looking for help on question 4 chapter 11 Randy Moran is the GM of the Holiday Plaza hotel.... Managerial accounting for the hospitality major, Dobson and Hayes

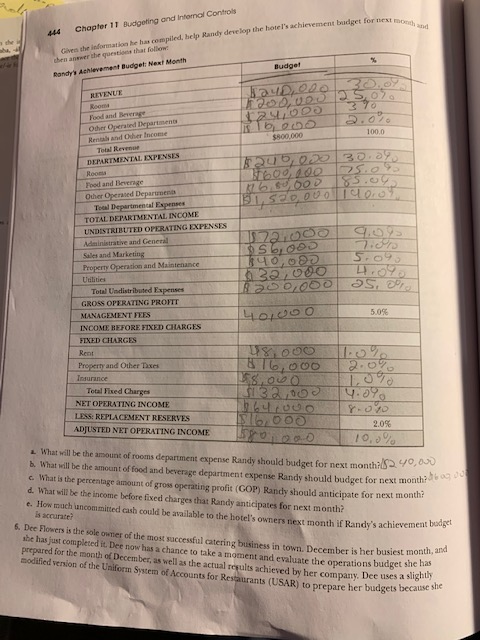

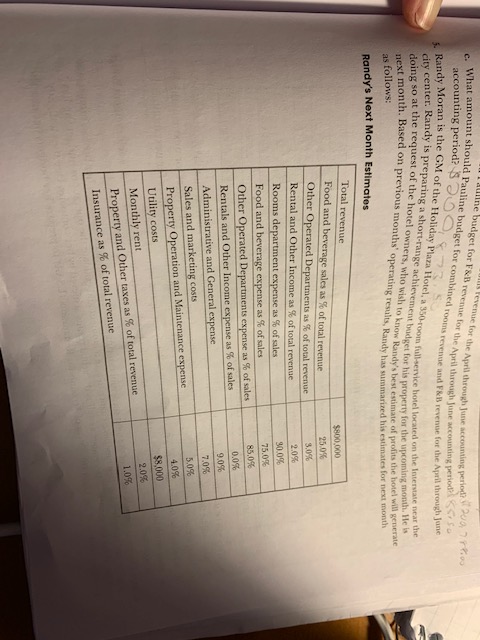

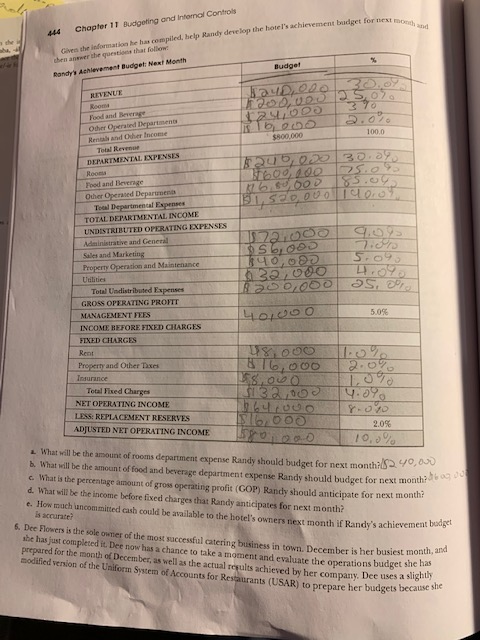

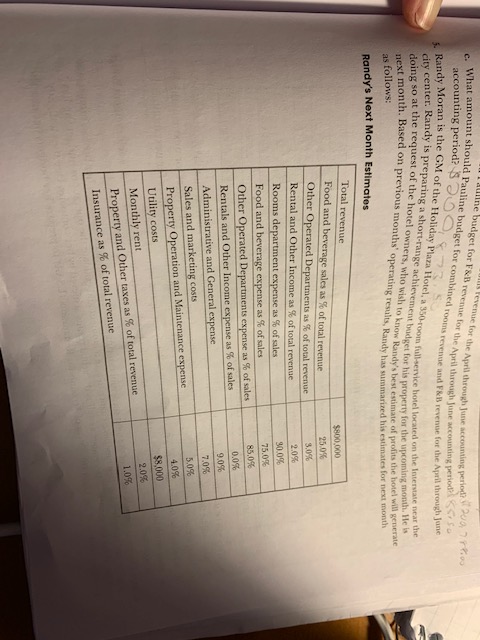

444 Chapter 11 Budgeting and Infomal Controls G h idmation he has compiled, help Randy develop the hotel's achievement! th e r the questions that follow Randy Achievement Budget: Next Month Budget REVENUE Food and Be Oder Operated Departments Rand Other Income JUD020 30. 2000 250 2 SLOD0370 TE $800.000 OY 100.0 Total Revenue DEPARTMENTAL EXPENSES $ 200,00 30.2% Roots $600,000 5.0% Food and Beverage 136, 80000 85.0 Other Operated Department 915200001400 Tocal Departmental Expenses TOTAL DEPARTMENTAL INCOME UNDISTRIBUTED OPERATING EXPENSES Administrative and General Sales and Marketing SOOD 140 0 5.09 Property Operation and Maintenance Uilities 0 32,000 Total Undistributed Expenses 8 0 0,000 OS, GROSS OPERATING PROFIT MANAGEMENT FEES LOOOO 5.0% INCOME BEFORE FIXED CHARGES FIXED CHARGES Root EUX0000 Property and Other Taxes 816,000 2.07 Insurance LS 000 ,00 Total Fixed Charges 32,00 9 .39 NET OPERATING INCOME 6400 LESS REPLACEMENT RESERVES OVO S OOS ADJUSTED NET OPERATING INCOME 2.0% 0 000 10,3% What will be the amount of rooms department expense and should budget for next month 5. What will be the amount of food and beverage department expense Randy should budget for next month 6. What is the percentage amount of gross operating profit (COP) Randy should anticipate for next mont d. What will be the income before fixed charges that Randy anticipates for next month? 6. How much uncommitted cash could be available to the hotel's owners next month if Randy's achievement ago dget for next month 6. Dee Flowers is the sole owner of the most successful catering business in town December is her busiest mont she has just completed it. Det now has a chance to take a moment and evaluate the operations budget she prepared for the month of December, as well as the actual results achieved by her company Dee uses a sig modified version of the Uniform System of Accounts for Restaurants (USAR) to prepare her budgets De er is her busiest month, and aluate the operations budget she has d by her company. Dee uses a slightly uline budget for F&B revenue for the April through June What amount should Pauline budget for combined to of the April through June accounting period 200, accounting period? S the April through June accounting period o OOS s revenue and F&B revenue for the April through June dy Moran is the GM of the Holiday Plaza Hotel, a 350-room full service hotel located on city center. Randy is preparing a short-range achievement doing so at the request of the hotel owners, who wish et budget for his property for the upcoming month. He next month. Based on previous months' op how Randy's best estimate of profits the hotel will generate perating results, Randy has marired his estimates for me Randy Moran is the en located on the Interstate near the as follows: Randy's Next Month Estimates Total revenue Food and beverage sales as % of total revenue Other Operated Departments as % of total revenue Rental and Other Income as % of total revenue Rooms department expense as % of sales Food and beverage expense as % of sales Other Operated Departments expense as % of sales Rentals and Other Income expense as % of sales Administrative and General expense $800,000 25.0% 3.0% 2.0% 30.0% 75.0% 85,0% 0.0% 9.0% 7.0% 5.0% 4.0% $8,000 Sales and marketing costs Property Operation and Maintenance expense Utility costs Monthly rent Property and Other taxes as % of total revenue Insurance as % of total revenue 2.0% 1.0%