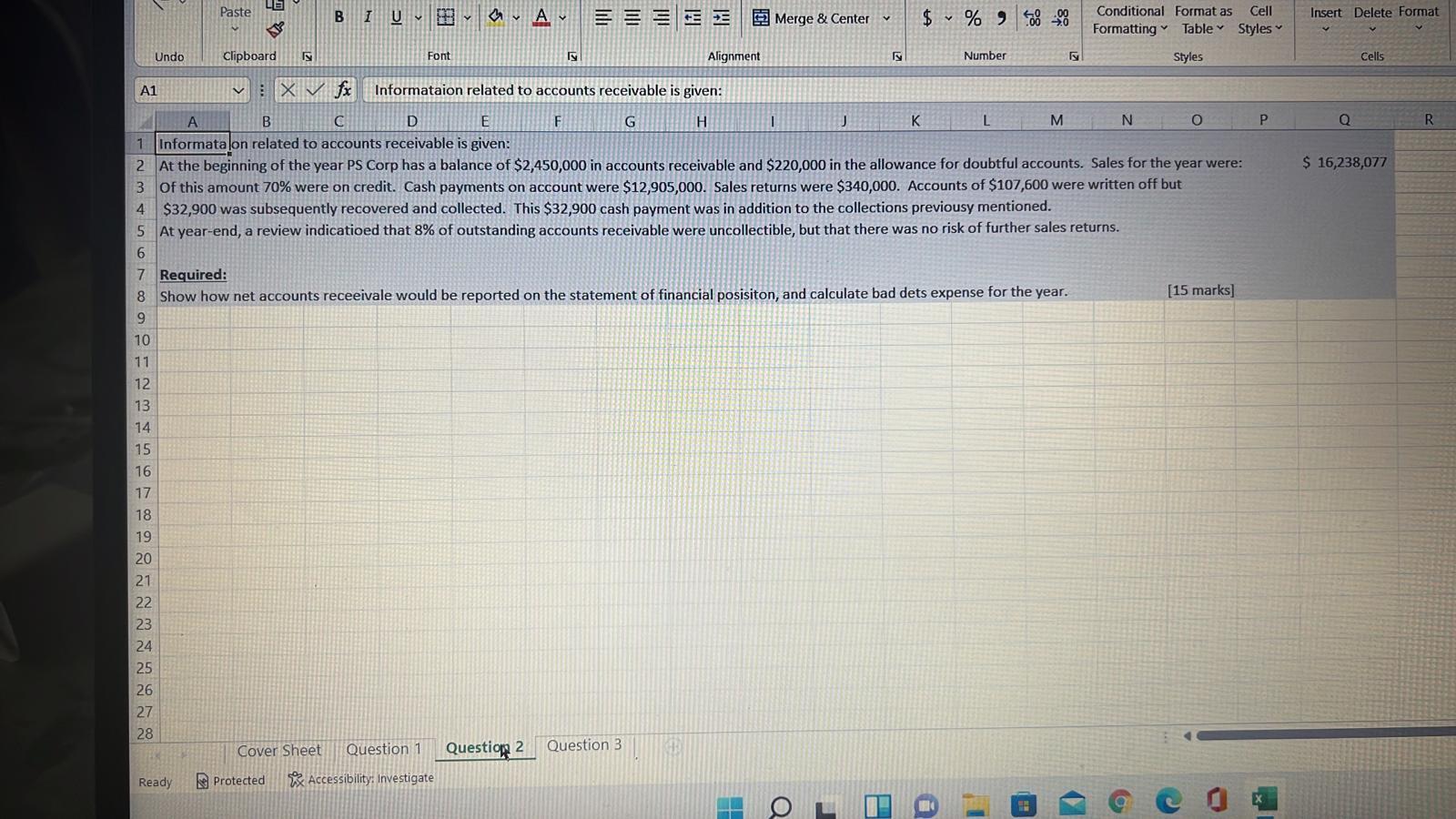

LOS Paste B I U V MA v E E Merge & Center Insert Delete Format $ ~ % 9ho ho v Conditional Format as Cell Formatting Table Styles Undo Clipboard Ig Font ly Alignment Number Styles Cells V P Q 0 R $ 16,238,077 A1 XV fx Informataion related to accounts receivable is given: D D E F G H 1 J K L M N O 1 Informatalon related to accounts receivable is given: 2 At the beginning of the year PS Corp has a balance of $2,450,000 in accounts receivable and $220,000 in the allowance for doubtful accounts. Sales for the year were: 3 Of this amount 70% were on credit. Cash payments on account were $12,905,000. Sales returns were $340,000. Accounts of $107,600 were written off but 4 $32,900 was subsequently recovered and collected. This $32,900 cash payment was in addition to the collections previousy mentioned. 5 At year-end, a review indicatioed that 8% of outstanding accounts receivable were uncollectible, but that there was no risk of further sales returns. 6 7 Required: 8 Show how net accounts receeivale would be reported on the statement of financial posisiton, and calculate bad dets expense for the year. [15 marks] 9 a 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Cover Sheet Question 1 Question 2 Question 3 Ready Protected Accessibility: Investigate EN Q LOS Paste B I U V MA v E E Merge & Center Insert Delete Format $ ~ % 9ho ho v Conditional Format as Cell Formatting Table Styles Undo Clipboard Ig Font ly Alignment Number Styles Cells V P Q 0 R $ 16,238,077 A1 XV fx Informataion related to accounts receivable is given: D D E F G H 1 J K L M N O 1 Informatalon related to accounts receivable is given: 2 At the beginning of the year PS Corp has a balance of $2,450,000 in accounts receivable and $220,000 in the allowance for doubtful accounts. Sales for the year were: 3 Of this amount 70% were on credit. Cash payments on account were $12,905,000. Sales returns were $340,000. Accounts of $107,600 were written off but 4 $32,900 was subsequently recovered and collected. This $32,900 cash payment was in addition to the collections previousy mentioned. 5 At year-end, a review indicatioed that 8% of outstanding accounts receivable were uncollectible, but that there was no risk of further sales returns. 6 7 Required: 8 Show how net accounts receeivale would be reported on the statement of financial posisiton, and calculate bad dets expense for the year. [15 marks] 9 a 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Cover Sheet Question 1 Question 2 Question 3 Ready Protected Accessibility: Investigate EN