Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lorna knew that Sigmund would become depressed without patient interaction, so she sold Sigmund to Dr. Skinner, a psychiatrist she had known for years

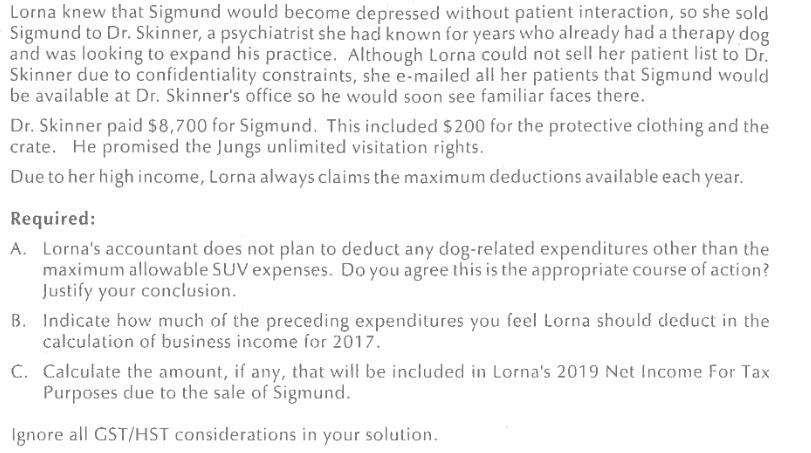

Lorna knew that Sigmund would become depressed without patient interaction, so she sold Sigmund to Dr. Skinner, a psychiatrist she had known for years who already had a therapy dog and was looking to expand his practice. Although Lorna could not sell her patient list to Dr. Skinner due to confidentiality constraints, she e-mailed all her patients that Sigmund would be available at Dr. Skinner's office so he would soon see familiar faces there. Dr. Skinner paid $8,700 for Sigmund. This included $200 for the protective clothing and the crate. He promised the Jungs unlimited visitation rights. Due to her high income, Lorna always claims the maximum deductions available each year. Required: A. Lorna's accountant does not plan to deduct any dog-related expenditures other than the maximum allowable SUV expenses. Do you agree this is the appropriate course of action? Justify your conclusion. B. Indicate how much of the preceding expenditures you feel Lorna should deduct in the calculation of business income for 2017. C. Calculate the amount, if any, that will be included in Lorna's 2019 Net Income For Tax Purposes due to the sale of Sigmund. Ignore all GST/HST considerations in your solution.

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started