Answered step by step

Verified Expert Solution

Question

1 Approved Answer

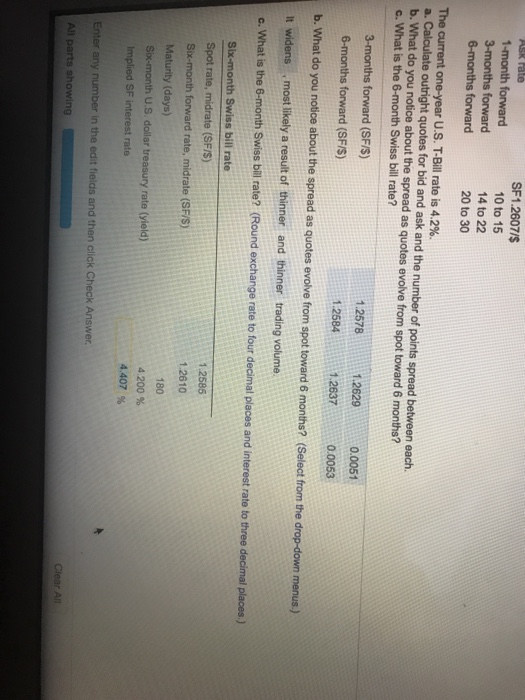

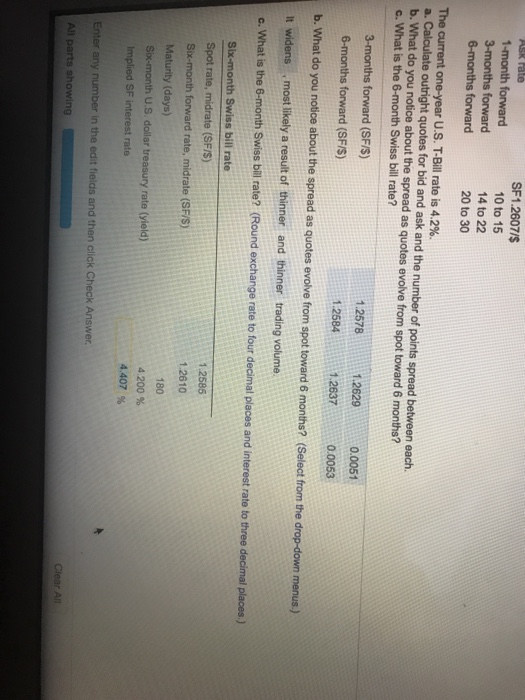

Looking for Implied SF interset rate My answer is wrong SF1.2607/S 10 to 15 14 to 22 20 to 30 0 3-months forward 6-months forward

Looking for Implied SF interset rate

SF1.2607/S 10 to 15 14 to 22 20 to 30 0 3-months forward 6-months forward The current one-year U.S. T-Bill rate is 4.2%. a. Calculate outright quotes for bid and ask and the number of points spread between each. b. What do you notice about the spread as quotes evolve from spot toward 6 months? c. What is the 6-month Swiss bill rate? 1.25781.2629 0.0051 6-months forward (SFIS) 1.2584 1.2637 0.0053 b. What do you notice about the spread as quotes evolve from spot toward 6 months? (Select from the drop-down menus.) t widens most likely a result of thinner and thinner trading volume. c. what is the 6-month Swiss bill rate? (Round exchange rate to four decimal places and interest rate to three decimal places.) Slx 1.2585 1.2610 Six-month forward rate, midrate (SF/s) Maturity (days) 180 4.200 % 4407 % SF My answer is wrong

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started