Answered step by step

Verified Expert Solution

Question

1 Approved Answer

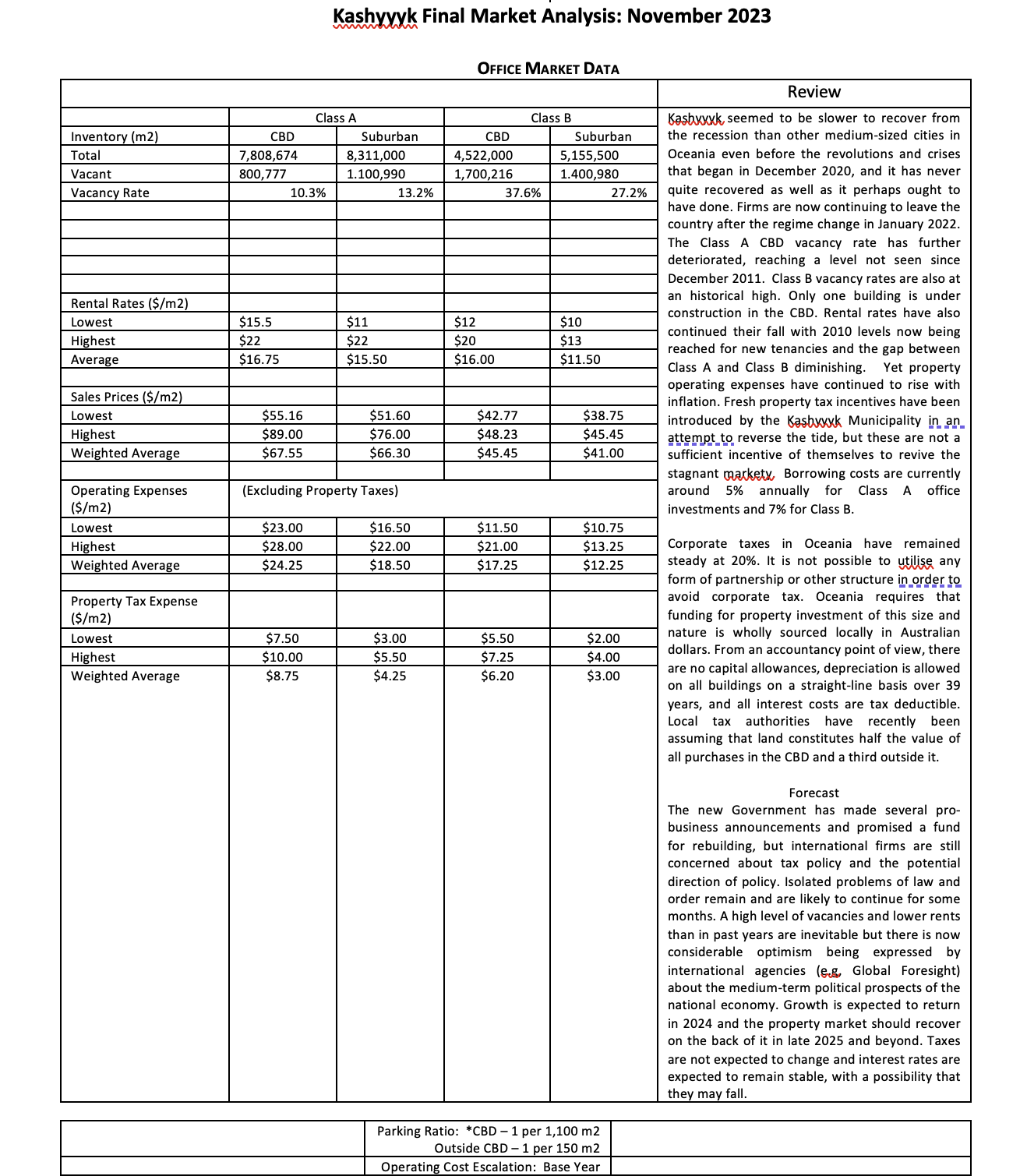

Looking for help with this excel discounted cash flow model if anyone could show how its done. Thank you. Kachvvyk Final Markot Analvcic: November 2023

Looking for help with this excel discounted cash flow model if anyone could show how its done. Thank you.

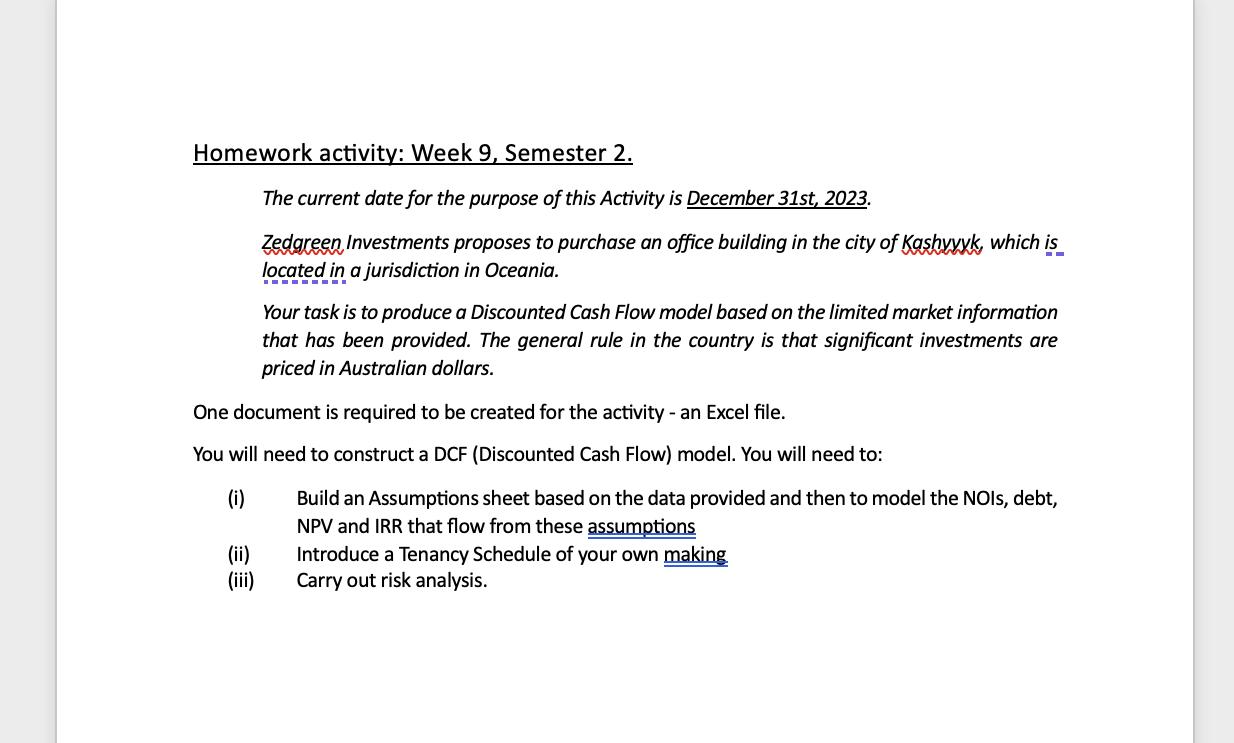

Kachvvyk Final Markot Analvcic: November 2023 Homework activity: Week 9, Semester 2. The current date for the purpose of this Activity is December 31st, 2023. Zedgreen Investments proposes to purchase an office building in the city of Kashyyyk, which is located in a jurisdiction in Oceania. Your task is to produce a Discounted Cash Flow model based on the limited market information that has been provided. The general rule in the country is that significant investments are priced in Australian dollars. One document is required to be created for the activity - an Excel file. You will need to construct a DCF (Discounted Cash Flow) model. You will need to: (i) Build an Assumptions sheet based on the data provided and then to model the NOIs, debt, NPV and IRR that flow from these assumptions (ii) Introduce a Tenancy Schedule of your own making (iii) Carry out risk analysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started