Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lord Peter Wimsey, a Bermudian citizen and resident, has real property holdings in the United States. The holdings consist of a fee ownership interest

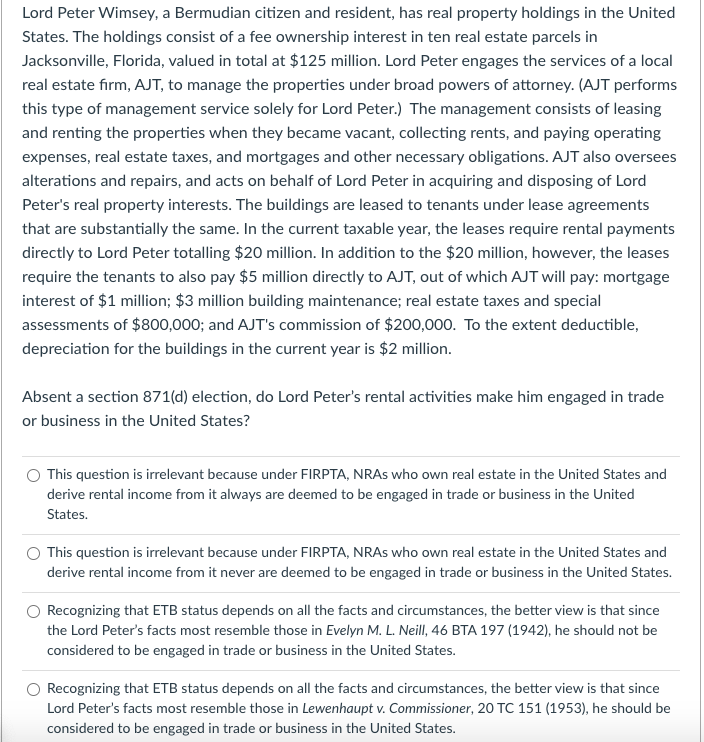

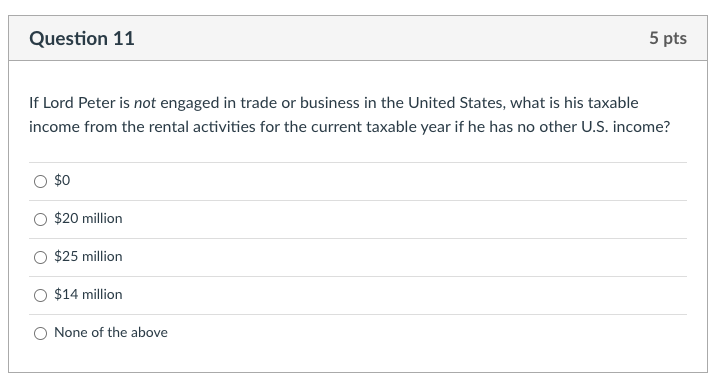

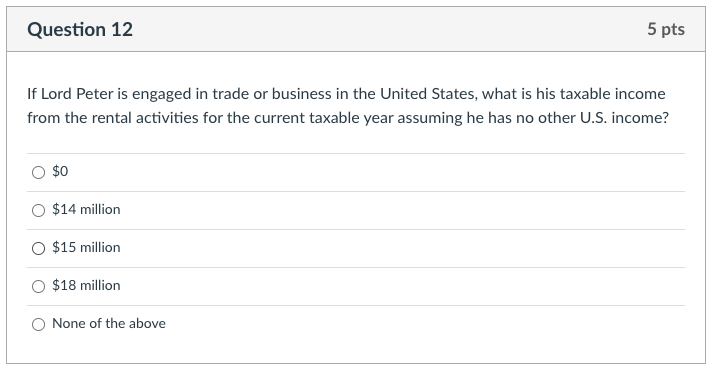

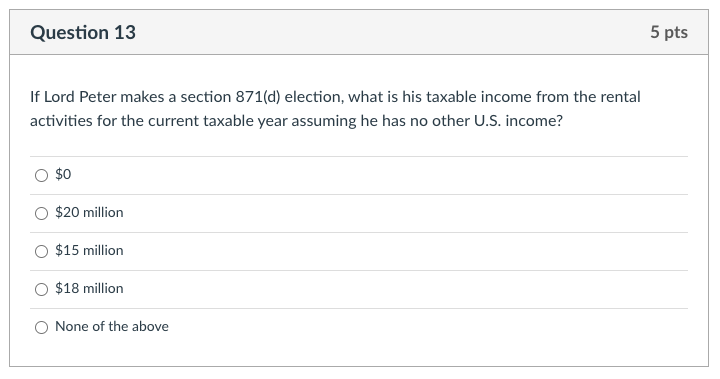

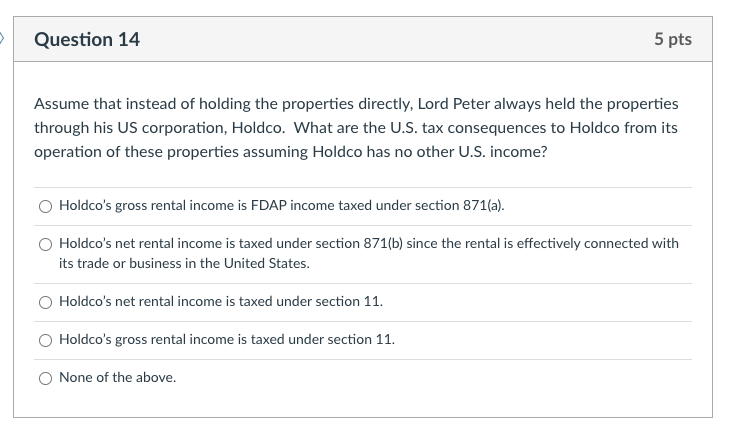

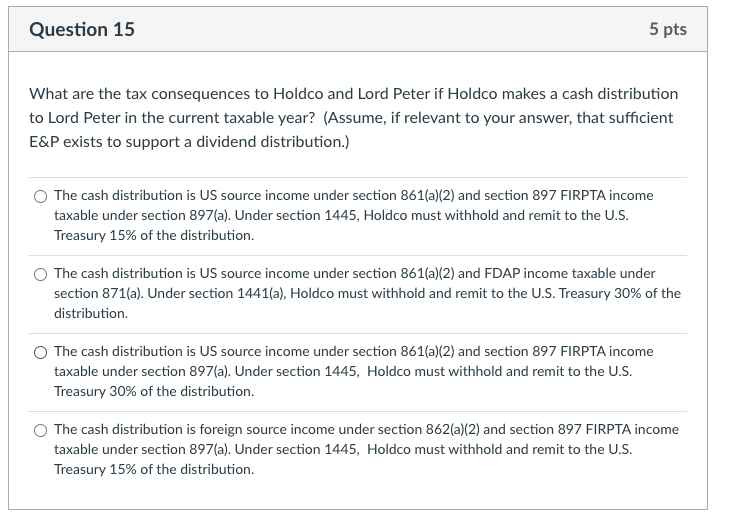

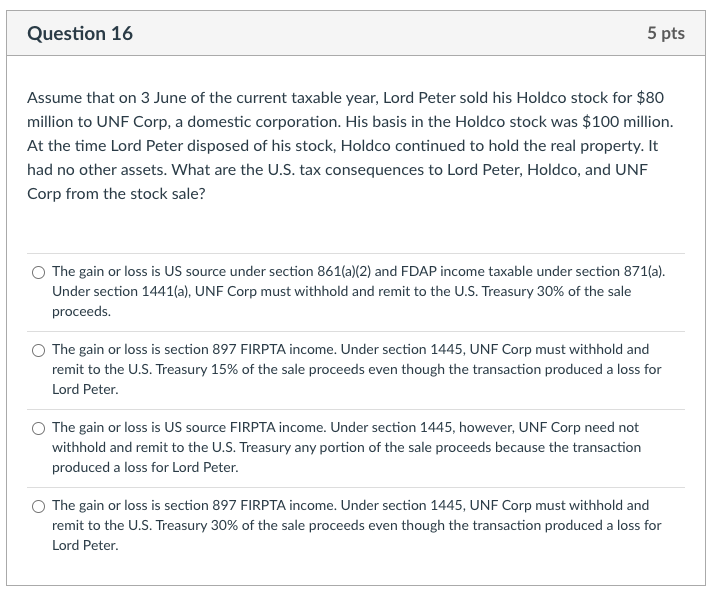

Lord Peter Wimsey, a Bermudian citizen and resident, has real property holdings in the United States. The holdings consist of a fee ownership interest in ten real estate parcels in Jacksonville, Florida, valued in total at $125 million. Lord Peter engages the services of a local real estate firm, AJT, to manage the properties under broad powers of attorney. (AJT performs this type of management service solely for Lord Peter.) The management consists of leasing and renting the properties when they became vacant, collecting rents, and paying operating expenses, real estate taxes, and mortgages and other necessary obligations. AJT also oversees alterations and repairs, and acts on behalf of Lord Peter in acquiring and disposing of Lord Peter's real property interests. The buildings are leased to tenants under lease agreements that are substantially the same. In the current taxable year, the leases require rental payments directly to Lord Peter totalling $20 million. In addition to the $20 million, however, the leases require the tenants to also pay $5 million directly to AJT, out of which AJT will pay: mortgage interest of $1 million; $3 million building maintenance; real estate taxes and special assessments of $800,000; and AJT's commission of $200,000. To the extent deductible, depreciation for the buildings in the current year is $2 million. Absent a section 871(d) election, do Lord Peter's rental activities make him engaged in trade or business in the United States? This question is irrelevant because under FIRPTA, NRAs who own real estate in the United States and derive rental income from it always are deemed to be engaged in trade or business in the United States. This question is irrelevant because under FIRPTA, NRAs who own real estate in the United States and derive rental income from it never are deemed to be engaged in trade or business in the United States. Recognizing that ETB status depends on all the facts and circumstances, the better view is that since the Lord Peter's facts most resemble those in Evelyn M. L. Neill, 46 BTA 197 (1942), he should not be considered to be engaged in trade or business in the United States. Recognizing that ETB status depends on all the facts and circumstances, the better view is that since Lord Peter's facts most resemble those in Lewenhaupt v. Commissioner, 20 TC 151 (1953), he should be considered to be engaged in trade or business in the United States. Question 11 If Lord Peter is not engaged in trade or business in the United States, what is his taxable income from the rental activities for the current taxable year if he has no other U.S. income? $0 $20 million $25 million $14 million 5 pts None of the above Question 12 If Lord Peter is engaged in trade or business in the United States, what is his taxable income from the rental activities for the current taxable year assuming he has no other U.S. income? $0 $14 million O $15 million $18 million 5 pts O None of the above Question 13 If Lord Peter makes a section 871(d) election, what is his taxable income from the rental activities for the current taxable year assuming he has no other U.S. income? $0 $20 million $15 million $18 million None of the above 5 pts 5 Question 14 Assume that instead of holding the properties directly, Lord Peter always held the properties through his US corporation, Holdco. What are the U.S. tax consequences to Holdco from its operation of these properties assuming Holdco has no other U.S. income? O Holdco's gross rental income is FDAP income taxed under section 871(a). O Holdco's net rental income is taxed under section 871(b) since the rental is effectively connected with its trade or business in the United States. Holdco's net rental income is taxed under section 11. 5 pts O Holdco's gross rental income is taxed under section 11. None of the above. Question 15 5 pts What are the tax consequences to Holdco and Lord Peter if Holdco makes a cash distribution to Lord Peter in the current taxable year? (Assume, if relevant to your answer, that sufficient E&P exists to support a dividend distribution.) The cash distribution is US source income under section 861(a)(2) and section 897 FIRPTA income taxable under section 897(a). Under section 1445, Holdco must withhold and remit to the U.S. Treasury 15% of the distribution. The cash distribution is US source income under section 861(a)(2) and FDAP income taxable under section 871(a). Under section 1441(a), Holdco must withhold and remit to the U.S. Treasury 30% of the distribution. The cash distribution is US source income under section 861(a)(2) and section 897 FIRPTA income taxable under section 897(a). Under section 1445, Holdco must withhold and remit to the U.S. Treasury 30% of the distribution. The cash distribution is foreign source income under section 862(a)(2) and section 897 FIRPTA income taxable under section 897(a). Under section 1445, Holdco must withhold and remit to the U.S. Treasury 15% of the distribution. Question 16 5 pts Assume that on 3 June of the current taxable year, Lord Peter sold his Holdco stock for $80 million to UNF Corp, a domestic corporation. His basis in the Holdco stock was $100 million. At the time Lord Peter disposed of his stock, Holdco continued to hold the real property. It had no other assets. What are the U.S. tax consequences to Lord Peter, Holdco, and UNF Corp from the stock sale? The gain or loss is US source under section 861(a)(2) and FDAP income taxable under section 871(a). Under section 1441(a), UNF Corp must withhold and remit to the U.S. Treasury 30% of the sale proceeds. The gain or loss is section 897 FIRPTA income. Under section 1445, UNF Corp must withhold and remit to the U.S. Treasury 15% of the sale proceeds even though the transaction produced a loss for Lord Peter. The gain or loss is US source FIRPTA income. Under section 1445, however, UNF Corp need not withhold and remit to the U.S. Treasury any portion of the sale proceeds because the transaction produced a loss for Lord Peter. The gain or loss is section 897 FIRPTA income. Under section 1445, UNF Corp must withhold and remit to the U.S. Treasury 30% of the sale proceeds even though the transaction produced a loss for Lord Peter.

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Recognizing that ETB status depends on all the facts and circumstances the better view is that since Lord Peters facts most resemble those in E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started