Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lopez Construction has a market to book value ratio of 3. Its stock price is $24 per share. Lopez Construction has 5 million shares

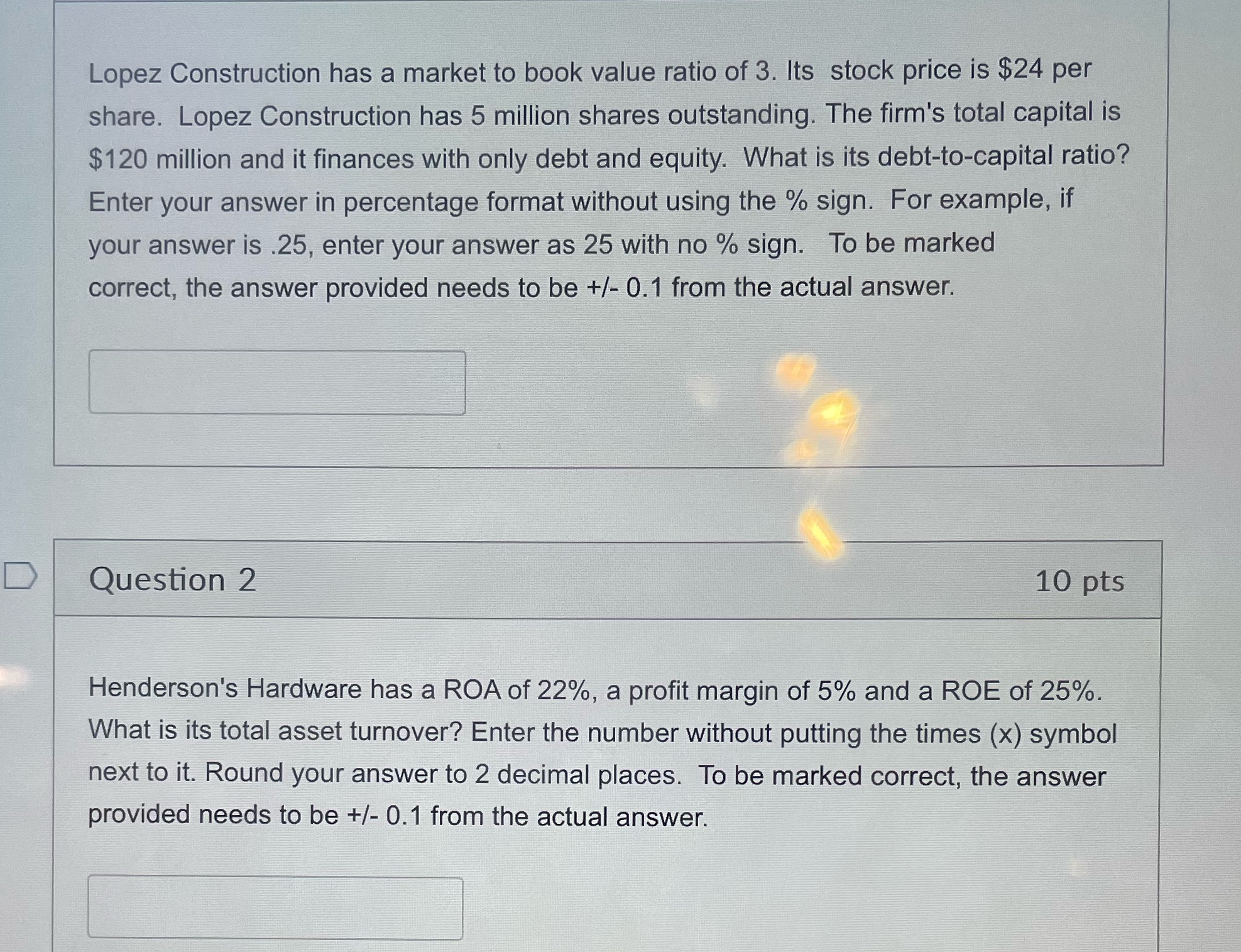

Lopez Construction has a market to book value ratio of 3. Its stock price is $24 per share. Lopez Construction has 5 million shares outstanding. The firm's total capital is $120 million and it finances with only debt and equity. What is its debt-to-capital ratio? Enter your answer in percentage format without using the % sign. For example, if your answer is .25, enter your answer as 25 with no % sign. To be marked correct, the answer provided needs to be +/- 0.1 from the actual answer. Question 2 10 pts Henderson's Hardware has a ROA of 22%, a profit margin of 5% and a ROE of 25%. What is its total asset turnover? Enter the number without putting the times (x) symbol next to it. Round your answer to 2 decimal places. To be marked correct, the answer provided needs to be +/- 0.1 from the actual answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 DebttoCapital Ratio The debttocapital ratio is calculated by dividing total debt by total capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642eec005af3_972784.pdf

180 KBs PDF File

6642eec005af3_972784.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started