Answered step by step

Verified Expert Solution

Question

1 Approved Answer

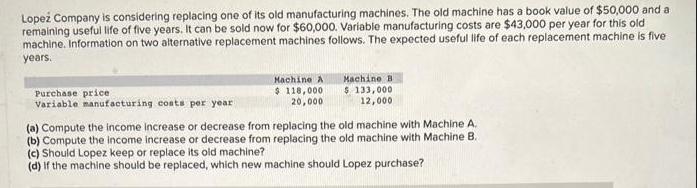

Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $50,000 and a remaining useful

Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $50,000 and a remaining useful life of five years. It can be sold now for $60,000. Variable manufacturing costs are $43,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. Purchase price Variable manufacturing costs per year Machine A $ 118,000 20,000 Machine B $ 133,000 12,000 (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase?

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To compute the income increase or decrease from replacing the old machine with Machine A we need to calculate the following 1 Calculate the annual cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started