Question

Lorenzo and Carlotta have three children (ages 5, 6, and 14). Lorenzo earned $36,000 in 2020. Carlotta worked part-time and earned $5,000. They had

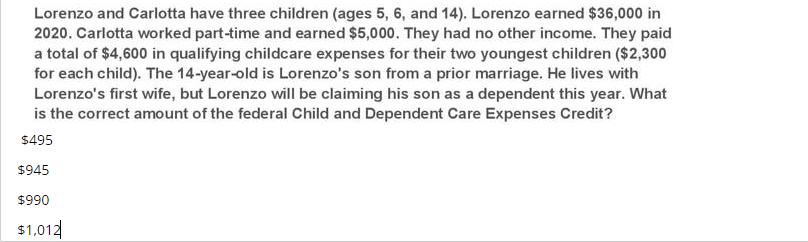

Lorenzo and Carlotta have three children (ages 5, 6, and 14). Lorenzo earned $36,000 in 2020. Carlotta worked part-time and earned $5,000. They had no other income. They paid a total of $4,600 in qualifying childcare expenses for their two youngest children ($2,300 for each child). The 14-year-old is Lorenzo's son from a prior marriage. He lives with Lorenzo's first wife, but Lorenzo will be claiming his son as a dependent this year. What is the correct amount of the federal Child and Dependent Care Expenses Credit? $495 $945 $990 $1,012

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Charles E. Davis, Elizabeth Davis

2nd edition

1118548639, 9781118800713, 1118338448, 9781118548639, 1118800710, 978-1118338445

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App