Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Looking for Amazon Info Year End Dec31, 2019 Does anyone know about their Co Stock? a) What are detaiks of stock offerings of Co? b)

Looking for Amazon Info Year End Dec31, 2019

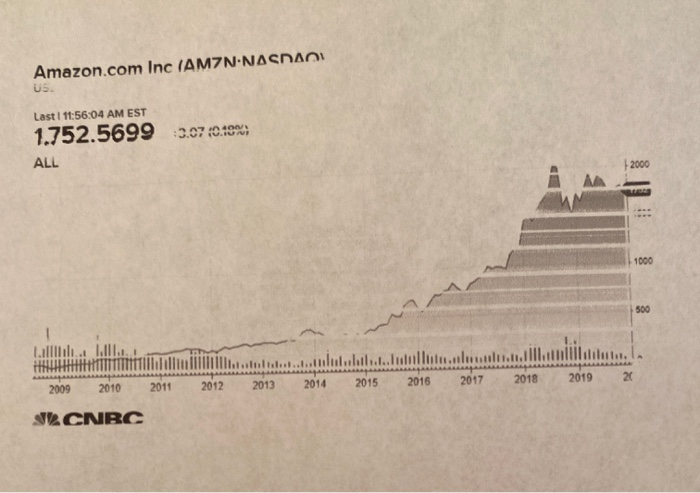

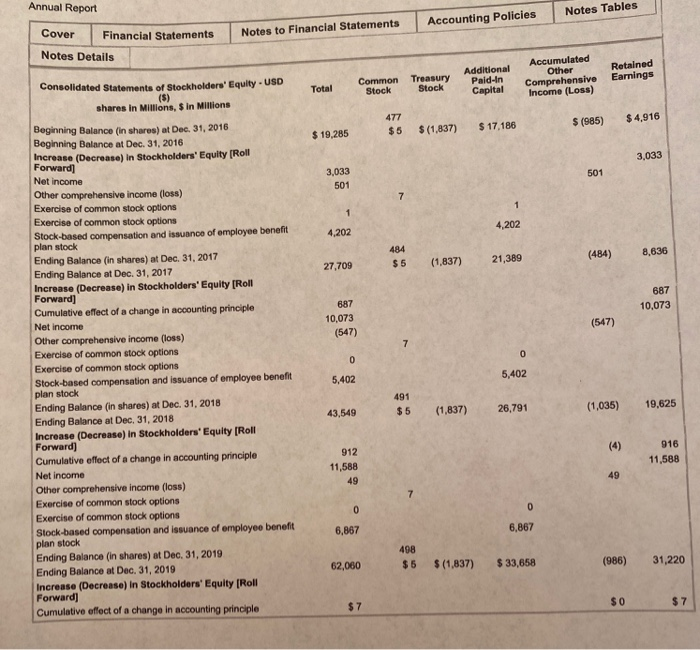

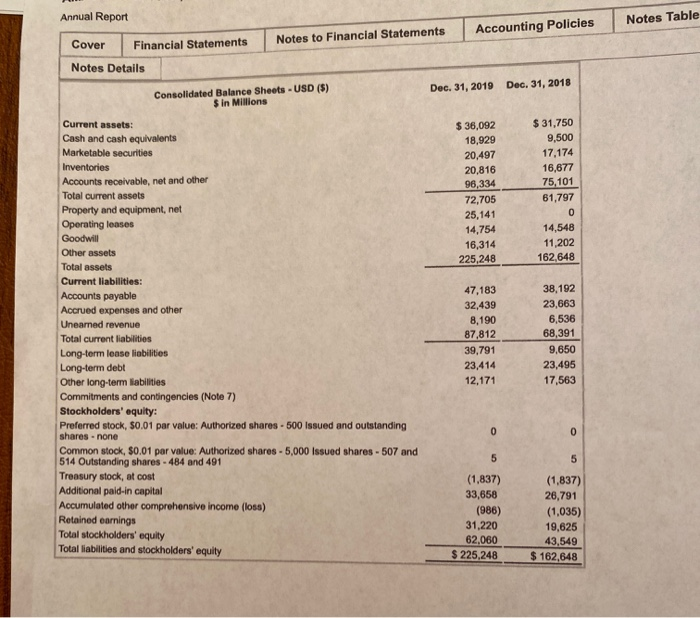

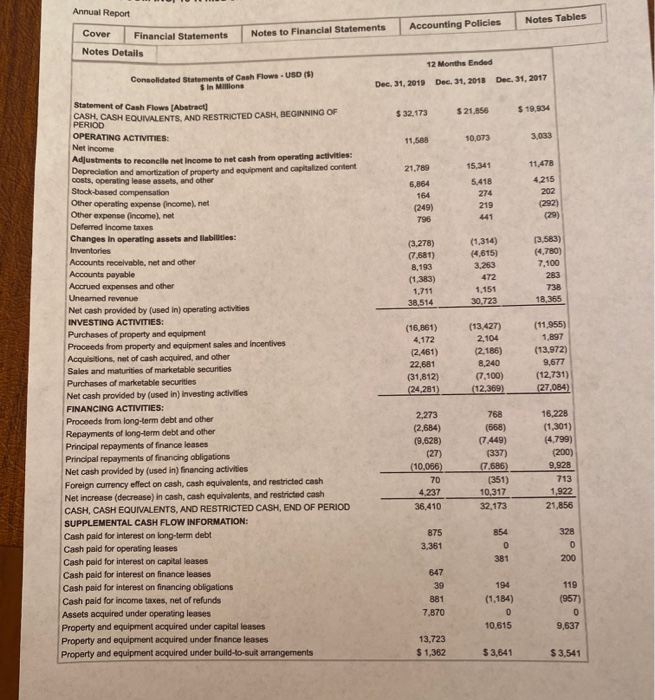

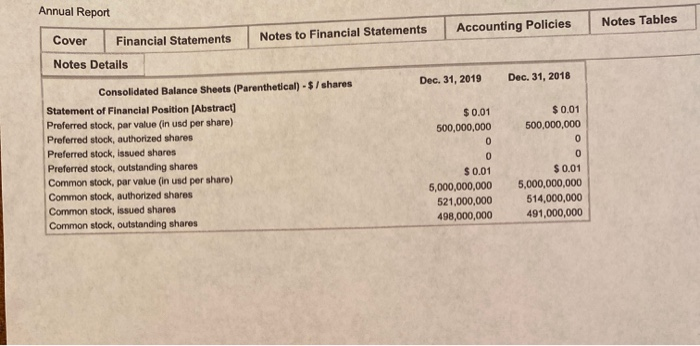

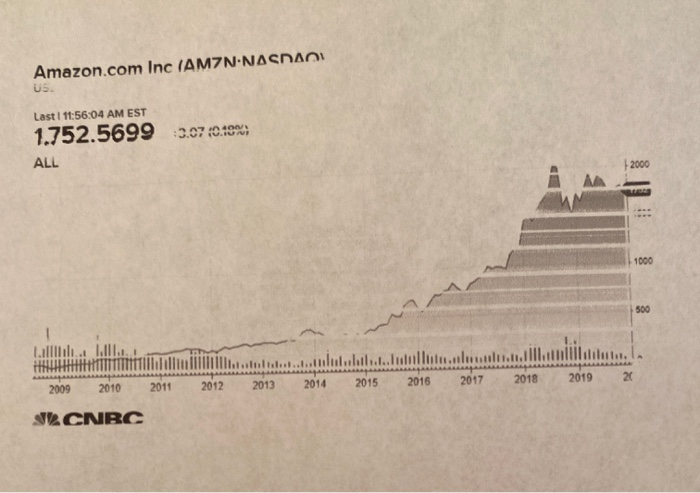

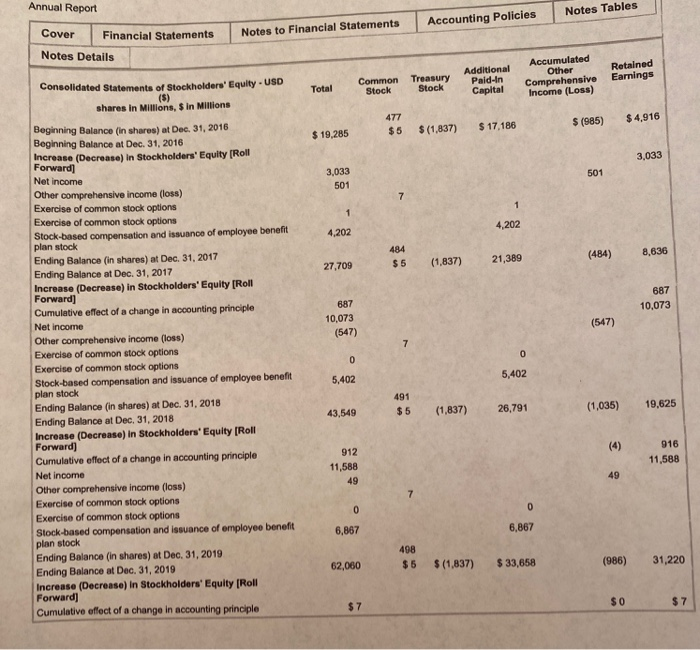

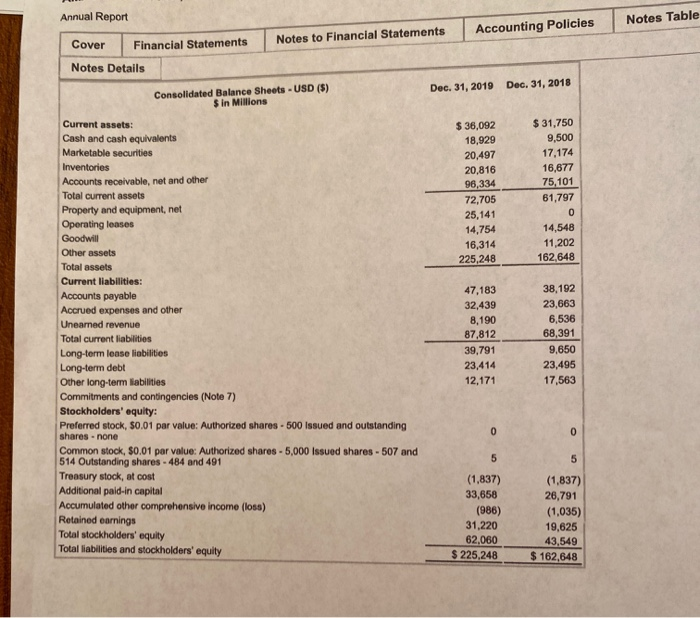

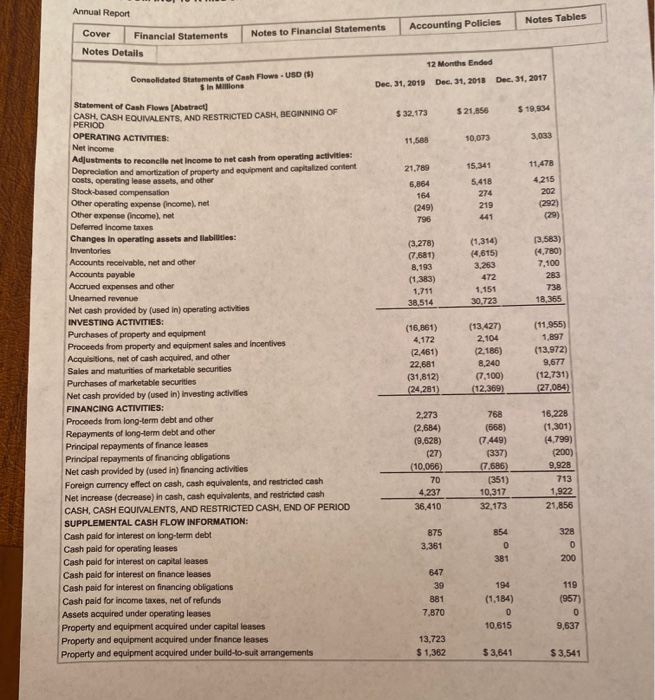

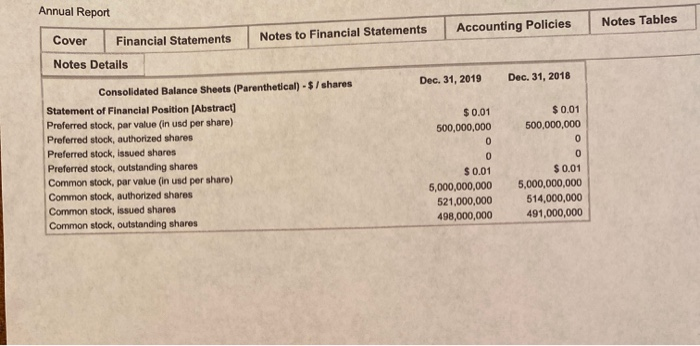

Amazon.com Inc (AMZN.NASDAQ US Last 11:56:04 AM EST 1.752.5699 3.070.19%; ALL 2000 1000 500 Llllll... LL. .................! 2016 2017 2018 2019 20 2015 2009 2010 2011 2012 2013 2014 CNBC Annual Report Notes Tables Accounting Policies Cover Financial Statements Notes to Financial Statements Notes Details Additional Pald-In Capital Accumulated Other Comprehensive Income (Loss) Retained Earnings Common Treasury Stock Stock Total 477 $5 $ 4,916 $ (985) $ 17,186 $ 19,285 $(1,837) 3,033 501 3,033 501 7 1 1 4,202 4,202 484 $ 5 8,636 (484) 21,389 27.709 (1.837) 687 10,073 687 10,073 (547) (547) 7 Consolidated Statements of Stockholders' Equity - USD (5) shares in Millions, $ in Millions Beginning Balance in shares) at Dec 31, 2016 Beginning Balance at Dec 31, 2016 Increase (Decrease) in Stockholders' Equity (Roll Forward] Net income Other comprehensive income (loss) Exercise of common stock options Exercise of common stock options Stock-based compensation and issuance of employee benefit plan stock Ending Balance (in shares) at Dec 31, 2017 Ending Balance at Dec 31, 2017 Increase (Decrease) in Stockholders' Equity [Roll Forward) Cumulative effect of a change in accounting principle Net Income Other comprehensive income (loss) Exercise of common stock options Exercise of common stock options Stock-based compensation and issuance of employee benefit plan stock Ending Balance (In shares) at Dec 31, 2018 Ending Balance at Dec 31, 2018 Increase (Decrease) in Stockholders' Equity (Roll Forward) Cumulative effect of a change in accounting principle Net Income Other comprehensive income (loss) Exercise of common stock options Exercise of common stock options Stock-based compensation and issuance of employee benefit plan stock Ending Balance (in shares) at Dec 31, 2019 Ending Balance at Dec 31, 2019 Increase (Decrease) in Stockholders' Equity (Roll Forward) Cumulative effect of a change in accounting principle 0 0 5,402 5,402 491 $ 5 43,549 19,625 (1,035) (1,837) 26,791 (4) 916 11,588 912 11,588 49 49 0 0 6,867 6,867 408 $5 62,060 $(1,837) $ 33,658 (986) 31,220 $ 7 $0 $7 Annual Report Notes Table Accounting Policies Cover Financial Statements Notes to Financial Statements Notes Details Dec. 31, 2019 Dec. 31, 2018 Consolidated Balance Sheets - USD ($) $ in Millions $ 36,092 18,929 20,497 20,816 96,334 72,705 25,141 14,754 16,314 225,248 $ 31,750 9,500 17.174 16,677 75, 101 61,797 0 14,548 11,202 162,648 Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Operating leases Goodwill Other assets Total assets Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, 50.01 par value: Authorized shares - 500 issued and outstanding shares - none Common stock, $0.01 par value: Authorized shares - 5,000 Issued shares - 507 and 514 Outstanding shares - 484 and 491 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 47,183 32,439 8,190 87,812 39,791 23,414 12,171 38,192 23,663 6,536 68,391 9,650 23,495 17,563 0 0 5 5 (1,837) 33,658 (986) 31,220 62,060 $ 225,248 (1,837) 26,791 (1,035) 19,625 43,549 $ 162,648 Annual Report Notes Tables Accounting Policies Notes to Financial Statements Cover Financial Statements Notes Details 12 Months Ended Consolidated Statements of Cash Flows. USD (5) Sin Millions Dec 31, 2019 Dec 31, 2018 Dec. 31, 2017 $ 32, 173 $ 21,856 $ 19,934 11,588 10.073 3,033 21,789 6,864 164 (249) 796 15,341 5.418 274 219 441 11,478 4.215 202 (292) (29) (3.278) (7.681) 8,193 (1.383) 1.711 38,514 (1,314) (4,615) 3,263 472 1.151 30,723 (3.583) (4.780) 7,100 283 738 18,365 Statement of Cash Flows [Abstract] CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD OPERATING ACTIVITIES: Net Income Adjustments to reconcile net income to net cash from operating activities: Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other Stock-based compensation Other operating expense (income), nel Other expense (income), net Deferred income taxes Changes in operating assets and liabilities: Inventories Accounts receivable, net and other Accounts payable Accrued expenses and other Uneamed revenue Net cash provided by (used in) operating activities INVESTING ACTIVITIES: Purchases of property and equipment Proceeds from property and equipment sales and incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES: Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of finance leases Principal repayments of financing obligations Net cash provided by (used in) financing activities Foreign currency effect on cash, cash equivalents, and restricted cash Net increase (decrease) in cash, cash equivalents, and restricted cash CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt Cash paid for operating leases Cash paid for interest on capital leases Cash paid for interest on finance leases Cash paid for interest on financing obligations Cash paid for income taxes, net of refunds Assets acquired under operating leases Property and equipment acquired under capital leases Property and equipment acquired under finance leases Property and equipment acquired under build-to-suit arrangements (16,861) 4,172 (2.461) 22,681 (31,812) (24,281) (13.427) 2,104 (2,186) 8.240 (7.100) (12,369) (11,955) 1.897 (13.972) 9,677 (12,731) (27.084) 2,273 (2,684) (9,628) (27) (10.056) 70 4.237 36,410 768 (668) (7449) (337) (7.686) (351) 10,317 32,173 16,228 (1,301) (4.799) (200) 9,928 713 1,922 21,856 875 3,361 854 0 381 328 0 200 647 39 881 7.870 194 (1.184) 0 10,615 119 (957) 0 9,637 13,723 $ 1,362 $ 3,841 $ 3,541 Annual Report Notes Tables Accounting Policies Notes to Financial Statements Cover Financial Statements Notes Details Dec. 31, 2019 Dec. 31, 2018 Consolidated Balance Sheets (Parenthetical) - $ 7shares Statement of Financial Position (Abstract] Preferred stock, par value (in usd per share) Preferred stock, authorized shares Preferred stock, issued shares Preferred stock, outstanding shares Common stock, par value (in usd per share) Common stock, authorized shares Common stock, issued shares Common stock, outstanding shares $ 0.01 500,000,000 0 0 $ 0.01 5,000,000,000 521,000,000 498,000,000 $ 0.01 500,000,000 0 0 $ 0.01 5,000,000,000 514,000,000 491,000,000 Does anyone know about their Co Stock?

a) What are detaiks of stock offerings of Co?

b) what has been Performance of stock past 10 years?

c) What is the dividend and dividend %

d) Calculate the value of the common stock of the firm.

Thanks for any Help

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started