Answered step by step

Verified Expert Solution

Question

1 Approved Answer

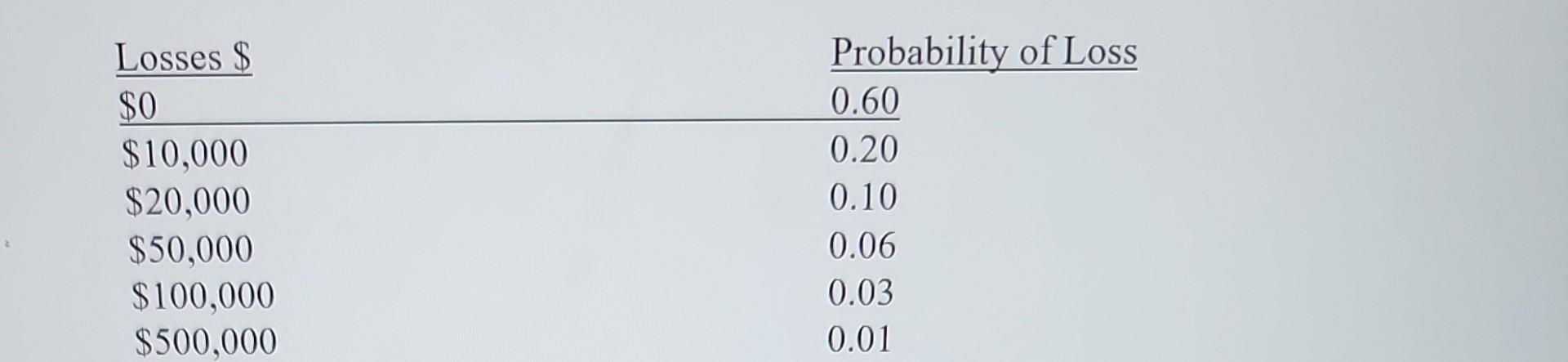

Losses $ $0 $10,000 $20,000 $50,000 $100,000 $500,000 Probability of Loss 0.60 0.20 0.10 0.06 0.03 0.01 Now suppose Terry joins a risk sharing

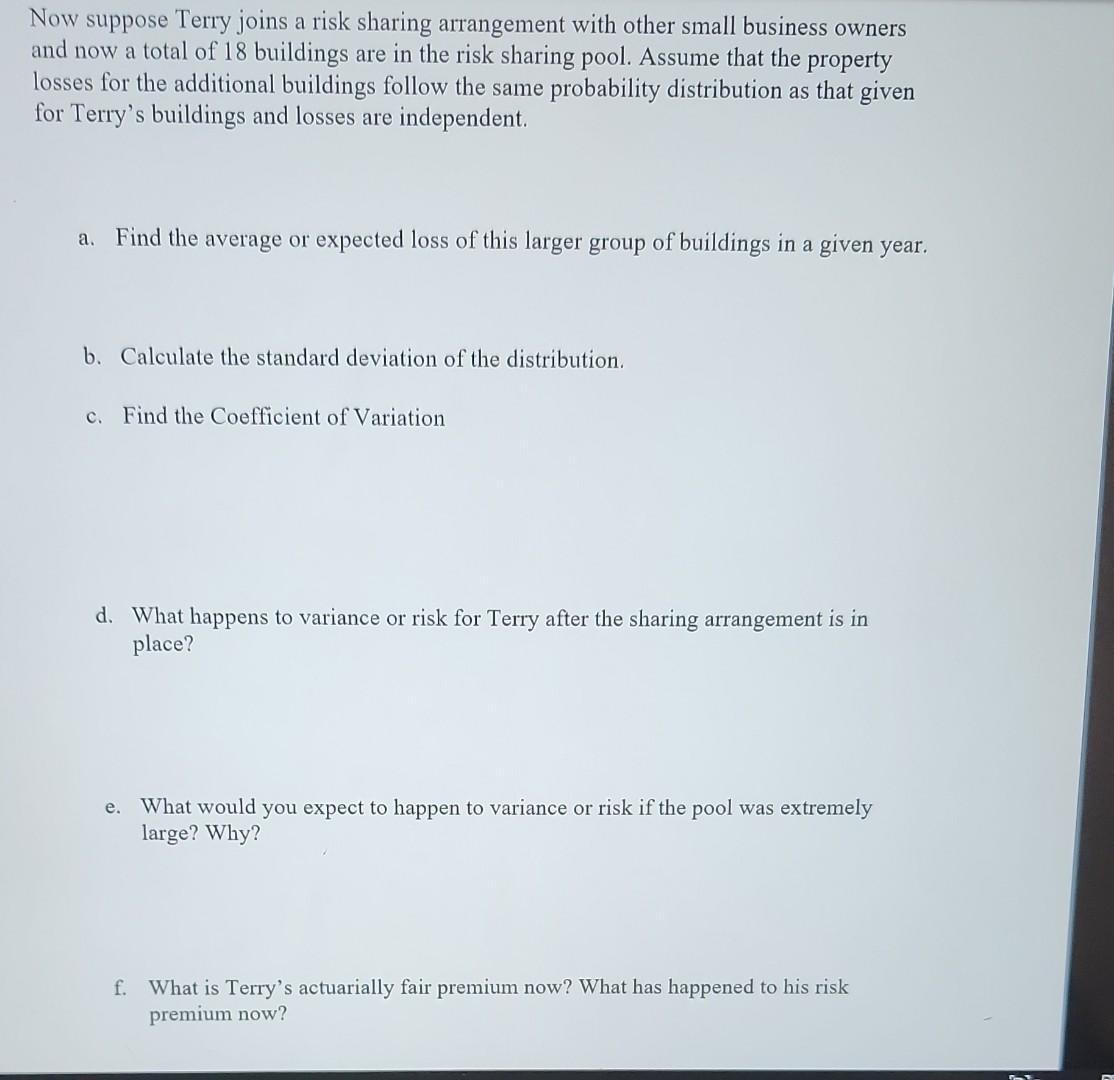

Losses $ $0 $10,000 $20,000 $50,000 $100,000 $500,000 Probability of Loss 0.60 0.20 0.10 0.06 0.03 0.01 Now suppose Terry joins a risk sharing arrangement with other small business owners and now a total of 18 buildings are in the risk sharing pool. Assume that the property losses for the additional buildings follow the same probability distribution as that given for Terry's buildings and losses are independent. a. Find the average or expected loss of this larger group of buildings in a given year. b. Calculate the standard deviation of the distribution. c. Find the Coefficient of Variation d. What happens to variance or risk for Terry after the sharing arrangement is in place? e. What would you expect to happen to variance or risk if the pool was extremely large? Why? f. What is Terry's actuarially fair premium now? What has happened to his risk premium now?

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer a meanaverage lossexpected lossExsumxpx15000 b standard deviationsdsqrtvariancesqrt27850...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started