Answered step by step

Verified Expert Solution

Question

1 Approved Answer

looking for the taxable income. The following applies to the current year for Revis and Patricia, a married couple. Revis is employed as a shoe

looking for the taxable income.

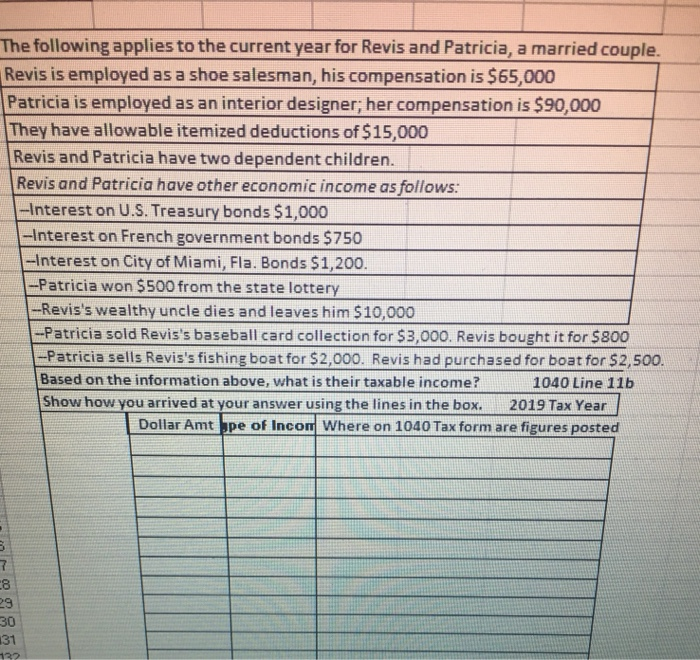

The following applies to the current year for Revis and Patricia, a married couple. Revis is employed as a shoe salesman, his compensation is $65,000 Patricia is employed as an interior designer; her compensation is $90,000 They have allowable itemized deductions of $15,000 Revis and Patricia have two dependent children. Revis and Patricia have other economic income as follows: -Interest on U.S. Treasury bonds $1,000 1-Interest on French government bonds $750 --Interest on City of Miami, Fla. Bonds $1,200. --Patricia won $500 from the state lottery -Revis's wealthy uncle dies and leaves him $10,000 --Patricia sold Revis's baseball card collection for $3,000. Revis bought it for $800 --Patricia sells Revis's fishing boat for $2,000. Revis had purchased for boat for $2,500. Based on the information above, what is their taxable income? 1040 Line 11b Show how you arrived at your answer using the lines in the box. 2019 Tax Year Dollar Amt pe of Incon Where on 1040 Tax form are figures posted The following applies to the current year for Revis and Patricia, a married couple. Revis is employed as a shoe salesman, his compensation is $65,000 Patricia is employed as an interior designer; her compensation is $90,000 They have allowable itemized deductions of $15,000 Revis and Patricia have two dependent children. Revis and Patricia have other economic income as follows: -Interest on U.S. Treasury bonds $1,000 1-Interest on French government bonds $750 --Interest on City of Miami, Fla. Bonds $1,200. --Patricia won $500 from the state lottery -Revis's wealthy uncle dies and leaves him $10,000 --Patricia sold Revis's baseball card collection for $3,000. Revis bought it for $800 --Patricia sells Revis's fishing boat for $2,000. Revis had purchased for boat for $2,500. Based on the information above, what is their taxable income? 1040 Line 11b Show how you arrived at your answer using the lines in the box. 2019 Tax Year Dollar Amt pe of Incon Where on 1040 Tax form are figures posted Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started