Answered step by step

Verified Expert Solution

Question

1 Approved Answer

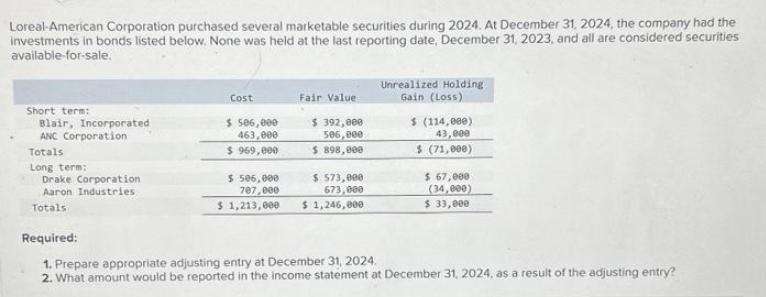

Loreal-American Corporation purchased several marketable securities during 2024. At December 31, 2024, the company had the investments in bonds listed below. None was held

Loreal-American Corporation purchased several marketable securities during 2024. At December 31, 2024, the company had the investments in bonds listed below. None was held at the last reporting date, December 31, 2023, and all are considered securities available-for-sale. Short term: Blair, Incorporated ANC Corporation Totals Long term: Drake Corporation Aaron Industries Totals Cost $ 506,000 463,000 $ 969,000 $ 506,000 707,000 $ 1,213,000 Fair Value $ 392,000 506,000 $ 898,000 $ 573,000 673,000 $ 1,246,000 Unrealized Holding Gain (Loss) $ (114,000) 43,000 $ (71,000) $ 67,000 (34,000) $ 33,000 Required: 1. Prepare appropriate adjusting entry at December 31, 2024. 2. What amount would be reported in the income statement at December 31, 2024, as a result of the adjusting entry?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To prepare the appropriate adjusting entry at December 31 2024 we need to account for the unrealiz...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started