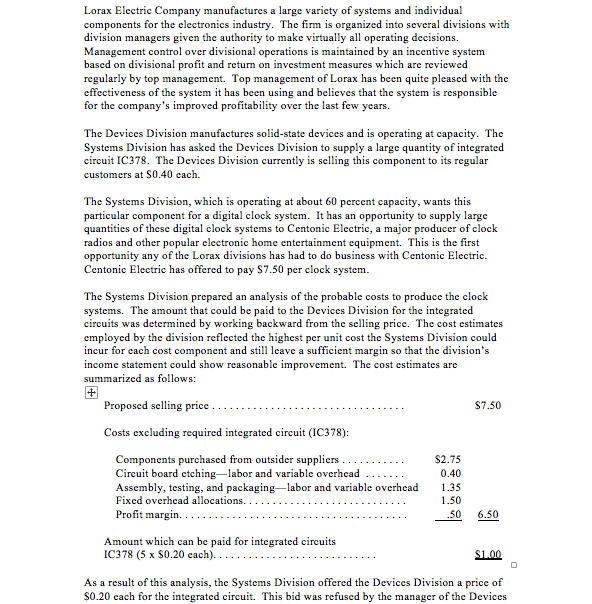

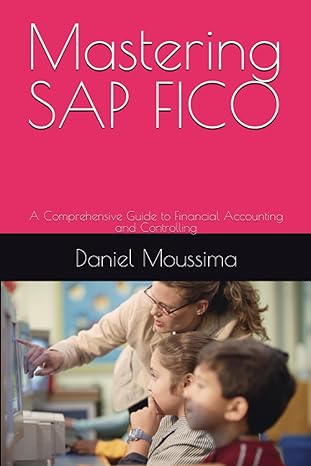

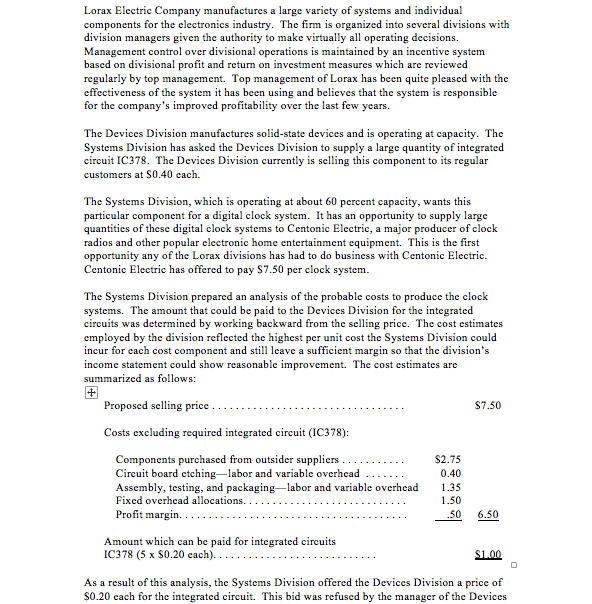

Lorax Electric Company manufactures a large variety of systems and individual components for the electronics industry. The firm is organized into several divisions with division managers given the authority to make virtually all operating decisions. Management control over divisional operations is maintained by an incentive system based on divisional profit and return on investment measures which are reviewed regularly by top management. Top management of Lorax has been quite pleased with the effectiveness of the system it has been using and believes that the system is responsible for the company's improved profitability over the last few years. The Devices Division manufactures solid-state devices and is operating at capacity. The Systems Division has asked the Devices Division to supply a large quantity of integrated circuit IC378. The Devices Division currently is selling this component to its regular customers at S0.40 each. The Systems Division, which is operating at about 60 percent capacity, wants this particular component for a digital clock system. It has an opportunity to supply large quantities of these digital clock systems to Centonic Electric, a major producer of clock radios and other popular electronic home entertainment equipment. This is the first opportunity any of the Lorax divisions has had to do business with Centonic Electric. Centonic Electric has offered to pay S7.50 per clock system. The Systems Division prepared an analysis of the probable costs to produce the clock systems. The amount that could be paid to the Devices Division for the integrated circuits was determined by working backward from the selling price. The cost estimates employed by the division reflected the highest per unit cost the Systems Division could incur for each cost component and stil leave a sufficient margin so that the division's income statement could show reasonable improvement. The cost estimates are summarized as follows: Proposed selling price $7.50 Costs excluding required integrated circuit (IC378): Components purchased from outsider suppliers Circuit board ctching-labor and variable overhead Assembly, testing, and packaging-labor and variable overhead1.35 Fixed overhcad allocations Profit margin. S2.75 0.40 1.50 50 6.50 Amount which can be paid for integrated circuits IC378 (5 x S0.20 cach) SL00 As a result of this analysis, the Systems Division offered the Devices Division a price of S0.20 cach for the integrated circuit. This bid was refused by the manager of the Devices