Looking for solutions for Part A to G

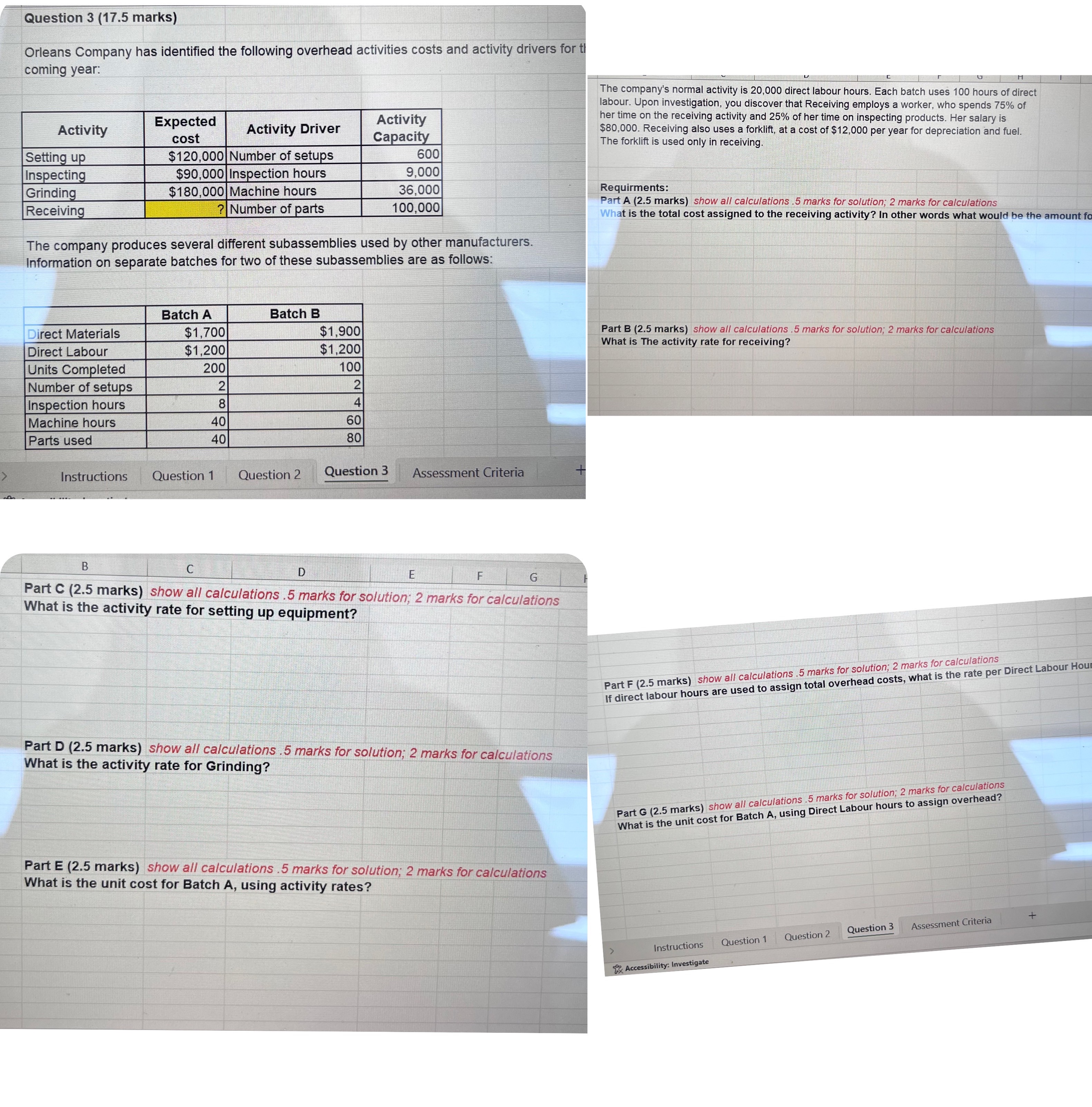

Question 3 (17.5 marks) Orleans Company has identified the following overhead activities costs and activity drivers for t coming year: The company's normal activity is 20,000 direct labour hours. Each batch uses 100 hours of direct labour. Upon investigation, you discover that Receiving employs a worker, who spends 75% of Activity Expected Activity Driver Activity her time on the receiving activity and 25% of her time on inspecting products. Her salary is cost Capacity $80,000. Receiving also uses a forklift, at a cost of $12,000 per year for depreciation and fuel. The forklift is used only in receiving. Setting up $120,000 Number of setups 600 Inspecting $90,000 Inspection hours 9,000 Grinding $180,000 Machine hours 36,000 Requirments: Receiving ? Number of parts 100,000 Part A (2.5 marks) show all calculations .5 marks for solution; 2 marks for calculations What is the total cost assigned to the receiving activity? In other words what would be the amount The company produces several different subassemblies used by other manufacturers. Information on separate batches for two of these subassemblies are as follows: Batch A Batch B Direct Materials $1,700 $1,900 Part B (2.5 marks) show all calculations . 5 marks for solution; 2 marks for calculations Direct Labour $1,20 $1,200 What is The activity rate for receiving? Units Completed 200 100 Number of setups Inspection hours Machine hours 60 Parts used 80 Instructions Question 1 Question 2 Question 3 Assessment Criteria B D E F G Part C (2.5 marks) show all calculations . 5 marks for solution; 2 marks for calculations What is the activity rate for setting up equipment? Part F (2.5 marks) show all calculations .5 marks for solution; 2 marks for calculations If direct labour hours are used to assign total overhead costs, what is the rate per Direct Labour Hou Part D (2.5 marks) show all calculations .5 marks for solution; 2 marks for calculations What is the activity rate for Grinding? Part G (2.5 marks) show all calculations . 5 marks for solution; 2 marks for calculations What is the unit cost for Batch A, using Direct Labour hours to assign overhead? Part E (2.5 marks) show all calculations .5 marks for solution; 2 marks for calculations What is the unit cost for Batch A, using activity rates? Instructions Question 1 Question 2 Question 3 Assessment Criteria 1 Accessibility. Investigate