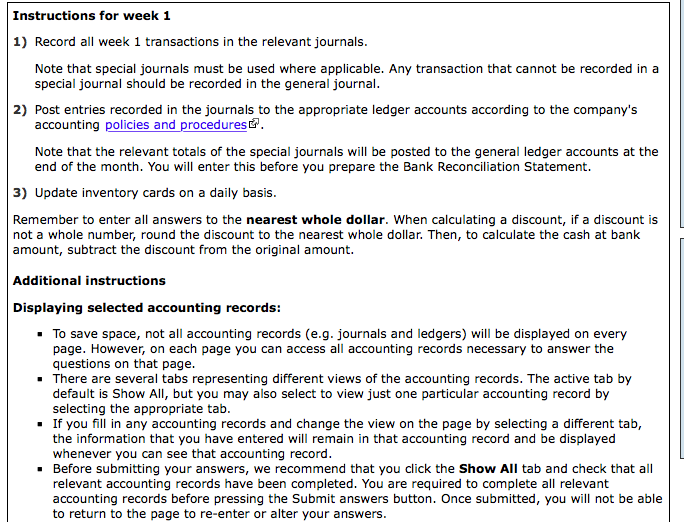

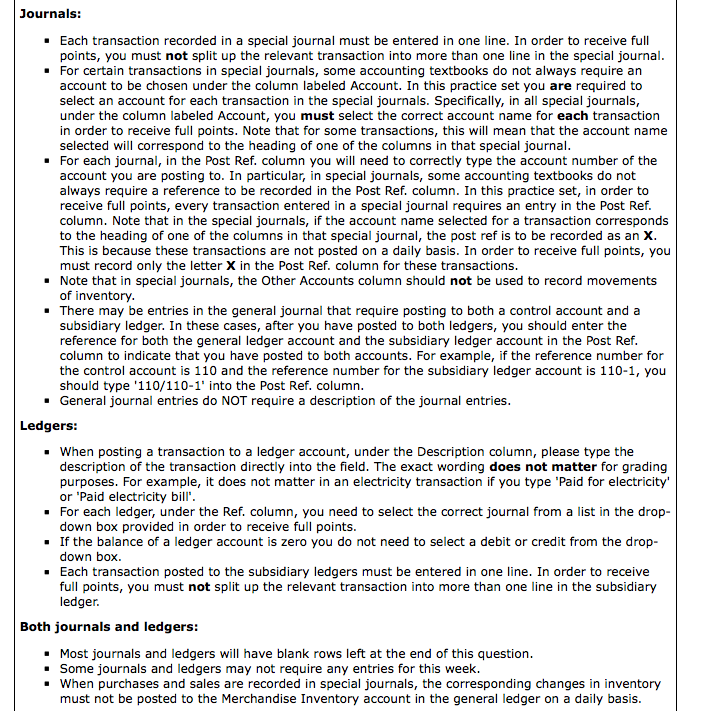

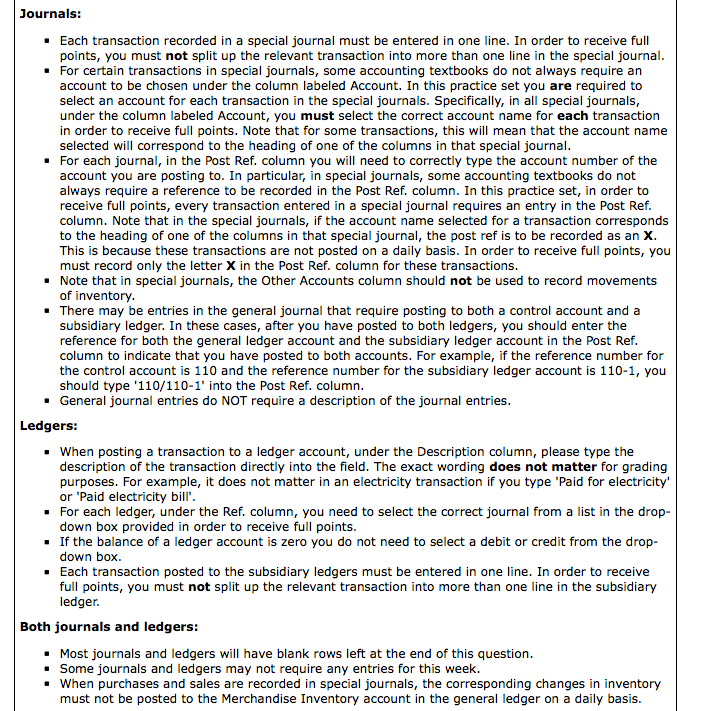

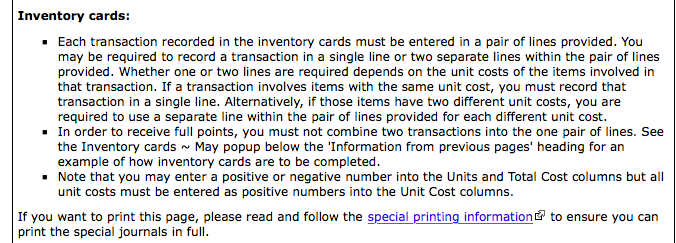

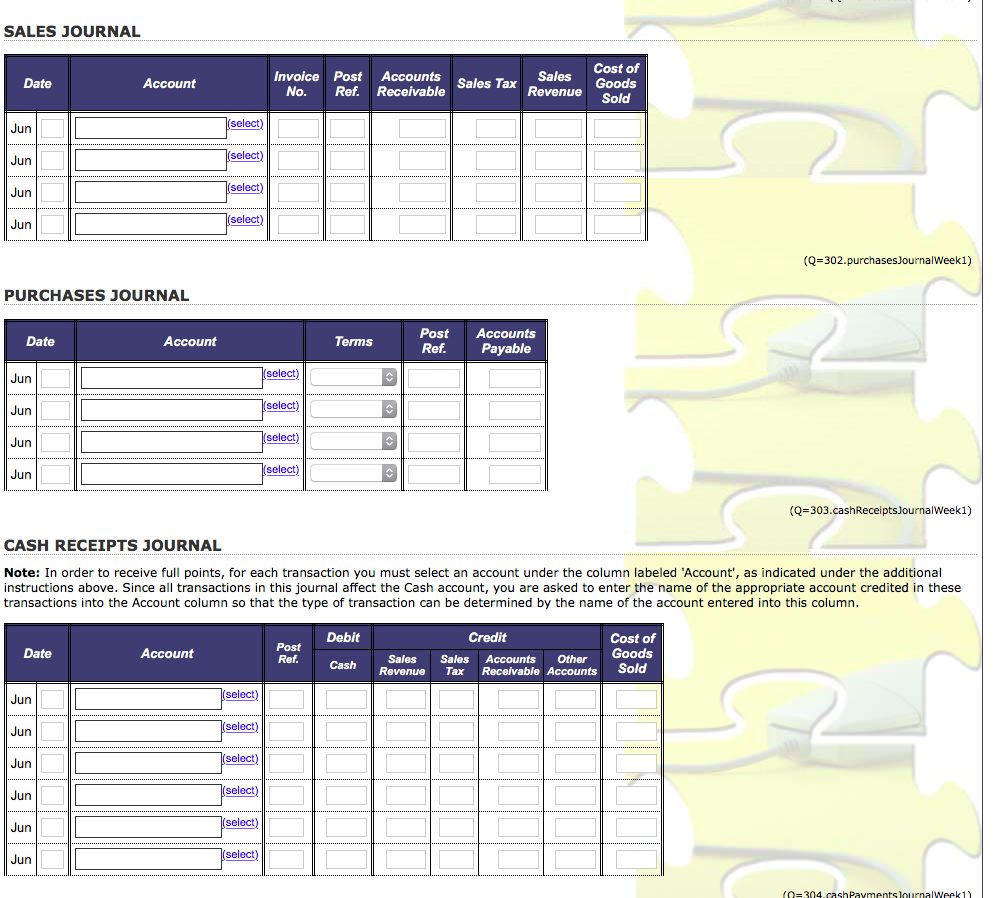

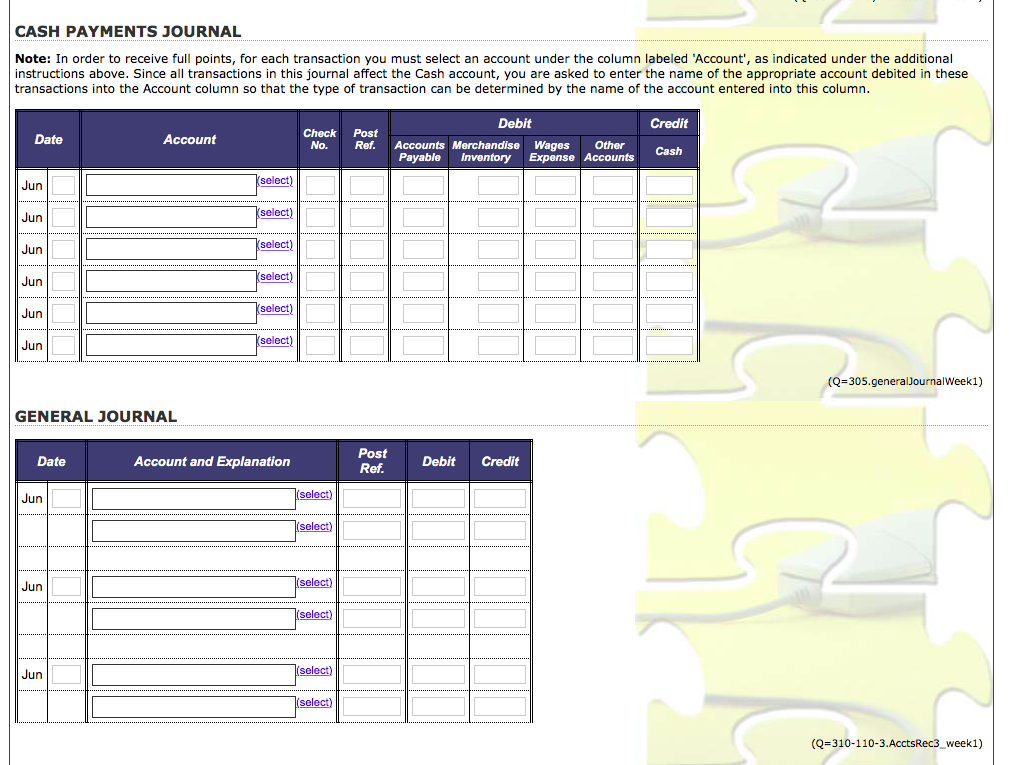

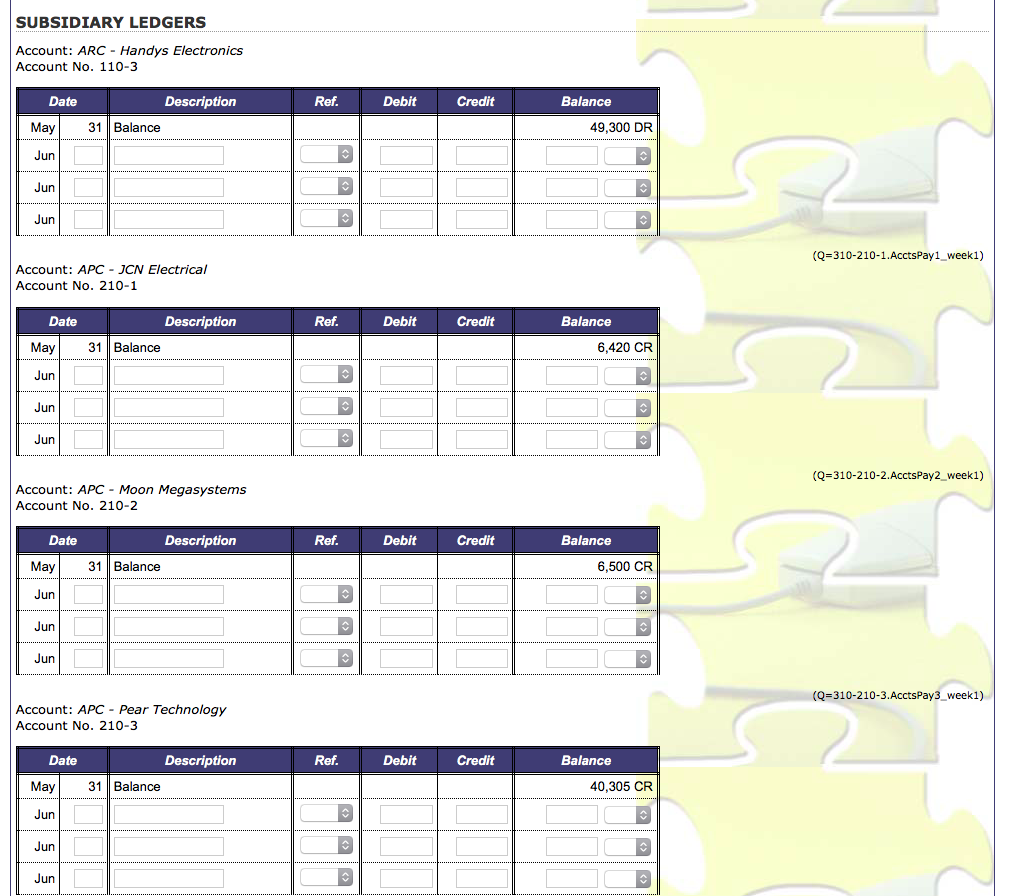

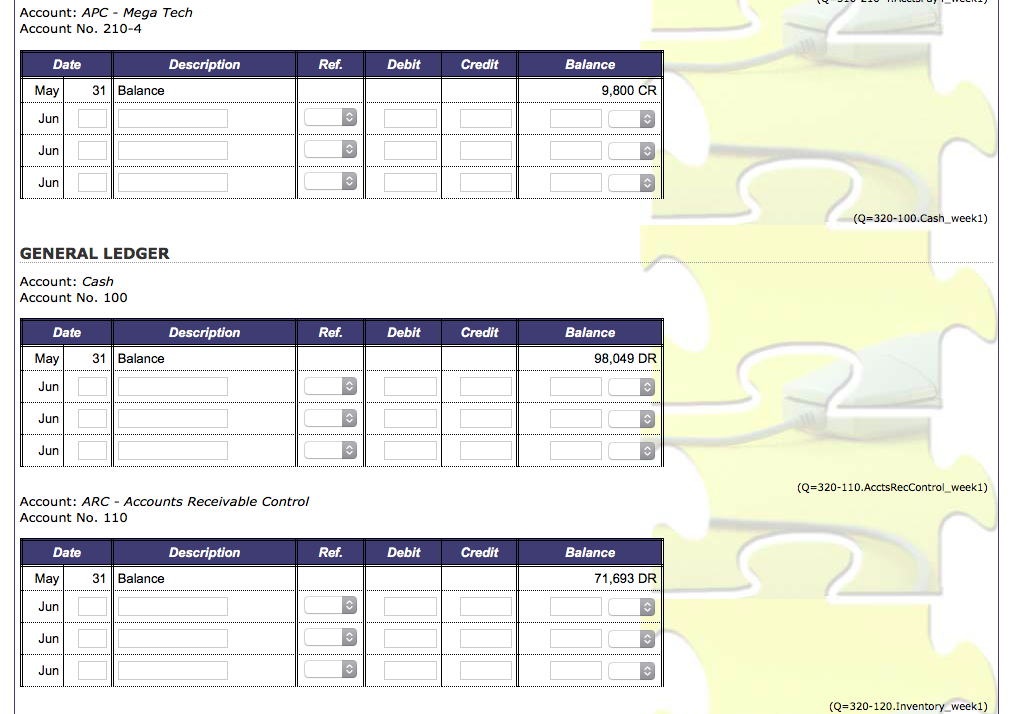

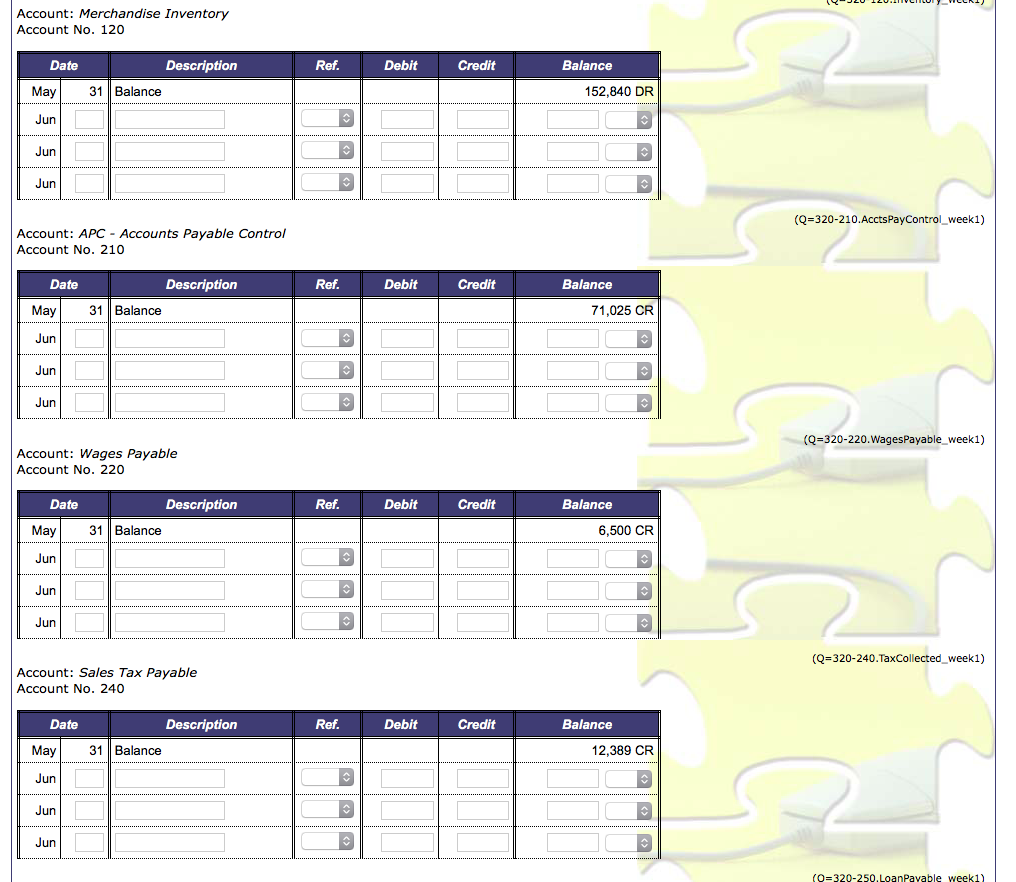

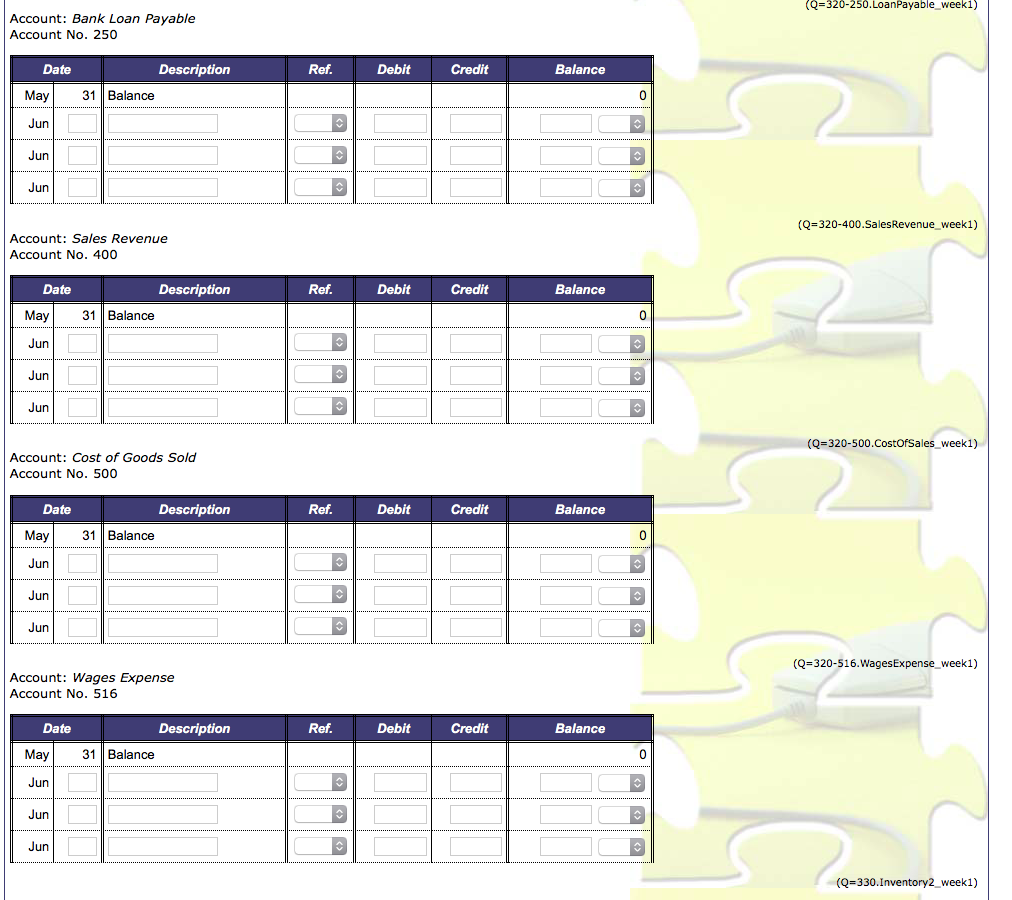

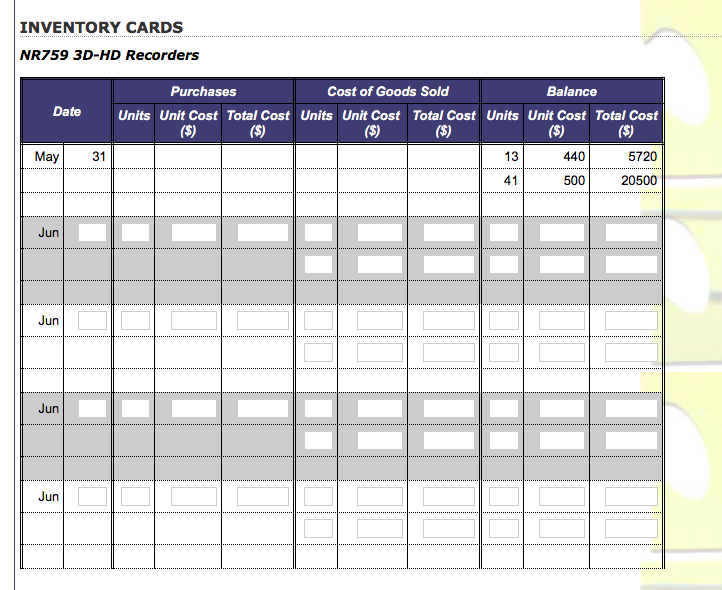

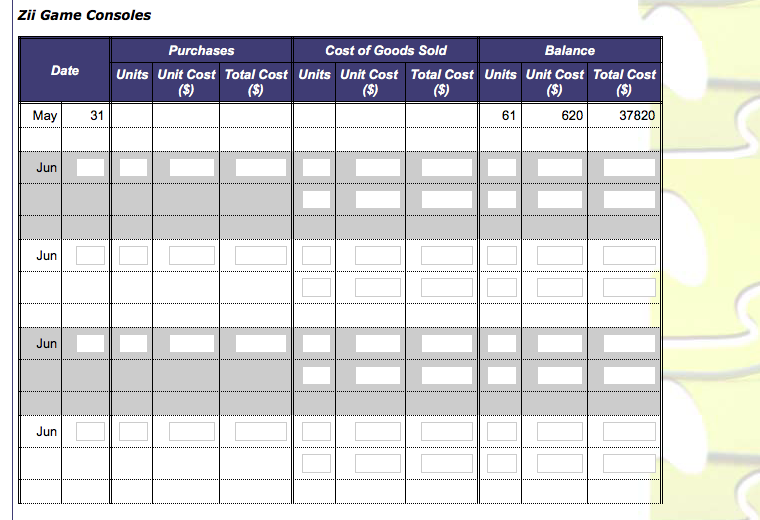

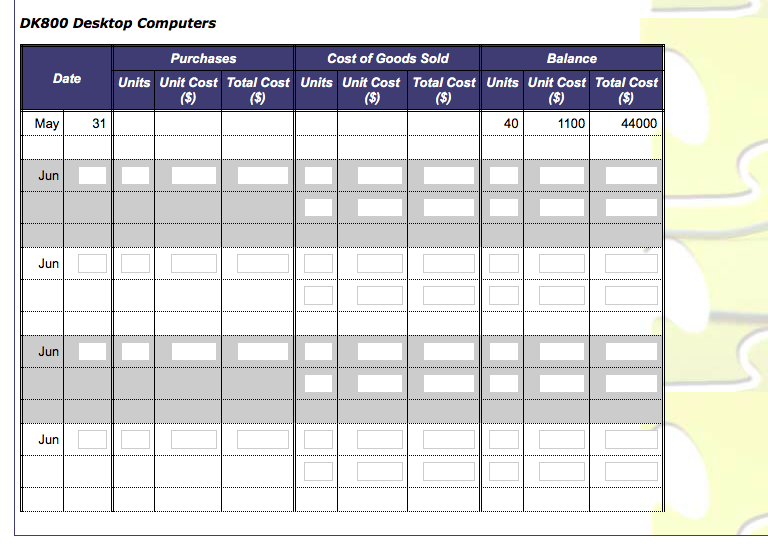

3 4 Week 1 Date Transaction description 1 Obtained a loan of $52,000 from ZNZ Bank at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2021 and the principal of the loan is to be repaid on June 1, 2025. 2 Purchased 24 NR759 3D-HD Recorders with cash for $500 each, Check No. 611. Purchased 16 DK800 Desktop Computers from JCN Electrical for $1,380 each, terms 2/10, n/30 4 Purchased 19 Zii Game Consoles from Pear Technology for $720 each, terms net 30. Paid the full amount owing to Mega Tech, Check No. 612. Payment fell outside discount period. Paid sales staff wages of $13,251 for the week up to and including yesterday, Check No. 613. Note that $6,500 of this payment relates to the wages expense incurred during the last week of May. 5 Sold 14 Zii Game Consoles to Handys Electronics for $1,220 each, plus 5% sales tax, Invoice No. 318. 5 Made cash sale of 13 NR759 3D-HD Recorders for $1,100 each plus 5% sales tax. 7 Paid the full amount owing to Moon Megasystems, Check No. 614. Payment fell outside discount period. After completing this practice set page, you should know how to record basic transactions in the journals provided below and understand the posting process in the manual accounting system. Note that you will record the remaining June transactions in the following sections of this practice set. Remember, one purpose of using special journals is to make the posting process more efficient by posting the total of most columns in the special journals after all of the transactions for the period have been recorded. However, some parts of a journal entry are still required to be posted on a daily basis. View the company's accounting policies and procedures for details of what is to be posted daily or monthly. Instructions for week 1 1) Record all week 1 transactions in the relevant journals. Note that special journals must be used where applicable. Any transaction that cannot be recorded in a special journal should be recorded in the general journal. 2) Post entries recorded in the journals to the appropriate ledger accounts according to the company's accounting policies and procedures. Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You will enter this before you prepare the Bank Reconciliation Statement. 3) Update inventory cards on a daily basis. Remember to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not a whole number, round the discount to the nearest whole dollar. Then, to calculate the cash at bank amount, subtract the discount from the original amount. Additional instructions Displaying selected accounting records: To save space, not all accounting records (e.g. journals and ledgers) will be displayed on every page. However, on each page you can access all accounting records necessary to answer the questions on that page. There are several tabs representing different views of the accounting records. The active tab by default is Show All, but you may also select to view just one particular accounting record by selecting the appropriate tab. If you fill in any accounting records and change the view on the page by selecting a different tab, the information that you have entered will remain in that accounting record and be displayed whenever you can see that accounting record. . Before submitting your answers, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. You are required to complete all relevant accounting records before pressing the Submit answers button. Once submitted, you will not be able to return to the page to re-enter or alter your answers. Journals: Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the special journal. . For certain transactions in special journals, some accounting textbooks do not always require an account to be chosen under the column labeled Account. In this practice set you are required to select an account for each transaction in the special journals. Specifically, in all special journals, under the column labeled Account, you must select the correct account name for each transaction in order to receive full points. Note that for some transactions, this will mean that the account name selected will correspond to the heading of one of the columns in that special journal. For each journal, in the Post Ref. column you will need to correctly type the account number of the account you are posting to. In particular, in special journals, some accounting textbooks do not always require a reference to be recorded in the Post Ref. column. In this practice set, in order to receive full points, every transaction entered in a special journal requires an entry in the Post Ref. column. Note that in the special journals, if the account name selected for a transaction corresponds to the heading of one of the columns in that special journal, the post ref is to be recorded as an X. This is because these transactions are not posted on a daily basis. In order to receive full points, you must record only the letter X in the Post Ref. column for these transactions. . Note that in special journals, the Other Accounts column should not be used to record movements of inventory. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. . General journal entries do NOT require a description of the journal entries. Ledgers: . When posting a transaction to a ledger account, under the Description column, please type the description of the transaction directly into the field. The exact wording does not matter for grading purposes. For example, it does not matter in an electricity transaction if you type 'Paid for electricity' or 'Paid electricity bill'. . For each ledger, under the Ref. column, you need to select the correct journal from a list in the drop- down box provided in order to receive full points. If the balance of a ledger account is zero you do not need to select a debit or credit from the drop- down box. Each transaction posted to the subsidiary ledgers must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the subsidiary ledger Both journals and ledgers: . Most journals and ledgers will have blank rows left at the end of this question. . Some journals and ledgers may not require any entries for this week. When purchases and sales are recorded in special journals, the corresponding changes in inventory must not be posted to the Merchandise Inventory account in the general ledger on a daily basis. Journals: Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the special journal. . For certain transactions in special journals, some accounting textbooks do not always require an account to be chosen under the column labeled Account. In this practice set you are required to select an account for each transaction in the special journals. Specifically, in all special journals, under the column labeled Account, you must select the correct account name for each transaction in order to receive full points. Note that for some transactions, this will mean that the account name selected will correspond to the heading of one of the columns in that special journal. For each journal, in the Post Ref. column you will need to correctly type the account number of the account you are posting to. In particular, in special journals, some accounting textbooks do not always require a reference to be recorded in the Post Ref. column. In this practice set, in order to receive full points, every transaction entered in a special journal requires an entry in the Post Ref. column. Note that in the special journals, if the account name selected for a transaction corresponds to the heading of one of the columns in that special journal, the post ref is to be recorded as an X. This is because these transactions are not posted on a daily basis. In order to receive full points, you must record only the letter X in the Post Ref. column for these transactions. . Note that in special journals, the Other Accounts column should not be used to record movements of inventory. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. . General journal entries do NOT require a description of the journal entries. Ledgers: . When posting a transaction to a ledger account, under the Description column, please type the description of the transaction directly into the field. The exact wording does not matter for grading purposes. For example, it does not matter in an electricity transaction if you type 'Paid for electricity' or 'Paid electricity bill'. . For each ledger, under the Ref. column, you need to select the correct journal from a list in the drop- down box provided in order to receive full points. If the balance of a ledger account is zero you do not need to select a debit or credit from the drop- down box. Each transaction posted to the subsidiary ledgers must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the subsidiary ledger Both journals and ledgers: . Most journals and ledgers will have blank rows left at the end of this question. . Some journals and ledgers may not require any entries for this week. When purchases and sales are recorded in special journals, the corresponding changes in inventory must not be posted to the Merchandise Inventory account in the general ledger on a daily basis. Inventory cards: Each transaction recorded in the inventory cards must be entered in a pair of lines provided. You may be required to record a transaction in a single line or two separate lines within the pair of lines provided. Whether one or two lines are required depends on the unit costs of the items involved in that transaction. If a transaction involves items with the same unit cost, you must record that transaction in a single line. Alternatively, if those items have two different unit costs, you are required to use a separate line within the pair of lines provided for each different unit cost. In order to receive full points, you must not combine two transactions into the one pair of lines. See the Inventory cards - May popup below the 'Information from previous pages' heading for an example of how inventory cards are to be completed. . Note that you may enter a positive or negative number into the Units and Total Cost columns but all unit costs must be entered as positive numbers into the Unit Cost columns. If you want to print this page, please read and follow the special printing information to ensure you can print the special journals in full. SALES JOURNAL Date Account Invoice Post Accounts No. Ref. Receivable Sales Tax Sales Revenue Cost of Goods Sold Jun (select) Jun (select) (select) Jun Jun (select) ) (Q=302.purchases JournalWeekl) PURCHASES JOURNAL Date Account Terms Post Ref. Accounts Payable Jun (select) Jun (select) Jun select) Jun (select) (Q=303.cashReceipts JournalWeek1) CASH RECEIPTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Account', as indicated under the additional instructions above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the appropriate account credited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. Debit Date Account Post Ref. Credit Sales Accounts Other Tax Receivable Accounts Cost of Goods Sold Cash Sales Revenue Jun (select) Jun (select) Jun (select) Jun (select) Jun (select) (select) Jun (O=304.cash Payments lournalWeek 1) CASH PAYMENTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Account', as indicated under the additional instructions above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the appropriate account debited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. Credit Date Account Check No. Post Ref. Debit Accounts Merchandise Wages Other Payable Inventory Expense Accounts Cash Jun select) Jun select) Jun select) Jun select) Jun select) Jun select) (Q=305.generalJournalWeek1) GENERAL JOURNAL Date Account and Explanation Post Ref. Debit Credit Jun (select) (select) Jun (select) (select) Jun (select) (select) (Q=310-110-3.AcctsRec3_week1) SUBSIDIARY LEDGERS Account: ARC - Handys Electronics Account No. 110-3 Date Description Ref. Debit Credit Balance May 31 | Balance 49,300 DR Jun Jun Jun (Q=310-210-1. AcctsPay1_weeks) Account: APC - JCN Electrical Account No. 210-1 Date Ref. Debit Credit Balance Description 31 Balance May 6,420 CR Jun Jun Jun (Q=310-210-2.AcctsPay2_weekl) Account: APC - Moon Megasystems Account No. 210-2 Date Description Ref. Debit Credit Balance 6,500 CR May 31 Balance Jun Jun Jun (Q=310-210-3.AcctsPay3_weekl) Account: APC - Pear Technology Account No. 210-3 Date Ref. Debit Credit Balance Description 31 Balance May 40,305 CR Jun . Jun Jun Account: APC - Mega Tech Account No. 210-4 Date Description Ref. Debit Credit Balance 9,800 CR May 31 Balance Jun Jun Jun (Q=320-100.Cash_week1) GENERAL LEDGER Account: Cash Account No. 100 Date Ref. Debit Credit Balance Description 31 Balance May 98,049 DR Jun Jun Jun (Q=320-110.AcctsRecControl_week1) Account: ARC - Accounts Receivable Control Account No. 110 Date Ref. Debit Credit Balance Description 31 Balance May 71,693 DR Jun Jun Jun (Q=320-120.Inventory_weekl) Account: Merchandise Inventory Account No. 120 Date Ref. Debit Credit Balance Description 31 Balance May 152,840 DR Jun Jun Jun (Q=320-210.AcctsPayControl_weekl) Account: APC - Accounts Payable Control Account No. 210 Date Ref. Debit Credit Balance Description 31 Balance May 71,025 CR Jun Jun Jun (Q=320-220. WagesPayable_weekl) Account: Wages Payable Account No. 220 Date Description Ref. Debit Credit Balance May 31 Balance 6,500 CR Jun Jun Jun (Q=320-240. TaxCollected_week1) Account: Sales Tax Payable Account No. 240 Date Description Ref. Debit Credit Balance May 31 Balance 12,389 CR Jun Jun Jun (O=320-250. LoanPayable week1) (Q=320-250.LoanPayable_week1) Account: Bank Loan Payable Account No. 250 Date Ref. Debit Credit Balance Description 31 | Balance May 0 Jun Jun Jun (Q=320-400.SalesRevenue_weeki) Account: Sales Revenue Account No. 400 Date Description Ref. Debit Credit Balance May 31 Balance Jun Jun Jun (Q=320-500.CostOfSales_week1) Account: Cost of Goods Sold Account No. 500 Date Ref. Debit Credit Balance Description 31 Balance May Jun Jun Jun (Q=320-516. WagesExpense_weekl) Account: Wages Expense Account No. 516 Date Description Ref. Debit Credit Balance May 31 Balance 0 Jun Jun Jun (Q=330. Inventory2_week1) INVENTORY CARDS NR759 3D-HD Recorders Date Purchases Cost of Goods Sold Balance Units Unit Cost Total Cost Units Unit Cost Total Cost Units Unit Cost Total Cost ($) 13 440 5720 41 500 20500 May 31 Jun Jun DD Jun Jun zii Game Consoles Date Purchases Cost of Goods Sold Balance Units Unit Cost Total Cost Units Unit Cost Total Cost Units Unit Cost Total Cost May 31 61 620 37820 Jun Jun DD Jun Jun DD DK800 Desktop Computers Date Purchases Cost of Goods Sold Balance Units Unit Cost Total Cost Units Unit Cost Total Cost Units Unit Cost Total Cost ($) ($) 40 1100 44000 May 31 Jun Jun DOO Jun Jun DD 3 4 Week 1 Date Transaction description 1 Obtained a loan of $52,000 from ZNZ Bank at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2021 and the principal of the loan is to be repaid on June 1, 2025. 2 Purchased 24 NR759 3D-HD Recorders with cash for $500 each, Check No. 611. Purchased 16 DK800 Desktop Computers from JCN Electrical for $1,380 each, terms 2/10, n/30 4 Purchased 19 Zii Game Consoles from Pear Technology for $720 each, terms net 30. Paid the full amount owing to Mega Tech, Check No. 612. Payment fell outside discount period. Paid sales staff wages of $13,251 for the week up to and including yesterday, Check No. 613. Note that $6,500 of this payment relates to the wages expense incurred during the last week of May. 5 Sold 14 Zii Game Consoles to Handys Electronics for $1,220 each, plus 5% sales tax, Invoice No. 318. 5 Made cash sale of 13 NR759 3D-HD Recorders for $1,100 each plus 5% sales tax. 7 Paid the full amount owing to Moon Megasystems, Check No. 614. Payment fell outside discount period. After completing this practice set page, you should know how to record basic transactions in the journals provided below and understand the posting process in the manual accounting system. Note that you will record the remaining June transactions in the following sections of this practice set. Remember, one purpose of using special journals is to make the posting process more efficient by posting the total of most columns in the special journals after all of the transactions for the period have been recorded. However, some parts of a journal entry are still required to be posted on a daily basis. View the company's accounting policies and procedures for details of what is to be posted daily or monthly. Instructions for week 1 1) Record all week 1 transactions in the relevant journals. Note that special journals must be used where applicable. Any transaction that cannot be recorded in a special journal should be recorded in the general journal. 2) Post entries recorded in the journals to the appropriate ledger accounts according to the company's accounting policies and procedures. Note that the relevant totals of the special journals will be posted to the general ledger accounts at the end of the month. You will enter this before you prepare the Bank Reconciliation Statement. 3) Update inventory cards on a daily basis. Remember to enter all answers to the nearest whole dollar. When calculating a discount, if a discount is not a whole number, round the discount to the nearest whole dollar. Then, to calculate the cash at bank amount, subtract the discount from the original amount. Additional instructions Displaying selected accounting records: To save space, not all accounting records (e.g. journals and ledgers) will be displayed on every page. However, on each page you can access all accounting records necessary to answer the questions on that page. There are several tabs representing different views of the accounting records. The active tab by default is Show All, but you may also select to view just one particular accounting record by selecting the appropriate tab. If you fill in any accounting records and change the view on the page by selecting a different tab, the information that you have entered will remain in that accounting record and be displayed whenever you can see that accounting record. . Before submitting your answers, we recommend that you click the Show All tab and check that all relevant accounting records have been completed. You are required to complete all relevant accounting records before pressing the Submit answers button. Once submitted, you will not be able to return to the page to re-enter or alter your answers. Journals: Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the special journal. . For certain transactions in special journals, some accounting textbooks do not always require an account to be chosen under the column labeled Account. In this practice set you are required to select an account for each transaction in the special journals. Specifically, in all special journals, under the column labeled Account, you must select the correct account name for each transaction in order to receive full points. Note that for some transactions, this will mean that the account name selected will correspond to the heading of one of the columns in that special journal. For each journal, in the Post Ref. column you will need to correctly type the account number of the account you are posting to. In particular, in special journals, some accounting textbooks do not always require a reference to be recorded in the Post Ref. column. In this practice set, in order to receive full points, every transaction entered in a special journal requires an entry in the Post Ref. column. Note that in the special journals, if the account name selected for a transaction corresponds to the heading of one of the columns in that special journal, the post ref is to be recorded as an X. This is because these transactions are not posted on a daily basis. In order to receive full points, you must record only the letter X in the Post Ref. column for these transactions. . Note that in special journals, the Other Accounts column should not be used to record movements of inventory. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. . General journal entries do NOT require a description of the journal entries. Ledgers: . When posting a transaction to a ledger account, under the Description column, please type the description of the transaction directly into the field. The exact wording does not matter for grading purposes. For example, it does not matter in an electricity transaction if you type 'Paid for electricity' or 'Paid electricity bill'. . For each ledger, under the Ref. column, you need to select the correct journal from a list in the drop- down box provided in order to receive full points. If the balance of a ledger account is zero you do not need to select a debit or credit from the drop- down box. Each transaction posted to the subsidiary ledgers must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the subsidiary ledger Both journals and ledgers: . Most journals and ledgers will have blank rows left at the end of this question. . Some journals and ledgers may not require any entries for this week. When purchases and sales are recorded in special journals, the corresponding changes in inventory must not be posted to the Merchandise Inventory account in the general ledger on a daily basis. Journals: Each transaction recorded in a special journal must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the special journal. . For certain transactions in special journals, some accounting textbooks do not always require an account to be chosen under the column labeled Account. In this practice set you are required to select an account for each transaction in the special journals. Specifically, in all special journals, under the column labeled Account, you must select the correct account name for each transaction in order to receive full points. Note that for some transactions, this will mean that the account name selected will correspond to the heading of one of the columns in that special journal. For each journal, in the Post Ref. column you will need to correctly type the account number of the account you are posting to. In particular, in special journals, some accounting textbooks do not always require a reference to be recorded in the Post Ref. column. In this practice set, in order to receive full points, every transaction entered in a special journal requires an entry in the Post Ref. column. Note that in the special journals, if the account name selected for a transaction corresponds to the heading of one of the columns in that special journal, the post ref is to be recorded as an X. This is because these transactions are not posted on a daily basis. In order to receive full points, you must record only the letter X in the Post Ref. column for these transactions. . Note that in special journals, the Other Accounts column should not be used to record movements of inventory. There may be entries in the general journal that require posting to both a control account and a subsidiary ledger. In these cases, after you have posted to both ledgers, you should enter the reference for both the general ledger account and the subsidiary ledger account in the Post Ref. column to indicate that you have posted to both accounts. For example, if the reference number for the control account is 110 and the reference number for the subsidiary ledger account is 110-1, you should type '110/110-1' into the Post Ref. column. . General journal entries do NOT require a description of the journal entries. Ledgers: . When posting a transaction to a ledger account, under the Description column, please type the description of the transaction directly into the field. The exact wording does not matter for grading purposes. For example, it does not matter in an electricity transaction if you type 'Paid for electricity' or 'Paid electricity bill'. . For each ledger, under the Ref. column, you need to select the correct journal from a list in the drop- down box provided in order to receive full points. If the balance of a ledger account is zero you do not need to select a debit or credit from the drop- down box. Each transaction posted to the subsidiary ledgers must be entered in one line. In order to receive full points, you must not split up the relevant transaction into more than one line in the subsidiary ledger Both journals and ledgers: . Most journals and ledgers will have blank rows left at the end of this question. . Some journals and ledgers may not require any entries for this week. When purchases and sales are recorded in special journals, the corresponding changes in inventory must not be posted to the Merchandise Inventory account in the general ledger on a daily basis. Inventory cards: Each transaction recorded in the inventory cards must be entered in a pair of lines provided. You may be required to record a transaction in a single line or two separate lines within the pair of lines provided. Whether one or two lines are required depends on the unit costs of the items involved in that transaction. If a transaction involves items with the same unit cost, you must record that transaction in a single line. Alternatively, if those items have two different unit costs, you are required to use a separate line within the pair of lines provided for each different unit cost. In order to receive full points, you must not combine two transactions into the one pair of lines. See the Inventory cards - May popup below the 'Information from previous pages' heading for an example of how inventory cards are to be completed. . Note that you may enter a positive or negative number into the Units and Total Cost columns but all unit costs must be entered as positive numbers into the Unit Cost columns. If you want to print this page, please read and follow the special printing information to ensure you can print the special journals in full. SALES JOURNAL Date Account Invoice Post Accounts No. Ref. Receivable Sales Tax Sales Revenue Cost of Goods Sold Jun (select) Jun (select) (select) Jun Jun (select) ) (Q=302.purchases JournalWeekl) PURCHASES JOURNAL Date Account Terms Post Ref. Accounts Payable Jun (select) Jun (select) Jun select) Jun (select) (Q=303.cashReceipts JournalWeek1) CASH RECEIPTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Account', as indicated under the additional instructions above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the appropriate account credited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. Debit Date Account Post Ref. Credit Sales Accounts Other Tax Receivable Accounts Cost of Goods Sold Cash Sales Revenue Jun (select) Jun (select) Jun (select) Jun (select) Jun (select) (select) Jun (O=304.cash Payments lournalWeek 1) CASH PAYMENTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Account', as indicated under the additional instructions above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the appropriate account debited in these transactions into the Account column so that the type of transaction can be determined by the name of the account entered into this column. Credit Date Account Check No. Post Ref. Debit Accounts Merchandise Wages Other Payable Inventory Expense Accounts Cash Jun select) Jun select) Jun select) Jun select) Jun select) Jun select) (Q=305.generalJournalWeek1) GENERAL JOURNAL Date Account and Explanation Post Ref. Debit Credit Jun (select) (select) Jun (select) (select) Jun (select) (select) (Q=310-110-3.AcctsRec3_week1) SUBSIDIARY LEDGERS Account: ARC - Handys Electronics Account No. 110-3 Date Description Ref. Debit Credit Balance May 31 | Balance 49,300 DR Jun Jun Jun (Q=310-210-1. AcctsPay1_weeks) Account: APC - JCN Electrical Account No. 210-1 Date Ref. Debit Credit Balance Description 31 Balance May 6,420 CR Jun Jun Jun (Q=310-210-2.AcctsPay2_weekl) Account: APC - Moon Megasystems Account No. 210-2 Date Description Ref. Debit Credit Balance 6,500 CR May 31 Balance Jun Jun Jun (Q=310-210-3.AcctsPay3_weekl) Account: APC - Pear Technology Account No. 210-3 Date Ref. Debit Credit Balance Description 31 Balance May 40,305 CR Jun . Jun Jun Account: APC - Mega Tech Account No. 210-4 Date Description Ref. Debit Credit Balance 9,800 CR May 31 Balance Jun Jun Jun (Q=320-100.Cash_week1) GENERAL LEDGER Account: Cash Account No. 100 Date Ref. Debit Credit Balance Description 31 Balance May 98,049 DR Jun Jun Jun (Q=320-110.AcctsRecControl_week1) Account: ARC - Accounts Receivable Control Account No. 110 Date Ref. Debit Credit Balance Description 31 Balance May 71,693 DR Jun Jun Jun (Q=320-120.Inventory_weekl) Account: Merchandise Inventory Account No. 120 Date Ref. Debit Credit Balance Description 31 Balance May 152,840 DR Jun Jun Jun (Q=320-210.AcctsPayControl_weekl) Account: APC - Accounts Payable Control Account No. 210 Date Ref. Debit Credit Balance Description 31 Balance May 71,025 CR Jun Jun Jun (Q=320-220. WagesPayable_weekl) Account: Wages Payable Account No. 220 Date Description Ref. Debit Credit Balance May 31 Balance 6,500 CR Jun Jun Jun (Q=320-240. TaxCollected_week1) Account: Sales Tax Payable Account No. 240 Date Description Ref. Debit Credit Balance May 31 Balance 12,389 CR Jun Jun Jun (O=320-250. LoanPayable week1) (Q=320-250.LoanPayable_week1) Account: Bank Loan Payable Account No. 250 Date Ref. Debit Credit Balance Description 31 | Balance May 0 Jun Jun Jun (Q=320-400.SalesRevenue_weeki) Account: Sales Revenue Account No. 400 Date Description Ref. Debit Credit Balance May 31 Balance Jun Jun Jun (Q=320-500.CostOfSales_week1) Account: Cost of Goods Sold Account No. 500 Date Ref. Debit Credit Balance Description 31 Balance May Jun Jun Jun (Q=320-516. WagesExpense_weekl) Account: Wages Expense Account No. 516 Date Description Ref. Debit Credit Balance May 31 Balance 0 Jun Jun Jun (Q=330. Inventory2_week1) INVENTORY CARDS NR759 3D-HD Recorders Date Purchases Cost of Goods Sold Balance Units Unit Cost Total Cost Units Unit Cost Total Cost Units Unit Cost Total Cost ($) 13 440 5720 41 500 20500 May 31 Jun Jun DD Jun Jun zii Game Consoles Date Purchases Cost of Goods Sold Balance Units Unit Cost Total Cost Units Unit Cost Total Cost Units Unit Cost Total Cost May 31 61 620 37820 Jun Jun DD Jun Jun DD DK800 Desktop Computers Date Purchases Cost of Goods Sold Balance Units Unit Cost Total Cost Units Unit Cost Total Cost Units Unit Cost Total Cost ($) ($) 40 1100 44000 May 31 Jun Jun DOO Jun Jun DD