Answered step by step

Verified Expert Solution

Question

1 Approved Answer

looking for help on this project. 2-5 i need to answer with excel and not a written answer Chapter 11 Analytical Thinking: TufStuff, Inc. sells

looking for help on this project. 2-5 i need to answer with excel and not a written answer

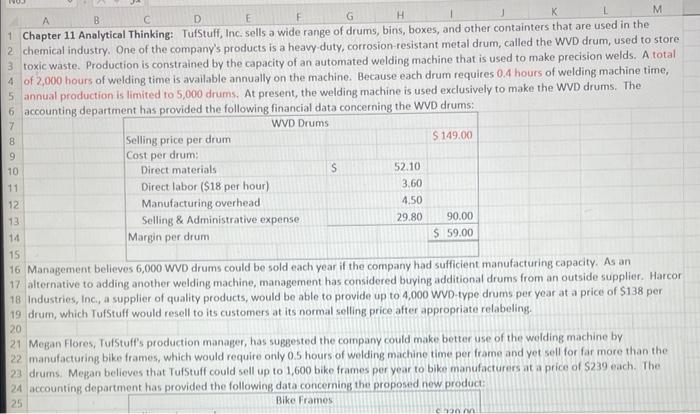

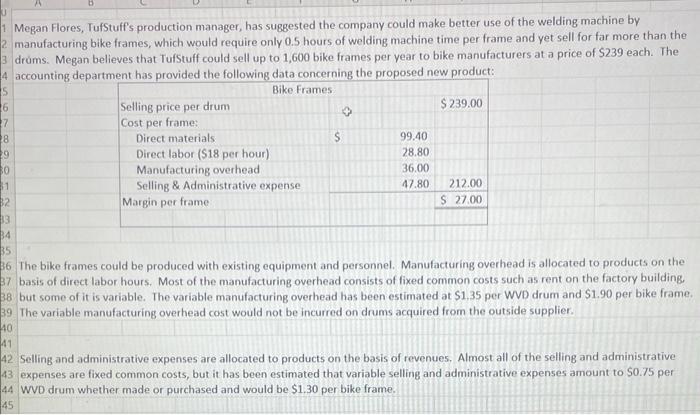

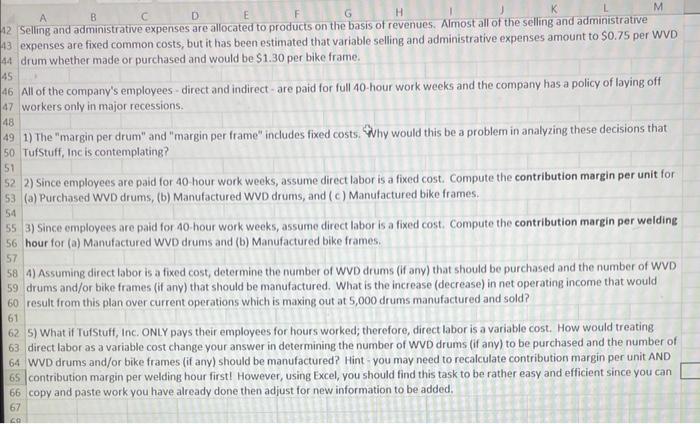

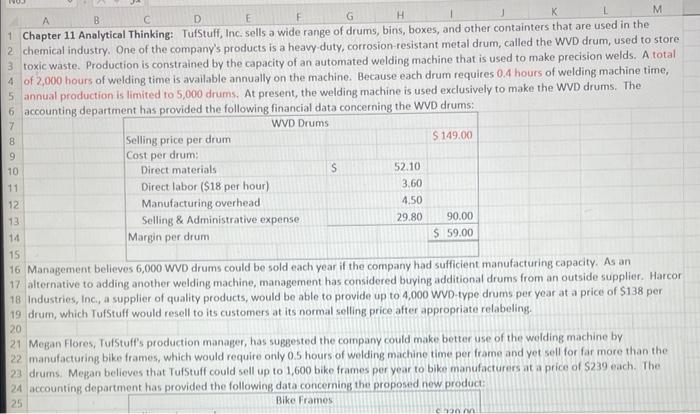

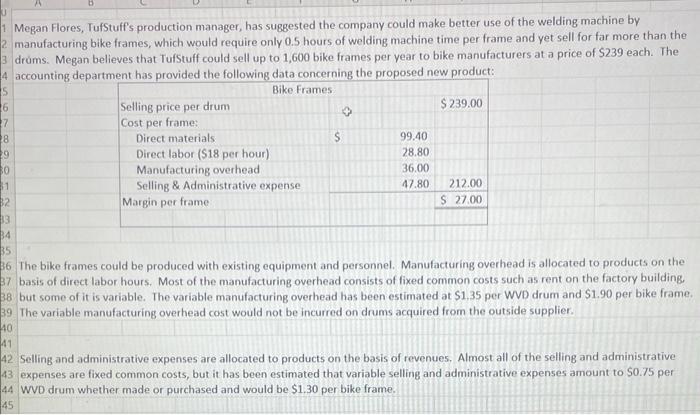

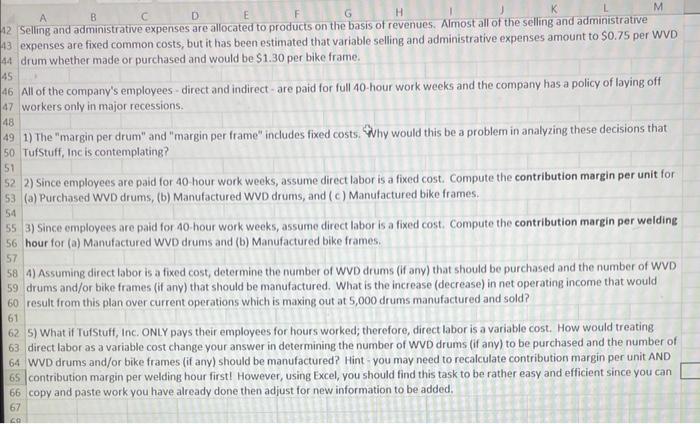

Chapter 11 Analytical Thinking: TufStuff, Inc. sells a wide range of drums, bins, boxes, and other containters that are used in the chemical industry. One of the company's products is a heavy-duty, corrosion-resistant metal drum, called the WVD drum, used to store toxic waste. Production is constrained by the capacity of an automated welding machine that is used to make precision welds. A total of 2,000 hours of welding time is available annually on the machine. Because each drum requires 0.4 hours of welding machine time, annual production is limited to 5,000 drums. At present, the welding machine is used exclusively to make the WVD drums. The accounting department has orovided the following financial data concerning the WVD drums: Management believes 6,000 WVD drums could be sold each year if the company had sufficient manufacturing capacity. As an alternative to adding another welding machine, management has considered buying additional drums from an outside supplier. Harcor Industries, Inc, a supplier of quality products, would be able to provide up to 4,000 WVD-type drums per year at a price of $138 per drum, which TufStuff would resell to its customers at its normal selling price after appropriate relabeling. Megan Flores, TufStuff's production manager, has suggested the company could make better use of the welding machine by 22. manufacturing bike frames, which would require only 0.5 hours of welding machine time per frame and yet sell for far more than the 23. drums. Megan believes that TufStuff could sell up to 1,600 bike frames per year to bikn manufacturers at a price of $239 each. The 24 accounting department has provided the following data concerming the proposed new product: Megan Flores, TufStuff's production manager, has suggested the company could make better use of the welding machine by manufacturing bike frames, which would require only 0.5 hours of welding machine time per frame and yet sell for far more than the drms. Megan believes that TufStuff could sell up to 1,600 bike frames per year to bike manufacturers at a price of $239 each. The accounting department has provided the following data concerning the proposed new product: The bike frames could be produced with existing equipment and personnel. Manufacturing overhead is allocated to products on the basis of direct labor hours. Most of the manufacturing overhead consists of fixed common costs such as rent on the factory building. but some of it is variable. The variable manufacturing overhead has been estimated at $1.35 per WVD drum and $1.90 per bike frame. The variable manufacturing overhead cost would not be incurred on drums acquired from the outside supplier. Selling and administrative expenses are allocated to products on the basis of revenues. Almost all of the selling and administrative expenses are fixed common costs, but it has been estimated that variable selling and administrative expenses amount to $0.75 per WVD drum whether made or purchased and would be $1.30 per bike frame. expenses are fixed common costs, but it has been estimated that variable selling and administrative expenses amount to 50.75 per WVD drum whether made or purchased and would be $1.30 per bike frame. All of the company's employees - direct and indirect - are paid for full 40 -hour work weeks and the company has a policy of laying off workers only in major recessions. 1) The "margin per drum" and "margin per frame" includes fixed costs. "Why would this be a problem in analyzing these decisions that TufStuff, Inc is contemplating? 2) Since employees are paid for 40 hour work weeks, assume direct labor is a fixed cost. Compute the contribution margin per unit for (a) Purchased WVD drums, (b) Manufactured WVD drums, and (c) Manufactured bike frames. 3) Since employees are paid for 40 -hour work weeks, assume direct labor is a fixed cost. Compute the contribution margin per welding hour for (a) Manufactured WVD drums and (b) Manufactured bike frames. 4) Assuming direct labor is a fixed cost, determine the number of WVD drums (if any) that should be purchased and the number of WVD drums and/or bike frames (if any) that should be manufactured. What is the increase (decrease) in net operating income that would result from this plan over current operations which is maxing out at 5,000 drums manufactured and sold? 5) What if TufStuff, Inc. ONLY pays their employees for hours worked; therefore, direct labor is a variable cost. How would treating direct labor as a variable cost change your answer in determining the number of WVD drums (if any) to be purchased and the number of WVD drums and/or bike frames (if any) should be manufactured? Hint - you may need to recalculate contribution margin per unit AND contribution margin per welding hour firstl However, using Excel, you should find this task to be rather easy and efficient since you can copy and paste work you have already done then adjust for new information to be added

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started