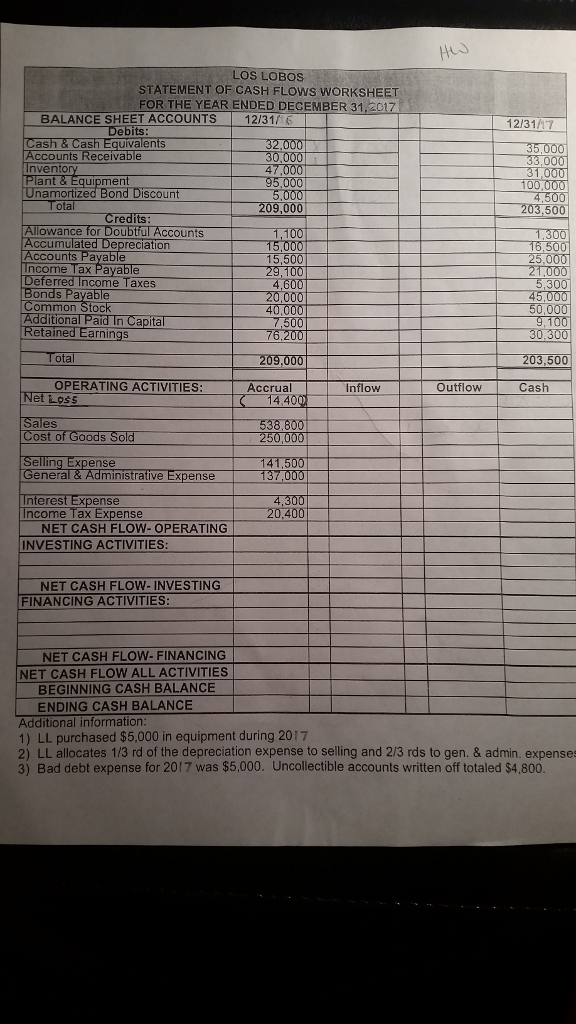

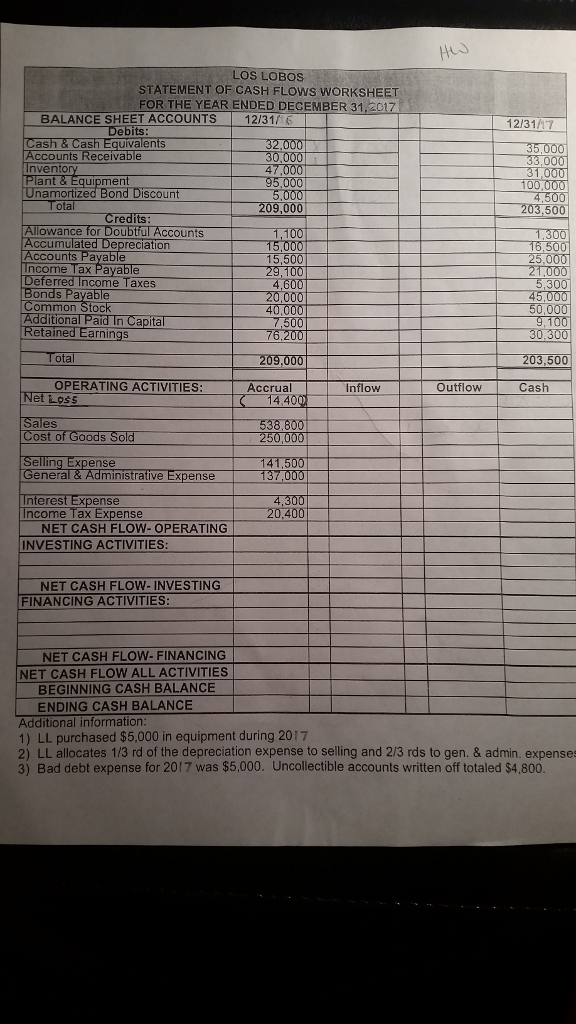

LOS LOBOS STATEMENT OF CASH FLOWS WORKSHEET FOR THE YEAR ENDED DECEMBER 31,2017 BALANCE SHEET ACCOUNTS12/31 12/3117 as ccounts Receiva as 30,000 4 nvento 31,000 ant uipmen Unamortized Bond Discount ota 203.500 209,000 Credits: owance for Doubtful Accounts Accumulated Depreciation Accounts P Income Tax Payable 1,100 15,000 16,50 ayable 21,00 ferred Income Taxes ef onds Payable ommon Stoc 300 20,000 50,000 9,100 Additional Paid ital etain d Earnin 203,500 OPERATING ACTIVITIES: Outflow Cash Accrual 1440 Inflow et BLoss ales Cost of Goods Sold elling Expense General & Administrative Expense nterest Expense ncome Tax Expense 4,300 20,400 NET CASH FLOW-OPERATING INVESTING ACTIVITIES: NET CASH FLOW- INVESTING FINANCING ACTIVITIES NET CASH FLOW- FINANCING NET CASH FLOW ALL ACTIVITIES BEGINNING CASH BALANCE ENDING CASH BALANCE Additional information 1) LL purchased $5,000 in equipment during 2017 2) LL allocates 1/3 rd of the depreciation expense to selling and 2/3 rds to gen. & admin. expenses 3) Bad debt expense for 2017 was $5,000. Uncollectible accounts written off totaled $4,800 LOS LOBOS STATEMENT OF CASH FLOWS WORKSHEET FOR THE YEAR ENDED DECEMBER 31,2017 BALANCE SHEET ACCOUNTS12/31 12/3117 as ccounts Receiva as 30,000 4 nvento 31,000 ant uipmen Unamortized Bond Discount ota 203.500 209,000 Credits: owance for Doubtful Accounts Accumulated Depreciation Accounts P Income Tax Payable 1,100 15,000 16,50 ayable 21,00 ferred Income Taxes ef onds Payable ommon Stoc 300 20,000 50,000 9,100 Additional Paid ital etain d Earnin 203,500 OPERATING ACTIVITIES: Outflow Cash Accrual 1440 Inflow et BLoss ales Cost of Goods Sold elling Expense General & Administrative Expense nterest Expense ncome Tax Expense 4,300 20,400 NET CASH FLOW-OPERATING INVESTING ACTIVITIES: NET CASH FLOW- INVESTING FINANCING ACTIVITIES NET CASH FLOW- FINANCING NET CASH FLOW ALL ACTIVITIES BEGINNING CASH BALANCE ENDING CASH BALANCE Additional information 1) LL purchased $5,000 in equipment during 2017 2) LL allocates 1/3 rd of the depreciation expense to selling and 2/3 rds to gen. & admin. expenses 3) Bad debt expense for 2017 was $5,000. Uncollectible accounts written off totaled $4,800