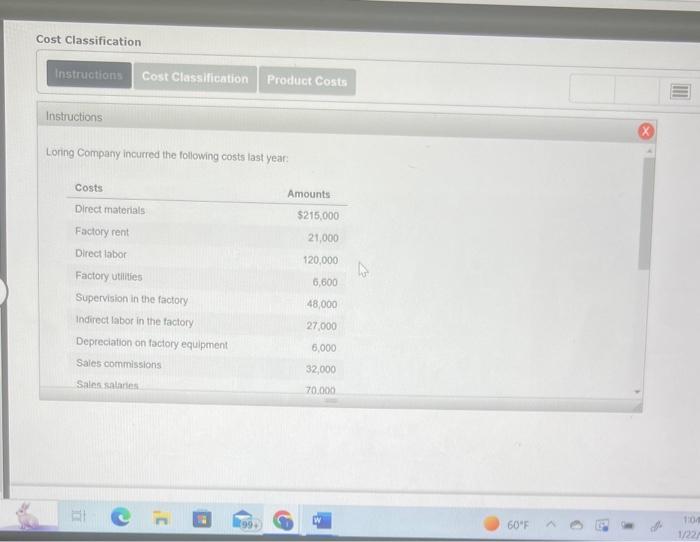

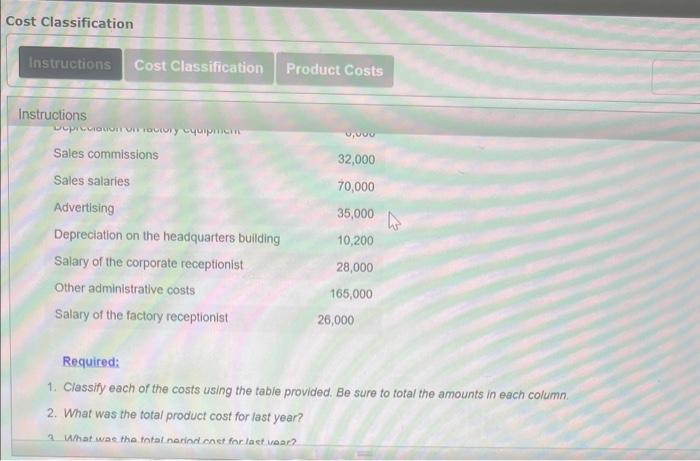

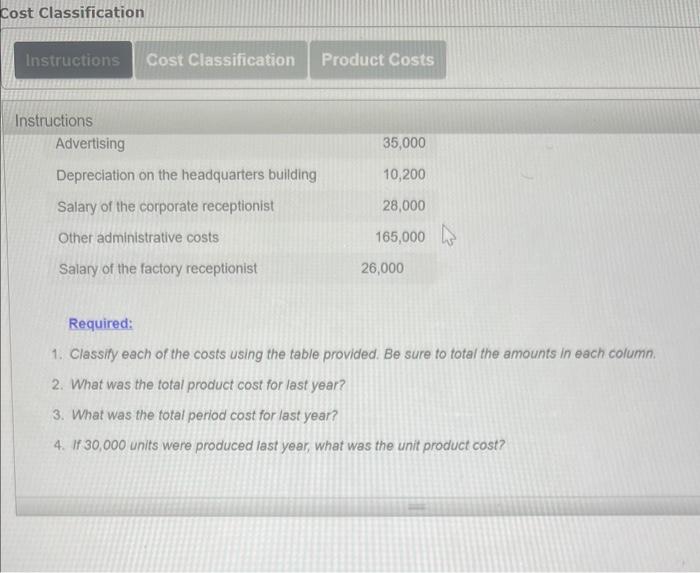

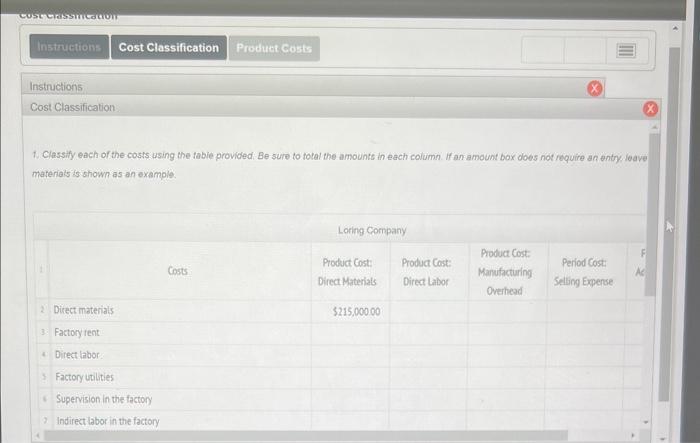

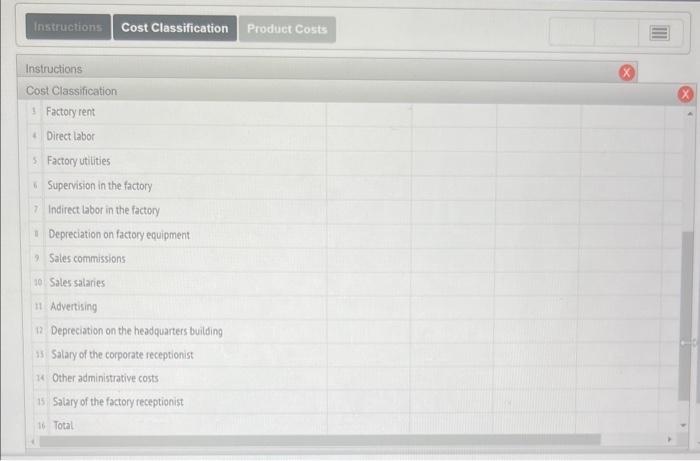

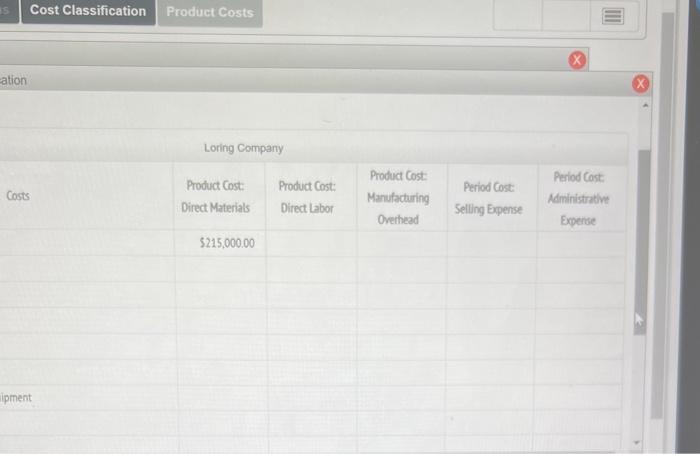

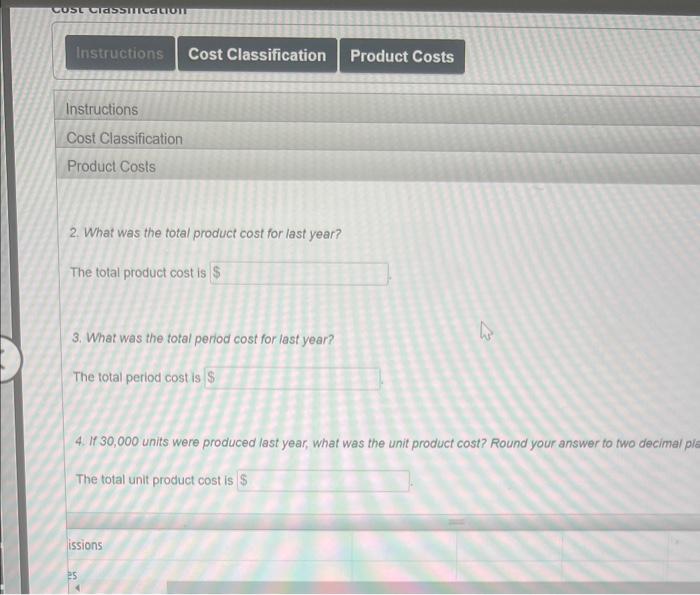

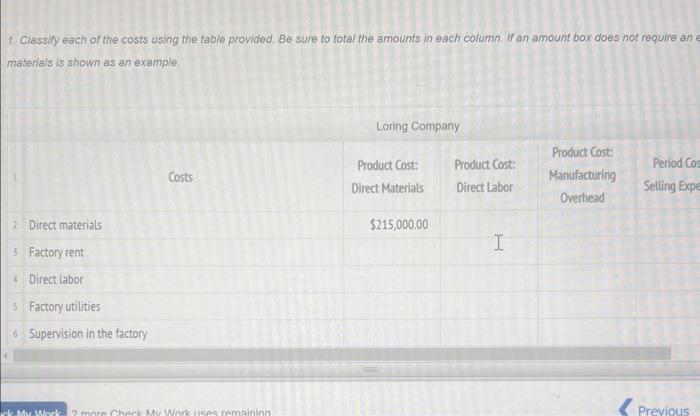

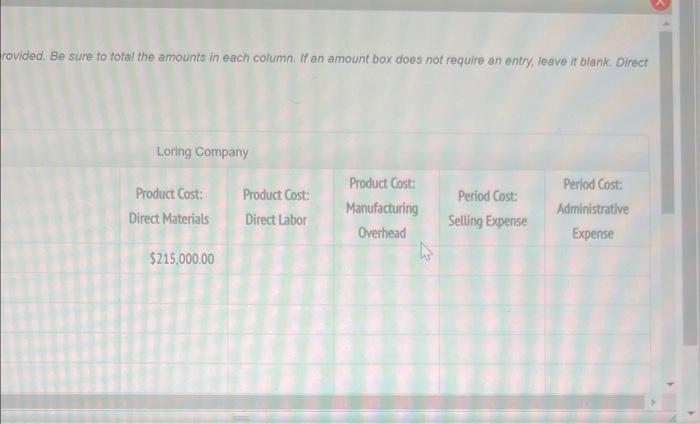

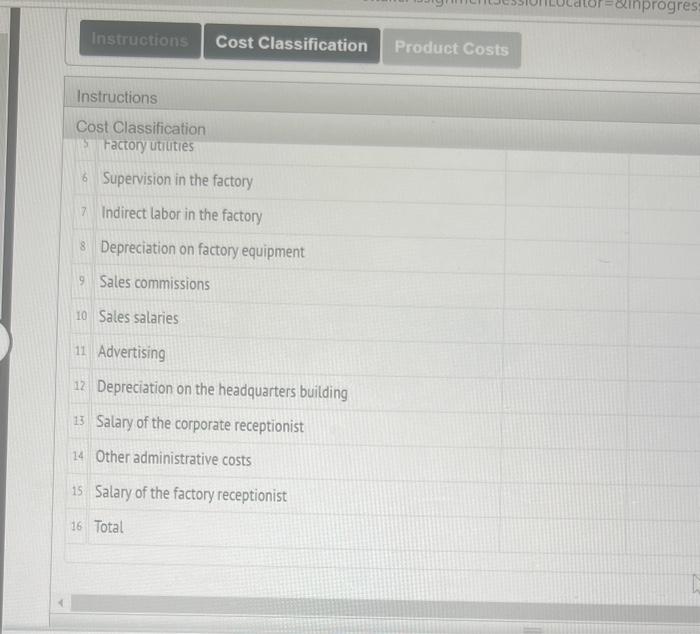

Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the table provided. Be sure to total the amounts in each column. 2. What was the total product cost for last year? 3 What was the intal nerind onet for laet vean? Required: 1. Classify each of the costs using the table provided. Be sure to total the amounts in each column. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost? 1. Classify each of the costs using the table provided. Be sure to total the amounts in each column. If an amount box does not require an entry leave materials is shown as an example. \begin{tabular}{|l|l|l|} \hline Instructions & Cost Classification \\ \hline \end{tabular} Instructions Cost Classification. Factory rent Direct labor Factory utilities Supervision in the factory 7 Indirect labor in the factory II Depreciation on factory equipment 9. Sales commissions: Sales salaries II Advertising 12. Depreciation on the headquarters building Salary of the corporate receptionist Other administrative costs Salary of the factory receptionist. Total Cost Classification Product Costs: Loring Company 2. What was the total product cost for last year? The total product cost is 3. What was the total period cost for last year? The total period cost is 4. If 30,000 units were produced lest year, what was the unit product cost? Round your answer to two decimal ple The total unit product cost is 1. Classify each of the costs using the table provided. Be sure to total the amounts in each column. If an amount box does not require an e materials is shown as an example rovided. Be sune to total the amounts in each column. If an amount box does not require an entry, teave it blank. Direct Instructions Cost Classification Product Costs Instructions Cost Classification 3 Factory utiuties 6 Supervision in the factory 7 Indirect labor in the factory 8 Depreciation on factory equipment 9 Sales commissions 10 Sales salaries 11. Advertising 12. Depreciation on the headquarters building 13 Salary of the corporate receptionist 14 Other administrative costs 15 Salary of the factory receptionist 16 Total