Answered step by step

Verified Expert Solution

Question

1 Approved Answer

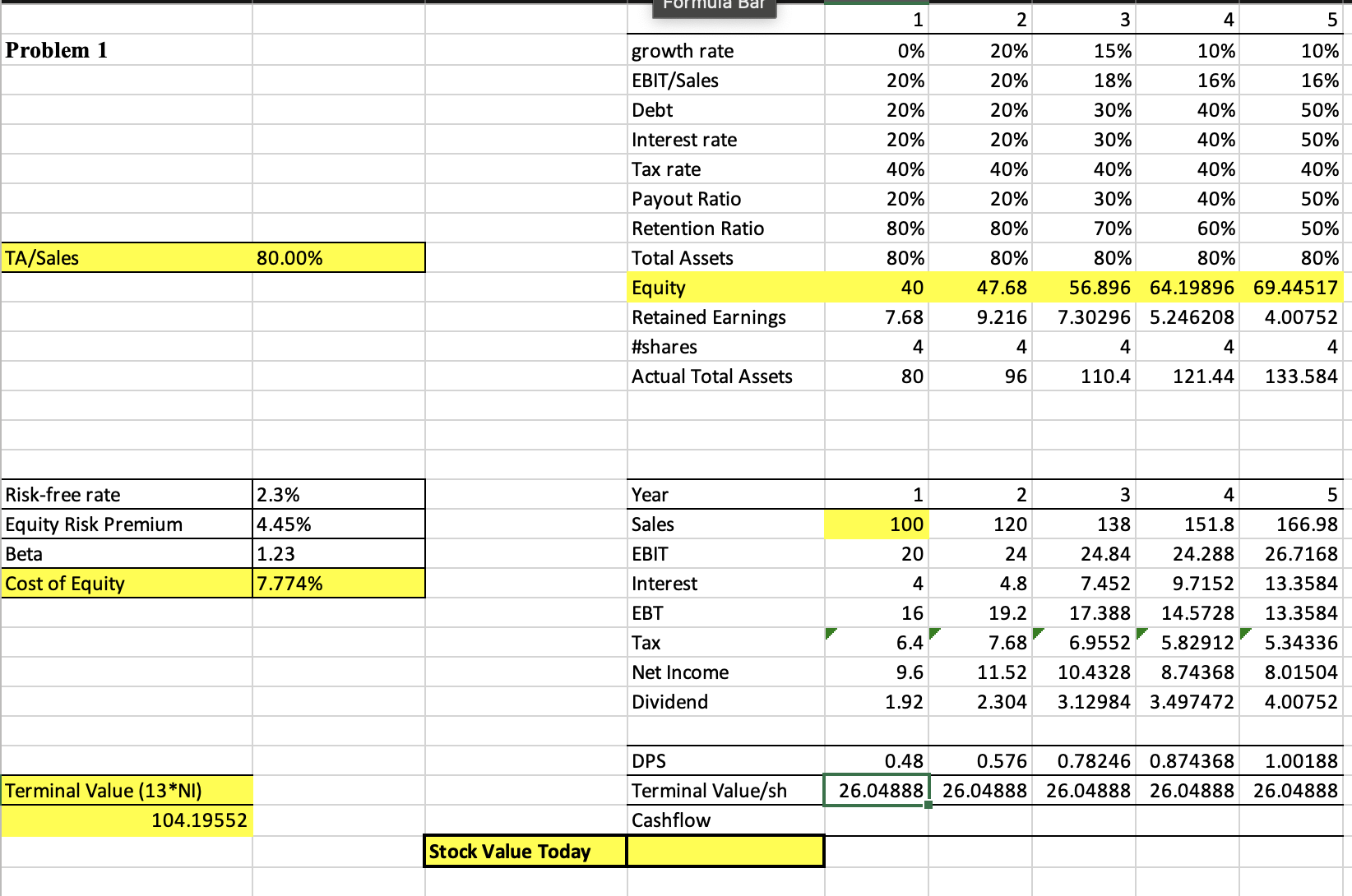

Looking for DPS, Terminal Value/share, Cashflow, and stock value today begin{tabular}{|c|c|c|c|c|c|c|c|c|} hline & & & & 1 & 2 & 3 & 4 & 5

Looking for DPS, Terminal Value/share, Cashflow, and stock value today

\begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & & & & 1 & 2 & 3 & 4 & 5 \\ \hline \multirow[t]{7}{*}{ Problem 1} & & & growth rate & 0% & 20% & 15% & 10% & 10% \\ \hline & & & EBIT/Sales & 20% & 20% & 18% & 16% & 16% \\ \hline & & & Debt & 20% & 20% & 30% & 40% & 50% \\ \hline & & & Interest rate & 20% & 20% & 30% & 40% & 50% \\ \hline & & & Tax rate & 40% & 40% & 40% & 40% & 40% \\ \hline & & & Payout Ratio & 20% & 20% & 30% & 40% & 50% \\ \hline & & & Retention Ratio & 80% & 80% & 70% & 60% & 50% \\ \hline \multirow[t]{7}{*}{ TA/Sales } & 80.00% & & Total Assets & 80% & 80% & 80% & 80% & 80% \\ \hline & & & Equity & 40 & 47.68 & 56.896 & 64.19896 & 69.44517 \\ \hline & & & Retained Earnings & 7.68 & 9.216 & 7.30296 & 5.246208 & 4.00752 \\ \hline & & & \#shares & 4 & 4 & 4 & 4 & 4 \\ \hline & & & Actual Total Assets & 80 & 96 & 110.4 & 121.44 & 133.584 \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline Risk-free rate & 2.3% & & Year & 1 & 2 & 3 & 4 & 5 \\ \hline Equity Risk Premium & 4.45% & & Sales & 100 & 120 & 138 & 151.8 & 166.98 \\ \hline Beta & 1.23 & & EBIT & 20 & 24 & 24.84 & 24.288 & 26.7168 \\ \hline \multirow[t]{7}{*}{ Cost of Equity } & 7.774% & & Interest & 4 & 4.8 & 7.452 & 9.7152 & 13.3584 \\ \hline & & & EBT & 16 & 19.2 & 17.388 & 14.5728 & 13.3584 \\ \hline & & & Tax & 6.4 & 7.68 & 6.9552 & 5.82912 & 5.34336 \\ \hline & & & Net Income & 9.6 & 11.52 & 10.4328 & 8.74368 & 8.01504 \\ \hline & & & Dividend & 1.92 & 2.304 & 3.12984 & 3.497472 & 4.00752 \\ \hline & & & & & & & & \\ \hline & & & DPS & 0.48 & 0.576 & 0.78246 & 0.874368 & 1.00188 \\ \hline Terminal Value (13NI) & & & Terminal Value/sh & 26.04888 & 26.04888 & 26.04888 & 26.04888 & 26.04888 \\ \hline \multirow[t]{2}{*}{104.19552} & & & Cashflow & & & & & \\ \hline & & Stock Value Today & & & & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started